Maritime Resources Announces Mineral Resource Estimate for the Lac Pelletier Gold Project

Maritime Resources Corp. (TSXV: MAE) (“Maritime” or the “Company”) is pleased to report the completion of a mineral resources estimate¹ (the “2022 MRE”), on its 100%-owned, Lac Pelletier Gold Project (“Lac Pelletier“) located in Rouyn Noranda, Quebec, Canada. The 2022 MRE was completed in accordance with National Instrument 43-101 (“NI 43-101“) standards of disclosure. Maritime acquired Lac Pelletier in 2021 from Rambler Metals and Mining PLC, along with the Nugget Pond gold circuit in Newfoundland and Labrador and a number of additional gold assets and royalty interests.

Highlights

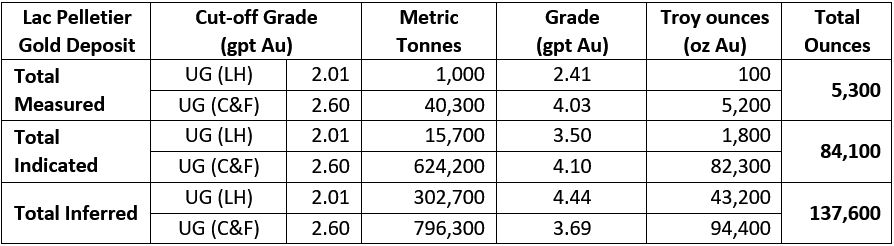

The 2022 MRE demonstrates an extensive gold resource suited for potential underground mining (see Table 1):

- 41,300 tonnes grading 3.99 grams per tonne (“gpt”) gold (“Au”) for 5,300 ounces (Measured)

- 639,900 tonnes grading 4.09 gpt Au for 84,100 ounces (Indicated)

- 681,200 tonnes grading 4.08 gpt Au for 89,400 ounces (total Measured and Indicated)

- 1,099,000 tonnes grading 3.89 gpt Au for 137,600 ounces (Inferred)

- Project has valid certificate of authorization for 1,000 tonnes per day production

- Considerable exploration upside along strike and at depth

¹There is no certainty that Indicated mineral resource estimates will be converted to the Measured resource and Proven and Probable mineral reserve categories and there is no certainty that the 2022 MRE will be realized. There is no guarantee that Inferred mineral resource estimates can be converted to Indicated or Measured mineral resource categories, or that Indicated or Measured mineral resource estimates will be converted to mineral reserves. Mineral resource estimates that are not mineral reserves do not have demonstrated economic viability. The 2022 MRE may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties and other factors, as more particularly described in the Cautionary Statements at the end of this news release. See “Caution Regarding Forward-Looking Statements”.

“Lac Pelletier is a unique asset located in the heart of the Abitibi mining district, with several operating mines and development projects within driving distance. The project benefits from over 85,000 metres of surface and underground drilling, 2,500 metres of ramp access and underground development plus the completion of three separate bulk sampling programs that demonstrated the geological and grade continuities and gold recoveries of 96% at a nearby mill. A certificate of authorization from the Province for 1,000 tonnes per day of mine production remains in effect,” comments Garett Macdonald, President and CEO. “The current deposit has been defined to 250 metres below surface with excellent potential for expansion along strike and at depth. The 1,200 metre deep former Stadacona mine lies only 1 kilometre east of the Lac Pelletier gold deposit. Further exploration upside potential exists within a nickel-copper-PGM zone found on the edge of a gabbro intrusion located on the west side of the project, where previous drilling intersected extensive nickel and copper sulphides with associated palladium and platinum over wide intervals. We are excited about this project’s potential and are evaluating all opportunities to unlock value for Maritime and its shareholders.”

