Sitka Increases Gold Mineral Resource Estimate to 1.3 Million Ounces Indicated and 1.5 Million Ounces Inferred at Its RC Gold Project in Yukon

- Updated Mineral Resource Estimate (“MRE”) at the Company’s 100% owned Blackjack gold deposit located at the RC Gold Project, Yukon using a 0.3 g/t gold cut-off grade:

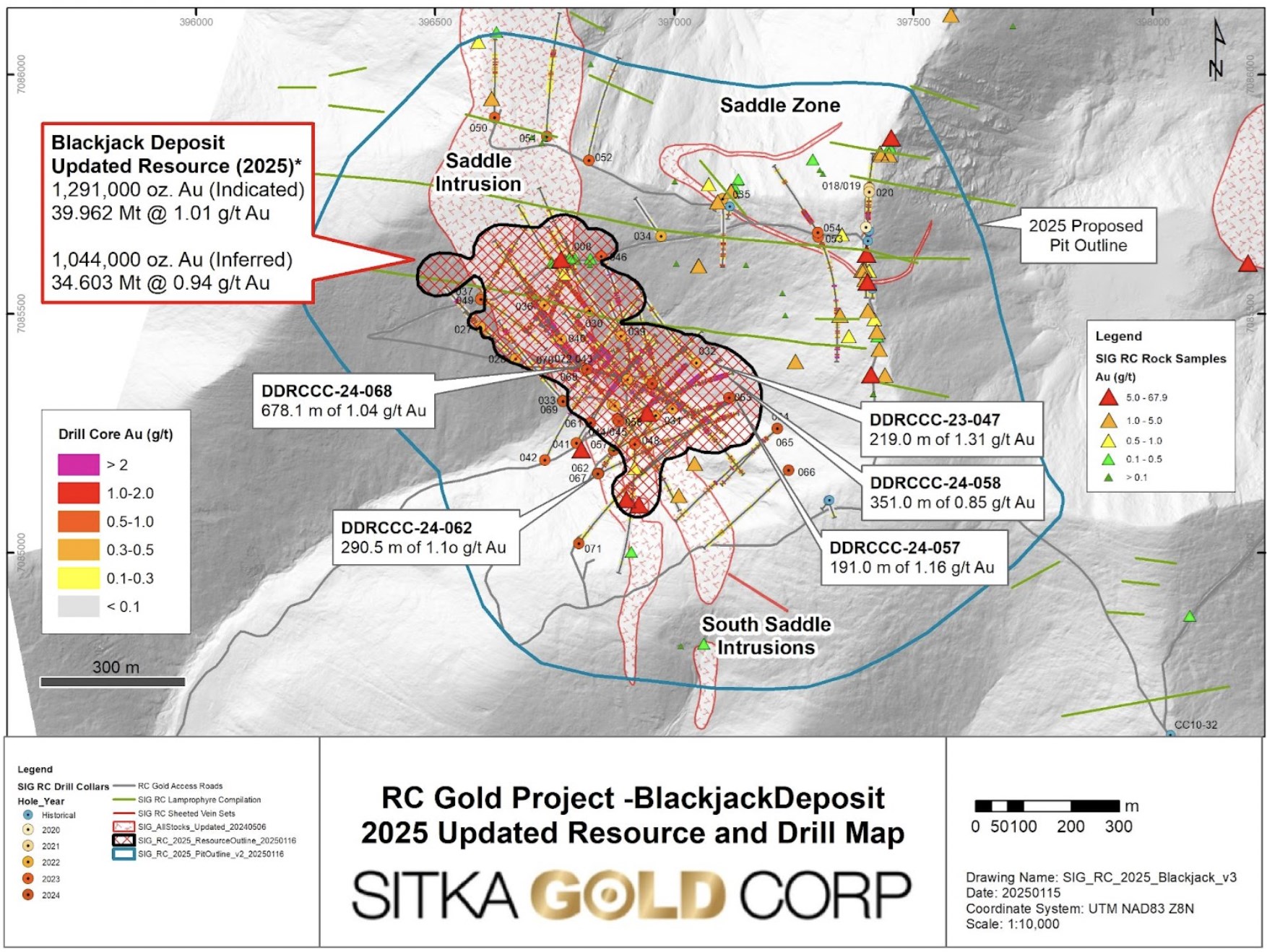

○ Indicated Mineral Resource: 1,291,000 ounces of gold at a grade of 1.01 g/t

○ Inferred Mineral Resource: 1,044,000 ounces of gold at a grade of 0.94 g/t

- The updated MRE represents a significant increase in both average grade and contained ounces at the Blackjack deposit where an initial inferred MRE of 900,000 ounces of gold at a grade of 0.83 g/t with a cut-off of 0.25 g/t gold was announced in 2023 (see Company News Release dated January 19, 2023).

