Pan American unveils PEA for US$2.8 billion skarn project

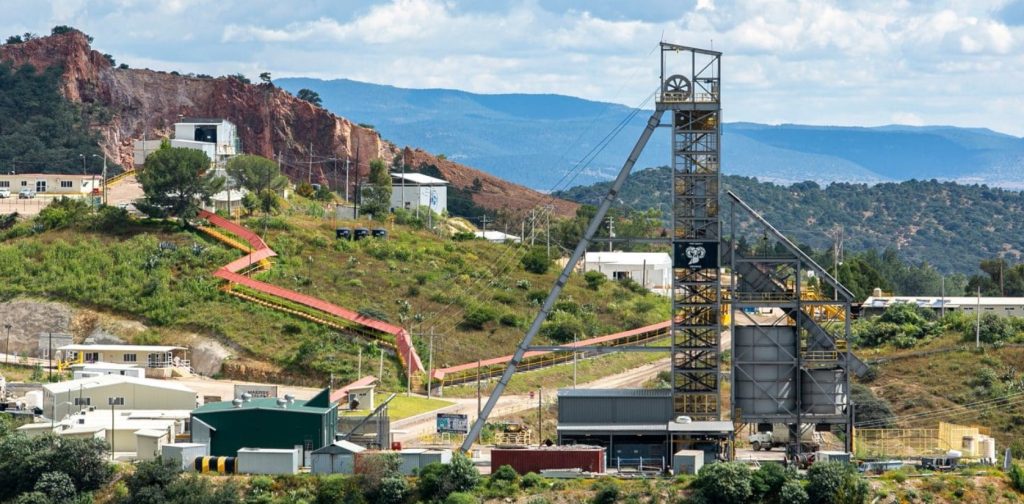

Pan American Silver Corp. [PAAS-TSX, NASDAQ] has released a preliminary economic assessment (PEA) for its 100%-owned La Colorada skarn project in Zacatecas, Mexico, which is located below and adjacent to its currently producing La Colorada mine.

“Our objective is to provide investors with exposure to silver, and the La Colorada Skarn provides that exposure in scale, with average annual production estimated to average 17.2 million ounces during the first 10 years,’’ said Pan American Silver President and CEO Michael Steinmann. “It is also expected to produce 427,000 tonnes of zinc annually during that period, which we anticipate would coincide with decreasing zinc supply in the market,’’ he said. “Given the volume of base metals in the deposit, Pan American is assessing interest from base metal producers and other capable parties to explore long-term partnerships to develop this polymetallic project, allowing Pan American to focus on the large amount of anticipated silver production.’’

Pan American shares rose 1.6% or 33 cents to $21 on Tuesday. The shares trade in a 52-week range of $26.54 and $18.14.

Pan American Silver is a leading producer of precious metals in the Americas, operating silver and gold mines in Canada, Mexico, Peru, Bolivia, Chile and Brazil. Its portfolio also includes the Escobal mine in Guatemala that is currently not in operation.

Steinmann went on to say that discovering a deposit of this magnitude beneath the currently producing La Colorada mine is an exceptional opportunity to create long-term value for the company’s shareholders. He said the mineral resource does not include any drill results from 2023, which will continue to expand the resource envelope and provide opportunities to enhance the life-of-mine economics.

The PEA for the La Colorada Skarn project envisions development of a mine utilizing a 50,000 tonnes per day sub-level cave mining method, accessed via decline ramps and two ventilation shafts. A conventional 50,000 tonne-per-day capacity selective zinc and lead flotation processing plant and dry-stack tailings facility would produce silver-bearing mineral concentrates at an average rate of 2,000 tonnes per day of zinc concentrate grading 59% zinc, and 846 tonnes per day of lead concentrate, grading 61% lead.

The estimated annual silver, zinc and lead production would be 17.2 million ounces, 427,000 tonnes and 218,000 tonnes respectively, during the first decade of production. The estimated 17-year mine life does not take into account the 2023 drill results that were disclosed by Pan American in May, 2023, and December 5, 2023.

The PEA envisages an initial capital cost of US$2.8 billion over a six-year construction period, with peak spending in years four and five when the mill is being constructed. Total life of mine sustaining capital is estimated at US$951 million.

The PEA is based on an indicated mineral resource of 173.6 million tonnes, containing 183 million ounces of silver, 4.8 million tonnes of zinc, and 2.3 million tonnes of lead. On top of that is an inferred resource of 103.6 million tonnes, containing 116 million ounces of silver, 2.6 million tonnes of zinc and 1.1 million tonnes of lead.