The prospective spell of the Yukon lives on

By Peter Kennedy

Renowned for its placer gold mines, as made famous by the Robert Service poem The Spell of the Yukon, the Canadian territory was recently ranked among the world’s top mining jurisdictions.

In February, 2019, the Fraser Institute said a survey of mining executives ranked 83 jurisdictions around the world based on their geological attractiveness for minerals and metals and the extent to which government policies encourage or deter exploration and investment. The Yukon was one of four Canadian jurisdictions that ranked among the top 10 most attractive jurisdictions globally for mining investment.

The survey said active engagement from the Territorial government in streamlining processes and marketing exploration and mining opportunities is encouraging for investors. The Yukon has also been praised for a made-in-the-territory environmental assessment process that was developed collaboratively by Yukon First Nations and governments.

The mining industry participates fully in this process, implementing recommendations either as permit conditions or through economic benefit agreements with Yukon First Nations.

As a result, mining contributes hundreds of millions of dollars to the territory’s economy and social initiatives every year whether commodity prices are up or down.

The Yukon is best known for the fabled Klondike District gold fields near Dawson City, which have produced 20 million ounces of gold, with virtually all of that metal coming from placer gold mines that continue to operate to this day.

However, the territory has turned a corner in recent years with the development of new hard rock mines. There are currently three in production, including Victoria Gold’s [VIT-TSXV] Eagle gold mine, the Minto Exploration/Pembridge Minto copper-gold mine, and the Alexco Resources [AXR-TSX; AXU-NYSE] Keno Hill silver mine.

The Eagle mine is part of the larger Dublin Gulch Project located in south-central Yukon, 85 kilometres north of Mayo It ranks as the largest hard rock gold mine in the Yukon’s history.

This year, the mine is expected to produce between 180,000 and 200,000 ounces at an all-in-sustaining cost of between US$1,050 and US$1,175 an ounce, utilizing heap leach processing methods. Full construction commenced on March 15, 2018.

In November, 2020, Alexco announced that it has commissioned the mill and launched initial production of lead-silver and zinc concentrates at its flagship Keno Hill silver project.

Keno Hill is expected to produce an average of approximately 4.0 million ounces of silver annually contained in lead-silver and zinc concentrates.

An updated life-of-mine plan contemplates average annual production from Keno Hill of 4.4 million ounces of silver at an average all-in sustaining cost (AISC), including corporate costs and working capital, of US$11.59/oz. In keeping with that plan, during the first quarter of 2021, Keno Hill was ramping up towards design capacity of 400 tonnes/day.

Meanwhile the potential for new developments was underlined recently by news that Rio Tinto Plc [RIO-NYSE] is making a $25.6 million strategic investment in Western Copper & Gold Corp.’s [WRN-TSX, NYSE American] Casino Copper-Gold Project.

The move is seen as an opportunity for Rio Tinto to gain a better understanding of Casino Project, which ranks as one of the largest copper-gold projects in Canada. It is estimated to host measured and indicated resources 14.5 million ounces of gold and 7.6 billion pounds of copper. On top of that is an inferred resource of 6.6 million ounces of gold and 3.3 billion pounds of copper.

Western Copper just released a positive PEA that envisages the project being constructed as an open pit mine, with a concentrator processing 120,000 tonnes/day and a gold heap leach facility nominally processing 25,000 tonnes/day.

Casino is located in an area that also hosts Triumph Gold Corp.’s [TIG-TSXV; TIGCF-OTC; 8N61-FSE] Freegold Mountain Project, well as Newmont Corp.’s [NGT-TSX, NEM-NYSE] Coffee deposit, and Rockhaven Resources Ltd.’s [RK-TSXV] Klaza gold project.

Rio Tinto is taking an 8.0% stake in Western Copper by acquiring 11.8 million shares in the junior for $2.17 a share. Proceeds will be used to fund specific areas of study, which will form part of the feasibility study and permitting.

