Roughrider Generates 10 Drill Targets along Empire Mine Multi-Kilometer Trends

Roughrider Exploration Limited (“Roughrider” or the “Company”; TSX-V: REL) is pleased to announce the results from the historical data review of its road accessible 15,764 hectares Empire Mine Property (the “Property“) located on northern Vancouver Island, which can be explored almost all year round. Roughrider has an option to acquire a 100% interest in the Property by making staged cash and share payments and completing certain expenditure commitments (as announced September 24, 2020).

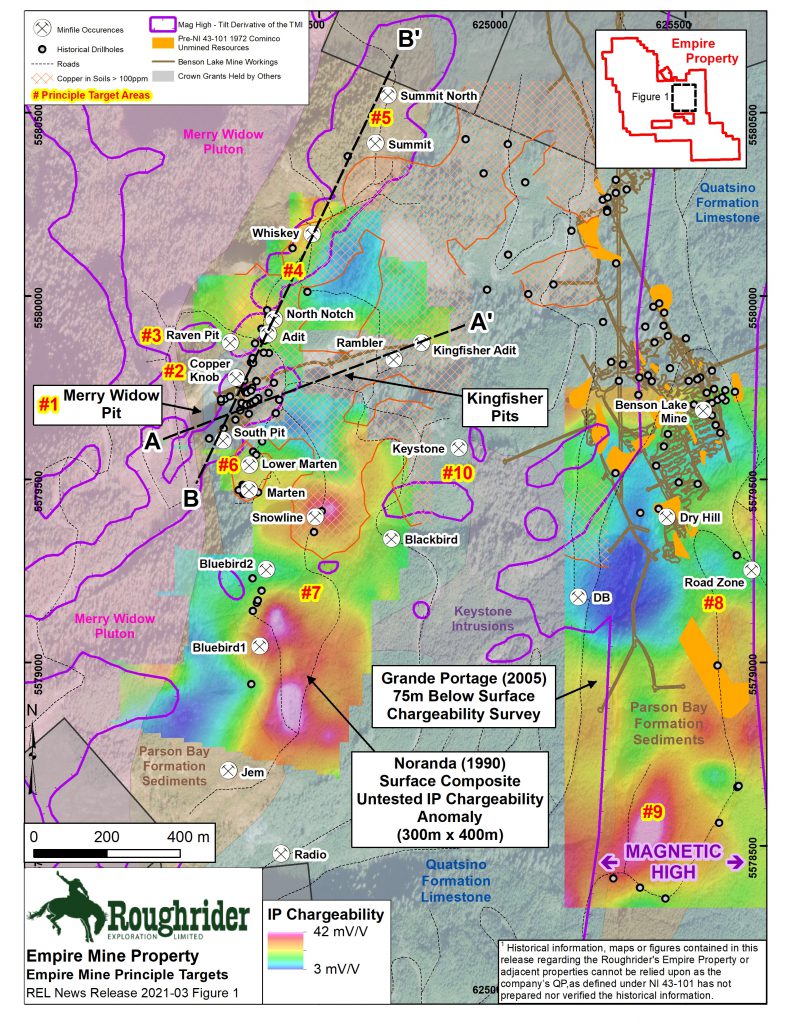

The Empire Mine consists of a series of former workings (open pit and underground), outcroppings and anomalies identified by previous exploration including drilling. The footprint of the main exploration target area covers approximately 400 hectares (2 kilometer (“km”) x 2 km) with 10 principal target zones outlined (see Figure 1). Roughrider believes that through a comprehensive review of historical data and information leading to systematic exploration across the entire Property using modern techniques it will be able to significantly advance the Property.

Figure 1

Adam Travis, Roughrider CEO and Director comments: “We recognized the copper-gold exploration potential at Empire from our first property examination and our initial review of historical records. It was clear that historic exploration focused on only two zones: Empire Mines Merry Widow and Kingfisher open pits and the underground Benson Lake mine operated by Cominco in the 1970s. Our compilation work is indicating at least 10 principal targets in a 2 km x 2 km area around these former producing mines. It is also important to note that these targets are concentrated in <5 % of the overall property, indicating it’s a great starting point but we’ve a much larger area still to evaluate. Indeed, through analyzing the last significant work programs, we have greatly advanced our knowledge of the entire Property and generated several significant exploration targets that were not tested during the last phase of these historical exploration programs which took place relatively recently between 2006 and 2010.”

