Pasofino Gold Announces Commencement of Joint Strategic Review Process with Hummingbird Resources plc for the Dugbe Gold Project, and Pasofino’s Optimization of the Feasibility Study

Pasofino Gold Limited (TSXV: VEIN) (OTCQB: EFRGF) (FSE: N07A) (“Pasofino” or the “Company“) is pleased to announce that further to Pasofino’s press release on November 1, 2022 (the “November 1 Press Release“), announcing the exercise by Pasofino of its right to acquire 100% (prior to giving effect to the Government of Liberia’s 10% carried interest) of the Dugbe Gold Project from Hummingbird Resources plc (“Hummingbird“) (the “100% Vend-In“), Pasofino and Hummingbird have commenced a joint strategic review process in order to maximize value for 100% (prior to giving effect to the Government of Liberia’s 10% carried interest) of the Dugbe Gold Project.

Krisztian Toth, Chairman of the Board of Pasofino, commented:

“We are delighted to announce the joint strategic review process being undertaken with Hummingbird to showcase the Dugbe Gold Project internationally and to unlock the tremendous potential and value of the Dugbe Gold Project.”

Dan Betts, Chairman of the Board of Hummingbird, commented:

“We are excited to work with Pasofino to achieve a positive result in connection with the joint strategic review process in respect of the Dugbe Gold Project.”

Pasofino’s board of directors has determined it is timely, prudent, and in the best interests of the Company and its stakeholders that Pasofino and Hummingbird engage in a joint strategic review process, in light of Pasofino exercising the 100% Vend-In in order for Pasofino to acquire the Dugbe Gold Project and given the expressions of interest received to date by the Company.

Highlights of the Dugbe Gold Project

- Strong financial metrics:

- Pre-tax NPV5% of USD690M (USD530M post-tax), 26.35% IRR (23.6% post-tax) at a base gold price of USD1,700/oz.

- Fast capital payback of approximately 3.5 years from start of production:

- Life of mine (LOM) All In Sustaining Cost (AISC) of USD1,005oz and USD29/t cash cost[1].

- Pre-production capital requirement of USD397M excluding owners’ costs for a 5Mtpa processing plant.

- Large Mineral Reserve with potential for expansion:

- 2.27Moz gold produced over a 14-year LOM.

- Average annual production of 200,000oz for the first 5 years.

- 2.76Moz of Mineral Reserves.

- Additional 67koz of Inferred Mineral Resources within the FS pit and immediate sidewalls which have not been included in the Mineral Reserves.

- Simple project with economies of scale:

- LOM strip ratio of 4.21:1 highlighted by a low 3.56:1 ratio in the first five years.

- Simple (Gravity-CIL) process flow sheet which enhances project economics.

- Low power costs of USD0.175/kWh, with opportunities for long-term savings with alternative renewable energy sources.

