The Copper Price is Near an All-Time High

A look at what is driving the price surge in copper; and some investment opportunities that flow out of the red metal’s red-hot streak.

By Lawrence Roulston

Electrification is often cited as the driving force in the copper market and it is certainly an important aspect of the market. Electric vehicles, along with the global obsession with electronic devices plus the build-out of renewable energy, has added impetus to what was already a steady upward march in copper demand. With the market already stretched tight by constraints in supply, the copper price recently surpassed even the heady level that created so much excitement from 2006 to 2011. That earlier explosion in the copper price was driven by the rapid economic growth of China, which quickly grew to consume half the world copper supply. This copper market comes when growth in China may have cooled, at least for the moment.

Source: Trading Economics

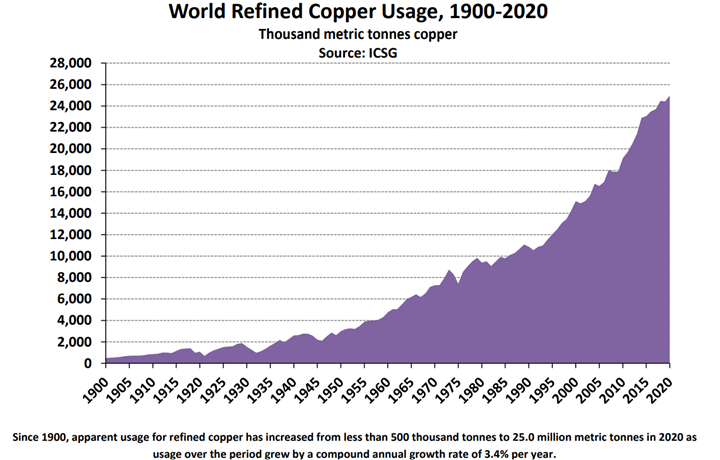

Steady Growth in Usage

Demand for copper has been growing steadily for decades, with copper used in a growing array of electronics as well as a huge range of other products, from plumbing fixtures to anti-microbial surfaces.

Source: International Copper Study Group, www.icsg.org

Copper demand will continue that long-term growth trend, boosted by growing electrification. There is simply no substitute for the physical traits that have made copper a mainstay in everything electric since the days of Edison.

Uncertainty on the Supply Side

The supply-side is less clear. Ivanhoe’s massive new Kamoa-Kakula copper mine in Congo has been supplying copper to the market since May. A smooth ramp-up saw the mine exceed design capacity by September and expansion construction is already underway, due for completion mid-2022. Once the expansion is complete, this mine will produce 400,000 tonnes per year and enter the top ten copper mines. (1)

Less certain is the expansion of the Oyu Tolgoi mine in Mongolia. A conflict among the joint venture partners with regard to funding the projected $1.2 billion cost overrun for the expansion is slowing progress. OT is expected to produce up to 180,000 tonnes of copper this year. The expansion, expected to cost $6.8 billion, will add 360,000 tonnes per year. (2)

Other new sources of copper supply include:

- AngloAmerican’s Quellaveco mine will add 300,000 tonnes per year beginning next year. (3)

- BHP is adding 200,000 tonnes per year capacity at its Spence operation in Chile. (4)

- Teck’s Quebrada Blanca Phase 2 is expected to begin production in the second half of next year, with a design capacity of about 300,000 tonnes. (5)

- Udokan in northern Russia is due to begin production next year at a rate of 130,000 tonnes per year. (6)

That sounds like a lot of new production coming on stream in a short time but remember that the average annual growth in copper demand of 3.4% implies the need for an additional 850,000 tonnes of copper production each year. If all of these projects come on stream in 2021 and 2022 as scheduled and at design capacity, they will almost satisfy the projected growth in demand over that two-year period. It is not clear how the next years of demand growth will be supplied.

Beyond the growth in demand, further new capacity is needed to offset declines from existing mines. Pressing hard on the supply-side is the steady decline in the grade of copper mines. The average mined ore grade has been decreasing steadily as higher-grade deposits are depleted. The average mined grade is now just 0.62%. (7)

As the higher-grade portions of deposits are mined out, operators are forced to process lower grade ore, which means that output will decline unless expansion capital is deployed in order to process more ore to maintain output.

