Stillwater Critical Minerals drills up to 1.13 g/t rhodium at Stillwater West Project, Montana

Stillwater Critical Minerals Corp. [TSXV: PGE; OTCQB: PGEZF; FSE: J0G] reported results of rhodium assays conducted on core from resource expansion drilling on its 100%-owned Stillwater West platinum group element, nickel, copper, cobalt, and gold (PGE-Ni-Cu-Co + Au) project in Montana, USA, adjacent to Sibanye-Stillwater’s world-class critical minerals mining operations.

Highlights: Widespread rhodium was returned in drill results at potentially significant co-product grades including: 1.13 g/t Rh in an interval that totaled 7.96 g/t Pt+Pd+Au+Rh (4E) over 1.2 metres in CM2023-03, starting at 308.8 metres and set within 14.6 metres of1.38 g/t 4E including 0.118 g/t Rh; and 0.162 g/t Rh over 3.7 metres in CM2023-01 starting at 407.8 metres within an interval of 0.99 g/t 4E.

Supply constraints have resulted in elevated rhodium prices since 2017. At its current two-year average price of US$6,500/oz, and three-year year average price of US$9,500/oz, rhodium equates to more than five times the current value of palladium or platinum.

Results are expected to expand upon the 115,000 ounces of rhodium defined in the January 2023 Mineral Resource Estimate (MRE) and are similar to results from past campaigns which returned 0.103 g/t Rh over 7.9 metres in hole CM2020-05, and 0.100 g/t Rh over 6.1 meters in hole CM2007-02.

Rhodium is mined solely as a co-product at grades that are often below 0.1 g/t. South Africa dominates global production, and there is very little mine supply in North America.

Sibanye-Stillwater, adjacent to Stillwater’s Stillwater West project across 32 km in the Stillwater Igneous Complex, is the primary US producer of Rh, mining the highest-grade PGE deposit in the world, the J-M Reef deposit.

Recent announcements concerning lay-offs and reduced production at Sibanye-Stillwater (as a result of depressed global palladium prices) have brought bipartisan support for mining jobs in Montana and US critical mineral supply from Senators Jon Tester and Steve Daines, both of Montana, in addition to support from other local, state, and federal officials.

Rhodium has a high melting point, is highly corrosion resistant, and is critical in catalytic converters, along with platinum and palladium, for cleaner vehicle emissions.

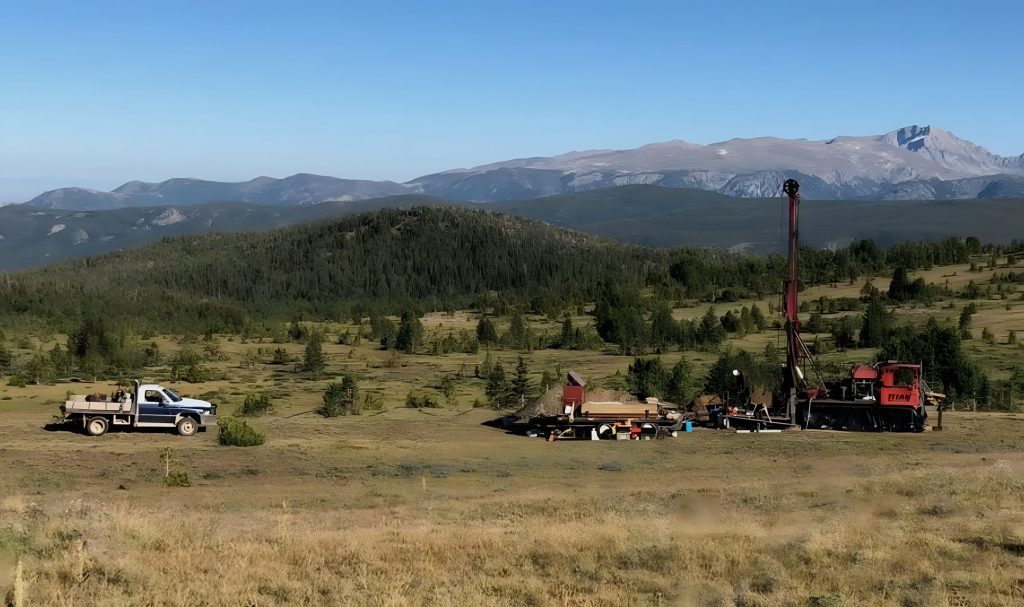

Complete results from the expansion drill campaign, which focused on the west side of the DR and Hybrid deposits at Chrome Mountain, are being incorporated into updated block models driven by an updated 3D geologic model as announced October 16, 2024. Updated from that release, this demonstrates the impressive grade and scale of mineralization at the Stillwater West project with wide intervals at successively higher grades contained within very wide bulk-tonnage grade intervals across the 9.5-km-long area that contains the current deposits, including: 13.2 metres of 2.31% Ni, 0.35% Cu, 0.115% Co, and 1.51 g/t 4E starting at 37.6 metres and within 400.8 meters of continuous mineralization in hole CM2021-05; 50.2 metres of 1.05 g/t 4E plus 0.19% Ni and other values within 728.1 meters of continuous mineralization in hole CM2021-01; and 44.1 metres of 0.57% Ni, 0.34% Cu, 0.045% Co, and 0.74 g/t 4E starting at 32.8 metres and within 367.6 metres of continuous mineralization in hole CZ2021-01.

Metallurgical testing completed by AMAX confirmed recovery of rhodium along with palladium and platinum in preliminary bench-scale flotation testing at the CZ deposit area in the early 1970s.

Past work previously reported by the company included surface sample results of up to 5.78 g/t Rh at the HGR target in the Iron Mountain area, and 1.07 g/t Rh at Chrome Mountain in reconnaissance-scale rock sample programs.

Early results for other rare PGEs show potential for additional value from iridium, osmium, and ruthenium which often occur along with platinum, palladium, and rhodium at Stillwater West.

Michael Rowley, President and CEO, commented, “The strength and sheer scale of mineralization at Stillwater West continues to impress us as we add mineralization at several grade cut-offs, providing us with excellent optionality on potential mine methods as we advance towards our vision of becoming a primary source of critical minerals in the US. The polymetallic nature of our deposits is also strongly in our favor as the longest lived and most profitable mines in the world are almost without exception large and polymetallic.”

Dr. Danie Grobler, Vice-President of Exploration, commented, “The wealth of exploration drilling and assay data available on the Stillwater West project area greatly advanced our understanding of the mineralization controls and detailed geological interpretation. Recent drill results further support our geological models and understanding of mineralization controls within the main target areas. The current models now confirm continuity of the mineralized zones and their correlation with the A and B Chromitite horizons within the lower part of the Peridotite Zone. Both these chromite-rich horizons, viewed as thick stratiform ‘reef’- type horizons, are PGE-enriched and particularly rich in rhodium. More importantly, the reported high-grade rhodium results have now been confirmed to correlate with these two specific chromitite units and correspond to geochemical and geophysical anomalies associated with our existing resource areas defined during 2023. This largely confirms our understanding of their occurrence, and our ability to effectively target extensions and new areas.”

Most recently, Sibanye-Stillwater celebrated the publication of the final regulations for Section 45X of the Inflation Reduction Act from the US Department of the Treasury which clarified important points that will likely result in significant tax credits for production of critical minerals from their US operations.

Stillwater Critical Minerals is focused on its flagship Stillwater West Ni-PGE-Cu-Co + Au project in the Stillwater mining district, Montana.