Thesis Gold Drills 4.05 m of 119.49 g/t Gold at the Bonanza Zone

Thesis Gold Inc. (TSXV: TAU) (WKN: A3EP87) (OTCQX: THSGF) (“Thesis” or the “Company“) is pleased to report assay results from the Bonanza Zone at its 100% owned Ranch Gold Project. The drill program at Ranch has focused largely on definition and exploration drilling in preparation for a maiden resource estimate expected in Q2 2024. The Ranch Project is road-accessible by way of the Company’s Lawyers Gold-Silver Project, and together the two projects form a contiguous, 325 km2 land package in the prolific Toodoggone Mining District in northern British Columbia.

Highlights

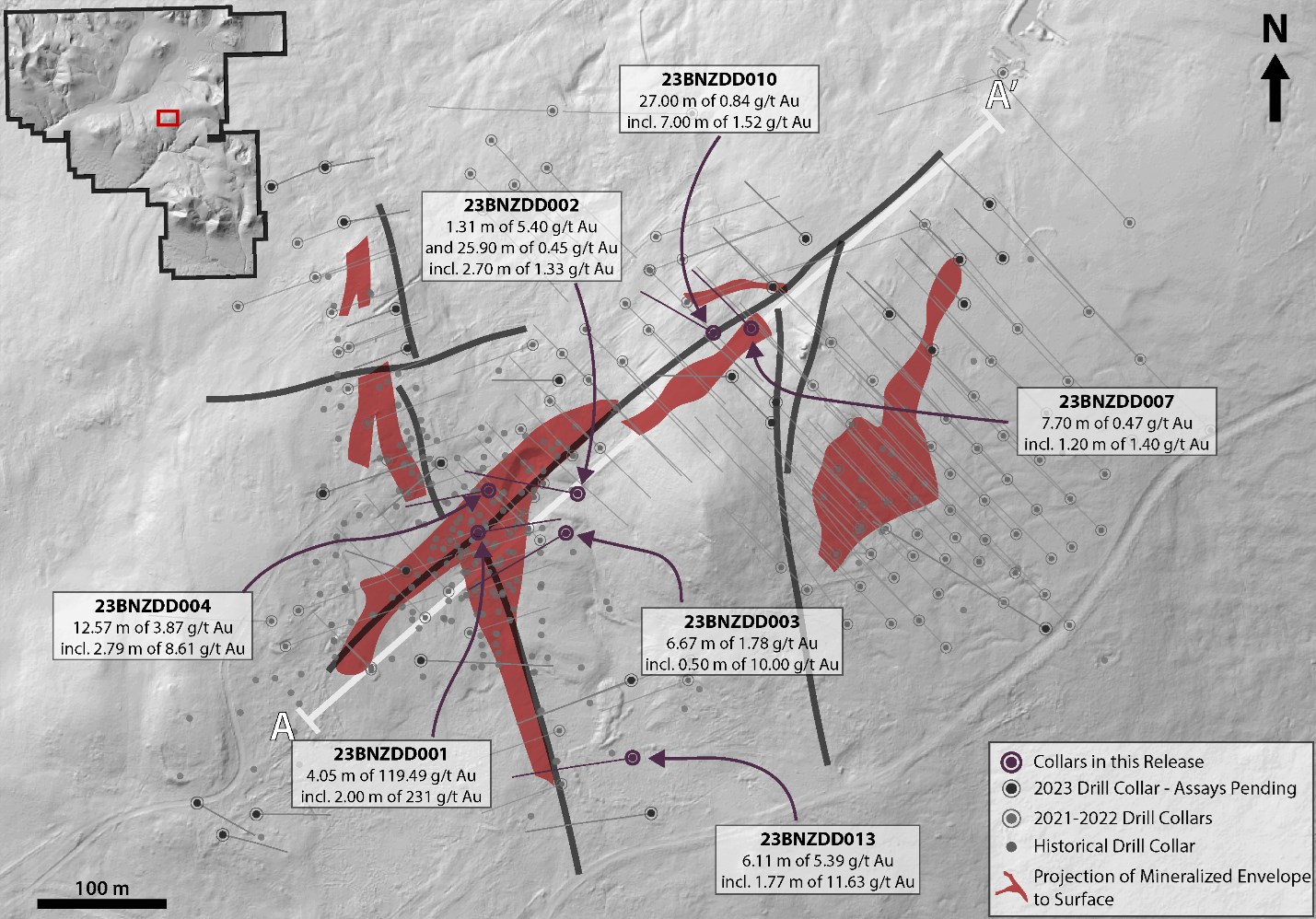

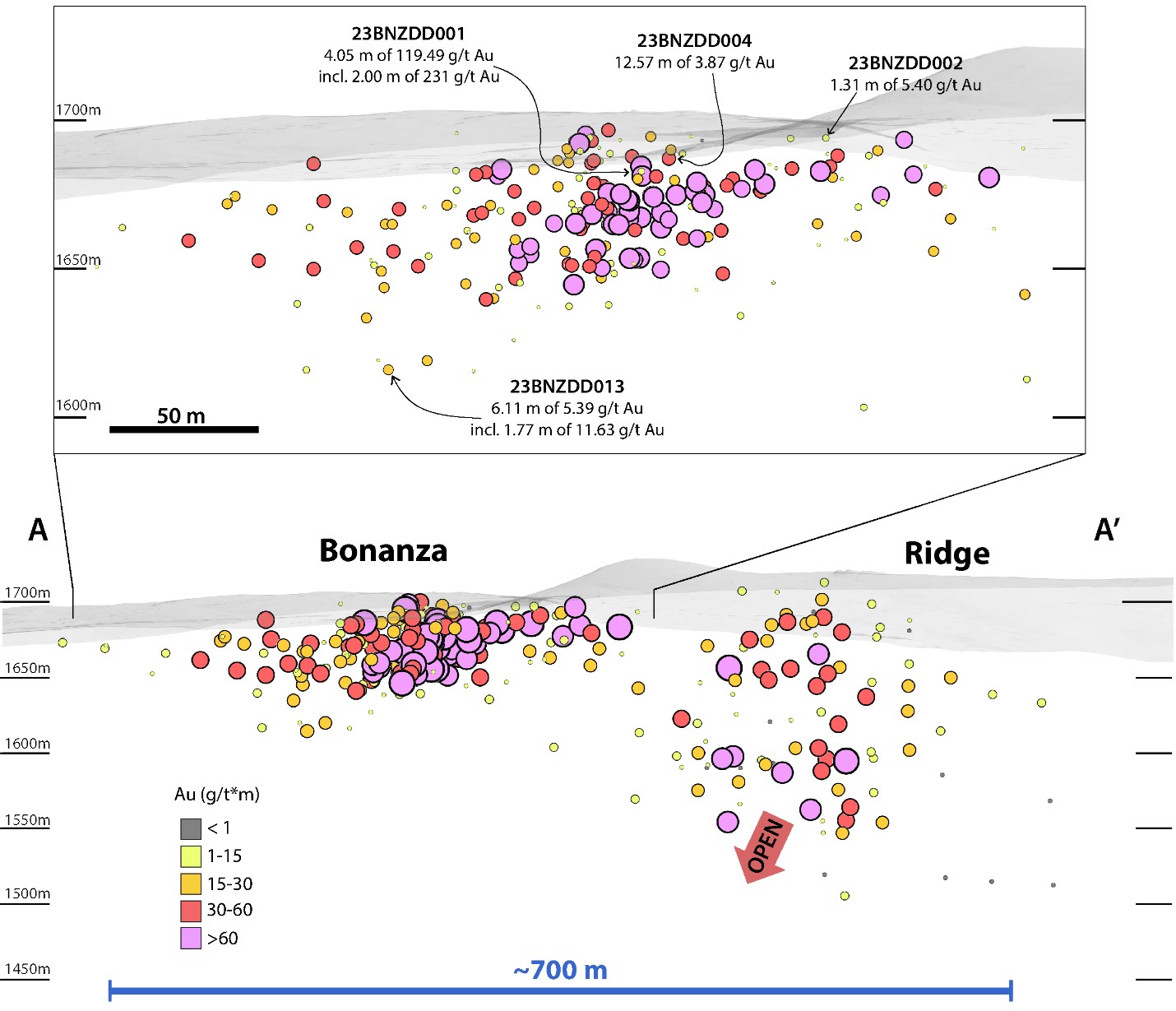

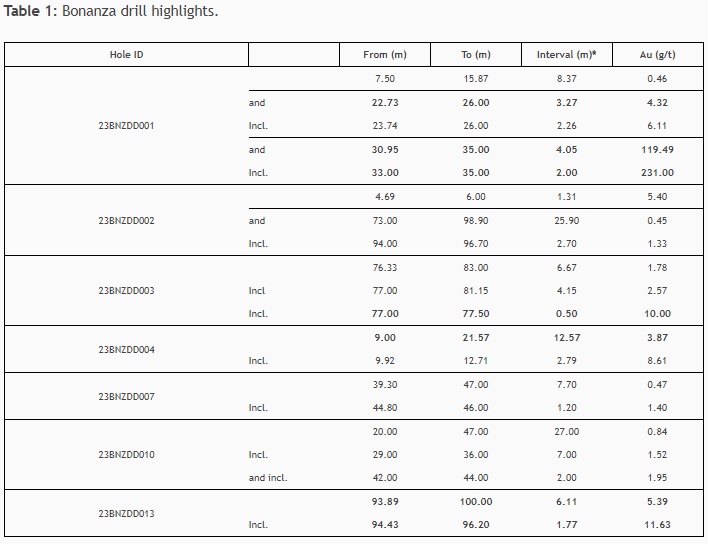

- 23BNZDD001 intercepted 4.05 metres (m) of 119.49 grams per tonne (g/t) gold (Au) beginning at 30.95 m core length (Table 1, Figures 1 and 2).

- Including a 2.00 m zone of 231.00 g/t Au

- 23BNZDD004 returned 12.57 m of 3.87 g/t Au, including 2.79 m of 8.61 g/t Au beginning at 9.00 m core length (Table 1, Figure 1 and 2).