The investment gives Rio Tinto – part owner of the N.W.T.’s Diavik Diamond Mine – another foothold in Canada’s north. It also adds to the likelihood that Casino is going to be a mine sooner rather than later.

Other major mining companies with interests in the Yukon include Kinross Gold Corp. [K-TSX; KGC-NYSE] and Agnico Eagle Mines Ltd. [AEM-TSX, NYSE], each of which have shares in White Gold Corp. [WGO-TSXV; WHGOF-OTC].

White Gold holds a claim portfolio of over 420,000 hectares, representing over 40% of the White Gold District. Its resources include the flagship Golden Saddle and Arc gold deposits.

Golden Predator Mining Corp. [GPY-TSXV; NTGSF-OTCQX] has been advancing its 100%-owned Brewery Creek heap leach gold project 55 km east of Dawson City towards production where a bankable feasibility study is under way.

Rockhaven Resources Ltd. [RK-TSXV] is a well-funded resource junior with a focus on the exploration and development of its 100%-owned and road-accessible Klaza gold silver project in the Yukon.

Rockhaven Resources Ltd. [RK-TSXV] is a well-funded resource junior with a focus on the exploration and development of its 100%-owned and road-accessible Klaza gold silver project in the Yukon.

Klaza hosts one of the highest-grade gold deposits ever found in the Yukon, a mining-friendly jurisdiction that is already well known for its placer gold mining operations.

Located in the Dawson Range Gold Belt of south-central Yukon, 50 kilometres west of Carmacks, the project is situated in an area that hosts a historical gold mine, rich placer gold deposits, and key infrastructure, such as roads and electrical power lines.

In June, 2018, Rockhaven announced an updated resource estimate for the high-grade Western BRX, Central BRX, Central Klaza and Western Klaza zones.

They are estimated to host 4.5 million tonnes, containing an Indicated Resource of 686,000 ounces of gold and 14 million ounces of silver (or 907,000 ounces of gold equivalent.

Inferred Resources now stand at 5.7 million tonnes, containing 507,000 ounces gold and 13.9 million ounces of silver (725,000 ounces of gold equivalent).

At present, 60% of the total mineral resources at Klaza are classified as Indicated and 40% as Inferred.

According to an updated preliminary economic assessment (PEA) released in July 13, 2020, the project could produce 750,000 ounces of gold and 13.8 million ounces of silver over a 12-year mine-life. The robust PEA has a Post-Tax NPV(5%) of C$378 million and an IRR of 37% (US$1,450/oz gold; US$17/oz silver).

According to an updated preliminary economic assessment (PEA) released in July 13, 2020, the project could produce 750,000 ounces of gold and 13.8 million ounces of silver over a 12-year mine-life. The robust PEA has a Post-Tax NPV(5%) of C$378 million and an IRR of 37% (US$1,450/oz gold; US$17/oz silver).

The PEA envisages annual metal production in excess of 100,000 ounces of gold equivalent in years three through seven.

The initial capital cost of what would initially be an open pit mine is pegged at $244 million, and includes 32 million in contingency costs. Life-of-mine sustaining capital costs are estimated at $114 million.

Average life-of-mine operating cash costs are estimated at US$613 an ounce gold equivalent (AuEq). The total all-in sustaining cost is pegged at US$875 an ounce AuEq.

“This [PEA] study demonstrates that Rockhaven’s Klaza Deposit could support a mine with a long life and robust economics,” said Rockhaven President Matt Turner. He said the company looks forward to adding value through additional discoveries while advancing the deposit through the pre-feasibility phase.

In keeping with that plan, Rockhaven aims to complete 12,000-metres of diamond drilling this year.

The 2021 work program combines the hunt for new, large-scale discoveries with continued de-risking of the project through focused infill drilling, metallurgical test work and engineering studies.

This program is intended to advance the known deposits in support of a planned preliminary feasibility study while simultaneously evaluating the potential for new areas of mineralization extending from the porphyry core to the adjacent high-grade gold-silver epithermal vein field, which currently has an impressive 15 km2 extent.

