Scandium increases the value of Doubleview Gold’s Hat deposit

By Ian Foreman

Scandium has a relatively brief history. It was first discovered in 1879 by Swedish chemist Lars Fredrik Nilson who named it after ‘Scandia’, the Latin name for Scandinavia. Scandium is a transition metal, and some consider it a rare earth element. It is a relatively soft metal and has more similarities to the rare earth element yttrium than it has to aluminum and titanium. The isolation of scandium took several decades to accomplish, with the pure metal eventually being produced in the 1930’s. From the 1940’s through to today the uses for the metal have grown exponentially.

Scandium has great potential due to it having a low density like aluminum but a much higher melting point. This, combined with its exceptional strength-to-weight ratio, makes it a crucial component in lightweight, high-performance alloys. This property is especially beneficial in aerospace, where scandium-aluminum alloys reduce the weight of aircraft structures and thus enhance fuel efficiency. Scandium’s heat resistance and corrosion resistance make it ideal for high-temperature applications. Understandably, it is of particular interest to designers of spacecraft. Scandium also serves as a catalyst in the chemical industry by improving the efficiency of certain reactions. Furthermore, scandium can enhance the performance of high-end sports equipment by providing increased strength and durability while keeping the products lightweight.

The increasing focus on reducing carbon emissions and the transition to cleaner energy sources has further boosted the demand for scandium. This is being driven in particular by the growing demand for sustainable and eco-friendly technologies such as fuel cells, wind turbines, and lightweight vehicle components.

But uses aren’t limited to vehicles and equipment; a study at the University of Wisconsin has shown that scandium radioisotopes are potentially useful for medical imaging such as positron emission tomography scans. However, health care providers do not currently use these isotopes to image cancer because they are difficult to produce in the amounts and purities appropriate for human use.

Owing to its scarcity and limited production, scandium is one of the most expensive of all the natural elements. According to the CRM Alliance, Scandium is not traded on any metals exchange as scandium products are sold between private parties at undisclosed prices. Price for pure scandium fluctuates between $4,000 and $20,000 per kilogram.

Scandium production is relatively limited and geographically dispersed. The primary sources of scandium are found in Russia, China, and Kazakhstan. These nations extract scandium as a byproduct of rare earth element mining or uranium production. Worldwide scandium production is relatively small, estimated at only a few metric tons annually.

Although the demand for scandium has been growing, production capacity remains constrained. Continued research into more efficient extraction methods appears key to the metal being more readily available. That, or new sources of easily extractable scandium.

Doubleview Gold Corp. [TSXV-DBG; OTC-DBLVF; GER-A1WO38], with their wholly owned Hat Project, may just be sitting on the world’s largest concentration of easily extractable scandium. But the company didn’t identify the true potential of the deposit for many years.

Doubleview Gold Corp. [TSXV-DBG; OTC-DBLVF; GER-A1WO38], with their wholly owned Hat Project, may just be sitting on the world’s largest concentration of easily extractable scandium. But the company didn’t identify the true potential of the deposit for many years.

