Western USA offers more than gold, silver and copper

By Ellsworth Dickson

In Part I of our Western USA Feature, we noted the large scale of gold and copper exploration and production; however, the region is also host to other metals too. In Part II, we take a look at other valuable metals that are seeing increases in demand.

The important Clayton Valley Lithium play in southwest Nevada is active for exploration and production. Albemarle Corp. [ALB-NYSE] recently confirmed that it will expand capacity at its lithium production facility in Silver Peak, Nevada, and begin a program to evaluate clays and other available Nevada resources for commercial production of lithium. Starting this year, the company plans to invest US$30-US$50 million to double the current production at the Nevada site by 2025 which is the only lithium-producing resource in the United States and in production since 1966.

Cypress Development Corp. [CYP-TSXV; CYDVF-OTCQB; C1Z1-FSE] discovered a world-class resource of lithium-bearing claystone adjacent to Albermarle’s Silver Peak Lithium Mine.

Cypress recently announced an updated Mineral Resource Estimate for its Clayton Valley Lithium Project of 5.2 million tonnes of lithium carbonate equivalent (LCE) measured and indicated.

Noram Ventures Inc. [NRM-TSXV; NRVTF-OTC] is exploring its Zeus Lithium Project in the Clayton Valley along with other lithium explorers.

The Pure Energy Minerals Ltd. [PE-TSXV; PEMIF-OTCQB; A111EG-FSE] flagship lithium brine project is also adjacent to Albemarle’s mine. The project contains an inferred resource of 218,000 tonnes of LCE. The company is at the leading edge of new processing technologies for lithium through its collaboration with global multinational technology partners.

Nevada Sunrise Gold Corp. [NEV-TSXV; NYSGF-OTC] has begun a strategic review of its two lithium brine projects in Nevada. The company owns 100% interests in the Gemini lithium project and the Jackson Wash lithium project, both in the Lida Valley basin in Esmeralda County.

Silver Elephant Mining Corp. [ELEF-TSX; SILEF-OTCQX; 1P2N-FSE] is advancing its Gibellini vanadium project 25 miles south of Eureka where a positive PEA was completed. The mine would be an open pit heap leach operation.

First Vanadium Corp. [FVAN-TSXV; FVANF-OTCQX; 1PY-FSE] has an option to earn a 100% interest in the Carlin vanadium project in Elko County, six miles south from the town of Carlin, where it is conducting an induced polarization geophysical survey over its identified gold system on the Carlin vanadium-gold property on the Carlin gold trend.

In east-central Idaho, near the town of Salmon, Australian-based Jervois Mining [JRV-ASX] is building a 1,200 tonne per day cobalt mine. So far, various operators have spent over US$100 million on the project.

Global Energy Metals Corp. [GEMC-TSXV; GBLEF; 5GE1-FSE] is evaluating exploration plans for its 85%-optioned (from Nevada Sunrise) Lovelock cobalt-nickel past-producing mine project 150 km east of Reno.

NioCorp Developments Ltd. [NB-TSX; NIOBF-OTCQX; BR3-FSE] has a 100% interest in the Elk Creek rare earths-niobium-titanium-scandium project south of Lincoln, Nebraska. A final feasibility study showed an 36-year mine life.

Energy Fuels Inc. [EFR-TSX; UUUU-NYSE American] is the leading U.S. producer of uranium and owns the producing Nichols Valley mine 76 miles northeast of Casper, Wyoming. The company also owns a number of suspended uranium mines throughout the west and the White Mesa uranium mill near Blanding, Utah.

Rio Tinto mine borates, a naturally occurring mineral, at its mine in Boron, southern California – the famous 20 Mule Team Borax. The mine produces one million tonnes of refined borates every year, or approximately 30% of global demand.

Nevada has a great deal to offer explorers and miners. Besides being a favoured and secure jurisdiction, most of the state is wide open desert with easy access and a pro-mining government and citizenry. In addition to being prospective for precious metals, there are a variety of industrial metals awaiting discovery and development.