Figure 1: Lac Pelletier Location Map

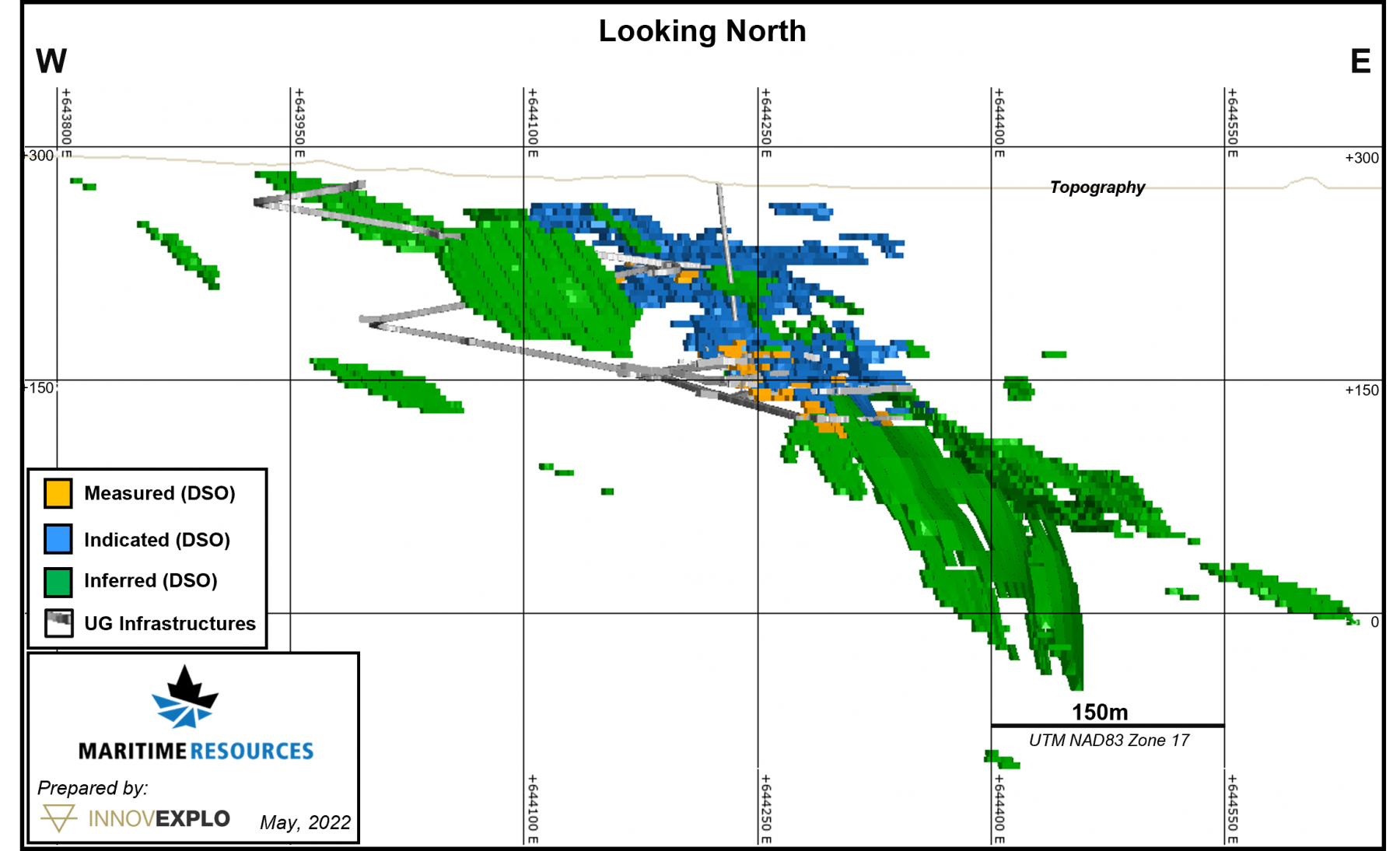

Figure 2: Lac Pelletier Deposit North View

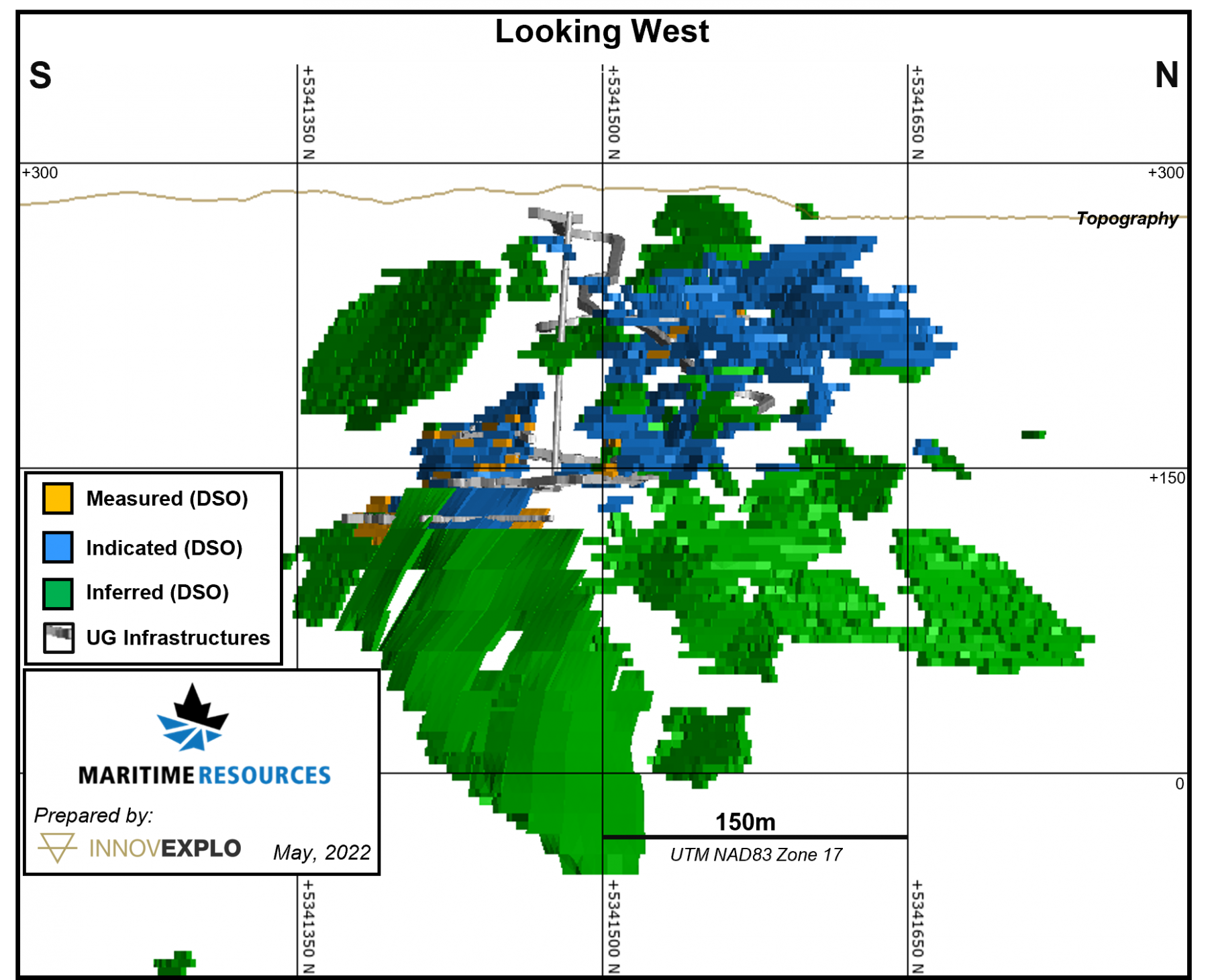

Figure 3: Lac Pelletier Deposit West View

Table 1: 2022 Mineral Resource Estimate of the Lac Pelletier Gold Deposit (effective date of May 10, 2022).

Note:Â Numbers may not add due to rounding. Please review “Notes to the 2022 MRE” at the end of the news release for additional information.

2022 MRE

The 2022 MRE is based on 455 drill holes totaling approximately 66,000 metres (“m“) of drilling information, based on meters/DDHs intersecting the BM.

Unsampled boreholes are not included in the count and follows the CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014) and the 2019 CIM Mineral Resources and Mineral Reserves Best Practice Guidelines (collectively, the “CIM Standards“).

The 2022 MRE was generated using various cut-off grades depending on the proposed underground (“UG“) potential extraction method: 2.01 gpt Au for potential long hole operation (“LH“) when the dip of the zones are higher than 45° and 2.60 gpt Au for the potential cut & fill (“C&F“) method when the dip of the zones is shallower than 45°. Specific extraction methods are used only to establish reasonable cut-off grades for various portions of the deposits. No Preliminary Economic Analysis, Pre-Feasibility Study or Feasibility Study has been completed to support economic viability and technical feasibility of exploiting any portion of the mineral resources, by any specified mining method. The reasonable prospect for an eventual economical extraction is met by having used reasonable cut-off grades both for a potential LH and C&F extraction scenarios and constraining volumes (Deswik shapes).