The Chilean producers are facing an additional challenge: Already scarce water is getting harder to find with the on-going drought in the main copper-producing region. At least two of the producers have cut production forecasts for next year. (8) (9)

Developing a new copper mine is very different than, for example, building a giga-factory to produce batteries for electric vehicles. Both require planning, permits and lots of capital. The difference is that a copper mine also requires a copper deposit as a starting point.

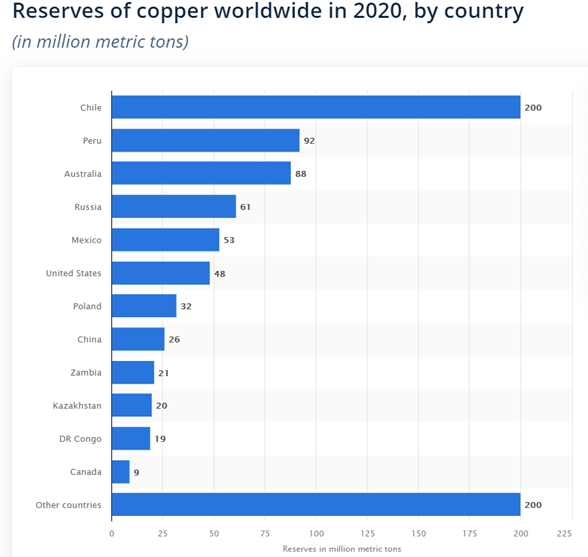

Source: Copper reserves by country 2020 | Statista

A glance at the chart of global copper reserves suggests that there is a lot of copper in known deposits. The reality is that if every pound of copper was extracted from the current mines and every one of the other deposits were developed, and factoring in the long-term annual growth in consumption, there would be enough copper for 21 years. Some of the deposits that are known today will not be developed, in the next couple of decades or at all.

Beyond the deposits at the reserves stage, there are additional pounds of copper at the resource stage. However, many of the deposits available for development face logistical and geopolitical challenges. Consider Reko Diq, one of the largest undeveloped copper deposits in the world: The owners have been in a legal dispute with the Pakistan government since 2006, fighting back against what has been characterized as indirect expropriation. The project is located on a finger of Pakistan between Iran and Afghanistan, a location that is certain to provide challenges for development funding, even assuming the ownership dispute is finally settled.

The mining industry is on the hunt for large deposits that have favorable grades and are in locations that are amenable to mine development.

A Look at Where Copper is Currently Produced

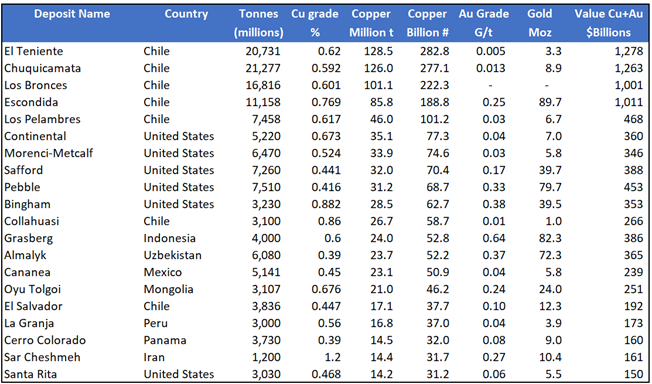

The table lists the top 20 copper mines in the world.

Source: The Largest Copper Mines in the World by Capacity (visualcapitalist.com) * Tied.

That list of the largest copper mines points out a very important geological point: sixteen of the top 20 copper mines are based on porphyry deposits and every one of those porphyries is located in close proximity to the Pacific Ring of Fire. That geological feature, a belt of heightened volcanic activity which circles the Pacific Ocean, is related to subduction of tectonic plates.

