McEwen prices US$50 million offering

McEwen Mining Inc. [MUX-TSX, NYSE] on Wednesday November 20 announced the pricing of a US$50 million underwritten public offering that it said will be used to fund its current mining projects and exploration prospects.

McEwen said the offering consists of 37.75 million units. Each unit consists of one common share and one-half of a warrant, entitling the holder to purchase one common share for $1.325 per unit.

Each full warrant is exercisable for one common share at an exercise price of $1.72. The warrants are exercisable immediately and for up to five years following the date of issuance.

Roth Capital Partners and Cantor Fitzgerald Canada Corp. are acting as joint book-running managers for the offering.

McEwen said it has granted the underwriters a 30-day option to purchase an additional 5.66 million common shares and/or warrants to purchase up to 2.83 million shares at the public offering price per share and per warrant. The offering is expected to close by November 22, 2019.

McEwen has said it aims to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer with a focus on the Americas, including the U.S., Canada, Mexico and Argentina.

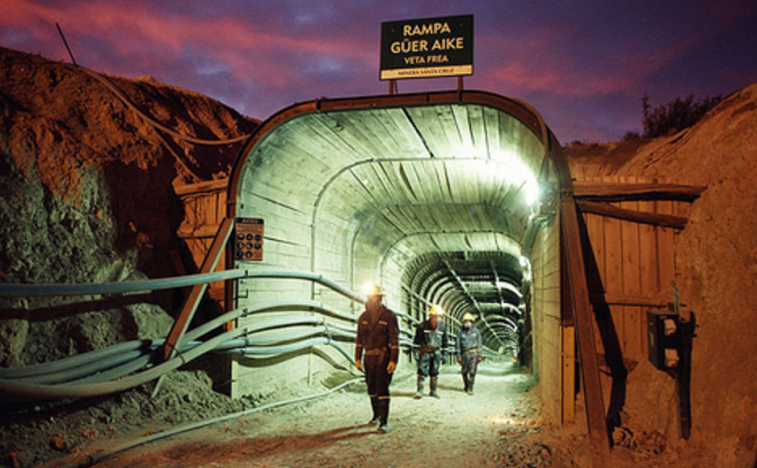

Its key assets are the San Jose Mine in Santa Cruz, Argentina, the Black Fox Mine near Timmins, Ontario, the El Gallo Fenix Project in Mexico, the Gold Bar Mine in Nevada, and the Los Azules copper project in San Juan, Argentina.

Robert McEwen, the Bay Street financier who owns 22% of McEwen Mining’s 362 million shares outstanding, has said he hopes to see the company increase its production from 175,000 ounces in 2018 to at least 220,000 ounces by 2020.

On Wednesday, McEwen shares eased 12.5% or $0.25 to $1.74 on volume of 930,149. The shares are currently trading in a 52-week range of $1.67 and $2.84.

When McEwen announced its third quarter 2019 financial results, the company said it expects to produce between 42,000 and 46,000 ounces of gold in the fourth quarter, placing it near the mid-point of its guidance range for the year.

The recent third quarter was the first full quarter of commercial production at the Gold Bar Mine.

For Gold Bar, cash costs and all-in-sustaining costs for the full year 2019 are expected to be higher than the company’s guidance of US$930 to US$975 per gold equivalent ounce. That compares to actual cash costs and all-in-sustaining costs of US$1,014 and US$1,200 per gold equivalent ounce in the third quarter of 2019.

The company said higher costs at Gold Bar are the result of a delayed mine start-up, and higher than expected operating expenses and sustaining capital expenses that were required to correct plant deficiencies and improve performance.

The company has said it plans to increase production at Gold Bar next year to 65,000 to 70,000 ounces. It expects costs to moderate and then decline as improvements take effect.