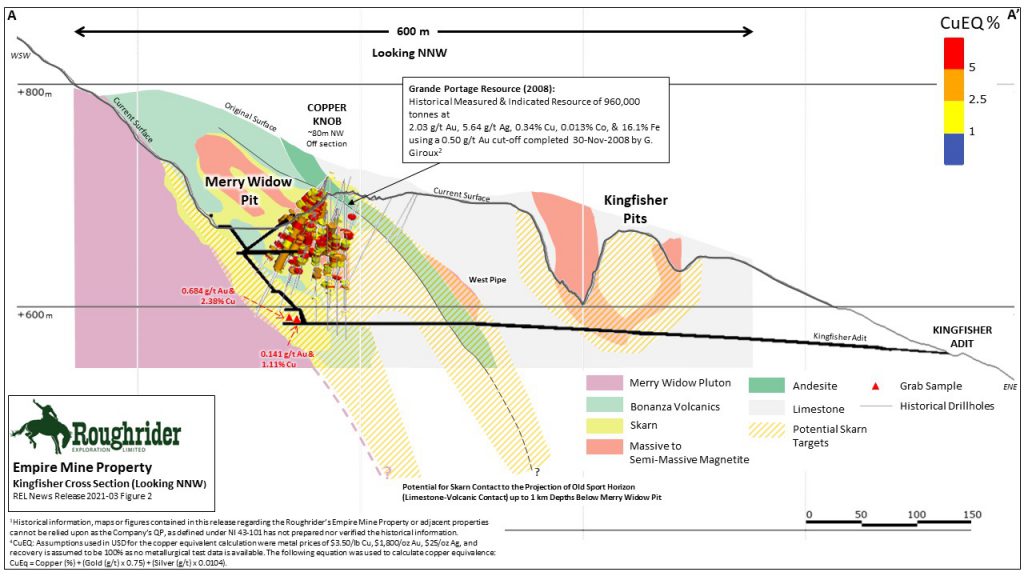

In November 2008, Grande Portage published a 43-101 technical report on the Merry Widow open pit of 960,000 tonnes at 2.03 grams/tonne (“g/t”) Gold (“Au”) and 0.34% Copper (“Cu”) ¹ & ². The historical results published in this news release highlight significant additional areas for potential discoveries both along strike and down dip, and along the main trends associated with the past producing Merry Widow open pit mine and Benson Lake underground mine (see Figures 1,2 & 3).

Historical records and maps from 1972, when Cominco Ltd. operated the Benson Lake Mine, indicate 454,500 tonnes at 0.59 g/t Au and 1.3 % Cu classified as “measured and indicated” and a further 2,700,000 tonnes at 1.7% Cu ³ (no Au grade estimated) to the 2100 level as of December 31, 1972 classified as “inferred”. While Roughrider notes that Cominco’s historical results are not NI 43-101 compliant and have not been verified by the Company’s QP, these combined historical resources total nearly 3.154 million tonnes and will help guide Roughrider’s exploration programs for 2021.