Most of the mines on that list have been in production for decades. Chuquicamata, for example, has seen large scale production for more than a century. The two US mines on the list have even longer production histories:

- Bingham has been in production since 1863, with Kennecott taking control in 1903.

- Morenci has been in production since 1872, with the current open pit starting in 1937. The average reserve grade is now 0.23%.

The United States Geological Survey (USGS) compiled information for the known porphyry copper deposits around the world in 2008, summing production with current resources to get an estimate of the size of the underlying deposits. That information is not up to date but it gives a pretty good approximation of the size and rankings of the large copper deposits.

The Largest Porphyry Copper Deposits (Info from the USGS)

Source: Porphyry copper deposits of the world (usgs.gov)

Updating the List of Large Copper Deposits

One deposit that has received an enormous amount of exploration in recent years and therefore deserves to be updated on that list is Sulphurets in the Golden Triangle of British Columbia. That region has the same geological setting as the other big porphyry districts around the Pacific.

On September 30, 2021, Resource World published an article that noted the metal endowment of that big porphyry system as presently outlined. (10) That article focused on the gold and silver figures, which are truly impressive, with 199 million ounces of gold and 790 million ounces of silver. Equally impressive is the 51 billion pounds of contained copper.

If we place Sulphurets into the USGS ranking based solely on the copper content, it ranks number 14, placing it among the giant porphyry deposits in the world.

Sulphurets is different than many of the other big porphyry deposits in that it has a particularly high gold content. In fact, exploration on and around the Sulphurets system has focused primarily on gold. If we add the value of the gold to the value of the copper for Sulphurets and the other deposits on the USGS list we see a different ranking, with Sulphurets now in the number five position.

Of course, these are rough approximations which are imprecise on many levels. Updating the other deposits might shift the rankings somewhat, but nobody can argue that Sulphurets ranks among the monster porphyry copper-gold systems in the world.

Many of the large deposits on this list have been explored for decades, meaning that the remaining exploration potential has been diminished. Not so for Sulphurets. Both the KSM and the Treaty Creek portions continue to grow with exploration, as do the peripheral gold deposits.

Seabridge has conducted a preliminary economic assessment on its KSM deposits, on a stand-alone basis, and the results show very favourable project economics. (11) Shareholders of the five companies that own a piece of the Sulphurets system have enjoyed huge gains in the values of their companies as exploration progresses.

Recent Discoveries …

Porphyry deposits typically occur in clusters, and like the other porphyry districts, the Golden Triangle hosts multiple porphyry deposits. While the others don’t match Sulphurets, none of them has come anywhere near being fully explored.

Production of Chilean porphyries began more than century ago, providing the capital and the infrastructure to explore and thereby continue to expand those deposits. Production in the Golden Triangle goes back all of 6 years, on the Red Chris deposit. Red Chris was developed by Imperial Metals, then a small producer, and began production even as exploration drilling continued, with a plan to fund further exploration from operating cash flow. Newcrest, Australia’s largest gold producer, bought control of Red Chris two years ago with the knowledge that the deposit was much larger than indicated by the mine plan. A recently completed pre-feasibility study projects gold production from an expanded mine of 316,000 ounces per year along with 80,000 tonnes of copper. (12)

The other deposits in the region are at earlier stages, with exploration paused while the owners look at development options. The Galore deposit, owned by Teck and Newmont, is focused on development logistics. Teck’s Schaft Creek deposit is also in the evaluation stage. That deposit has an interesting background: Exploration in the 1970s ignored the gold content and focused solely on copper. Junior company Copper Fox optioned the property from the major and assayed the original drill samples for gold. They found 5 million ounces of gold that had been overlooked. That gold dramatically changed the project economics, leading the major to buy their way back into control of the project.

The Saddle deposit was acquired by Newmont earlier this year and is still at an early stage in the exploration cycle. It is telling that a porphyry deposit was acquired by the largest gold company.

