The Future of Graphite and Graphene: Game-Changing Materials for a Sustainable Tomorrow

By Peter Kennedy

Imagine a world where your smartphone could charge faster, your electric vehicle could go farther, and your buildings could be stronger and more energy efficient. This is the world of graphite and graphene, two materials that are revolutionizing industries and transforming the way we live.

The graphite and graphene markets are poised for significant growth in the coming years, driven by increasing demand from various applications such as energy storage, electronics, composites, and nanomaterials. According to a report by ReportLinker, in 2022, the global graphite market was valued at US$23.73 billion and is expected to grow to US$37.68 billion by 2028., while Grand View Research reported the global graphene market size was valued at US$175.9 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 46.6% or US$3,752.9 million from 2023 to 2030.

Graphite, a form of carbon, has been around for centuries and is known for its unique properties, including high thermal conductivity, electrical conductivity, and chemical stability. These properties make it an ideal material for a range of applications, from refractory linings to battery electrodes. But recent advancements in graphite technology have taken it to new heights.

One of the most promising applications of graphite is in the field of electric vehicles. Graphite-based battery electrodes have the potential to significantly improve the range and charging time of electric vehicles, making them more practical and accessible to consumers. Additionally, graphite is being explored for use in advanced nuclear reactors, which could provide a cleaner and more sustainable source of energy.

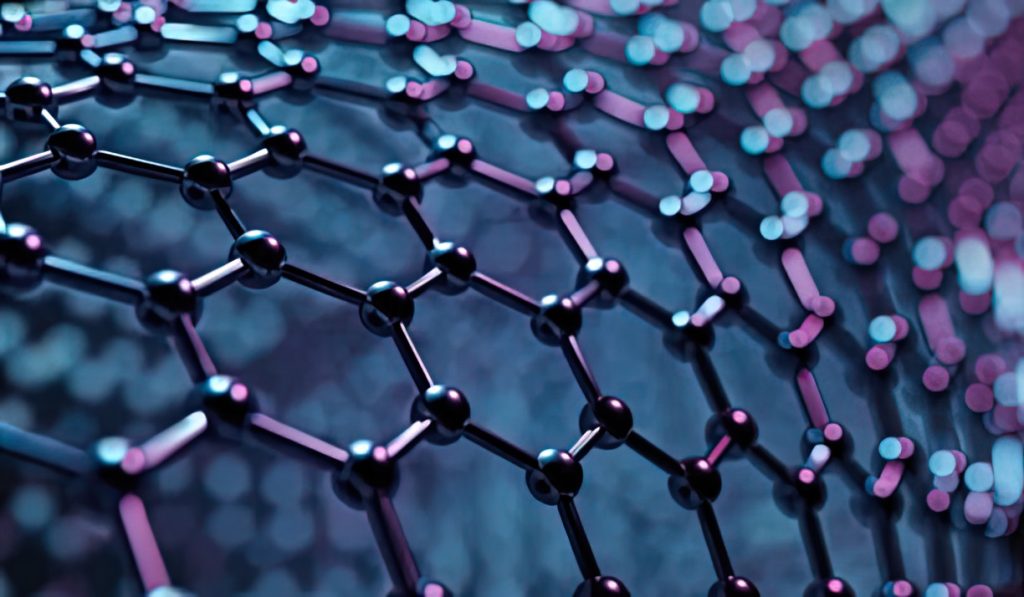

Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, is one of the strongest and most conductive materials known to man. Graphene is made from graphite through a process called exfoliation or mechanical exfoliation. The process involves separating individual layers of graphene from the layered structure of graphite. Its unique properties make it an ideal material for a range of applications, from electronics to medicine.

One of the most exciting applications of graphene is in the field of energy storage. Graphene-based batteries have the potential to store more energy and charge faster than traditional batteries, making them ideal for electric vehicles and other high-power applications. Additionally, graphene is being explored for use in solar cells, where it could significantly improve efficiency and reduce costs.

