Power One Resources Corp. Advances Exploration of Battery Metals and Rare Earth Elements in Canada

In a recent report published International Energy Agency (IEA), “Global Critical Minerals Outlook 2024”, mineral demand for critical minerals will double by 2030, and quadrupling by 2040. Copper, essential for connecting an increasingly electrified energy system, will see the largest production volume increase. Meanwhile, the need for nickel, cobalt, and rare earth elements will double by 2040.

The combined market value of key energy transition minerals—including copper, lithium, nickel, cobalt, graphite, and rare earth elements—is projected to more than double, reaching USD 770 billion by 2040. Currently valued at approximately USD 325 billion, these minerals already match the market value of iron ore. By 2040, the market value of copper alone is expected to reach that scale.

Recently listed, Power One Resources [PWRO-TSXV] is taking advantage of this growing demand, particularly as nations push towards decarbonization and renewable energy initiatives. The Company focuses on the exploration and acquisition of critical minerals, specifically in the area of energy metals and rare earth elements. The company’s objectives are centered on harnessing resources essential for modern technologies, particularly in the automotive and energy sectors.

The Company has made significant strides in expanding its portfolio with the acquisition of key land holdings in Canada that are rich in uranium, nickel, platinum group metals, and other critical minerals. This strategic positioning ensures that the company remains relevant in a rapidly evolving market that increasingly prioritizes sustainability and the availability of rare earth materials.