- 23BNZDD013 returned 6.11 m of 5.39 g/t Au, including 1.77 m of 11.63 g/t Au from 93.89 to 100 m core depth (Table 1, Figures 1 and 2).

- This hole demonstrates continuation of high-grade mineralization at depth along a south-southeasterly trend off the main zone at Bonanza. This spur trend remains open for further testing.

- Shallow, targeted drilling continues to verify the expected grades, thickness and continuity of modelled high-grade mineralization at the Bonanza zone, positioning the Company for a maiden resource estimate at the Ranch Gold Project in Q2 2024.

Ewan Webster, President and CEO, commented, “We are very pleased with today’s results; Bonanza is certainly living up to its name with hole one. The key to this year’s program at Bonanza-Ridge is to further define the high-grade, near-surface mineralization as we work towards a maiden resource estimate. Assays are pending from up-dip drilling at the Ridge zone, where we expect additional strong results within this interconnected fault network of northeast and northwest structures, defining over 1 kilometer of drill-tested mineralized strike extent. Drilling is still ongoing at several zones across the project, and we look forward to sharing those results as they become available.”

Mineralization at Bonanza is hosted in variably altered, crystal lithic tuff. These rocks are typically quite porous and alter readily with the passage of hydrothermal fluids. Alteration styles at Bonanza are typical of high sulfidation hydrothermal systems — they include leached vuggy silica to silica-clay altered volcanic rock. Mineralization is often, but not always associated with this style of alteration. In places it is hosted in hydrothermal breccias, and in other places it is hosted in faulted rocks with a local increase in hematization. Pyrite and other fine-grained sulphides are commonly, but not always, associated with mineralization. To date, Thesis has defined a trend of Bonanza grade gold beyond the bounds of the existing historical Bonanza starter pit along intersecting NW- and NE-trending faults.

The Bonanza deposit was one of three areas brought to production by Cheni Gold Mines Inc. in 1991 alongside BV and Thesis III. A 65 m-long starter pit was developed at Bonanza, and the material extracted augmented production at the historical Lawyers Gold Mine. Production from Bonanza pit comprised less than 20% of the 40,000 tonnes historically produced from Ranch. Since establishing 100% ownership at the Ranch project in 2020, Thesis has drilled over 150 RC and diamond drill holes to expand the mineralized footprint across Bonanza-Ridge to what now defines collectively over 1.1 kilometres of gold mineralization.

*Intervals are core length.

Figure 1: Plan view map showing mineralized zones at Bonanza and Ridge projected to surface.

Figure 2: All drilling at Bonanza and Ridge projected onto a 500-meter-wide long section.

Quality Assurance and Control

Results from samples were analyzed at ALS Global Laboratories (Geochemistry Division) in Vancouver, Canada (an ISO/IEC 17025:2017 accredited facility). The sampling program was undertaken by Company personnel under the direction of Rob L’Heureux, P.Geol. A secure chain of custody is maintained in transporting and storing of all samples. Gold was assayed using a fire assay with atomic emission spectrometry and gravimetric finish when required (+10 g/t Au). Drill intervals with visible gold were assayed using metallic screening. Rock chip samples from outcrop/bedrock are selective by nature and may not be representative of the mineralization hosted on the project.

The technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc, P.Geol., P.Geo., a qualified person as defined by National Instrument 43-101.

On behalf of the Board of Directors

Thesis Gold Inc.

“Ewan Webster”

Ewan Webster Ph.D., P.Geo.

President, CEO, and Director

About Thesis Gold Inc.

Thesis Gold, following its strategic merger with Benchmark Metals, is unlocking the combined potential of the Ranch and Lawyers Gold-Silver Projects in the Toodoggone mining district of north central British Columbia, Canada. A 2022 Preliminary Economic Assessment for the Lawyers project alone projected an open-pit mining operation yielding 163,000 gold equivalent ounces annually over a 12-year span. By integrating the Ranch project, the company aims to enhance these figures and bolster the overall project’s potential. Central to this ambition is the 50,000-metre drill program, which aims to define the high-grade underground resource at Lawyers and augment the near-surface high-grade deposits at Ranch. The company’s roadmap includes releasing a combined Ranch-Lawyers resource estimate by Q2 2024, with an updated Preliminary Economic Assessment slated for Q3 2024. Through these strategic moves, Thesis Gold aspires to elevate the Ranch-Lawyers project to the forefront of global precious metals ventures.

For further information or investor relations inquiries, please contact:

Dave Burwell

Vice President Corporate Development

Email: daveb@thesisgold.com

Tel: 403-410-7907

Toll Free: 1-888-221-0915

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding the use of proceeds from the Company’s recently completed financings and the future plans or prospects of the Company. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market, and economic risks, uncertainties, and contingencies that may cause actual results, performance, or achievements to be materially different from those expressed or implied by forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Other factors which could materially affect such forward-looking information are described in the risk factors in the Company’s most recent annual management’s discussion and analysis, which is available on the Company’s profile on SEDAR at www.sedarplus.com. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.