This program is intended to advance the known deposits in support of a planned preliminary feasibility study while simultaneously evaluating the potential for new areas of mineralization extending from the porphyry core to the adjacent high-grade gold-silver epithermal vein field, which currently has an impressive 15 km2 extent.

The planned 2021 exploration program is fully funded and is scheduled to begin in early June, the company has said. It will utilize two diamond drills and include 5,000 metres of drilling, work that will be focused on continued conversion of resources from inferred to indicated and 7,000 metres designed to expand the scope of the project by testing high priority targets outside the current mineral resources.

Priority exploration targets include bulk tonnage copper-gold-molybdenum-silver porphyry targets that are likely the main driver for mineralization at the Klaza district and yet are relatively underexplored.

Porphyry-style targets to be tested this year include:

The Kelly Porphyry Target, which lies immediately southeast of the vein system hosting the Klaza Deposit. It will be the focus of two fences of holes.

The Kelly Porphyry Target, which lies immediately southeast of the vein system hosting the Klaza Deposit. It will be the focus of two fences of holes.

The Etzel/Cyprus Porphyry Target, which is located southeast of the Kelly Porphyry and hosts gold and copper-gold mineralization spread over a 4.5 square kilometre area that will be tested by four holes.

Rockhaven also plans to continue to explore for extensions to known higher-grade gold-silver vein systems, including the high-grade Western BRX and newly discovered Rusk vein complex:

The Rusk Target is located 3.0 kilometres south of the Klaza Deposit and is outlined by a 2.6 square kilometre, highly elevated arsenic-in-soil anomaly. It is adjacent to the largest placer gold mine in the Mount Nansen Gold Camp.

The Western BRX Zone is the highest-grade zone identified on the property to date and is only lightly explored to the west of the current mineral resource.

Infill drilling at the Klaza Deposit will focus on upgrading inferred resources into indicated resources.

On June 22, 2021, Rockhaven shares were trading at $0.135 cents in a 52-week range of 25 cents and $0.11, leaving the company with a market cap of $28.08 million, based on 208 million shares outstanding.

Triumph Gold Corp. [TIG-TSXV; TIGCF-OTC; 8N61-FSE] is a growth-oriented precious metals exploration and development company with a focus on creating exploring and developing its 100%-owned district-scale Freegold Mountain Project in the Yukon. The property already has over 2 million ounces gold equivalent on three deposits that still have lots of growth in them. Apart from growing these, following up on new exploration discoveries is also high up on the company’s list of priorities.

Triumph Gold Corp. [TIG-TSXV; TIGCF-OTC; 8N61-FSE] is a growth-oriented precious metals exploration and development company with a focus on creating exploring and developing its 100%-owned district-scale Freegold Mountain Project in the Yukon. The property already has over 2 million ounces gold equivalent on three deposits that still have lots of growth in them. Apart from growing these, following up on new exploration discoveries is also high up on the company’s list of priorities.

The company is led by an experienced team with a collective history of exploration to mining success, technical acumen, and capital raising ability. CEO John Anderson has raised over $50 million for Triumph Gold. Brian Bower, Lead Director joined the company last summer and has been building an all-star technical team to support Jesse Halle, VP Exploration. With a new office in Kelowna to focus completely on leveraging the 80 years of technical data on the property, including almost 150,000 metres of drilling and the recent 3-D inverse magnetic studies and recent AI work performed by Minerva Geosciences.

Triumph Gold’s flagship project is the Freegold Mountain Project located in the Dawson Range gold-copper belt. The project covers a 200 km2 road accessible portion of the Big Creek Fault, a structural system directly related to gold-rich porphyry, epithermal and related polymetallic vein and skarn mineralization. The district scale project is host to abundant copper-gold prospects, as well as three NI 43-101 compliant mineral deposits.