Strategic Review

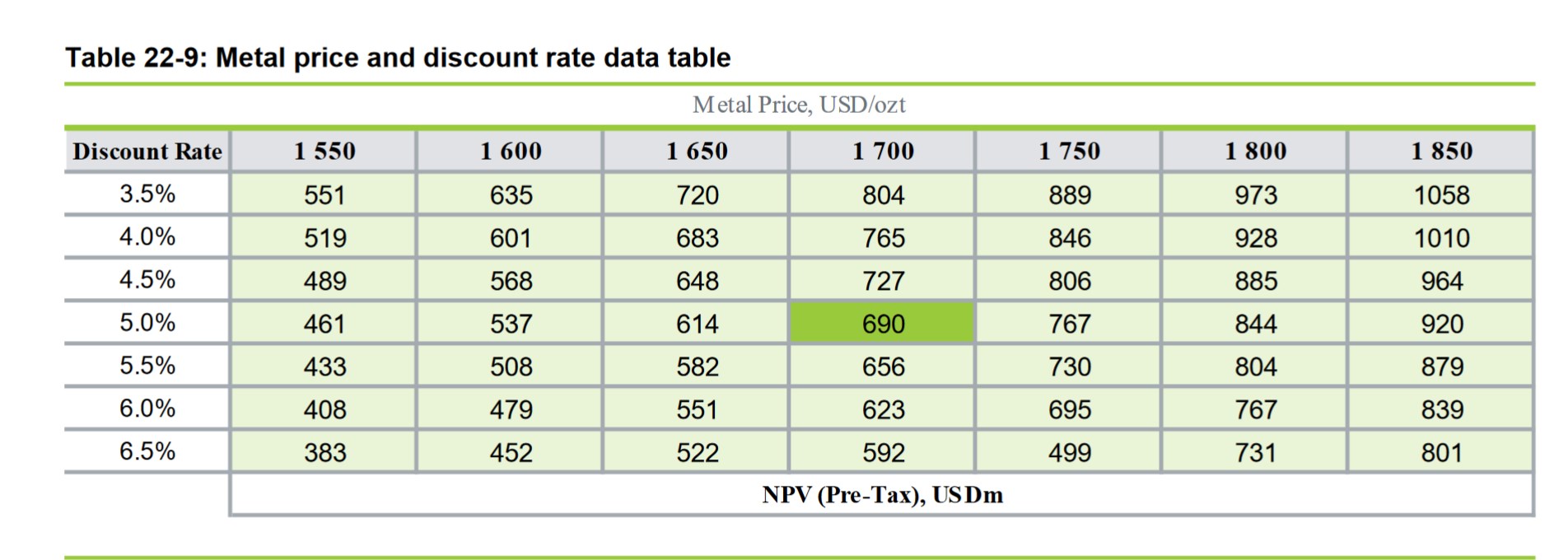

The joint strategic review process is being initiated as it is Pasofino’s view that the Dugbe Gold Project is significantly undervalued based on historical expenditures, current gold prices and the results of the recently completed Feasibility Study (which used a USD 1,700/oz gold price in the economic analysis for the Feasibility Study – see the Pasofino press released dated June 13, 2022). Total historical expenditures by Hummingbird and Pasofino on the Dugbe Gold Project is approximately USD100M. The impact of flexing gold price and discount rate on NPV (pre-tax) was assessed in the Feasibility Study and is presented below:

It is management’s view that based on the foregoing, the initiation of a joint strategic review process with Hummingbird is required in order for the Dugbe Gold Project to be appropriately valued by the market and in order to maximize value for the shareholders of Pasofino.

To date, several interested parties have engaged in discussions with Pasofino and Hummingbird in respect of the Dugbe Gold Project and each of Pasofino and Hummingbird are continuing discussions with interested parties. Pasofino’s intention is to disclose developments with respect to the strategic review when the board of directors has approved a specific transaction or course of action or otherwise determines that disclosure is necessary or appropriate. Pasofino cautions that there are no assurances or guarantees that the strategic review will result in a course of action or transaction or, if a course of action or transaction is undertaken, the terms or timing of such course of action or transaction. Pasofino has not yet set a definitive schedule to complete its identification, examination, and consideration of strategic alternatives. As a result of the 100% Vend-In of the Dugbe Gold Project to Pasofino, Pasofino anticipates that an additional financial advisor will be appointed in due course.

Independent Review/Project Optimization

Due to the recent normalization of pricing and supply factors post-COVID, Management is undertaking the following initiatives to potentially rationalize project economics of the Dugbe Gold Project:

- Review of the initial capital cost and operating costs assumed in the Feasibility Study (“FS”) filed under the Company’s profile at www.sedar.com on August 1, 2022, which included elevated cost estimates arising from extraordinary inflation from the COVID pandemic which have since subsided.

- Review of run-of-river hydropower options that could provide long-term, affordable renewable energy to the project in addition to the currently planned LNG/solar power mix.

- Review of LNG supply logistics and solar generation costs to improve the overall levelized cost of energy supplied to the project.

- Re-assessment of the process flow diagrams and mining schedule to potentially improve metallurgical recovery.

- Increasing focus on Environmental, Social, and Governance (ESG) matters through initiatives such as a comprehensive Resettlement Action Plan and a sustainable forestry project, the latter of which could be both carbon net positive and protective of sensitive habitat. Existing project design features include:

-

- Project layout adjusted to avoid areas of high biodiversity and sensitive wetlands.

- Treatment of TSF water to meet effluent standards prior to discharge – tailings geochemistry indicates the presence of potentially acid forming (PAF) material.