One of the biggest challenges facing the graphite and graphene markets is the availability of high-quality deposits. Many of the world’s largest graphite deposits are located in China, which has led to concerns about the country’s dominance in the global graphite market. However, there are also deposits located in Canada and USA, which could help diversify the market and reduce dependence on China and Graphite One Resources Inc. and Graphano Energy Ltd. are two companies that aim to do just that.

Graphite One Resources Inc. [GPH-TSXV; GPHOF-OTCQX] recently received a US$37.5 million grant from the U.S. Department of Defense, is working to establish a complete domestic U.S. supply chain for advanced graphite materials.

Graphite One Resources Inc. [GPH-TSXV; GPHOF-OTCQX] recently received a US$37.5 million grant from the U.S. Department of Defense, is working to establish a complete domestic U.S. supply chain for advanced graphite materials.

It is a strategy anchored by the company’s Graphite Creek project in Alaska, which according to the U.S. Geological Survey, hosts the largest known flake graphite resource in the U.S. and ranks among the largest in the world.

The United States is currently 100% import dependent for natural graphite, a commodity that has been designated as one of the battery materials deemed under Defence Production Act law to be “essential to the national defense.”

The objective of the US$37.5 million grant is to modernize and expand domestic production capacity and supply for graphite battery anodes that are necessary for electronic vehicles and alternative energy batteries, as an essential national defense technology item.

Graphite One will use the grant to fund an accelerated feasibility study at Graphite Creek. It will also use proceeds of a US$5 million loan from its controlling shareholder Taiga Mining Co. in a bid to double the size of the Graphite Creek resource.

Completing the US$75 million feasibility study is part of a project plan that could see Graphite One mining graphite, producing concentrates at the mine site and shipping that material to a battery anode manufacturing facility, likely to be located in Washington State.

The plan includes a recycling facility to reclaim graphite and other battery materials that will be co-located at the Washington State site, a development that would mark the third link in Graphite One’s circular economic strategy.

The plan includes a recycling facility to reclaim graphite and other battery materials that will be co-located at the Washington State site, a development that would mark the third link in Graphite One’s circular economic strategy.

A production decision is expected to occur after the feasibility study is complete.

Alaska Senator Lisa Murkowski has described Graphite One’s overall plan as a “major opportunity” for the United States.

As the strategy is rolling out, Graphite One shares were trading July 25, 2023 at $1.49 in a 52-week range of $1.97 and 93 cents, leaving the company with a market cap of $181 million, based on 125.4 million shares outstanding.

Graphite, an industrial mineral that has previously been tied to steel production, is gaining investor attention because of surging global demand for graphite used in electrical vehicle batteries, fuel cells, power storage and other emerging next generation applications.

Graphite has long established itself as the dominant anode material in commercial lithium-ion batteries because its “capacity is very good and it’s (sic) structural stability is superb”.

Against sharply rising demand, the accelerated use of lithium-ion batteries and the broader green energy transition will require 4.5 million tonnes of graphite by 2050, according to World Bank data released in 2020 – a nearly 500% increase over 2018 levels.

Simon Moores, managing director of Benchmark Mineral Intelligence, declared in 2019 that “we are in the midst of a global battery arms race,” in which the U.S. and Europe were slow getting off the mark.

Graphite One President and CEO Anthony Huston has said at least five new mines may be required to meet future demand.

In a bid to support critical supply chains and help the U.S. and its allies make up ground in the global battery arms race, Graphite One is planning to build out a vertically integrated U.S.-based supply chain capable of delivering 41,850 tonnes of battery grade coated spherical graphite (CSG), and 13,500 tonnes of additional advanced graphite materials annually.

In a bid to support critical supply chains and help the U.S. and its allies make up ground in the global battery arms race, Graphite One is planning to build out a vertically integrated U.S.-based supply chain capable of delivering 41,850 tonnes of battery grade coated spherical graphite (CSG), and 13,500 tonnes of additional advanced graphite materials annually.

It is why Graphite Creek was recently designated a high-priority infrastructure project by the U.S. government.