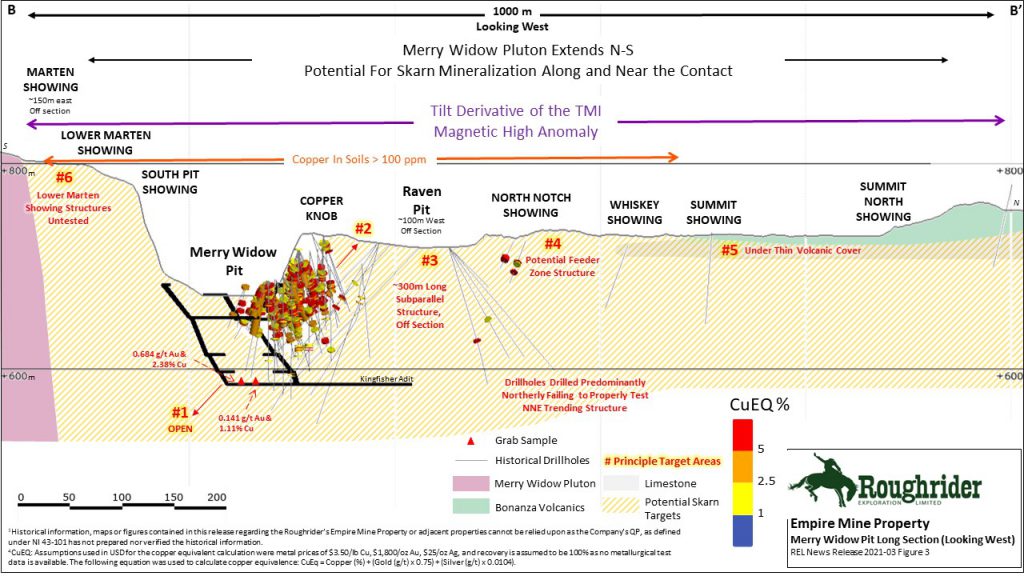

Roughrider’s historical review work has also identified considerable exploration potential along the 1 km “Merry Widow Trend” with at least 10 mineral showings having coincident airborne magnetic highs and anomalous copper values in soils on trend with the historical 2008 resource; and a 1 km trend south of the Merry Widow Pit with 5 mineral showings, copper in soil anomalies. In addition, a newly recognized and never publicly reported IP survey indicates an untested 300 m x 400 m chargeability anomaly ³ (see Figure 1).

Please refer to Figures 1, 2 & 3 that show Roughrider’s Cu-Au exploration targets at the Empire Mine Property. Per the Company’s news release of December 8, 2020, an initial budget of $1 million has already been approved from the existing treasury to advance exploration as soon as permits are forthcoming and is expected to include up to 5,000 m of drilling.

Empire Mine Property – 1 km NNE Merry Widow Cu-Au Trend

Target #1: Down Dip of Historical Merry Widow Resource: Compilation of the 2008 Grande Portage historical resource in the context of historical underground sampling and geological mapping has indicated prospective areas down dip and down plunge of the historical resource towards the Merry Widow Pluton that have not been tested.

Target #2: Along Strike to the North of the Merry Widow Resource (Copper Knob/Gossan Zone): This area appears to be the up dip and the northerly projection of the 2008 historical resource where Roughrider previously reported channel sampling results (as announced October 20, 2020) highlighted by results from Copper Knob returning 9.77 g/t Au and 2.35% Cu across 10.5 m. Although a few previous drillholes were collared in this area they were either not sampled and/or not collared to adequately test the orientation of the mineralization noted in our channel sampling.

Target #3: Subparallel Mineralized Structure Never Drilled (Raven Pit): The Raven magnetite body is located at the southwesterly end of a >300 m long northeasterly trending zone of greenstone associated with a northeasterly trending fault that is approximately 100 m west of the Merry Widow trend. The pit was excavated in the 1960’s and is now completely covered by surrounding waste rock piles but reportedly consisted of magnetite with associated sulphides pyrrhotite, pyrite, sphalerite and chalcopyrite. High sulphide content made the magnetite deposit uneconomic, and after extracting some 20,000 tonnes, the pit was abandoned âµ. No exploration drilling appears to have been undertaken at the Raven Pit or along its northeasterly trending fault structure.