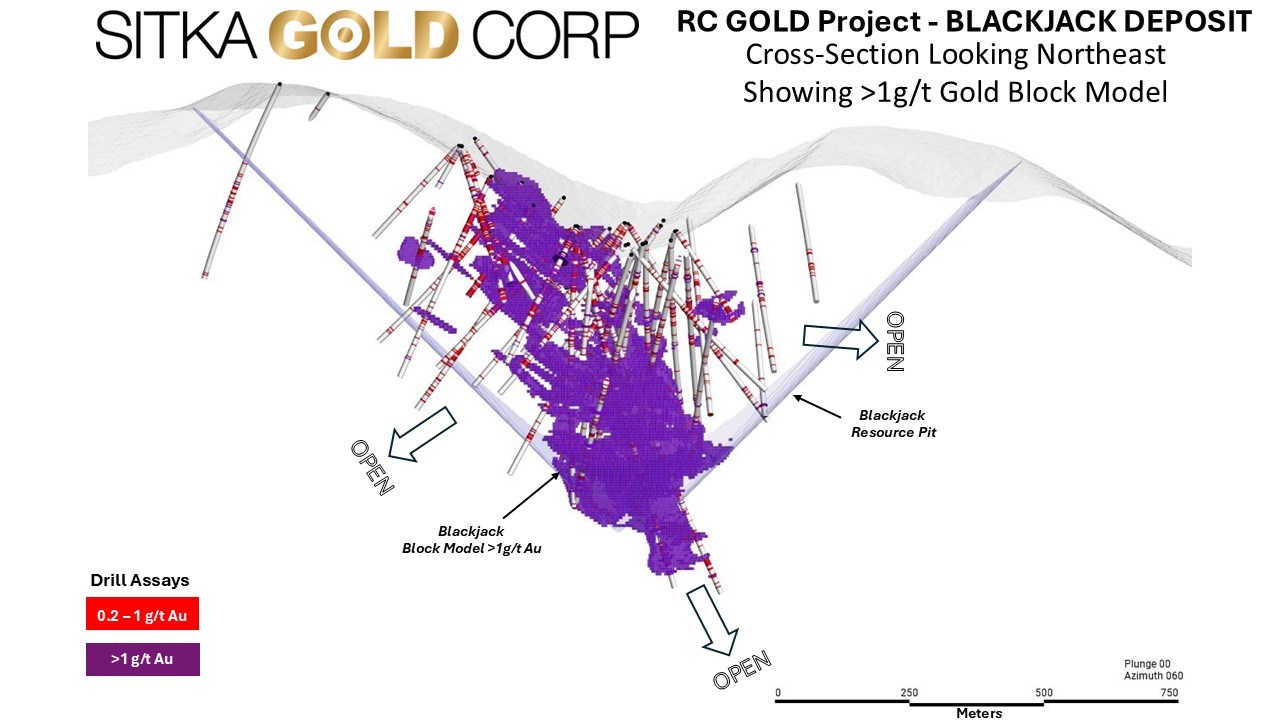

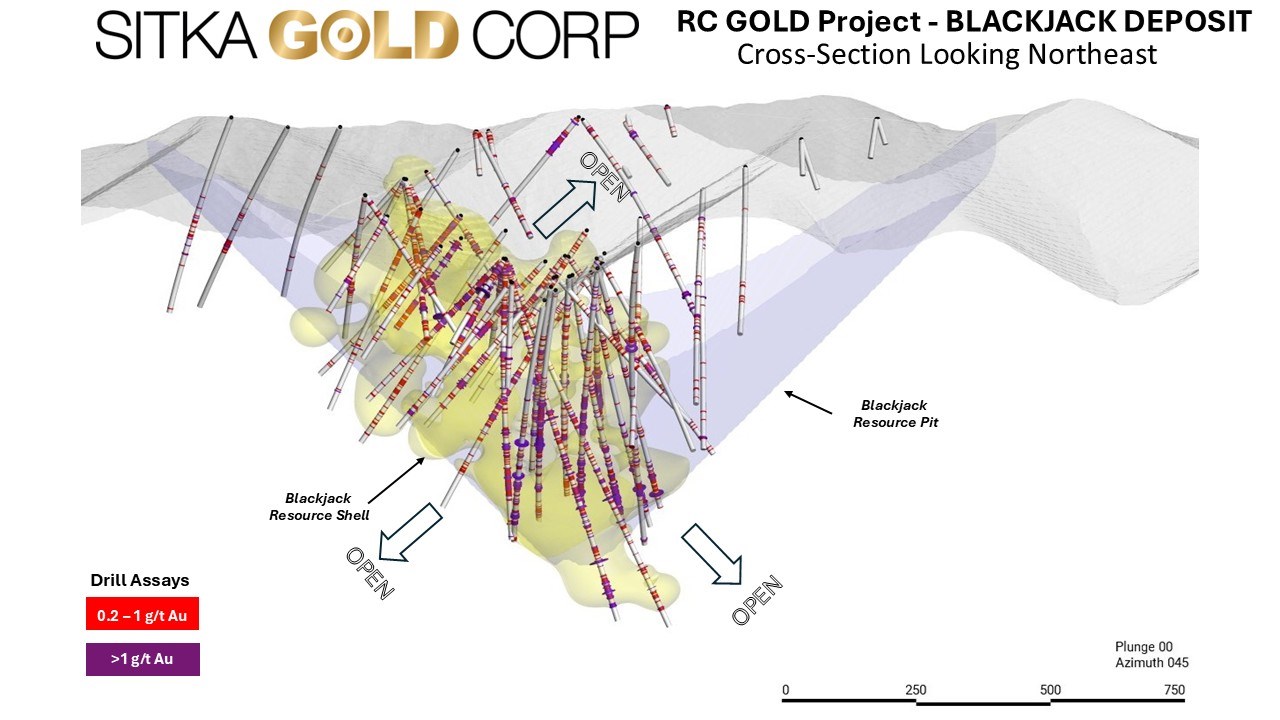

- The updated MRE at Blackjack has a well defined and consistent core of 1 g/t or greater material that extends from surface to a depth of 660 m and remains open in all directions.

- Initial metallurgical testing indicates that the gold in the Blackjack deposit is not refractory and has high recoveries of up to 94% with minimal NaCN consumption (see News Release dated July 13, 2022).