A pre-feasibility study for Graphite Creek envisages an operational life of 26 years, (a mine life of 23 years) producing 75,026 tonnes of advanced graphite products annually.

The initial capital cost, including a US$170 million contingency is pegged at $1.24 billion. The study foresees an average production price of US$7,301 per tonne.

According to an updated resource estimate, the project is now estimated to host a measured and indicated resource of 32.5 million tonnes of 5.25% Cg (graphitic carbon).

The mine is planned as a conventional open pit operation, using drilling, blasting, loading and hauling. Over its 23-year life, the mine is expected to produce 22.4 million tonnes of ore with an average grade of 5.6% Cg, at a 2.2:1 strip ratio.

Peak production is expected to be approximately 11,000 tonnes per day.

While those projections are from the Graphite One PFS, the Feasibility Study — which DoD funding will accelerate, supporting added field resources for the G1 drilling program now underway at Graphite Creek– will aim at significantly increasing projected production.

While Graphite One aims to focus primarily on the electric vehicle and energy storage systems markets, it hasn’t lost sight of the considerable potential of non-energy applications for graphite. To that end, Graphite One has teamed up with Vorbeck Materials Corp, a U.S. company that is focused on developing innovative products based on graphene a highly conductive and strong nano material made from a single layer of carbon atoms.

Vorbeck was established in 2006 based on technology licensed by Princeton University. The aim is to explore opportunities to develop entirely new markets in both the commercial and defense sectors.

Meanwhile, Graphite One has said its planned drilling program for 2023 will continue to delineate the scope and size of resource, as the Graphite Creek deposit remains open to the west, east and down dip. It is worth noting that the updated resource did not include Hole 22GC079, drilled 2.1 kilometres west of the current block model, which encountered 58 metres of 4.18% graphite.

Graphano Energy Ltd. [GEL-TSXV; GELEF-OTCQB; 97G0-FSE] is working to expand the North American supply of graphite by developing properties in the Lac-Aux Bouleaux (LAB) mine region of Quebec, a Canadian province that has historically been a source of graphite production and known as “mining friendly”.

Graphano Energy Ltd. [GEL-TSXV; GELEF-OTCQB; 97G0-FSE] is working to expand the North American supply of graphite by developing properties in the Lac-Aux Bouleaux (LAB) mine region of Quebec, a Canadian province that has historically been a source of graphite production and known as “mining friendly”.

Its flagship LAB property is adjacent to Northern Graphite Corp.’s [NGC-TSXV; NGPHF-OTCQB] Lac Des Iles graphite mine, the only significant producing graphite mine in Canada and the United States.

The location next to the highly acessible Lac Des Iles graphite mine and proximity to clean power, paved roads and water in an established graphite mining district presents obvious opportunities for Graphano and its shareholders. It could make the company a takeover target if it outlines a NI 43-101-compliant graphite resource on its Quebec properties.

All of Graphano’s properties are located within trucking distance of each other to allow for the company’s resource consolidation strategy that could entail feeding a centralized processing plant.

In an interview with Resource World, Graphano CEO, Dr. Luisa Moreno said she believes LAB could be fast-tracked to production. But she said the priority is to properly assess the potential size of a resource at both LAB and the nearby Standard Mine property. In keeping with the consolidation strategy, the company has staked two sets of additional graphite claims, 5.0 kilometres and 10.0 kilometres south from the LAB property. A total of 11 claims covering 600 hectares were staked and consist of the Dudley and Lac Vert-Bouthillier graphite showings.

“We are confident that we will define a compliant mineral resource to supply graphite to the rapidly growing North American battery supply chain in the near term. This would continue to make this region of Quebec the only local source of graphite in North America,’’ said Moreno.

The LAB property claims (covering 738.12 hectares) are located in southern Quebec about 180 kilometres northwest of Montreal. The claims were held by Lac des Iles’ previous owner Imerys Graphite & Carbon (Imerys), [formerly TIMCAL Canada Inc.] until November, 2014.