Assumptions and Parameters

The 2022 MRE includes a few assumptions and parameters that are in accordance with today’s mining reality, which are indicated in the “Notes to the 2022 MRE” section below.

Qualified Persons

Technical information related to the 2022 MRE contained in this news release has been reviewed and approved by Vincent Nadeau-Benoit, P.Geo., Martin Perron, P. Eng. and Simon Boudreau, P.Eng. of InnovExplo, who are Independent and Qualified Persons as defined by NI 43-101, with the ability and authority to verify the authenticity and validity of this data.

A site visit was conducted by Vincent Nadeau-Benoit, P. Geo. A review of the general access and a visual check of the overall condition of the site was completed. Drill collar coordinates were validated in the field and assays certificates were verified as well as a review on available drill core. Underground access was not possible so no validation of underground holes was possible, but the validation of assays certificates for u/g holes was performed.

Jeremy Niemi, P.Geo., technical advisor to Maritime for the Lac Pelletier project, who is Independent and a Qualified Person as defined by NI 43-101, has also reviewed and approved of the scientific and technical disclosure contained in this news release.

Notes to the 2022 MRE

- The effective date of the 2022 MRE is May 10, 2022.

- The independent and qualified persons for the 2022 MRE are Vincent Nadeau-Benoit, P. Geo., Martin Perron, P. Eng. and Simon Boudreau, P.Eng. all from InnovExplo Inc.

- The 2022 MRE follows the CIM Standards.

- These mineral resources are not mineral reserves, as they do not have demonstrated economic viability. The results are presented undiluted and are considered to have reasonable prospects of economic viability.

- The estimate encompasses 19 mineralized lenses in two (2) zones (Zone 3 and Zone 4) using the grade of the adjacent material when assayed or a value of zero when not assayed. Dilution zones encompassing all mineralized zones were created to better reflect the internal dilution within the constraining shapes.

- High-grade capping supported by statistical analysis was done on raw assay data before compositing and established on a per-zone basis varying from 25 to 50 gpt Au for mineralized zones and 5 to 10 gpt Au for the dilution zones. Composites (1.5-m) were calculated within the zones using the grade of the adjacent material when assayed or a value of zero when not assayed.

- The estimate was completed using a sub-block model in Leapfrog Edge 2021.2.4. A 5m x 5m x 5m parent block size was used.

- Grade interpolation was obtained by Inverse Distance Squared (ID2Â )using hard boundaries. Dynamic anisotropy was used for the interpolation of all mineralized lenses.

- A density value of 2.826 g/cm3Â was assigned all mineralized zones.

- The mineral resource estimate is classified as Measured, Indicated and Inferred. The Inferred category is defined with a minimum of two (2) drill holes within the areas where the drill spacing is less than 50 m and shows reasonable geological and grade continuity. The Indicated mineral resource category is defined with a minimum of three (3) drill holes within the areas where the drill spacing is less than 25 m and shows reasonable geological and grade continuity. Measured mineral resources were classified as Mineral Resources present within 10 m of an underground opening within a mineralized zone. Clipping boundaries were used to refine classification based on those criteria.

- The 2022 MRE is locally constrained within Deswik Stope Optimizer shapes using a minimal mining width of 1.8 m for LH and 3.6 m for C&F. It is reported at a rounded cut-off grade of 2.01 gpt Au using the LH method, and 2.60 gpt Au, using the C&F method. The cut-off grades were calculated using the following parameters: mining cost = C$60/t to C$100.00/t; transport to process cost = C$15.00/t; processing cost = C$45.00/t; G&A = C$15.00/t; refining costs = C$5.00/oz; selling costs = C$22.00/oz; gold price = US$1,700.00/oz; USD:CAD exchange rate = 1.30; and mill recovery = 96.0%. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The number of metric tonnes was rounded to the nearest hundred, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects. The metal contents are presented in troy ounces (tonnes x grade / 31.10348) rounded to the nearest hundred.

- The independent and qualified persons for the 2022 MRE are not aware of any known environmental, permitting, legal, political, title-related, taxation, socio-political, or marketing issues that could materially affect the Mineral Resource Estimate.

Table 2: Sensitivity of the 2022 MRE to different gold prices (Effective date of May 10, 2022).