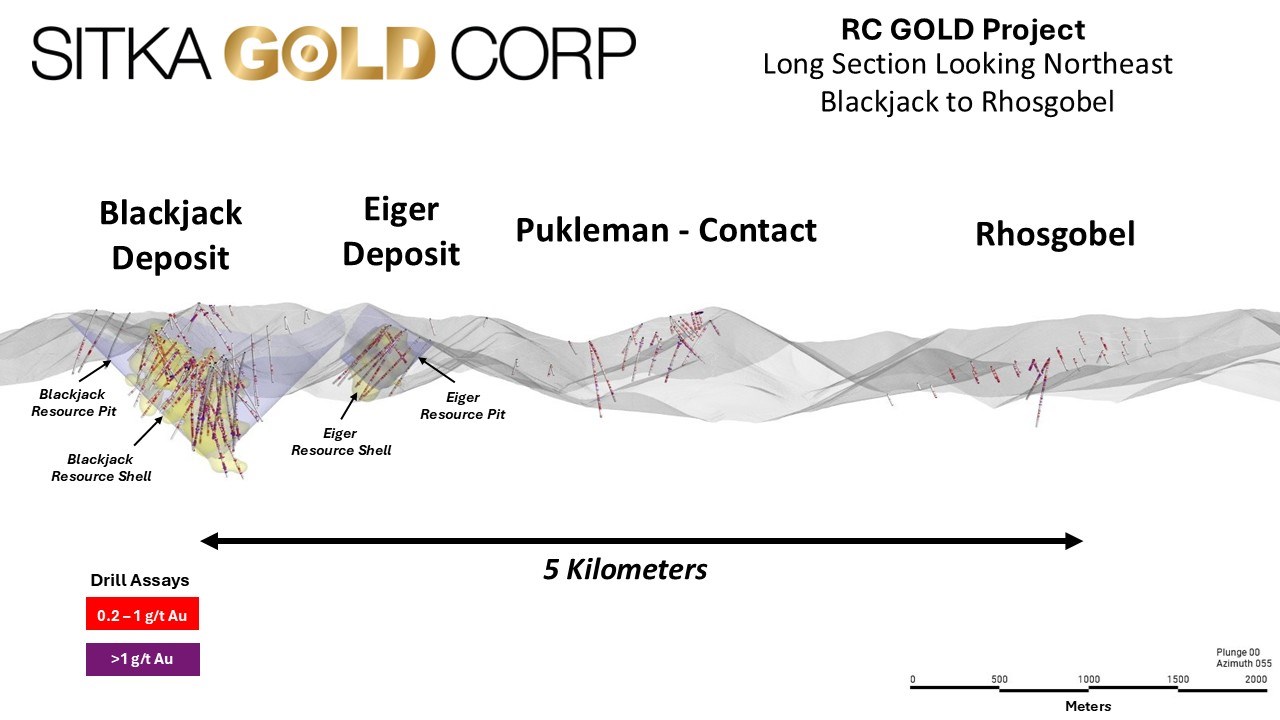

- 30,000 m of drilling planned at RC Gold this year to continue upgrading and expanding the Blackjack resource and further develop other significant centres of gold mineralization within the Clear Creek Intrusive Complex (“CCIC”), including the Eiger Deposit, which contains an initial inferred MRE of 440,000 ounces of gold (see Table 3 and Figure 5), and the Saddle, Rhosgobel, Contact, Pukelman, Bear Paw and Josephine targets (see Figures 4 and 5).

Sitka Gold Corp. (TSXV: SIG) (FSE: 1RF) (OTCQB: SITKF) (“Sitka” or the “Company”) is pleased to announce an updated Mineral Resource Estimate (“MRE”) in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards incorporated by reference in National Instrument 43-101 (“NI 43-101”) for the Blackjack gold deposit located on the Company’s road accessible, contiguous 431 square kilometre RC Gold Project (“RC Gold” or the “Project”) located in the Yukon’s prolific Tombstone Gold Belt (“TGB”). The MRE was prepared on behalf of the company by GeoSim Services Inc. and is based on additional drilling completed by the Company in 2023 and 2024.

“We are thrilled with the remarkable growth of the Blackjack gold deposit that has been achieved in just two years at our flagship RC Gold Project in Yukon,” stated Cor Coe, Director and CEO of Sitka. “With just 11,725 metres of additional diamond drilling since the initial mineral resource estimate was published in 2023, we have substantially increased the number of ounces contained at the Blackjack gold deposit by over 2.5 times while also increasing the overall grade. This updated resource estimation reflects the quality of this discovery, highlighted by the robust, non-refractory gold mineralization that has a significant core of higher-grade material of 1 gram per tonne or greater that begins at surface and extends to a currently defined depth of 660 metres (see Figure 2). These results also illustrate the exceptional scalability that can be achieved with relatively modest drilling at RC Gold and emphasize the potential of this extensive gold system to host world-class, multi-million ounce gold deposits. The Blackjack deposit provides a benchmark for what can be achieved at the several other intrusions within the Clear Creek Intrusive Complex, which have all been shown to host similar gold mineralization. With 30,000 metres of diamond drilling planned for this year – which exceeds all the drilling we have completed to date at RC Gold – we are on track to rapidly advance what is quickly becoming a multi-million ounce gold camp.”