Freegold Mountain is located in an area that also hosts Western Copper and Gold’s [WRN-TSX] Casino Project as well as Newmont Corp.’s [NGT-TSX; NEM-NYSE] Coffee deposit, and Rockhaven Resources Ltd.’s [RK-TSXV] Klaza gold project. Goldcorp, a Canadian company that subsequently merged with Newmont, gained exposure to the road-accessible Freegold Project by taking a 19.9% stake in Triumph for $6.3 million.

Since Triumph Gold acquired the property in 2006, more than 20 mineralized zones have been identified, and NI 43-101-compliant mineralized resources have been delineated in the Revenue (gold-silver-copper-molybdenum porphyry-related) deposit, the Nucleus (gold-silver-copper) deposit, and the Tinta Hill (gold-silver-copper-lead-zinc vein-related) deposits.

Since Triumph Gold acquired the property in 2006, more than 20 mineralized zones have been identified, and NI 43-101-compliant mineralized resources have been delineated in the Revenue (gold-silver-copper-molybdenum porphyry-related) deposit, the Nucleus (gold-silver-copper) deposit, and the Tinta Hill (gold-silver-copper-lead-zinc vein-related) deposits.

The three deposits host open-pit constrained mineral resources, with two of the deposits (Revenue and Tinta Hill) including deeper, high-grade mineralized resources considered amenable to underground extraction methods.

Recent drilling on two new discoveries include 400 metres of 0.73 g/t gold, 0.23% copper and 0.025% molybdenum within over 600 metres of 0.67 g/t gold, 0.19% copper and 0.032% moly. This sits above another 102 metres of 0.7 g/t gold, 0.18% copper and 0.055% moly in the same hole that the company believes is near the source for these impressive grades as it is in higher temperature Potassic altered chalcopyrite and magnetite.

Higher grade (+1.4 g/t gold equivalent) mineralization in the newly discovered Blue Sky Porphyry Breccia is now included in an underground portion of the Revenue resource. Similarly, the new Irene Zone, which is a higher grade epithermal vein discovered in 2018 and confirmed last summer to be part of a 3.7-km long structure where most drilling has confirmed multi-gram gold over multi-metres, will be sure to awaken the market to what this property could host. Triumph recently expanded its Yukon land holdings by striking a deal with Teck Resources Ltd. [TECK.B-TSX; TECK.A-TSX; TECK-NYSE] to acquire the Big Creek copper-gold property. The acquisition is both strategic and accreditive as it is situated along the proposed road extension to either Western Copper’s Casino Deposit or Newmont’s Coffee Project. When the road is built, the additional property will have the same benefits the company currently enjoys from the current infrastructure on the Freegold Mountain Project.

Triumph’s technical team is in the final stages of designing an exploration program for the Freegold Mountain Project this year, which is scheduled to commence in late spring. It said the program will focus on both resource expansion and testing of new targets at Revenue, Nucleus, and the Melissa Zone as well as the Tinta Deposit.

Triumph’s technical team is in the final stages of designing an exploration program for the Freegold Mountain Project this year, which is scheduled to commence in late spring. It said the program will focus on both resource expansion and testing of new targets at Revenue, Nucleus, and the Melissa Zone as well as the Tinta Deposit.

The program will be based on the significant advancements made in the first half of 2021 through a number of successful initiatives. They include the digitization and validation of geological, geochemical and geophysical data in a recently-acquired 3D modelling software, resulting in confirmation and generation of new exploration targets throughout the project area.

The company continues to aggressively explore, building ounces at the existing deposits and evaluating the multitude of other targets located on the Freegold Mountain property.

Meanwhile, Triumph expects to benefit from the Yukon’s Resource Gateway Project, which is expected to deliver $360 million for upgrades to infrastructure in the Dawson Range, including upgrades to the existing Mount Freegold Road.

The 6,464-hectare Tad/Toro property is also expected to benefit from this upgrade as it is located 40 kilometres northwest of Freegold Mountain. Historical drill results from the Main Zone include 1.05 g/t gold and 19.5 g/t silver across 7.15 metres. Values in old trenches that require further investigation include 0.46 g/t gold and 26.1 g/t silver over 37.8 metres.