- Fully lined TSF designed to conform with Global Industry Management on Tailings Management (GISTM).

- Community development management plan framework prepared to guide identification and prioritisation of initiatives funded by the Company’s Mineral Development Agreement (MDA) community fund.

In addition to the FS upside there are exploration opportunities that Pasofino is actively considering, including drill-ready targets within a 10km radius of the planned mine-site. The intended exploration targets have either actively (artisanal) mined gold, or gold in the Company’s trench samples, all from fresh rock (i.e., not simply gold in soil or laterite).

100% Vend-In

Further to the November 1, 2022 Press Release, Pasofino is in the process of preparing the documentation required to obtain shareholder and TSX Venture Exchange approval for the 100% Vend-In. The Company will provide an update at the time the Management Information Circular is mailed and when TSX Venture Exchange approval is obtained.

The TSX Venture Exchange has not approved or disapproved of the information contained herein.

ABOUT THE DUGBE GOLD PROJECT

The 2,559 km2 Dugbe Gold Project is in southern Liberia and situated within the southwestern corner of the Birimian Supergroup which is host to most West African gold deposits. To date, two deposits have been identified on the Project; Dugbe F and Tuzon discovered by Hummingbird in 2009 and 2011 respectively. The deposits are located within 4 km of the Dugbe Shear Zone which is thought to have played a role in large scale gold mineralization in the area.

A significant amount of exploration in the area was conducted by Hummingbird up until 2012 including 74,497 m of diamond coring. Pasofino drilled an additional 14,584 metres at Tuzon and Dugbe during 2021. Both deposits have Mineral Resource Estimates dated 17 November 2021 with total Measured and Indicated of 3.3 Moz with an average grade of 1.37 g/t Au, and 0.6 Moz in Inferred. Following the completion of the Feasibility Study in June 2022 a Mineral Reserve Estimate was declared, based on the open-pit mining of both deposits over a 14-year Life of Mine. A technical report for the Dugbe Gold Project was prepared in accordance with National Instrument 43-101 and filed on SEDAR at www.sedar.com and on the Company’s website.

QUALIFIED PERSONS STATEMENT

Scientific or technical information in this disclosure that relates to exploration results was prepared and approved by Mr. Andrew Pedley. Mr. Pedley is a consultant of Pasofino Gold Ltd.’s wholly-owned subsidiary ARX Resources Limited. He is a member in good standing with the South African Council for Natural Scientific Professions (SACNASP) and is as a Qualified Person under National Instrument 43-101.

About Pasofino Gold Ltd.

Pasofino Gold Ltd. is a Canadian-based mineral exploration company listed on the TSX-V (VEIN).

Pasofino, through its wholly-owned subsidiary, owns a 49% economic interest (prior to the issuance of the Government of Liberia’s 10% carried interest) in the Dugbe Gold Project (the “Project”).

Pasofino has exercised its option to consolidate ownership in the Project by converting Hummingbird Resources Plc’s 51% ownership of the Project for a 51% shareholding in Pasofino, such that Pasofino would own 100% of the Project (prior to the government of Liberia’s 10% carried interest), subject to the receipt of all required approvals including the TSX Venture Exchange and shareholder approval.

For further information, please visit www.pasofinogold.com or contact:

Lincoln Greenidge, CFO

T: 416 451 0049

E: lgreenidge@pasofinogold.com

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking statements” that are based on expectations, estimates, projections and interpretations as at the date of this news release. Forward-looking statements are frequently characterised by words such as “plan”, “expect”, “project”, “seek”, “intend”, “believe”, “anticipate”, “estimate”, “suggest”, “indicate” and other similar words or statements that certain events or conditions “may” or “will” occur, and include, without limitation, statements regarding the ability to raise the funds to finance its ongoing business activities including the acquisition of mineral projects and the exploration and development of its projects. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors may include, but are not limited to, the ability to successfully complete the strategic review process, the ability to obtain all requisite regulatory approvals including the approval of the TSX Venture Exchange, the results of business operation, the results of exploration activities; the ability of the Company to complete further exploration activities; timing and availability of external financing on acceptable terms and those risk factors outlined in the Company’s Management Discussion and Analysis as filed on SEDAR. The Company does not undertake to update any forward-looking information except in accordance with applicable securities laws.