Updated Mineral Resource Estimate

The updated Mineral Resource Estimate (MRE) for the Blackjack Zone includes 11,725 m of drilling in 25 holes in addition to the 7,074 m of drilling in 21 holes which comprised the initial resource estimate. At a 0.30 g/t gold cut off grade, the updated MRE at Blackjack includes an Indicated resource of 39,962,000 tonnes at 1.01 g/t gold containing 1,291,000 ounces and an Inferred resource of 34,603,000 tonnes at 0.94 g/t gold containing 1,044,000 ounces (Figure 1 and Table 1). A 0.30 g/t cut of grade is achievable because of the nature of the deposit, the good gold recoveries obtained from initial metallurgical testing and the favourable logistics of the RC Project, including year-round road access and proximity to infrastructure.

The modelling for the updated MRE identified a consistent higher grade core of the deposit that contains greater the 1 g/t Au material that trends from surface to a currently identified depth of 660 m (Figures 2 and 3). The morphology and grade of this mineralization allows for the possible development of a higher-grade starter pit and a faster capital cost payback of potential future mine development. The MRE is also relatively insensitive to changing cut-off grades, further confirming the quality of the resource (see Table 2).

A National Instrument 43-101 Technical Report describing the details of the mineral resource estimate is in preparation and will be filed on SEDAR within 45 days of this news release.

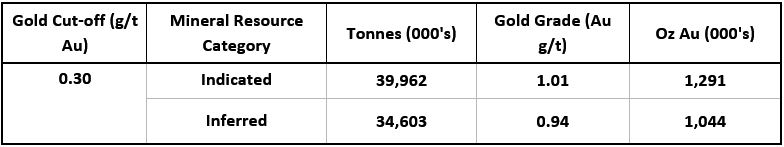

Table 1: Blackjack Deposit Gold Mineral Resource Estimate with Indicated and Inferred Contained Gold at a 0.30 g/t Cut-off Grade

Notes:

1. Mineral resource estimate prepared by Ronald G. Simpson of GeoSim Services Inc. with an effective date of January 21, 2025.

2. Mineral Resources are estimated consistent with CIM Definition Standards and reported in accordance with NI 43-101.

3. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

4. Mineral resources are constrained by an optimized pit shell using the following assumptions: US$2000/oz Au price; a 45° pit slope; assumed metallurgical recovery of 85%; mining costs of US$2.00 per tonne; processing costs of US$10.00 per tonne; G& A of US$4.00/t.

5. The base case cut-off of 0.3 g/t Au is believed to provide a reasonable margin over operating and sustaining costs for open-pit mining and processing.

6. Totals may not sum due to rounding.

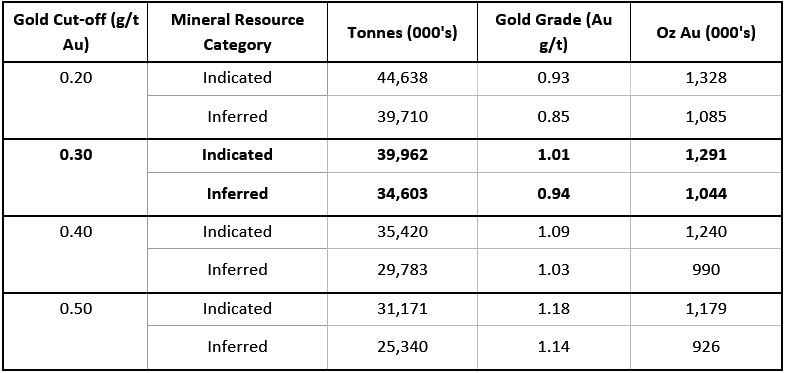

Table 2: Blackjack Deposit Gold Mineral Resource Estimate Showing the Sensitivity of the Resource Model to Changing Gold Cut-off Grades

Notes:

1. Bolded row represents the base case for the mineral resource estimate.

2. Cut-off grades as low as 0.2 g/t Au are still considered to meet NI 43-101 standards for Reasonable Prospects for Eventual Economic Extraction.

Figure 1: Updated Blackjack Deposit Mineral Resource Estimate Outline with highlighted drill hole intercepts.

Figure 2: Block Model of the Blackjack resource illustrating the coherent core of greater than 1 g/t material that extends from surface to a currently defined depth of 660 m.

