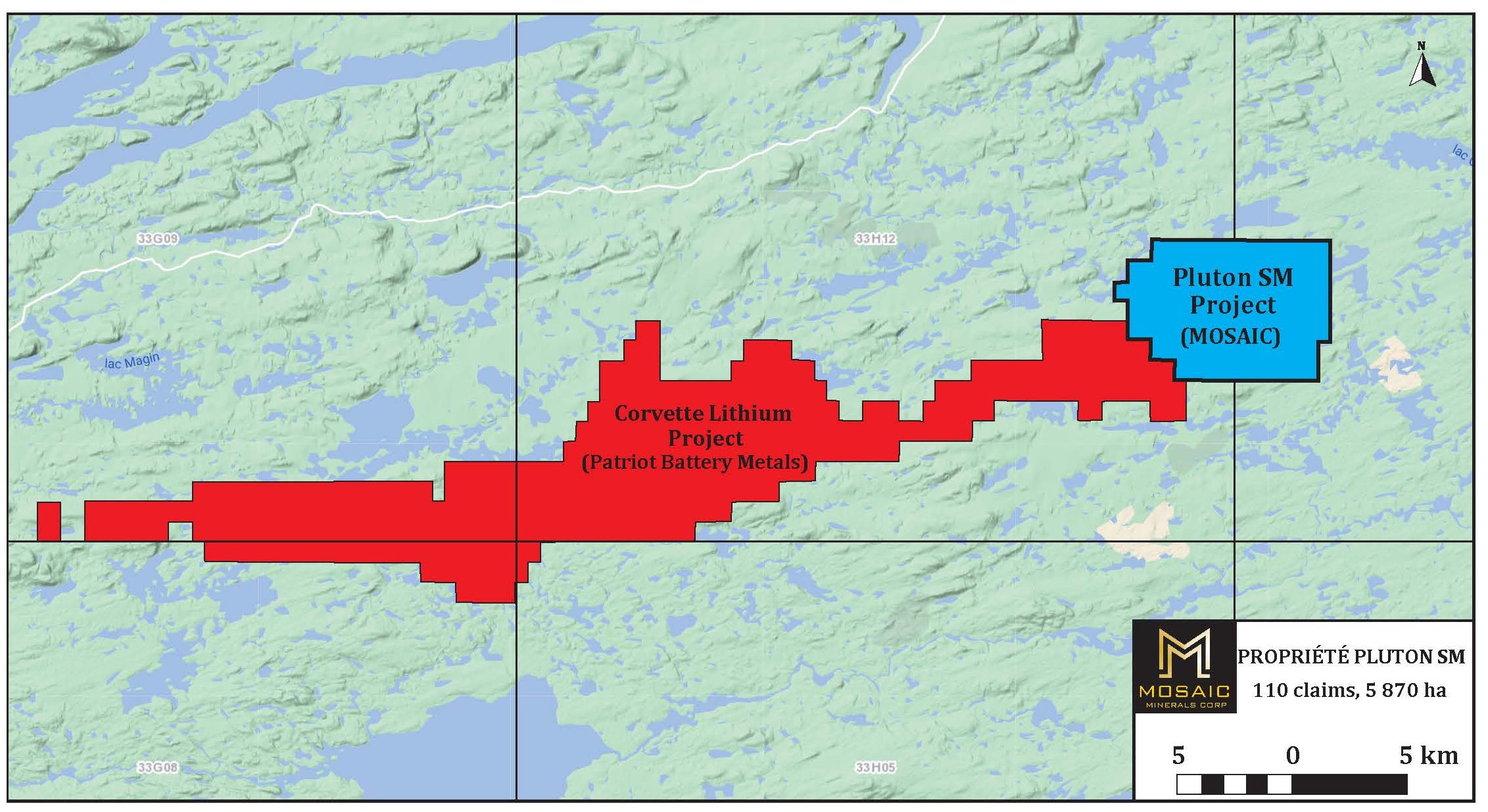

Mosaic Acquires 5,650 Hectares in the East Extension of Patriot Battery Metals Corvette Lithium Project

Mosaic Minerals Corporation (CSE: MOC) (“Mosaic” or “The Company”) announces the acquisition of 110 mining claims adjacent to the eastern edge of Patriot Battery Metals Corvette, located in James Bay, Quebec. Recent drilling on Corvette has intersected high grade Lithium (CV22-093: 52.2 meters at 3.34% Li2O including 15 meters at 5.10% Li2O).

