Marathon Gold tables Valentine regulatory update

Marathon Gold Corp. [MOZ-TSX, MGDPF-OTC] said it has received confirmation that changes to its Newfoundland gold project to accommodate an open pit at the Berry deposit do not require a new impact assessment.

The company said the assessment and subsequent permitting of the Berry Complex can proceed as previously anticipated, consisting of an Environmental Assessment (EA) and modified decision statement.

Consistent with previous guidance and the feasibility study, Marathon anticipates that these review processes will be completed during 2023 and 2024, well in advance of the scheduled start of mining at Berry in the second quarter of 2025.

Marathon Gold shares were largely unchanged on the news, easing 0.62% or $0.005 to 79.5 cents on volume of 495,760. The shares are currently trading in a 52-week range of $1.73 and 69 cents.

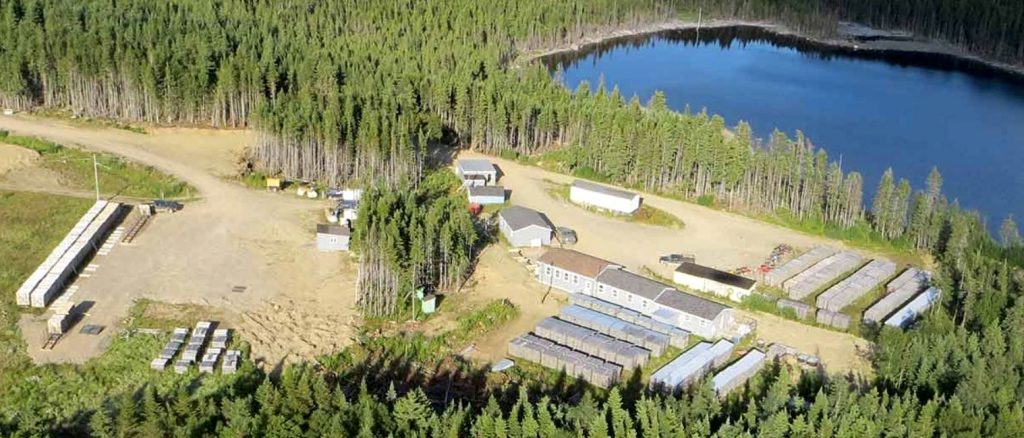

Marathon’s Valentine Gold Project was approved for construction in September, 2022 and early works commenced in October 2022. An updated feasibility study was completed in December, 2022, describing for the first time a three-pit mine plan based on the Marathon, Leprechaun and Berry deposits.

First ore is scheduled to be delivered to the mill in late 2024, with production ramp-up scheduled for the first quarter of 2025.

However, the updated feasibility study released in December, 2022, incorporates an amended permitting strategy to allow for the Berry Deposit to be included in the mining schedule for the first year of mine operations.

The updated study for the project outlined an open pit conventional mining operation, producing 195,000 ounces of gold annually for 12 years within a 14.3-year mine-life.

The project has an estimated proven mineral reserve of 1.43 million ounces (23.36 million tonnes at 1.89 g/t) and a probable reserve of 1.27 million ounces (28.22 million tonnes at 1.40 g/t). Total measured resources (including mineral reserves) stand at 2.06 million ounces.

But the company has said 2023-2024 exploration work at Valentine will be designed to maintain the project’s momentum of mineral resource growth even as mine development moves forward. “We see potential for this growth both within the mineral deposits in the existing mine plan, and more broadly over the full 32 kilometres of mineralized shear zone trend on the property,” said Marathon Gold President and CEO Matt Manson.

He said the project has benefitted from the addition of the Berry Deposit to the mine plan, allowing the company to present a project with a longer operating life and a significantly improved production profile.

“Our first three years of production will average 200,000 ounces annually at an all-in-sustaining cost of US$890 an ounce at an expected head grade of 3.75 g/t gold,’’ Mason said. “This is expected to generate substantial cash flow in the early years of mining.’’