SDX Energy reports Egyptian natural gas discovery

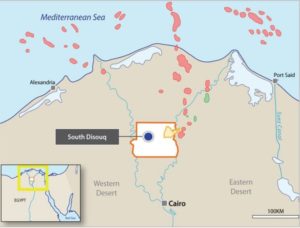

Location map of the South Disouq gas discovery, Egypt. Source: SDX Energy Inc.

Shares of SDX Energy Inc. [SDX-TSXV, AIM] advanced Thursday April 12 after the North Africa-focused oil and gas company said a gas discovery has been made at its Ibn Yunus-IX exploration well at South Disouq, Egypt. SDX has a 55% working interest in the project and is the operator.

Investors reacted to the news, sending SDX up 1.09% or $0.01 to 93 cents on volume of over 1 million shares. The 52-week range for the shares is 70 cents and $1.18.

The Ibn Yunus-1X well was drilled to a total depth of 9,068 feet and encountered 100.8 feet of net conventional natural gas pay in the Abu Madi horizon, which had an average porosity in the pay section of 28.5%. The well came in on prognosis but with a reservoir section that was of better quality and thicker than pre-drill expectations.

The well will be completed as a producer in the Abu Madi section and then tested after the drilling rig has moved off location. The testing is anticipated to commence between 30 and 45 days after the rig departs, depending on the availability of testing equipment.

After a successful test, it is anticipated that the well will be connected to the infrastructure located adjacent to the original SDX discovery in the basin, SD-IX, where production start-up is anticipated in the second half of 2018.

“We are extremely encouraged with today’s discovery, our second consecutive discovery at South Disouq,” said SDX President and CEO Paul Welch. “This highly positive drilling result further demonstrates the very significant natural potential the licence holds,” he said.

“Combined, these two successful wells confirm our views of the subsurface geology and demonstrate that we are on course to realise the full potential of the license.”

Welch went on to say that the company looks forward to updating shareholders on future developments at South Disouq in due course.

SDX is an international oil and gas exploration, production and development company, based in London, England. Its principal focus is on North Africa. In Egypt, SDX has a working interest in two producing assets [50%-owned North West Gemsa and 50% owned Meseda]. They are located on shore in the Eastern Desert, adjacent to the Gulf of Suez.

These producing assets are characterized by exceptionally low operating costs, making them particularly resilient in a low oil price environment.

SDX’s portfolio also includes high impact exploration opportunities in Egypt and Morocco.

It aims to create value through high margin production. The company’s mid-term objective is to achieve production of 5,000 barrels of energy per day through the implementation of its stated strategy. The longer term objective is to become a full cycle energy and petroleum company with production in excess of 20,000 barrels of energy per day.