Teck poised for copper production increase in 2024

Teck Resources Ltd. (TECK.B-TSX, TECK.A-TSX, TECK-NYSE) has provided an unaudited 2023 production volumes for its Quebrada Blanca operations, an update on the QB2 project as well as unaudited fourth quarter steelmaking coal sales volumes and realized prices.

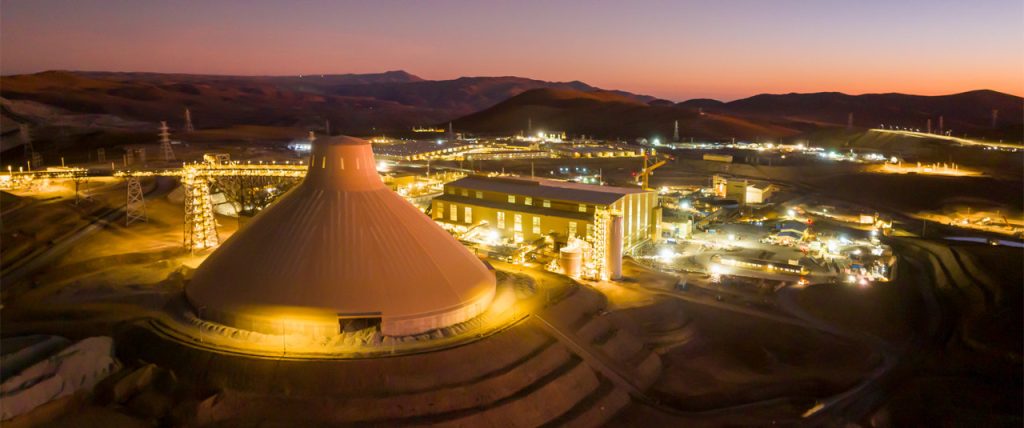

QB2 is essentially the next phase of the original Quebrada Blanca open pit operation, which is located in the Tarapaca Region of northern Chile. At full production, the new QB will double Teck’s copper production on a consolidated basis.

“We are pleased that QB is now operating near design throughput capacity with strong recoveries, positioning Teck for significantly increased copper production in 2024,’’ said Teck President and CEO Jonathan Price. “We had strong fourth quarter performance in our steelmaking coal operations, with improvements in plant performance leading to an increase in production, and sales volumes of 6.1 million tonnes near the top end of our guidance [of 5.9 million to 6.2 million tonnes],’’ he said.

The realized steelmaking coal price in the fourth quarter was US$270 per tonne.

The update comes after Teck said it had completed the sale of a minority interest in its steelmaking coal business (Elk Valley Resources EVR) to Nippon Steel Corp. Closing of the sale of the remaining 77% interest in EVR to Glencore PLC is expected to occur in the third quarter of 2024.

Meanwhile, 2023 unaudited contained copper production volumes for QB, excluding copper cathode, totalled 56,200 tonnes, below the bottom end of the company’s guidance range of 80,000 tonnes for 2023, due to reliability and consistency issues in the fourth quarter. Fourth quarter production was 35,000 tonnes.

During the second half of 2023, each of the operations at QB, including mine operations, crushing, grinding, flotation, tailings, desalination and concentrate handling, all operated at or above design capacity, the company said in a press release.

The focus in the fourth quarter was on achieving reliable and consistent operations. This took longer than expected to achieve, and, as a result, production did not meet forecast. However, by the end of December, QB was operating near design throughput capacity, and this has continued into 2024. The company said recoveries have generally been in line with expectations, and head grades remain within expected levels.

In an update on the QB2 project, Teck said construction of the molybdenum plant was substantially completed in December, and commissioning has commenced. Ramp-up of the molybdenum plant is expected to be completed by the end of he second quarter of 2024.

Construction of the port offshore facilities is progressing to plan and is expected to be completed by the end of he first quarter of 2024. The last jetty pile was completed in December, representing a major milestone in the port construction. Its previously disclosed QB2 project capital cost guidance is unchanged at US$8.6 billion to US$8.8 billion.

Teck shares were largely unchanged on the news, easing 1.1% or 62 cents to $53.54 on volume of 334,360. The shares are currently trading in a 52-week range of $66.04 and $44.70.