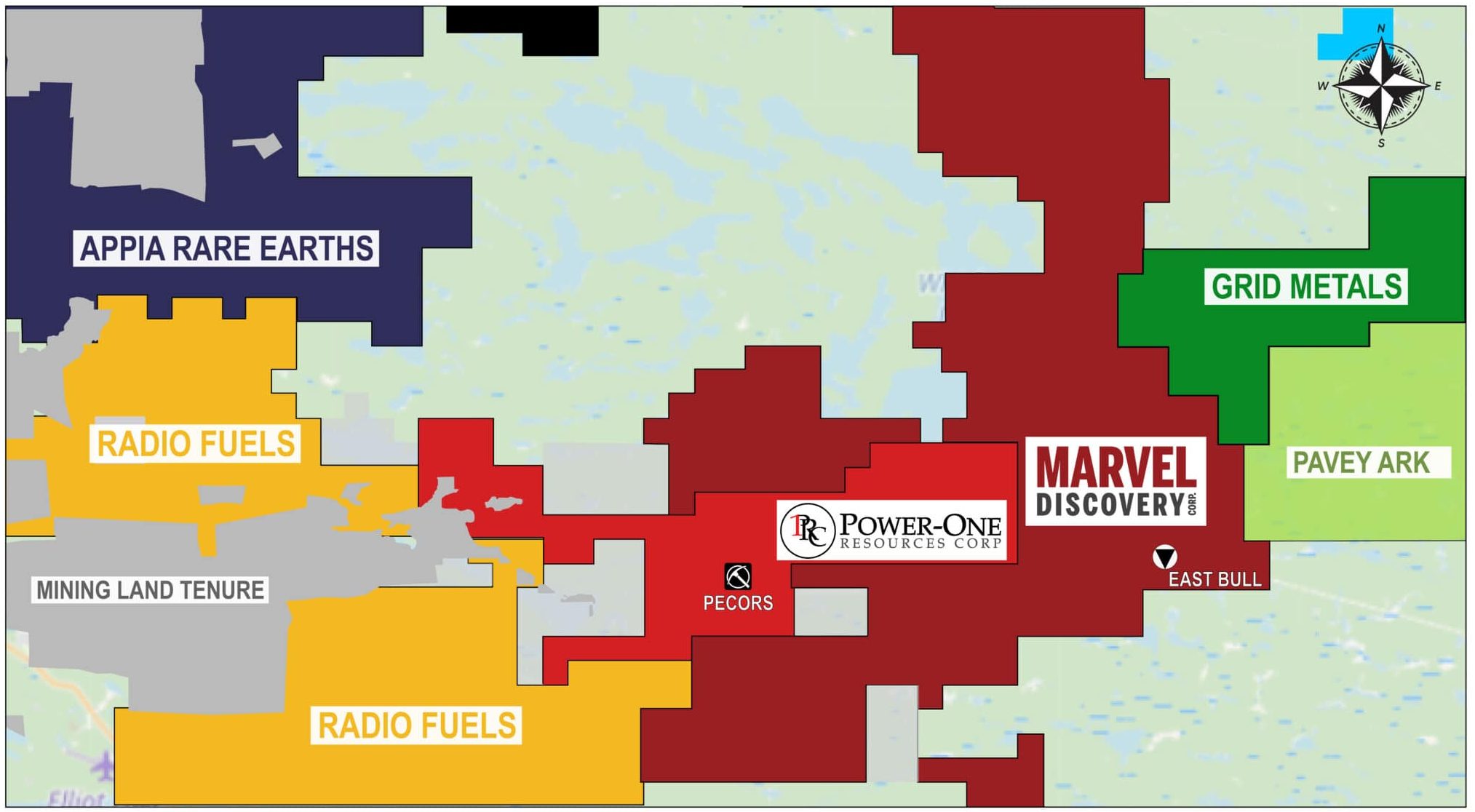

One of the company’s primary assets is the Pecors Property, which has undergone extensive exploration activities. International Montoro Resources previously conducted three drilling campaigns on this property from 2007 to 2015, covering nearly 5,944 meters. This property is believed to host magmatic copper, nickel, uranium and PGM mineralization, which are important energy metals.

One of the company’s primary assets is the Pecors Property, which has undergone extensive exploration activities. International Montoro Resources previously conducted three drilling campaigns on this property from 2007 to 2015, covering nearly 5,944 meters. This property is believed to host magmatic copper, nickel, uranium and PGM mineralization, which are important energy metals.

Power One Resources reported they have commenced drilling on the Pecors Property in an announcement dated July 11, 2024. Mr. Karim Rayani, Chief Executive Officer stated, “We are very excited to get the drills turning, The Pecors Property is a dynamic piece of ground holding a massive 7km by 3 km wide anomaly. The project holds significant potential for Ni-Cu-PGM mineralization and uranium and rare-earth oxide mineralization. The nearby Eco Ridge Project with almost 60 Mt of uranium and rare-earth oxide resources further adds merit to the Project area.”

The Pecors Property consists of ten mining claims encompassing approximately 1,840 hectares (115 units) in the Sault Ste. Marie Mining Division, Elliot Lake area of Northern Ontario. The Pecors East Zone within this property hosts a non-43-101 indicated resource of 20,000,000 tons, grading 0.037% U308, equivalent to 14,800,000 pounds of U308 based on limited drilling which indicates potential for expansion in the Pecors East Zone. The Property also lies immediately east of Radio Fuels Corp. [CSE-CAKE] Eco Ridge Project where indicated resources total 22.306 Mt grading 0.045% U3O8 and 1,613 ppm REO (rare-earth oxides) and inferred resources of 36.955 Mt grading 0.046 % U3O8 and 1,560 ppm REO.

Geological surveys and drilling initiatives have led to the identification of promising anomalies. Detailed analyses indicate that the lithologies in the region are favorable for high-grade hydrothermal-type mineralization. This positions Power One Resources to leverage the exploratory data and enhance its resource base.

