Steppe Gold raises $12.1 million for expansion in Mongolia

Steppe Gold Ltd. [STGO-TSX] said Thursday it has completed a $12.1 million upsized private placement with participation by financer Eric Sprott and the company’s management.

The amount raised was upsized from the original $9 million target. Under the private placement, the company issued 11 million common shares, priced at $1.10 per share.

Eric Sprott, through an Ontario numbered company controlled by him, acquired 909,091 common shares for a total investment of $1.0 million. Sprott is an insider of the company, meaning the private placement constitutes a related party transaction.

Steppe President and CEO Bataa Tumur-Ochir acquired 1.8 million common shares for an investment of $2.0 million, a figure that amounts to 2.18% of the company’s outstanding shares following completion of the private placement.

Bataa Tumur-Ochir is a company insider and his participation in the private placement constitutes a related party transaction. Prior to the latest financing, he held 6.65 million common shares or 9.17% of the company.

Bataa also holds a convertible debenture with a principal amount of US$3.0 million, which is convertible into common shares at US$0.68 per share, with a maturity date of January 27, 2024. He also holds 800,000 options exercisable to purchase common shares, 66,666 restricted stock units exercisable to common shares, representing on a partially diluted basis, 15.33% of the company prior to completion of the private placement.

Now that the private placement has closed, he holds 8.5 million shares representing an undiluted ownership of approximately 10.14%.

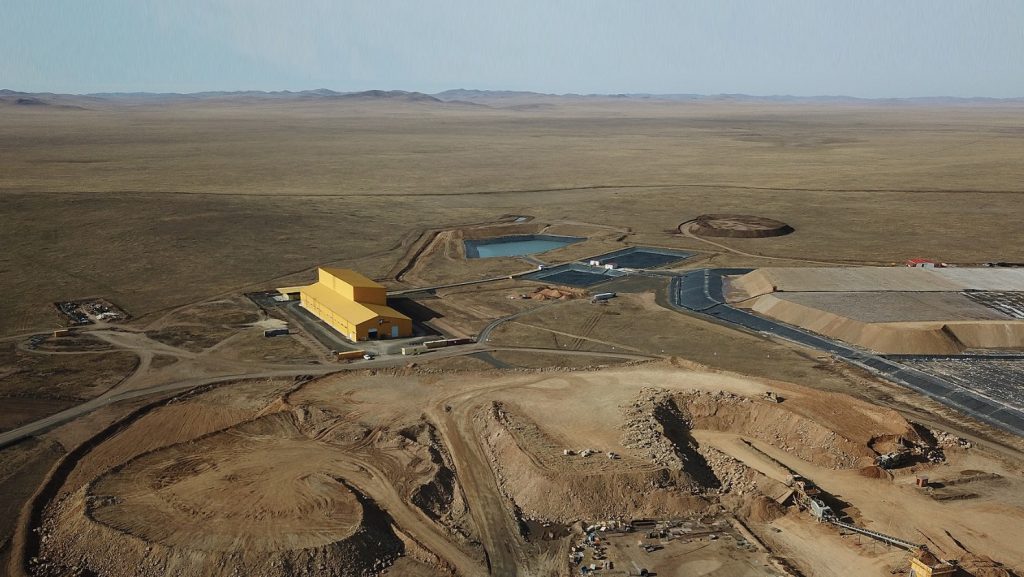

Steppe Gold’s key asset is the 100%-owned ATO Gold mine in Mongolia.

“These funds raised through this placement will be instrumental in achieving our strategic goal of securing project financing for the Phase 2 expansion at ATO,’’ Bataa said in a press release.

The Altan Tsagaan Ovoo (ATO) gold and silver project is located in Tsagaan Ovoo soum, Dornod province, eastern Mongolia. ATO consists of one mining license covering an area of 5,492 hectares.

Steppe recent reported 2022 revenue of US$62.4 million on sales of 33,681 gold ounces and 38,740 ounces of silver with average realized prices per ounce of US$1,818 and US$20 respectively.

The site all-in-sustaining cost for the year was US$796 per ounce. In February, 2023, the company announce the results of a technical report for the ATO project for a Phase 2 expansion that envisages a 12-year mine life and assumes production of 100,000 ounces of gold equivalent annually from fresh rock ore.

It said the results reinforce the company’s current Phase 2 expansion plans with construction already under way, and existing permitting and infrastructure in place. The expansion is scheduled to start with the first concentrates in the first quarter of 2025.

Steppe shares advanced on the news, rising almost 2.0% or $0.02 to $1.03. The shares are currently trading in a 52-week range of $1.36 and $0.95.