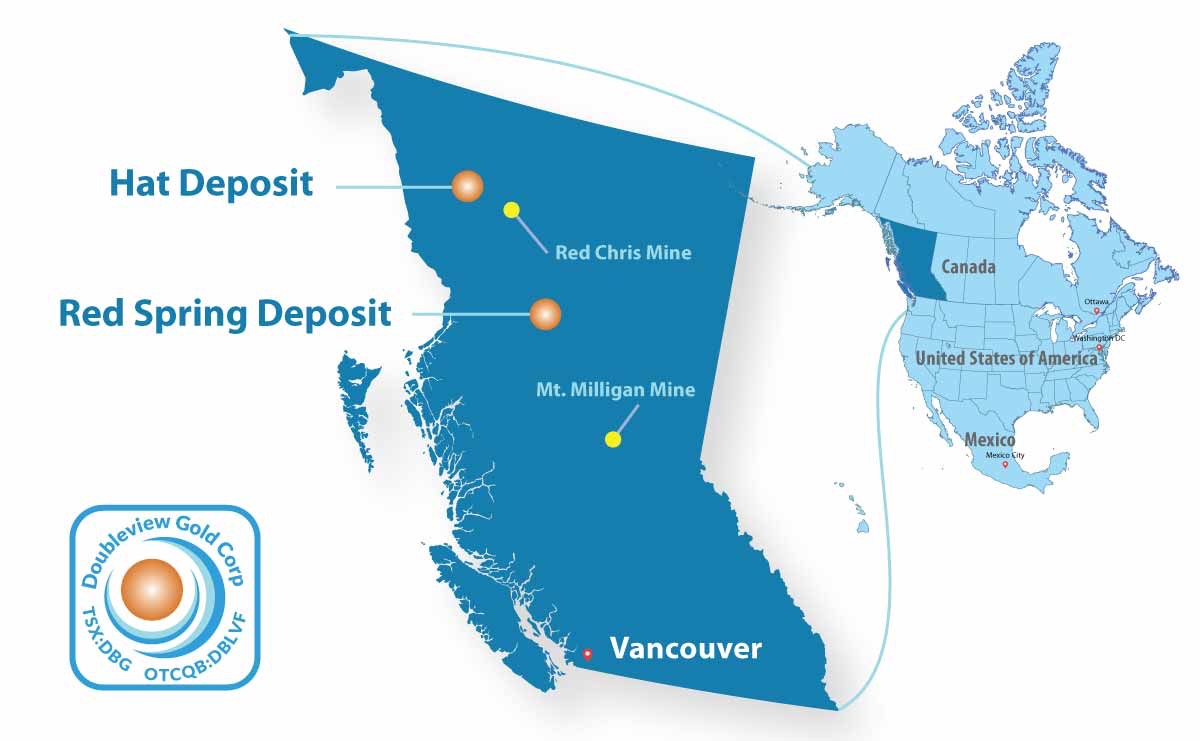

The company acquired the 6,308 hectare Hat Project as a greenfield prospect over a decade ago. It is located in northwestern British Columbia, 95 kilometres southwest of Dease Lake, which has grown considerably since the Red Chris mine was put into production.

The inaugural drill program discovered the Hat deposit and aggressive follow-up drilling resulted in the discovery of the Lisle Zone, a higher grade portion of the deposit. Further drilling in 2015, 2016 and 2021 confirmed the presence of a very large porphyry deposit. The dimensions of the deposit have yet to be determined and surface dimensions of the Lisle zone currently stand at 1,450 metres by 1,400 metres. This is a considerable footprint that compares favourably to the dimensions of the Mount Milligan deposit, which is currently Canada’s third largest copper mine.

Prior to 2021, all exploration at the Hat Project indicated that the project was host to an alkalic-type gold copper porphyry that had many similar characteristics in genesis, host rock types, alteration and mineralization to several important British Columbia mines, including Mount Polley, Mount Milligan, and Red Chris. But in 2021 all of that changed…

Prior to 2021, all exploration at the Hat Project indicated that the project was host to an alkalic-type gold copper porphyry that had many similar characteristics in genesis, host rock types, alteration and mineralization to several important British Columbia mines, including Mount Polley, Mount Milligan, and Red Chris. But in 2021 all of that changed…

It has long been understood that porphyry deposits have a wide variety of associated metals, including scandium, that occur in sufficient quantities that may be recovered as a byproduct.

Doubleview had noticed the presence of scandium, but a detailed analysis of their data showed that not only was there scandium in significant quantities but that is was relatively homogenous throughout the Hat deposit, which sets it apart from other porphyry systems.

The scandium occurs in all phases of the Hat deposit as exemplified by drill hole HO26 that contains an average of 29.2 g/t scandium over 799.5 metres.

“There is one significant issue with the scandium market”, stated Mr. Farshad Shirvani, president and CEO of Doubleview Gold, “and that is that no one has access to a large deposit. And this is a remarkable deposit that could solve that issue.”

“There is one significant issue with the scandium market”, stated Mr. Farshad Shirvani, president and CEO of Doubleview Gold, “and that is that no one has access to a large deposit. And this is a remarkable deposit that could solve that issue.”