Target #4: Along Strike to the North of the Merry Widow Resource (North Notch-Whiskey): Channel Sampling by Roughrider of the North Notch Showing (as announced October 20, 2020) has returned values of up to 0.70 g/t Au and 2.43% Cu across 5.1 m. Seven historical drillholes have been drilled in this area and have returned values up to 8.57 g/t Au and 0.72% Cu across 5.0 m in drillhole DDH89-030 â¶At Whiskey Jack, skarn mineralogy consists of diopside, garnet, epidote, actinolite and chlorite. Diamond drilling has indicated a mineralized zone that measures 90 m by 45 m â·. The zone strikes northeast and dips steeply to the southeast. These historical drillhole intercepts and mineralized surface outcrops have encouraging results and future exploration is warranted.

Target #5: Along Strike to the North of the Merry Widow Resource (Summit -Summit North): Chip sampling by Roughrider in the Summit Showing Area (as announced October 20, 2020) of sulphidized volcanics have returned values of 0.16 g/t Au and 0.11% Cu over 17.0 m. Elsewhere on the Property, the contact between the underlying limestones and overlying volcanics or sediments is a favourable setting for mineralization. Copper in soil anomalies are noted in the underlying limestones to the east and this, along with the magnetic trend from Merry Widow, suggest the potential for underlying mineralization beneath the shallow volcanic cap rocks. Two drillholes in the area were dominated by volcanics with weakly anomalous gold and copper, and better testing of the favourable horizons and structures is required.

Target #6: Along Strike to the South of the Merry Widow Resource (Marten, Lower Marten and South Pit): Two mineral showings and an arm of the Merry Widow Pit (South Pit) occur over a 250 m strike south of the Merry Widow Pit where the primarily NNE trend warps into a more north-south trend. The Marten showing was channel sampled by Roughrider (as announced October 20, 2020) and returned values of 2.89 g/t Au and 0.32% Cu across 10.0 m. Substantial amount of drilling was undertaken on the Marten showing in 2007 which indicates that known mineralization forms a < 5 m thick zone of massive magnetite and pyrrhotite near the limestone/volcanic contact over a < 50 m strike. Drillhole MW07-72 intercepted 4.50 m grading 9.25 g/t Au and 0.702 % cobalt (“Co“) â¸.  The Lower Marten showing was the location of five drillholes which were abandoned and failed to test the target. Mineralization at Lower Marten appears to cut up through limestones unlike the blanket style mineralization at Marten. This 250 m area south of the pit remains a high priority where the projected mineralized trends intersect the Merry Widow Pluton and where substantial albeit narrow gold, copper and cobalt values have been returned.

Empire Mine Property – 1 km South Merry Widow Cu-Au Trend

Target #7: Snowline, Bluebird 1, Bluebird 2, Jem and Radio: These 5 mineral occurrences occur along a 1 km trend south of the Merry Widow Pit. Channel sampling by Roughrider at Snowline (as announced October 20, 2020) returned 5.37 g/t Au and 0.32% Co across 1.0 m and at Bluebird 2 returned 3.17 g/t Au and 0.22% Cu across 2.0 m. Grab samples in the Bluebird 1 showing returned 11.2 g/t Au and 2.13% Cu. Digitization and data input of a 1990 Noranda IP Survey indicates a 200 m in diameter IP chargeability anomaly at Snowline and a 300 m x 400 m chargeability high downslope of the Bluebird 1 & 2 showings which appears untested ³.  Drilling in 1990-1991 at Bluebird 1 and 2 included 6 drillholes totaling 202.1 m (4 drillholes from 1990 which totaled 48.9 m were noted with no assays or geology). Drillhole NMW91-49 intersected 1.67 m grading 0.367 g/t Au and 0.17% Cu from 59.84 m â¹. The Snowline showing was drilled by 2 drillholes in 2007 located along a road and failed to return significant results but also appear to have not properly tested underneath the showing or an adjacent Airborne EM Anomaly. The Company is encouraged by the presence of showings and anomalous rock and drill results which cluster around these untested geophysical anomalies.

Two other showings (Jem and Radio) occur further to the south where only modest work has noted skarn style mineralization.

