Rua Gold raising $8 million for New Zealand project

Rua Gold [RUA-CSE, NZAUF-OTC, A4010V-WKN] said it is arranged to raise $8.0 million from a brokered offering of common shares, with proceeds earmarked for continuing exploration at the company’s Reelton project in New Zealand and for general working capital and general corporate purposes.

The company said it has entered into an agreement with a syndicate of agents in connection with a public offering of 44.4 million common shares priced at 18 cents per share. The offering is expected to close on July 25, 2024.

The company said the agents have been granted the option to sell up to 6.7 million additional shares, equal to 15% of the shares offered, to cover over-allotments, if any. That option can be exercised for 30 days after the closing date. Rua Gold (formerly First Uranium Resources Ltd.) is a new entrant to the mining industry, specializing in gold exploration and discovery in New Zealand. With permits that have a rich history dating back to the gold rush in the late 1800s, Rua Gold said it combines traditional prospecting practices with modern technologies to uncover and capitalize on valuable gold deposits.

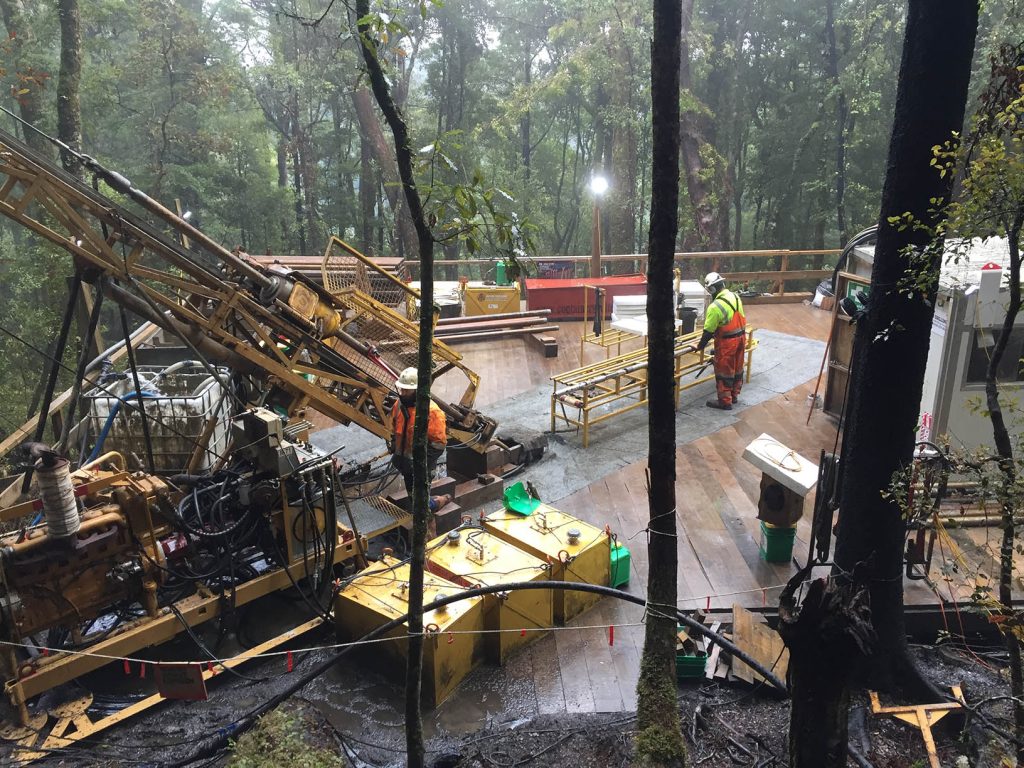

Historical mining in the Reefton Goldfield started in 1872, and by its close, had produced two million ounces of gold from high-grade underground operations in orogenic quartz veins systems.

In a press release on July 15, 2024, Rua said it had entered into a definitive share purchase agreement, enabling it to acquire 100% of the issued and outstanding shares of Reefton Resources Pty Ltd., a unit of Siren Gold Ltd [SNG-ASX], with tenements located adjacent to the company’s suite of properties in the Reefton Goldfield.

It said the transaction would establish Rua as the dominant landholder in the Reefton Goldfield on New Zealand’s South Island, with approximately 120,000 hectares of tenements. The company said the Reefton Goldfield is seeing a resurgence of interest, led by the construction of Federation Mining’s Blackwater mine, which is expected to produce 70,000 ounces of gold annually at an all-in-sustaining cost of US$738 an ounce.

Under the deal, Siren will receive A$2.0 million in cash ($1.8 million), of which A$1 million has been paid at the close of the transaction. Siren will also receive 83.9 fully paid shares of Rua, representing A$18 million ($16.6 million) to be issued at closing with agreed contractual resale restrictions.

Upon completion of the transaction, Siren will own 30% of Rua, and Siren Chairman Brian Rodan will join the Rua board. Rodan is a Fellow of the Australian Institute of Mining and Metallurgy with 48 years of experience. He was previously the owner and managing director of Australian Contract Mining Pty Ltd., a contract mining company.

On Thursday, Rua shares eased 5.0% or $0.01 to 19 cents. The shares trade in a 52-week range of 28 cents and 10 cents.