Miners target growing electric vehicle sector

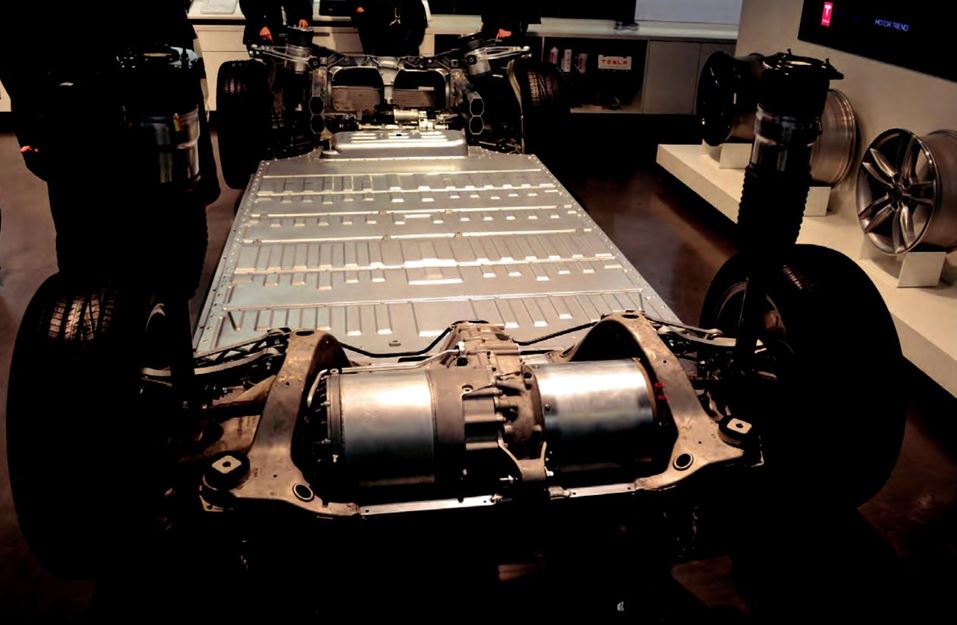

Tesla electric automobiles utilize lithium-ion batteries. Photo courtesy Tesla, Inc.

Declining discovery rates and the potential for long-term supply gaps of key metals remain important issues facing the mining sector, industry veterans told the Prospectors & Developers Association of Canada convention in Toronto.

Ivanhoe Mines Ltd. [IVN-TSX, IVPAF-OTC] Executive co-Chairman and founder Robert Friedland said he doubted the world had enough copper supply to meet demand in the years to come. He predicted that the global economy will increasingly shift to metal-intensive infrastructure, highlighting electric cars.

Friedland made the forecasts ahead of an announcement by General Motors Co. [GM-NYSE], which on Wednesday laid out a comprehensive plan to produce affordable electric vehicles, including several new models that are expected to arrive in the next two years.

General Motors says it is aiming to sell a million electric cars and trucks annually by 2025 in the United States and China.

Tesla Motors Ltd. [TSLA-NASDAQ] has dominated sales of electric cars so far in the United States and abroad, but GM is betting it can catch and possibly surpass its rival by lowering costs and attracting mainstream buys, the New York Times said in a report on Wednesday.

Along with other key metals, including lithium and cobalt, copper is expected to play a critical role in the production of electric vehicles. That’s because electric vehicles use a substantial amount of copper in their batteries as well as in the windings and copper rotors used in electric motors. A single car can have up to six kilometres of copper wiring, according to the International Copper Association.

Mining companies aiming to meet the expected demand include Sumitomo Metal Mining, which on Wednesday said it aims to boost its annual copper production through its shareholding to 300,000 tonnes by 2030. The target compares with 250,000 tonnes projected in November, 2019, for the current financial year ended March 31, 2020.

Sumitomo Metal, which also makes cathode materials used in automotive batteries, aims to get involved in the business of recovering lithium from salt-lake brine with high levels of impurities by 2030. It also wants to commercialize battery recycling that recovers cobalt.

Meanwhile, Friedland’s Ivanhoe is working to develop the huge Kamoa-Kakula Copper Project in the Democratic Republic of Congo. Kamoa-Kakula is a joint venture between Ivanhoe Mines (39.6%), China’s Zijin Mining Group (39.6%), Crystal River Global Ltd. (0.8%), and the DRC government (20%). It already ranks among the world’s biggest copper mines, with peak annual production expected to exceed 700,000 tonnes.

The Kamoa Deposit – originally discovered by Ivanhoe Mines’ geologists in 2008 – is one of two very large, near-surface, flat-lying, stratiform copper deposits discovered on a 400-square kilometre mining license. The other major deposit – Kakula is being fast-tracked to commercial production, with the initial 3.8 million-tonne-per-annum mining operation scheduled to produce first concentrate in the third quarter of 2021.

On Wednesday, Ivanhoe shares rose 3.6% or 11 cents to $3.19 on volume of 528,290. The shares are currently trading in a 52-week range of $3 and $4.54.