Empire Mine Property – 1 km South Benson Lake Cu-Au -Trend

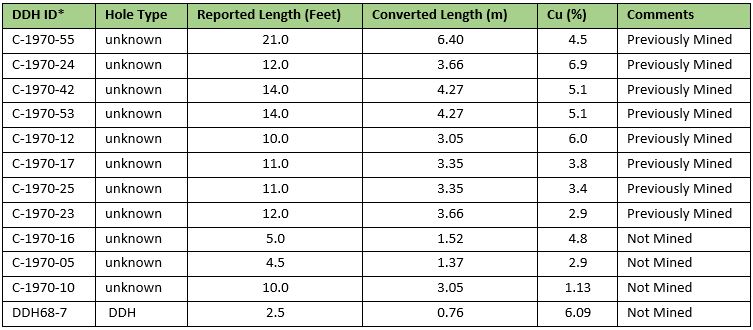

Target #8: Road Showing and Cominco Resource Block: The Road Showing was channel sampled by Roughrider (as announced October 20, 2020) and returned 0.19 % Cu across 6.5 m. The area was tested with 1 drill hole in 2006 (MW06-24) which intersected 1.04m of skarn alteration at the contact zone. Near the Cominco Resource Block drillhole MW07-51 was drilled and intersected 1.5m grading 0.11 g/t Au and 0.72% Cu from 327.0 m â¸. Drillhole MW06-25 drilled from the same location intersected 2.54 m grading 0.65 g/t Au and 0.27% Cu from 266.6 m ¹â°. These drillholes appear to have not properly tested the historic resource area defined by Cominco, which had historic underground drill intercepts of 0.76m grading 6.09% Cu, which were noted in a 1972 plan map ¹¹.

Target #9: Coincident Magnetic and Chargeability High 1 km South of Benson Lake Mine:   A 300 m diameter IP Chargeability is located within a prominent magnetic high trend 1 km south of the Benson Lake Mine. Drilling in the area included 4 drill holes (MW06-27, MW07-52, MW07-53, and MW07-54) that were located along the road and were all vertical holes that were drilled outside of the coincident chargeability and magnetic anomaly. The holes were dominated by the Quatsino limestone with some greenstone dikes and intermittent volcanic units and minor skarn altered intervals. The best intercept reported was in drillhole MW07-54 which intercepted 0.63 m grading 1.20 g/t Au and 5.25% Cu from 710.82 m and 3.49 m grading 0.38 g/t Au and 0.57% Cu from 732.70 m â¸. Although these intercepts are deep, they are considered very encouraging at the same horizon as the Benson Lake Mine nearly 1 km away especially given that they did not even test the main chargeability anomaly.

Empire Mine Property – Between the Benson Lake and Merry Widow Trend

Target #10: Keystone Intrusion: This area is located southwest of the Benson Lake Mine in an area mapped as underlain by the Keystone intrusions which have been noted at other showings and past producing mines on the property to have a close spatial association with mineralization. The Ministry of Mines Annual Report in 1960 shows several occurrences of magnetite in the area and this area is worthy of more prospecting and detailed surveys.

Figure 2

Figure 3

Appendix 1

Table 1: Merry Widow Significant Diamond Drill Intercepts ¹â°

Table 2: Benson Lake Mine – Old Sport Horizon Historical Underground Drill Drilling Significant Intercepts ¹¹

About Roughrider Exploration Limited

Roughrider’s current exploration focus is the Empire Mine Property, located on Northern Vancouver Island, B.C., which covers three historical open pit mines and two past-producing underground mines that yielded iron, copper, gold and silver. Roughrider’s other properties include its 100% owned Eldorado, Gin and Bonanza properties located in the Golden Triangle of northern B.C. which are adjacent to the Red Chris Mine as well as its 100% Sterling property which is located in central B.C. Roughrider management also continuously reviews strategic precious metals opportunities in western North America.

Qualified Persons

The scientific and technical information contained in this news release has been prepared, reviewed and approved by Wade Barnes, P.Geo. (British Columbia) of Tripoint Geological Services, Roughrider’s Geological Consultant and a Qualified Person (“QP“) within the context of Canadian Securities Administrators’ NI 43-101; Standards of Disclosure for Mineral Projects.