Figure 3: A 3D Representation of the Current Blackjack Resource Shell showing the gold deposit that begins at surface and is open in all directions.

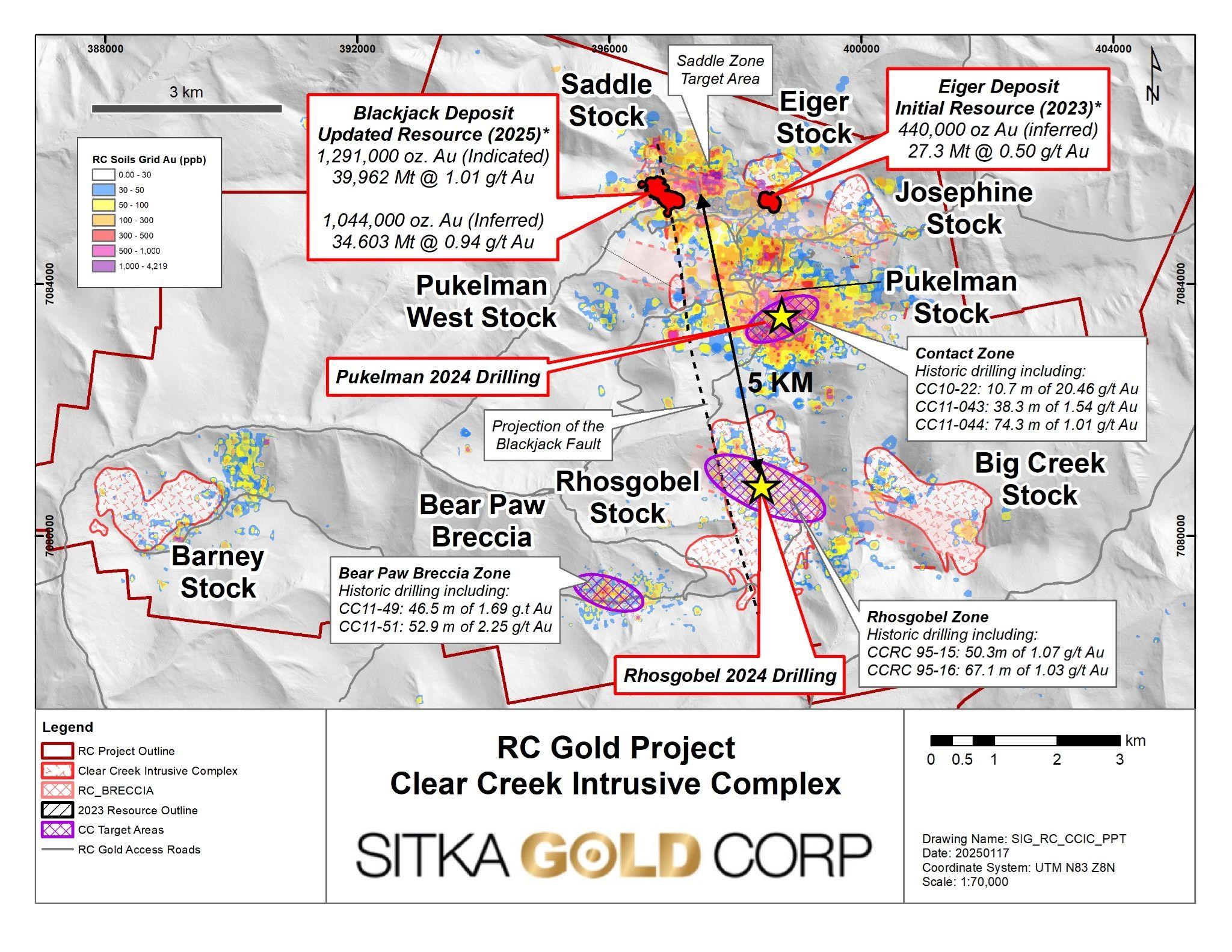

Figure 4: Longitudinal cross section showing locations of several of the intrusion targets within the Clear Creek Intrusive Complex. A 30,000 metre diamond drilling program planned for 2025 will focus on further expansion of the 2 km long Blackjack-Eiger area with 15,000 metres of drilling. An additional 10,000 metres of drilling is planned at Rhosgobel to follow up on the initial diamond drilling conducted by Sitka in late 2024 that discovered intervals of significant gold mineralization, including 119.0 metres of 1.05 g/t gold (see news releases dated November 25) and 5,000 metres of drilling is planned at Pukelman where initial drilling in late 2024 returned over a 100 gram-metre gold interval within the intrusion and on the periphery of a large geochemical anomaly target (see news release dated January 7, 2025).