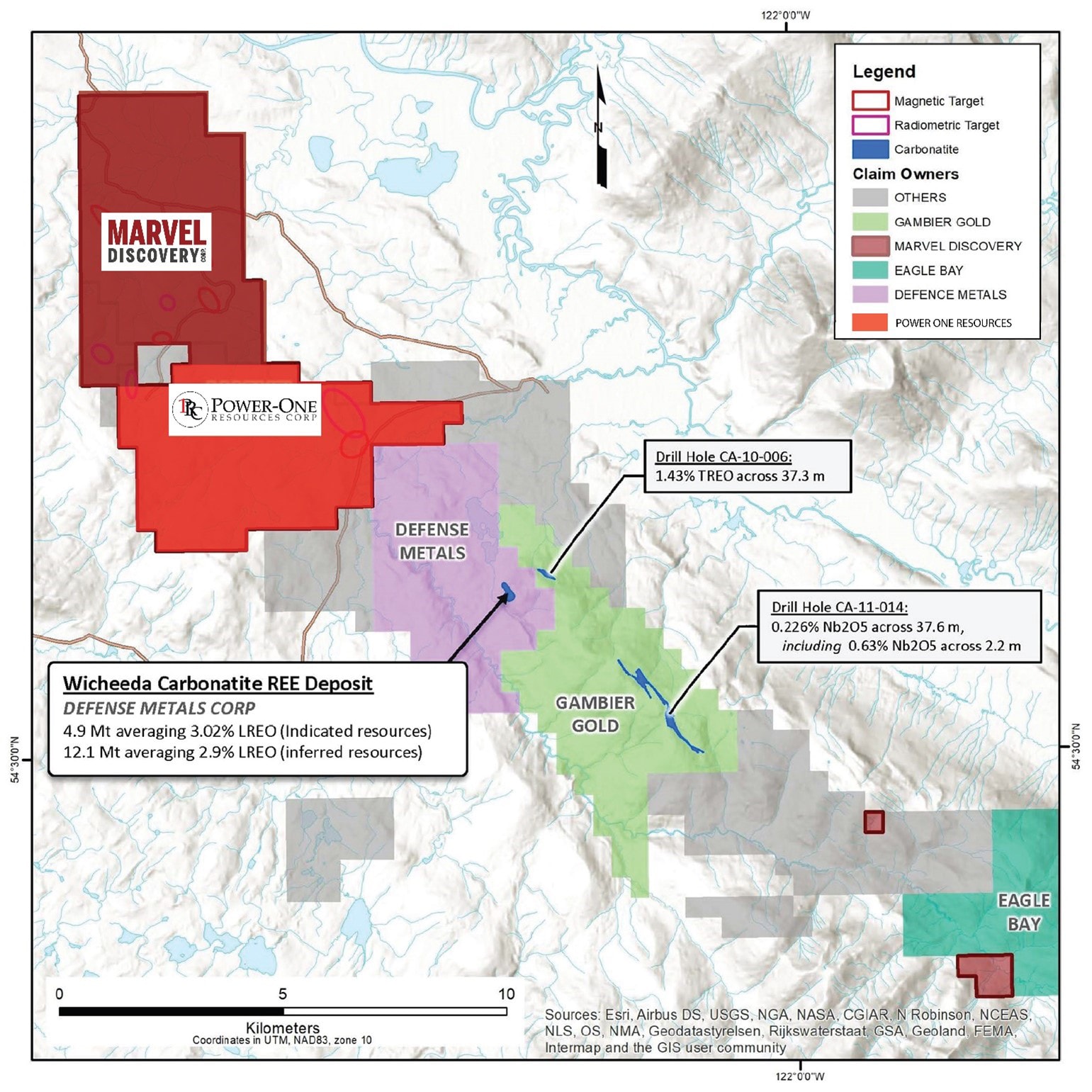

Equally notable as one of the largest landholders in the Rocky Mountain Rare Metal Belt is the Wicheeda rare earth project, located in close proximity to well-established rare earth mineral deposits in British Columbia including Defense Metals Corp. [DEFN-TSXV]. Defense Metals has made substantial progress on their Wicheeda Property, reporting an indicated resource of 4.89 million tonnes (Mt) at 3.02% light rare earth oxide (LREO), with an additional inferred resource of 12.1 Mt at 2.90% LREO. These impressive figures have set the bar high for the region and suggest significant potential for neighboring properties. Power One Resources has entered into acquisition agreements related to over 1,444 hectares of claims adjoining the Wicheeda area.

Equally notable as one of the largest landholders in the Rocky Mountain Rare Metal Belt is the Wicheeda rare earth project, located in close proximity to well-established rare earth mineral deposits in British Columbia including Defense Metals Corp. [DEFN-TSXV]. Defense Metals has made substantial progress on their Wicheeda Property, reporting an indicated resource of 4.89 million tonnes (Mt) at 3.02% light rare earth oxide (LREO), with an additional inferred resource of 12.1 Mt at 2.90% LREO. These impressive figures have set the bar high for the region and suggest significant potential for neighboring properties. Power One Resources has entered into acquisition agreements related to over 1,444 hectares of claims adjoining the Wicheeda area.

Mr. Rayani, commented on the strategic importance of the Wicheeda North property, “Our proximity to Defense Metals’ successful project gives us great confidence in the potential of our Wicheeda North property. We believe that the geological similarities between the properties could translate into significant discoveries for Power One.”

The Wicheeda properties are situated approximately 80 km northeast of Prince George and about 50 km east of Bear Lake in British Columbia, are conveniently accessible via all-weather gravel roads and are in close proximity to major infrastructure such as power transmission lines, railways, and major highways. Geologically, these properties lie within the Foreland Belt and the Rocky Mountain Trench, a significant continental geological feature.

The Foreland Belt includes part of an extensive alkaline igneous province that extends from the Canadian Cordillera to the southwestern United States and contains numerous carbonatite and alkaline complexes. Among these, the Aley (niobium), Rock Canyon (REE), and Wicheeda (REE) complexes are notable for their high concentrations of Rare Earth Element minerals.

Power One Resources Corp. presents significant opportunities in the acquisition and exploration of battery metals and rare earth elements in Canada. Leveraging a skilled management team with extensive experience in financial management, project development, and mineral exploration, Power One is well-equipped to capitalize on the burgeoning market for battery metals, thus offering a compelling opportunity for investors seeking exposure to this vital sector of the future economy.

Power One Resources has 33,218,597 shares outstanding trading at C$0.045 cents giving it a market cap of approximately C$ 1.5m as of July 30, 2024.