Covering an area of 5,650 hectares, these 110 claims constituting the Pluton SM project are located in an environment comprising granitic intrusives with the presence of biotite and muscovite, two minerals considered as markers in the search for lithium. A few surface samples taken in this environment by the MERN gave indications of lithium and thorium contents. The latter is a potential indicator for the presence of minerals such as cesium or rubidium which are themselves useful markers for the search for lithium.

“This new project is located in a favorable and conducive environment for the exploration of lithium and strategic minerals. The presence of possible pegmatites on this project is to be verified but we are confident to find some during our exploration program which we plan to start as soon as access conditions allow us. It should be noted that in their latest press release, Patriot Battery Metals mentions that their latest easternmost drilling revealed significant lithium content. It’s interesting to see that the potential Patriot Battery area continues east,” said Jonathan Hamel, President, and CEO of Mosaic Minerals.

The Company is determined to build an extensive portfolio of mining properties focused on strategic minerals, particularly lithium and nickel. With the addition of the Pluton SM project, Mosaic Minerals now holds over 784 claims covering approximately 42,000 hectares divided into 10 separate projects. Other projects could eventually be added to this portfolio.

Acquisition from prospectors

The Pluton SM project was acquired partly from 2 independent prospectors (39 claims) and by staking (71 claims). In return for the acquisition of the 39 claims held by the prospectors, the company will issue them respectively 450,000 and 1,000,000 shares and will grant them 0.50% NSR for one and 2% NSR for the other, of which 1% may be bought back for $1 million. The transaction is subject to the approval of the competent authorities.

The technical content of this press release has been reviewed and approved by Mr. Gilles Laverdière, P.Geo., an independent consulting geologist and a Qualified Person as defined in NI 43-101.

About Mosaic Minerals Corporation

Mosaic Minerals Corp. is a Canadian mineral exploration company listed on the Canadian Securities Exchange (CSE: MOC) now focusing on the exploration for future strategic Nickel and Lithium deposits in priority on the Province of Quebec territory.

M. Jonathan Hamel

President & CEO

jhamel@mosaicminerals.ca

This release contains certain “forward-looking information” under applicable Canadian securities laws concerning the Arrangement. Forward-looking information reflects the Company’s current internal expectations or beliefs and is based on information currently available to the Company. In some cases, forward-looking information can be identified by terminology such as “may”, “will”, “should”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “projects”, “potential”, “scheduled”, “forecast”, “budget” or the negative of those terms or other comparable terminology. Assumptions upon which such forward-looking information is based includes, among others, that the conditions to closing of the Arrangement will be satisfied and that the Arrangement will be completed on the terms set out in the definitive agreement. Many of these assumptions are based on factors and events that are not within the control of the Company, and there is no assurance they will prove to be correct or accurate. Risk factors that could cause actual results to differ materially from those predicted herein include, without limitation: that the remaining conditions to the Arrangement will not be satisfied; that the business prospects and opportunities of the Company will not proceed as anticipated; changes in the global prices for gold or certain other commodities (such as diesel, aluminum and electricity); changes in U.S. dollar and other currency exchange rates, interest rates or gold lease rates; risks arising from holding derivative instruments; the level of liquidity and capital resources; access to capital markets, financing and interest rates; mining tax regimes; ability to successfully integrate acquired assets; legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or technical difficulties in connection with mining or development activities; laws and regulations governing the protection of the environment; employee relations; availability and increasing costs associated with mining inputs and labour; the speculative nature of exploration and development; contests over title to properties, particularly title to undeveloped properties; and the risks involved in the exploration, development and mining business. Risks and unknowns inherent in all projects include the inaccuracy of estimated reserves and resources, metallurgical recoveries, capital and operating costs of such projects, and the future prices for the relevant minerals. The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release.