Figure 5: A map of the Clear Creek Intrusive Complex (CCIC) showing the location of the updated Blackjack resource outline, the 2023 Eiger resource outline, and the other intrusions of the CCIC such as the Pukelman intrusion and the Rhosgobel Intrusion.

About the flagship RC Gold Project

The RC Gold Project consists of a 431 square kilometre contiguous district-scale land package located in the heart of Yukon’s Tombstone Gold Belt. The project is located approximately 100 kilometres east of Dawson City, which has a 5,000 foot paved runway, and is accessed via a secondary gravel road from the Klondike Highway which is usable year-round and is an approximate 2 hour drive from Dawson City. It is the largest consolidated land package strategically positioned mid-way between the Eagle Gold Mine and the past producing Brewery Creek Gold Mine.

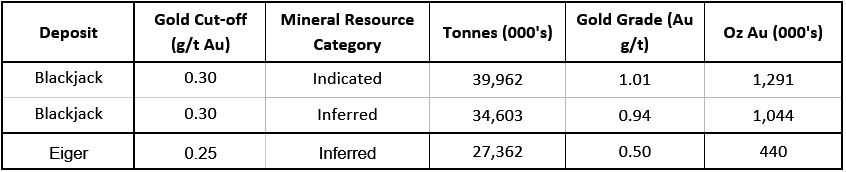

The RC Gold Project now has pit-constrained mineral resources prepared in accordance with National Instrument 43-101 (“NI 43-101”) guidelines that are contained in two zones: the Blackjack and Eiger deposits with 1,291,000 ounces of gold grading 1.01 g/t gold in an indicated category and 1,044,000 grading 0.94 g/t in an inferred category at Blackjack and 440,000 ounces grading 0.50 g/t gold in an inferred category at Eiger. Both of these deposits are at/near surface, are potentially open pit minable and amenable to heap leaching, with initial bottle roll tests indicating that the gold is not refractory and has high gold recoveries of up to 94% with minimal NaCN consumption (see News Release July 13, 2022). The Mineral Resource Estimate is presented in the following table:

Table 3: Current pit-constrained gold resources at the RC Gold Project

Notes:

1. The Eiger deposit resource is from the mineral resource estimate prepared in 2023 which was not updated as no additional drilling has been completed.

To date, 72 diamond drill holes have been drilled into this system by the Company for a total of approximately 25,136 metres. Other targets drilled to date include the Saddle, Josephine, Rhosgobel and Pukelman zones. The resource expansion drilling in 2023 at Blackjack produced results of up to 219.0 m of 1.34 g/t gold Including 124.8 m of 2.01 g/t gold and 55.0 m of 3.11 g/t gold in drill hole DDRCCC-23-047 (see news release dated September 26, 2023) and in 2024 results of up to 678.1 metres of 1.04 g/t gold starting from surface in DDRCCC-24-068, Including 409.5 metres of 1.36 g/t gold, 93.0 metres of 2.57 g/t gold and 5.5 metres of 17.59 g/t gold (see news release dated October 21, 2024).

(1) Simpson, R. January 19, 2023. Clear Creek Property, RC Gold Project, NI 43-101 Technical Report, Dawson Mining District, Yukon Territory.