Note:Â Numbers may not add due to rounding. The reader is cautioned that the figures provided in Table 2 should not be interpreted as a statement of mineral resources. Quantities and estimated grades for different gold prices (and cut-off grades) are presented for the sole purpose of demonstrating the sensitivity of the resource model to the choice of a specific gold price.

About Maritime Resources Corp.

Maritime holds a 100% interest- directly and subject to option agreements entitling it to earn 100% ownership- in the Green Bay Property. This includes the former Hammerdown gold mine and the Orion gold project plus the Whisker Valley exploration project, all located in the Baie Verte Mining District near the town of King’s Point, Newfoundland and Labrador. The Hammerdown Gold Project is characterized by near-vertical, narrow mesothermal quartz veins containing gold associated with pyrite. Hammerdown was last operated by Richmont Mines between 2000 and 2004. The Company also owns the gold circuit at the Nugget Pond metallurgical facility in Newfoundland and Labrador, the Lac Pelletier gold project in Rouyn Noranda, Québec and several other exploration properties and royalty interests in key mining camps across Canada.

On Behalf of the Board:

Garett Macdonald, MBA, P.Eng.

President and CEO

For further information, please contact:

Tania Barreto, CPIR

Head of Investor Relations

1900-110 Yonge Street, Toronto, ON M5C 1T4

Twitter

Facebook

LinkedIn

YouTube

Caution Regarding Forward-Looking Statements:

Certain of the statements made and information contained herein is “forward-looking information” within the meaning of National Instrument 51-102 -Â Continuous Disclosure Obligations. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expects”, “intends”, “indicates” “plans” and similar expressions. Forward-looking statements include statements concerning the potential to increase mineral resource and mineral reserve estimates, benefits of and production at the Lac Pelletier project, potential expansion and exploration potential relating to the Lac Pelletier project, increase in shareholder value attributed to the Lac Pelletier project, and generally the Company’s decision to acquire new mineral property interests and assets, amongst other things, which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. All forward-looking statements and forward-looking information are based on reasonable assumptions that have been made by the Company in good faith as at the date of such information. Such assumptions include, without limitation, the price of and anticipated costs of recovery of, base metal concentrates, gold and silver, the presence of and continuity of such minerals at modeled grades and values, the capacities of various machinery and equipment, the use of ore sorting technology will produce positive results, the availability of personnel, machinery and equipment at estimated prices, mineral recovery rates, and others. Forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the ability of the Company to continue to be able to access the capital markets for the funding necessary to acquire, maintain and advance exploration properties or business opportunities; global financial conditions, including market reaction to the coronavirus outbreak; competition within the industry to acquire properties of merit or new business opportunities, and competition from other companies possessing greater technical and financial resources; difficulties in advancing towards a development decision at Hammerdown and executing exploration programs at its Newfoundland and Labrador properties on the Company’s proposed schedules and within its cost estimates, whether due to weather conditions, availability or interruption of power supply, mechanical equipment performance problems, natural disasters or pandemics in the areas where it operates; increasingly stringent environmental regulations and other permitting restrictions or maintaining title or other factors related to exploring of its properties, such as the availability of essential supplies and services; factors beyond the capacity of the Company to anticipate and control, such as the marketability of mineral products produced from the Company’s properties; uncertainty as to whether the acquisition of assets and new mineral property interests including the Nugget Pond gold circuit will be completed in the manner currently contemplated by the parties; uncertainty as to whether mineral resources will ever be converted into mineral reserves once economic considerations are applied; uncertainty as to whether inferred mineral resources will be converted to the measured and indicated categories through further drilling, or into mineral reserves, once economic considerations are applied; government regulations relating to health, safety and the environment, and the scale and scope of royalties and taxes on production; and the availability of experienced contractors and professional staff to perform work in a competitive environment and the resulting adverse impact on costs and performance and other risks and uncertainties, including those described in each MD&A of financial condition and results of operations. In addition, forward-looking information is based on various assumptions including, without limitation, assumptions associated with exploration results and costs and the availability of materials and skilled labour. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking information. Except as required under applicable securities legislation, Maritime undertakes no obligation to publicly update or revise forward-looking information, whether as a result of new information, future events or otherwise.

Neither TSX Venture Exchange (“TSX-V”) nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.