On Behalf of the Board of Directors:

“Adam Travis”

Adam Travis, Chief Executive Officer and Director

Â

For further information, please contact:

Adam Travis, CEO

Roughrider Exploration Limited

625 Howe Street, Suite 420

Vancouver, B.C. V6C 2T6, Canada

P: 250-878-7554

E: adam@roughriderexploration.com|

NR21-03

Cautionary Notes Related to this News Release and Figures

- Historical information, maps or figures contained in this release regarding the Roughrider’s Empire Mine Property or adjacent properties cannot be relied upon as the Company’s QP, as defined under NI-43-101 has not prepared nor verified the historical information.

- NI 43-101 Technical Report: Giroux, G.H., & Raven, W. (November 30, 2008). Technical Report on the Copper Gold Resources for the Merry Widow Property. Filed on SEDAR January 22, 2009. The 2008 Grand Portage resource estimate was completed by Gary H. Giroux, P.Eng, MASc, of Giroux Consulting Ltd. in Vancouver, B.C. The estimate was based on a 3D geological model integrating 4,448 metres of diamond drilling of 43 drill holes, 2,290 assays, with 104 down-hole surveys collected between June and December 2006. The resource was reported utilizing gold cut-off grades ranging from 0.10 g/t to 3.00 g/t gold, as more particularly set out in the report. A complete copy of the report is available on Grand Portage’s public filings on SEDAR (www.sedar.com). A gold cut-off grade of 0.50 g/t gold was selected as representing one possible mining scenario. For the purposes of the calculations, lognormal cumulative frequency plots were used to assess grade distribution to see if capping of high values was required and if so at what levels. For all elements, capping levels were established based on the individual grade distributions as follows: Gold — a total of 18 gold assays were capped at 32.0 g/t gold, Silver –a total of 9 silver assays were capped at 165 g/t silver, Copper — a total of 7 assays were capped at 11.7% copper, Cobalt — a total of 5 assays were capped at 0.48% cobalt, Iron — all iron assays were capped at 50% iron (the analytical detection limit).

- Province of British Columbia Property File, Statement of Material Facts: VSE 22/09/75, Quatsino Copper-Gold Mines Limited

- CuEq Equation: Assumptions used in USD for the copper equivalent calculation were metal prices of $3.50/lb. Copper, $1,800/oz Gold, $25/oz Silver, and recovery is assumed to be 100% as no metallurgical test data is available. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Gold (g/t) x 0.75) + (Silver (g/t) x 0.0104)

- British Columbia Assessment Report 19,178, Equinox Resources Ltd, September 1989

- Province of British Columbia Property File, Diamond Drilling Report On Merry Widow Property, PF012364, Taywin Resources Ltd

- British Columbia Minfile Record Summary, Minfile No. 092L047, Whiskey Jack

- British Columbia Assessment Report 30,002, Grande Portage Resources Ltd, April 2008

- Noranda Exploration Company, Drill Section Maps, February 1991, Private Files

- British Columbia Assessment Report 28,863, Grande Portage Resources Ltd, December 2006

- Cominco Resources, Drill Section Maps “Plan of Cominco’s Benson Lake Operations on Empire Claims Showing Ore Reserves & Proposed Exploration Program”, 1970, Private Files

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in this press release, including any information regarding the proposed Transaction, private placement, board and management changes, as to our strategy, projects, plans or future financial or operating performance, constitutes “forward-looking statements.” All statements, other than statements of historical fact, are to be considered forward-looking statements. Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable by Roughrider, are inherently subject to significant business, economic, geological and competitive uncertainties and contingencies. Although Roughrider believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include but are not limited to: fluctuations in market prices, exploration and exploitation successes, continued availability of capital and financing, changes in national and local government legislation, taxation, controls, regulations, expropriation or nationalization of property and general political, economic, market or business conditions. Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance and, therefore, readers are advised to rely on their own evaluation of such uncertainties. All of the forward-looking statements made in this press release, or incorporated by reference, are qualified by these cautionary statements. We do not assume any obligation to update any forward-looking statements.