RC Gold Deposit Model

Exploration on the Property has mainly focused on identifying an intrusion-related gold system (“IRGS”). The property is within the Tombstone Gold Belt which is the prominent host to IRGS deposits within the Tintina Gold Province in Yukon and Alaska. Notable deposits from the belt include: Fort Knox Mine in Alaska with current Proven and Probable Reserves of 230 million tonnes at 0.3 g/t Au (2.471 million ounces; Sims 2018)(1); Eagle Gold Mine with current Measured and Indicated Resources of 233 million tonnes at a grade of 0.57 g/t Au at the Eagle Main Zone (4.303 million ounces; Harvey et al, 2022)(2); the Brewery Creek deposit with current Indicated Mineral Resource of 22.2 million tonnes at a gold grade of 1.11 g/t (0.789 million ounces; Hulse et al. 2020)(3); the Florin Gold deposit with a current Inferred Mineral Resource of 170.99 million tonnes grading 0.45 g/t (2.47 million ounces; Simpson 2021)(4); the AurMac Project with an Inferred Mineral Resource of 347.49 million tonnes grading 0.63 gram per tonne gold (7.00 million ounces)(5) and the Valley Deposit, with a current Indicated Mineral Resource of 4.05 million oz gold at 1.66 g/t and an additional Inferred Mineral Resource of 3.26 million oz at 1.25 g/t gold(6).

(1) Sims J. Fort Knox Mine Fairbanks North Star Borough, Alaska, USA National Instrument 43-101 Technical Report. June 11, 2018. https://s2.q4cdn.com/496390694/files/doc_downloads/2018/Fort-Knox-June-2018-Technical-Report.pdf.

(2) Harvey N., Gray P., Winterton J., Jutras M., Levy M.,Technical Report for the Eagle Gold Mine, Yukon Territory, Canada. Victoria Gold Corp. December 31, 2022. https://vgcx.com/site/assets/files/6534/vgcx_-_2023_eagle_mine_technical_report_final.pdf.

(3) Hulse D, Emanuel C, Cook C. NI 43-101 Technical Report on Mineral Resources. Gustavson Associates. May 31, 2020. https://minedocs.com/22/Brewery-Creek-PEA-01182022.pdf.

(4) Simpson R. Florin Gold Project NI 43-101 Technical Report. Geosim Services Inc. April 21, 2021. https://sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo=00005795&issuerType=03&projectNo=03236138&docI d=4984158.

(5) Thornton T., Jutras M., Malhotra D. Technical Report Aurmac Property Mayo Mining District, Yukon Territory, Canada. JDS Energy and Mining Inc. February 6, 2024. https://banyangold.com/site/assets/files/5251/banyan_gold_ni_43-101_technical_report_2024_03_18.pdf.

(6) Burrell H., Redmond D.J., Haggarty P., Rogue Gold Project: NI 43-101 Technical Report and Mineral Resource Estimate, Yukon Territory, Canada. Snowline Gold Corp. May 15, 2024. https://snowlinegold.com.

Upcoming Events

Sitka Gold will be attending and/or presenting at the following events*:

- RoundUp, Vancouver, BC: January 20 – 23, 2025

- PDAC, Toronto, ON: March 2 – 5, 2025

- Swiss Mining Institute, Zurich, Switzerland: March 18 – 19, 2025

*All events are subject to change.

About Sitka Gold Corp.

Sitka Gold Corp. is a well-funded mineral exploration company headquartered in Canada with approximately $15 million in its treasury and no debt. The Company is managed by a team of experienced industry professionals and is focused on exploring for economically viable mineral deposits with its primary emphasis on gold, silver and copper mineral properties of merit. Sitka is currently advancing its 100% owned, 431 square kilometre flagship RC Gold Project located within the Tombstone Gold Belt in the Yukon Territory. The Company is also advancing the Alpha Gold Project in Nevada and currently has drill permits for its Burro Creek Gold and Silver Project in Arizona and the Coppermine River Project in Nunavut.

*For more detailed information on the Company’s properties please visit our website at www.sitkagoldcorp.com.

The scientific and technical content of this news release has been reviewed and approved by Cor Coe, P.Geo., Director and CEO of the Company, and a Qualified Person (QP) as defined by National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS OF

SITKA GOLD CORP.

“Donald Penner“

President and Director

For more information contact:

Donald Penner

President & Director

778-212-1950

dpenner@sitkagoldcorp.com

or

Cor Coe

CEO & Director

604-817-4753

ccoe@sitkagoldcorp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary and Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would” or “occur”. This information and these statements, referred to herein as “forward‐looking statements”, are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management’s expectations and intentions and the Company’s anticipated work programs.

These forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, market uncertainty and the results of the Company’s anticipated work programs.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.