On June 22, 2021, Triumph Gold shares were trading at 19 cents in a 52-week range of 48 cents and 13 cents leaving the company with a market cap of $26.37 million based on 138.8 million shares outstanding.

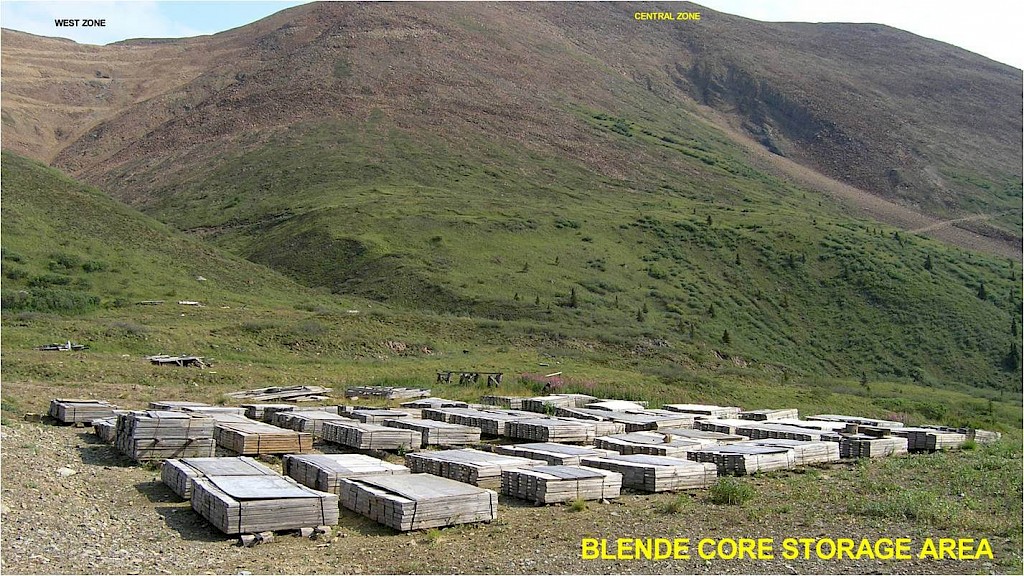

Blende Silver Corp. [BAG-TSXV] recently released new mineral resource estimates for its 100%-owned, 3% NSR, flagship Blende Deposit, the largest carbonate-hosted silver-zinc-lead deposit in north-central Yukon Territory. It’s a good time to be developing a silver-zinc-lead rich deposit due to the metal’s supply concerns, a strong demand outlook from China and declining inventories.

Blende Silver Corp. [BAG-TSXV] recently released new mineral resource estimates for its 100%-owned, 3% NSR, flagship Blende Deposit, the largest carbonate-hosted silver-zinc-lead deposit in north-central Yukon Territory. It’s a good time to be developing a silver-zinc-lead rich deposit due to the metal’s supply concerns, a strong demand outlook from China and declining inventories.

Located 63 kilometres northeast of the famous silver mining region of Keno Hill and only 20 kilometres north of ATAC’s recent high-grade Ocelot silver-lead-zinc discovery, the 5,345-hectare, winter road-accessible property has had over $9.2 million in past exploration, including $5.2 by the company.

This previous work included 25,195 metres of drilling in 132 drill holes that lead to completion of an initial independent NI 43-101 compliant open pit resource estimate.

The new Indicated Resource estimate stands at 4,643,000 tonnes grading 4.60% zinc equivalent (ZnEq) and Inferred Resources of 42,243,000 tonnes of 4.49% ZnEq, at a Base Case cut-off grade of 1.5% zinc. These new resource estimates equate to in situ metal content of 187 million lbs zinc, 167 million lbs lead and 4,526,000 oz silver Indicated and 1,706 million lbs zinc, 1,505 million lbs lead and 37,320,000 oz silver Inferred.