However, having a large deposit containing scandium is one thing but being able to extract the notoriously stubborn element is another. This, yet again, is where the Hat deposit stands out from its peers.

Doubleview has performed a variety of advanced and innovative metallurgical tests on mineralization from the Hat deposit. These tests have resulted in scandium recovery into secondary products of greater than 90 per cent. Continued fine tuning is anticipated to increase the recovery of the scandium while decreasing the cost of extraction. The company is now performing metallurgical test work to determine processes to produce a final scandium product.

The company is taking advantage of a number of innovations and advancements in scandium extraction technologies that have improved efficiency, reduced costs, and minimized environmental impact. These include selective leaching, solvent extraction and ion exchange, as well as hydrometallurgical and electrochemical extraction.

But Doubleview isn’t just working on the metallurgy of the deposit. The company is diligently progressing the project. The Archaeology Branch of the Ministry of Forests has confirmed the findings in the company’s interim archeological impact assessment and determined that no additional archeological work is required within the proposed development areas of the interim archaeological impact assessment.

This year’s drilling is successfully expanding the size of the deposit with several hundred metre step outs. Drill hole H054, a 250 metre step out, returned 617.5 metres of 0.95 percent copper equivalent that included a higher-grade section of 143 metres of 0.43 grams per tonne gold, 0.32 percent copper, 27.3 grams per tonne scandium and 136.9 grams per tonne cobalt, which is 1.29 percent copper equivalent.

So far in 2023 the company has drilled approximately 8,700 metres in 14 drill holes. Drilling is going to continue for as long as weather permits with a target of 10,000 metres. The company then plans to incorporate all drill holes and metallurgical data into a resource estimate.

So far in 2023 the company has drilled approximately 8,700 metres in 14 drill holes. Drilling is going to continue for as long as weather permits with a target of 10,000 metres. The company then plans to incorporate all drill holes and metallurgical data into a resource estimate.

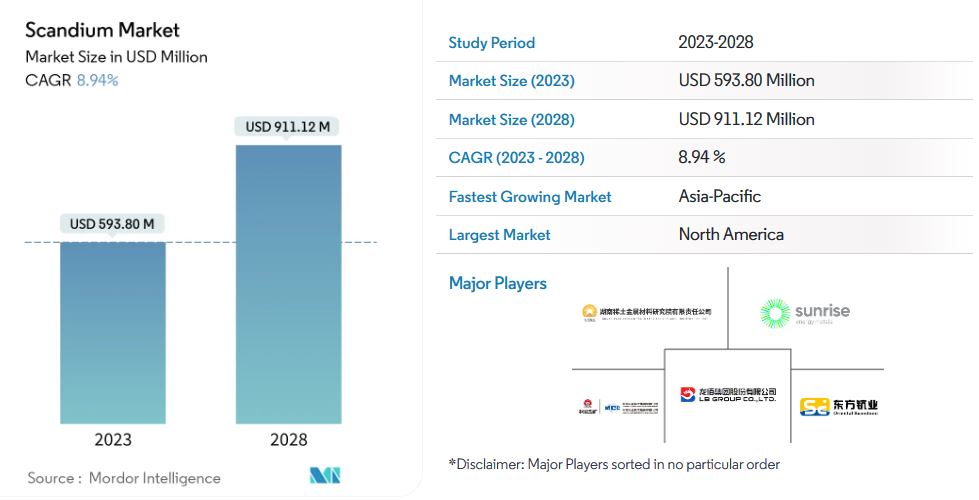

The market dynamics for scandium continue to evolve with increased investor interest and the establishment of new supply chains to meet the growing demand. Driven by its versatile applications and its potential to contribute to a more sustainable and low-carbon economy. The future of the scandium market appears promising.

Doubleview Gold has set lofty targets. Mr. Shirvani stated, “Our target is to have the single largest deposit of scandium in the world. And with that, we have the potential of controlling the world scandium market.”

So, as scandium delivers transformative strength to aluminum-based alloys, scandium may also be transformative to the economics of the Hat project.