There are many more large deposits to be found in the Golden Triangle porphyry cluster. For example, on October 18, Enduro Metals announced a new discovery, with an intersection of 331 meters grading 0.71% copper equivalent. (13) (See disclosure) Â Those figures would be very favourable in any porphyry belt. Even more so considering this statement from the company’s head geologist and CEO in describing the geology in that drill hole: “suggesting Burgundy Ridge is on the fringes of a large system, and we likely have not tested the best portions of the porphyry”. Â With that interpretation, in the midst of a belt that hosts one of the largest porphyries in the world, those results take on particular significance. That significance has not yet been recognized by investors.

… and Next to be Discovered

Now, the big question is: Who will be next to announce a major porphyry discovery in the Golden Triangle?

In my view Mountain Boy’s Telegraph project is high on that list. (I’m trying to be objective but am clearly conflicted; see disclosure.) On one hand, it’s an early-stage project, but it is building on an enormous amount of previous work. The geological team compiled results generated over five decades by more than 50 companies working on various parts of the present project area. The evaluation of that extensive data set led the company to consolidate a large property position, involving five separate agreements. The results point to two large porphyry systems.

Work in the 1970s focused on copper and largely ignored gold, as was common at that time. That work included four shallow holes drilled in 1972 by a Swiss company. Work in the 1980s and 1990s followed the discovery of two large high-grade gold deposits in the Golden Triangle (Snip and Eskay) and focused on finding repeats of those deposits. That gold-focused exploration activity generated highly encouraging results, but interest fizzled as mineral exploration shut down after 1999.

In 2004, the area that was drilled by the Swiss company was staked by a geologist who knew the area well, having mapped it for the provincial government’s geological survey. In 2011, he brought in a junior company joint venture partner (for a couple of years, there was also a second junior involved). Over the past decade, a lot of good work was done, including geology, geochemistry, geophysics… and a grand total of two drill holes. Those holes, in 2014, tested the same area as was drilling in 1972.

The drill results demonstrate the presence of a porphyry system, but the less than stellar grades resulted in a downgrade of the project and minimal follow-on work. An examination of those drill results by the MTB geological team, in the context of the current understanding of the Golden Triangle geology, makes it apparent that those holes were on the periphery of a porphyry copper-gold system.

Before MTB consolidated the ground, the previous operators were constrained by the proximity of the target area to the property boundary. Mountain Boy now controls both sides of the boundary. The MTB geological team has integrated the results of the work conducted on both properties, including the geophysical surveys conducted separately by the two owners. The consolidated data suggests the target zone extends from the area drilled, southward across the property boundary onto what was at that time a neighboring property. MTB, for the first time, is examining that whole trend.

A second porphyry copper-gold centre has been outlined 15 kilometres to the east on what is now also part of the MTB Telegraph property. This target is outlined by geology, alteration, structures, geophysical signatures and surface samples with elevated copper and gold values extending over several square kilometres. That second target has never been drilled.

Fieldwork over this past season included work on both target areas and the intervening ground. That work was aimed at confirming the earlier results and also extending the data set.

A lot more work needs to be done on this project, but the team has an exceptional starting point, building on 5 decades of previous work. Mountain Boy shareholders will benefit in the near term from on-going advances on the Telegraph property and from the growing realization of the enormous potential of this project. In addition to Telegraph, the company is advancing five other projects, providing multiple shots at a major discovery.

Lawrence Roulston is a geologist with nearly 40 years of experience in the mining industry. Lawrence worked in the management of juniors and one of the majors as well as an investment firm. For 15 years he wrote the highly regarded Resource Opportunities newsletter before getting back to managing mineral exploration. His experience in the Golden Triangle goes back to the 1980s when he ran an exploration program in the area. He is presently involved in three companies exploring in the Triangle – advisor to Metallis Minerals [MTS-TSXV], director of Enduro Metals [ENDR-TSXV] and CEO of Mountain Boy Minerals [MTB-TSXV]. He is also chairman of Metalla Royalty and Streaming [MTA-NYSE].

Disclosure: The author of this article, Lawrence Roulston, has an interest in two of the companies mentioned in this article: He is a director and shareholder of Enduro Metals and he is director, CEO and a shareholder of Mountain Boy.

Notes: