Noront narrows site selection for ferrochrome facility

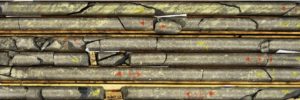

An example of Noront's Eagle's Nest Project high-grade nickel-copper-platinum group metals diamond drill core. Source: Noront Resources Ltd.

By Peter Kennedy

Noront Resources Ltd. [NOT-TSXV] has launched what it has dubbed the next and final phase of the site selection process for a proposed ferrochrome production facility that it hopes to build in Ontario. The move comes after Thunder Bay and Sudbury were eliminated last week as possible locations for the facility.

The company now says Timmins and Sault Ste. Marie are the two northern Ontario cities that are vying for the project. In a July 13, 2018 press release, the company said the site selection process includes substantial negotiation of commercial use terms with owners of the two favoured sites.

In the Sault, that is Algoma, an integrated steel producer, according to a report in the Sudbury Star. “There are lots of elements that we liked about that particular site,” said Noront President and CEO Alan Coutts. Those elements include road and rail access, Port of Algoma and close proximity to the community.

The Sudbury Star said Algoma has agreed to negotiate with Noront for the land needed for the facility. Additional industrial zoned land owned by the municipality is located nearby, the report said.

“Noront expects this stage of definition to be concluded in the fourth quarter of 2018,” the company said.

Noront is a company that is hoping to mine chromite from properties located in northern Ontario’s Ring of Fire region, an area that Ontario government officials have previously described as “one of the most promising mineral development opportunities in Ontario in almost a century.”

“Current estimates suggest multi-generational potential for chromite production as well as significant production of nickel, copper and platinum,” said George Ross, a former Deputy Minister in Ontario’s Northern Development and Mines Ministry. He made the comment during the Prospectors and Developers Association of Canada conference in Toronto back in March, 2013.

At the time, Ontario government officials were thinking that chromite mined from the Ring of Fire would support the province’s massive mining services and supply chain for many decades to come, bringing new jobs and industry to the hard-hit north and its aboriginal communities.

It was envisioned that the chromite would be extracted and then concentrated at source. It would then be shipped by road or rail to processing facilities further south in one of Ontario’s major mining centres, where it would be turned into ferrochrome, a critical ingredient used to manufacture stainless steel.

However, Noront faces significant challenges in carrying out such a plan. They include the uncertainties associated with mining in a region that is so far away from crucial processing and transportation infrastructure.

Mining industry officials say a railway that will be needed to ship concentrates from the Ring of Fire will likely be the most challenging part of the project.

That is because the nearest railway is located 285 kilometres south of the Ring of Fire region in Nakina, Ontario.

After stating that it was prepared to invest billions of dollars on the Ring of Fire, Cliffs Natural Resources Inc. [CLV-NYSE] pulled the plug in November, 2013, saying it was indefinitely suspending development of a massive chromite deposit in northern Ontario and wouldn’t be spending any more money on the project.

It did so because it was unable to build an all-weather road to the site because it would cross land staked by a rival company.

It later sold its Ring of Fire chromite properties to Noront for US$20 million March 2015.

Noront’s flagship project is the 100%-owned Eagle’s Nest deposit, which is has described as the highest grade nickel-sulphide find in Canada since the Voisey’s Bay discovery in Labrador. Noront also has outright ownership or controlling interests in the Black Thor, Blackbird, Blackbird, Black Label, and Big Daddy chromite deposits as well as the McFaulds copper-zinc deposit.

At the close of trading on July 16, 2017, Noront shares were priced at 35.5 cents, leaving the company with a market cap of $126.3 million, based on 360.76 million shares outstanding. The 52-week range is 52 cents and 27 cents.