The LAB property claims (covering 738.12 hectares) are located in southern Quebec about 180 kilometres northwest of Montreal. The claims were held by Lac des Iles’ previous owner Imerys Graphite & Carbon (Imerys), [formerly TIMCAL Canada Inc.] until November, 2014.

After being allowed to lapse, the LAB claims were immediately staked by Afzaal Pirzada of Geomap Exploration Inc. and ultimately acquired by Manganese X Energy Corp. [MN-TSXV] in June 2019. Manganese X elected to focus its attention on manganese by spinning out the project into Graphano, a company that began trading in late 2021.

Due to strongly growing demand from clean and green tech applications, and the supply risk related to the fact that China accounts for over 70% of the world’s production, graphite is deemed the new strategic material, one that is viewed as being critical to the economic security of the United States and European Union.

Graphite mineralization was discovered on the LAB property in 1957. The claims are known to contain an historic resource of 1.32 million tonnes of 9.0% graphitic carbon (Cg).

According to a technical report, LAB contains an onsite mill structure from the early 1990s, a tailings dam facility, and an historical open mining pit. Based on the size of the pit, it was estimated that over 100,000 tonnes of rock were removed for processing at the mill facility. The existing tailings dam facility was observed to be in good condition, the technical report says.

Trenching and sampling work in 2017 confirmed the presence of high-grade large flake graphite at several locations with values up to 22.3% Cg.

The company has said the historical resource at LAB, the recently announced Zone 3 discovery, and recent results from the Standard Mine project reinforce the economic potential of its consolidation strategy.

Zone 3 is one of eight target areas identified from the 2015 airborne high-resolution magnetic and time-domain electromagnetic (TDEM) survey completed on the LAB property. The majority of drill holes completed on the Zone 3 target intersected near surface mineralized horizons ranging from 1.0 metres to 14 metres in thickness (core length) over a 500-metre length.

Zone 3 is one of eight target areas identified from the 2015 airborne high-resolution magnetic and time-domain electromagnetic (TDEM) survey completed on the LAB property. The majority of drill holes completed on the Zone 3 target intersected near surface mineralized horizons ranging from 1.0 metres to 14 metres in thickness (core length) over a 500-metre length.

Drilling highlights from Zone 3 include LB22-33, which returned 6.26% graphitic carbon (CG) over 13.7 metres starting at 14.0 metres drilled depth, including 11.95% Cg over 4.7 metres at 14 metres.

The company has said three major zones of graphite mineralization have been defined so far on the Standard Mine project. A Spring 2023, program successfully extended the length of graphite mineralized zones by more than 225 metres to a combined length of more than 1,300 metres

During the spring program, 115 samples were collected from nine trenching locations, yielding the following highlight results: NW Gf Trend TR23-25 returned 8.91% graphitic carbon (Cg) over 23 m, including 12.09% cg over 14 metres and a second zone assaying 10.87% Cg over 6.00 metres.

“We are delighted with the consistently strong results at the Standard Mine Project, with the high-grade intersections from the surface,” Moreno said. “These results strengthen the short-term production potential of the historic Standard Mine site.”

Following the successful completion of Phase II drilling, the Company has engaged qualified engineering firms to determine a timely path to production.

Mercator Geological Services, a leading Canadian firm on resource estimation, has been engaged by the Company to help design future drilling programs and to prepare a resource estimate for the LAB and Standard projects.

WSP Canada Inc. was engaged to perform an analysis of the permitting requirements to fast track the development of the Company’s LAB and Standard projects, assuming an initial lower production quarry model.

SGS Canada Inc has been engaged to develop a metallurgical flowsheet for the company’s projects, which is essential for the commissioning of a preliminary economic assessment, planned for 2024.

On August 25, 2023, Graphano shares were trading at 11 cents in a 52-week range of 39.5 cents to 15 cents, leaving the junior with a market cap of just under $2.0 million, based on 17.08 million shares outstanding. And this with over $2m cash in bank!