The updated resource estimates were prepared to reflect current metal prices and costs which were used to calculate the cut-off grade of 1.5% ZnEq. Metal prices used were US$1.30/lb zinc, US$1.00/lb lead and US$26/troy oz silver. This resulted in an increase of 15% zinc, 7% silver and 6% lead. No additional drilling was completed or used to prepare the updated resource estimate.

The resource pit shape was independently defined for 160% of base case prices and the following cost assumptions (CDN$) per tonne included : Mining – $1.50; Processing – $15.00; G&A – $5.72; Surface Service – $6.25; Tailing Construction – $6.25, for a total of $33.22.

The resource pit shape was independently defined for 160% of base case prices and the following cost assumptions (CDN$) per tonne included : Mining – $1.50; Processing – $15.00; G&A – $5.72; Surface Service – $6.25; Tailing Construction – $6.25, for a total of $33.22.

Company director, Andrew H. Rees, commented, “The company is encouraged with the increase to both the Indicated and Inferred resources at the Blende Project. Our technical team has reviewed the data provided with the updated resource estimate and is finalizing a drill program for our 2021 field season as we prepare for the larger objective which will be to commission a Preliminary Economic assessment.”

As examples, drilling in the West Zone has returned 24.3 metres grading 7.43% lead+zinc and 61.1 g/t silver with other holes returning similar assays. Drilling in the East Zone has returned 21.7 metres of 7.03% lead+zinc and 52.1 g/t silver and other similar results. Metallurgical studies have determined that the Blende mineralogy will respond well to standard process techniques.

There is excellent potential for delineating further resources as mineralization on the property starts at surface and is open to the northwest, southeast and below the mineralization that extends along a 6km strike length, 20 metres wide and 700 metres vertical.

As such, the company’s objective for 2021 exploration will focus on upgrading and expanding known resources in preparation of an updated resource estimate. Camp facilities will also be upgraded to accommodate the work programs that are designed to advance the project towards the next phase of development, part of which is commissioning of a Preliminary Economic Assessment.

The company recently announced a non-brokered private placement of up to 20,000,000 units, at a price of $0.10 per unit, for gross proceeds of up to $2,000,000. Each unit will consist of one common share and one full share purchase warrant with each whole warrant exercisable at $0.20 per share for three years.

The company recently announced a non-brokered private placement of up to 20,000,000 units, at a price of $0.10 per unit, for gross proceeds of up to $2,000,000. Each unit will consist of one common share and one full share purchase warrant with each whole warrant exercisable at $0.20 per share for three years.

Blende Silver has now mobilized its field crew to the Blende silver-zinc-lead project.

Andrew Rees added, “Upon receipt of the company’s updated NI43-101 resource estimate prepared by Moose Mountain Technical Services, the company is commencing Phase 1 of an initial 20-hole drill program, with the objective of expanding and upgrading the classification of the current inferred resource on what is the largest carbonate-hosted Ag-Zn-Pb deposit in the Yukon and one of the largest undeveloped Ag-Zn-Pb deposits in western Canada.”

Blende Silver has 47,223,620 shares outstanding, a large percentage of which are held by insiders. On June 22, shares were trading at $0.12. The year High-Low is $0.27 and $0.035. The company has held consultations with the Na-Cho Nyäk First Nation and has also completed Heritage studies, a requirement for a Class 4 Permit.

Blende Silver has 47,223,620 shares outstanding, a large percentage of which are held by insiders. On June 22, shares were trading at $0.12. The year High-Low is $0.27 and $0.035. The company has held consultations with the Na-Cho Nyäk First Nation and has also completed Heritage studies, a requirement for a Class 4 Permit.

Under the guidance of Thomas Kennedy, CEO, with the Yukon a favoured pro-mining jurisdiction for explorers, plus rising metal prices and demand, Blende Silver is in an excellent position to advance the Blende Deposit.