The Competitive Edge of Aclara Resources in the Global Market

Aclara Pilot Plant

As the world embraces electrification, renewable energy and clean technologies, a lesser-known but crucial bottleneck is emerging: the supply of heavy rare earth elements. At the forefront of addressing this challenge is Aclara Resources Inc. [ARA-TSX], a company with ambitious plans to become a leading producer of sustainable heavy rare earths outside of China.

Rare earth elements, despite their name, are not particularly rare in the Earth’s crust. However, economically viable deposits, especially of heavy rare earths like dysprosium (Dy) and terbium (Tb), are scarce. These elements are critical for the production of high-performance permanent magnets used in electric vehicle motors, wind turbines, and other clean energy technologies.

The current rare earth market is dominated by China, which controls not only the majority of production but also much of the processing capacity, particularly for heavy rare earths, this concentration of supply has raised concerns about geopolitical risks and the need for diversification. Analysts project that by 2030, there could be a supply gap of over 3,400 tonnes of DyTb.

Despite growing demand, China’s production quotas for heavy rare earth elements have remained stagnant over the past decade, even decreasing in 2024. Meanwhile, a significant portion of global DyTb production has shifted to Myanmar, often under questionable environmental standards. This situation underscores the need for new, responsible sources of heavy rare earth.

Francois Motte, Aclara Resources CFO stated in an interview with Resource World, “The culmination of experience, corporate governance and industry support, position Aclara as a leading sustainable heavy rare earth resource company. Our patented processing technology will create a new paradigm in mining as we transition into the future of mining and mineral exploration for critical metals.”

Enter Aclara Resources, backed by the experienced Hochschild Mining group and Mr. Eduardo Hochschild’s 100% owned New Hartsdale Capital Inc. owning a combined 57% of Aclara stock and with strategic investment from Chilean mining giant CAP S.A., Aclara is positioning itself to address this critical supply gap with two promising projects: the Penco Module in Chile and the Carina Module in Brazil.

Both the Penco and Carina projects are based on ionic clay deposits, a type of resource that is relatively rare outside of southern China and parts of Southeast Asia. These deposits are particularly valuable because they are enriched in heavy rare earths and can be processed using more environmentally friendly methods compared to traditional hard rock mining and have a much higher ratio of dysprosium and terbium compared to most other projects outside of China, this positions the company to be a significant supplier of these critical elements that are essential for the energy transition.

Both the Penco and Carina projects are based on ionic clay deposits, a type of resource that is relatively rare outside of southern China and parts of Southeast Asia. These deposits are particularly valuable because they are enriched in heavy rare earths and can be processed using more environmentally friendly methods compared to traditional hard rock mining and have a much higher ratio of dysprosium and terbium compared to most other projects outside of China, this positions the company to be a significant supplier of these critical elements that are essential for the energy transition.

At the heart of Aclara’s competitive advantage is its innovative and environmentally friendly rare earth extraction process. This proprietary technology, developed in-house by Aclara, represents a significant departure from traditional rare earth processing methods.

The company has secured patent protection for this technology in multiple key jurisdictions, including Chile, Brazil, the United States, Australia, and China. This extensive patent coverage not only protects Aclara’s intellectual property but also positions the company as a technological leader in sustainable rare earth extraction.

Unlike conventional rare earth processing, which often involves energy-intensive methods and the use of harsh chemicals, Aclara’s patented process is remarkably clean and efficient. The technology uses a simple leaching process through an ionic exchange process and employs a common fertilizer (ammonium sulphate) that’s both effective at extracting rare earths and environmentally responsible.

A standout feature of this technology is its water efficiency. The process is designed to recycle over 95% of the water used, significantly reducing the project’s water footprint – a crucial consideration in many mining jurisdictions where water scarcity is a concern. In the case of Chile, the additional 5% water requirement is drawn from recycled local grey water sources, representing the first mining process to avoid any natural sources of water (including desalinated sea water) in the country.

Moreover, Aclara has demonstrated the viability of this technology beyond laboratory scale. The company operated a fully owned pilot plant that successfully processed material from both the Penco Module and the Carina Module, in Concepción, Chile. This operational experience provides Aclara with valuable data and expertise as it moves towards full-scale production.

Moreover, Aclara has demonstrated the viability of this technology beyond laboratory scale. The company operated a fully owned pilot plant that successfully processed material from both the Penco Module and the Carina Module, in Concepción, Chile. This operational experience provides Aclara with valuable data and expertise as it moves towards full-scale production.

The environmental benefits of this patented technology extend beyond the processing stage. Because it allows for the efficient extraction of rare earths from ionic clay deposits, it enables a mining approach with a much smaller physical footprint compared to traditional hard rock rare earth mining. This aligns with Aclara’s commitment to progressive site rehabilitation and biodiversity enhancement.

By developing and patenting this clean technology, Aclara has positioned itself not just as a potential rare earth supplier, but as a leader in sustainable mining practices. As governments and end-users increasingly prioritize responsibly sourced materials, Aclara’s patented process could become a significant differentiator in the global rare earth market and present potential added revenue streams through royalty agreements.

The strategic importance of securing reliable rare earth supplies has not gone unnoticed by governments. Both the United States and European Union have introduced initiatives to encourage the development of rare earth projects outside of China, potentially benefiting companies like Aclara.

In July 2024, Aclara announced a Memorandum of Understanding (MoU) with VACUUMSCHMELZE GmbH & Co. KG (VAC). This partnership aims to establish a non-binding agreement focusing on producing ESG-compliant permanent magnets, leveraging the strengths of both companies in the production and supply of critical elements like dysprosium and terbium.

VAC, a leading producer of rare earth magnets outside of Asia, recognizes the growing market demand driven by the clean technology sector. The collaboration seeks to create a robust supply chain for heavy rare earths, addressing a global need for materials essential to manufacturing permanent magnets. The strategic alliance positions Aclara as a significant supplier of DyTb, thereby enhancing the resilience of the global supply chain impacted by over-reliance on a few Asian suppliers.

As Aclara develops its projects in Chile and Brazil, the partnership aims to harness their innovative extraction processes and advanced technology to produce high-purity rare earth carbonates. These materials will be vital inputs for VAC, which is already advancing production capabilities to supply major automotive clients like General Motors.

The company recently released a Preliminary Economic Assessment (PEA) for its Carina Module in Brazil, showcasing the project’s potential. With an after-tax Net Present Value (NPV) of US$1.2 billion at an 8% discount rate and an Internal Rate of Return (IRR) of 29%, the Carina Module presents compelling economics.

The Penco Module in Chile, while smaller in scale, also shows promise with an after-tax NPV of US$128 million and an IRR of 23%. Combined, these two projects could position Aclara as a significant player in the heavy rare earth market outside of China.

The potential impact of Aclara’s production on the global heavy rare earth market is substantial. When both the Penco and Carina modules are operational, Aclara expects to produce approximately 258 tonnes of DyTb annually. To put this in perspective, this volume is equivalent to about 17% of China’s official DyTb production in 2023.

This significant production potential, combined with Aclara’s strategic location outside of China and its commitment to sustainable practices, positions the company as a potentially crucial player in diversifying and securing the global supply chain for these critical elements.

Aclara isn’t just focused on mining and initial processing. The company has laid out plans for vertical integration, aiming to offer a “mine-to-magnet” solution. This strategy includes partnerships for separation, metal and alloy production, and potentially magnet manufacturing.

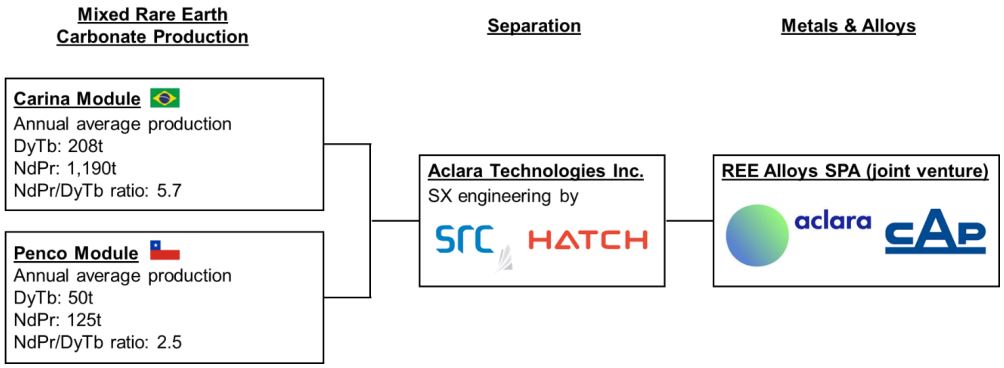

The Companys’ recently formed subsidiary, Aclara Technologies is expected to source high purity mixed rare earths carbonates from Aclara’s extraction modules in Chile and Brazil. These carbonates will be then converted into individual rare earths oxides in the separation facility. For this purpose, Aclara Technologies has awarded a contract to the Saskatchewan Research Council (SRC) to develop a production flowsheet specially designed for its premium carbonate, and to Hatch Ltd. to work on the engineering of the proposed separation facility.

Aclara´s Vertical Integration Strategy

A significant step in this direction was the recent strategic investment by CAP S.A., a major Chilean mining and steel company. CAP has committed up to US$80 million for a stake in Aclara’s Chilean subsidiary, providing not only capital but also valuable operational expertise and potentially easing the path for environmental permitting.

In an industry often scrutinized for its environmental impact, Aclara is taking a proactive approach to the protection of the environment through the responsible stewardship of its properties and has produced comprehensive corporate governance documents outlining stringent ESG principles to which the Company and its employees are to adhere.

From improving the land by replacing plantation forests with native species, enhancing biodiversity in the areas where they operate, and the preservation of essential natural resources for future generations, to the prioritization of respecting the rights, cultures, customs and values of the people and communities who live near their projects, Aclara has established a local presence through initiatives like “Casa Aclara” in Penco, Chile, which invites locals to participate in the early development of the projects and to learn about its proposal for progress and prioritizing local hiring and supplier development.

Despite the promising outlook, Aclara’s stock price has not yet reflected the potential value of its projects. As of July 2024, the company had a market capitalization of only US$61 million, with an enterprise value of just US$4 million when accounting for its cash position. This valuation discrepancy could present an opportunity for investors, especially considering the strategic importance of heavy rare earths and the limited number of advanced projects outside of China.

Aclara has set an aggressive timeline for development, aiming to bring the Penco Module into production by 2027 and the Carina Module by 2029. In the meantime, the company is advancing its projects on multiple fronts, from additional resource definition drilling to pilot plant operations and environmental studies.