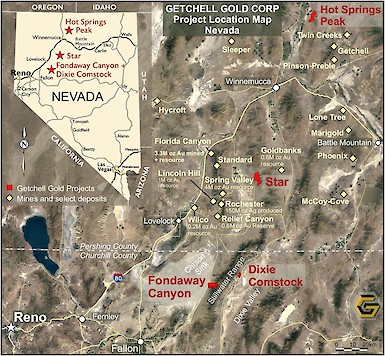

Getchell Gold Corp. [CSE: GTCH; OTCQB: GGLDF] has several mineral projects in Nevada: the 100%-optioned Fondaway Canyon in Churchill County, the 100%-owned Star Project in the Buena Vista Valley, Pershing County, the 100%-optioned Dixie Comstock property in Churchill County and the Hot Springs Peak Project. Currently, the company is focusing its efforts on its flagship, advanced-stage Fondaway Canyon Gold Project.

Getchell Gold Corp. [CSE: GTCH; OTCQB: GGLDF] has several mineral projects in Nevada: the 100%-optioned Fondaway Canyon in Churchill County, the 100%-owned Star Project in the Buena Vista Valley, Pershing County, the 100%-optioned Dixie Comstock property in Churchill County and the Hot Springs Peak Project. Currently, the company is focusing its efforts on its flagship, advanced-stage Fondaway Canyon Gold Project.

A 2017 resource estimate for Fondaway Canyon, at a 3.43g/t gold cut-off, estimated indicated resources at 2,050,000 tonnes averaging 6.18 g/t gold, for 409,000 ounces. Inferred resources stand at 3,200,000 tonnes averaging 6.4 g/t gold, for 660,000 ounces.

Getchell has been conducting a six-hole, 1,995-metre drilling program at Fondaway Canyon with results as good or better than expected. The central Target Area and Pediment Target Area were drilled. The recently reported last three holes of the 2020 drilling campaign all intersected broad zones of gold mineralization and significantly extended the previously defined gold domains.

For example, drill hole FCG20-04 returned 8.6 g/t gold over 9.8 metres at the main Half Moon Shear Vein 54 metres below surface. Hole FCG20-04 returned 2.5 g/t gold over 58.0 metres, including 10.3 g/t gold over 5.2 metres in the newly-identified North Fork Gold Zone that extended gold mineralization by 200 metres. At the Colorado SW Extension, hole FCG20-05 returned 1.8 g/t gold over 90.0 metres, including 4.4 g/t gold over 11.1 metres. These drill results follow earlier encouraging drill results. The gold zones remain open laterally and to depth with multiple target areas that indicate a significant gold mineralizing system.

For example, drill hole FCG20-04 returned 8.6 g/t gold over 9.8 metres at the main Half Moon Shear Vein 54 metres below surface. Hole FCG20-04 returned 2.5 g/t gold over 58.0 metres, including 10.3 g/t gold over 5.2 metres in the newly-identified North Fork Gold Zone that extended gold mineralization by 200 metres. At the Colorado SW Extension, hole FCG20-05 returned 1.8 g/t gold over 90.0 metres, including 4.4 g/t gold over 11.1 metres. These drill results follow earlier encouraging drill results. The gold zones remain open laterally and to depth with multiple target areas that indicate a significant gold mineralizing system.

The 2020 drill program successfully tested the geologic model, characterized the mineralization and extended gold mineralization.

The high-grade gold values encountered are particularly encouraging and Getchell Gold is now evaluating the project’s potential for both an open pit bulk tonnage operation and high-grade underground mining. Some areas of the property have already seen open pit mining, including the South Mouth Zone.

Other Projects

The Star Project comprises the Star Point copper project that was mined in the 1940s and 1950s and, 2 km south, the Star South copper-gold-silver project that has seen historic artisanal near surface mining. Sampling at Star Point and Star South has returned high-grade copper values – some well over 1% copper – plus favourable values in gold and silver. A 2020 IP geophysical survey over the Star Point mine area and Star South area delineated two priority areas at each locale warranting further exploration.

The Star Project comprises the Star Point copper project that was mined in the 1940s and 1950s and, 2 km south, the Star South copper-gold-silver project that has seen historic artisanal near surface mining. Sampling at Star Point and Star South has returned high-grade copper values – some well over 1% copper – plus favourable values in gold and silver. A 2020 IP geophysical survey over the Star Point mine area and Star South area delineated two priority areas at each locale warranting further exploration.

Located 17 km northeast of Fondaway Canyon is Getchell’s past-producing (1938-1970) Dixie Comstock property. There is a 1991 historic resource estimate of 146,000 ounces of gold in 4.26 million tonnes grading 1.06 g/t gold with a cut-off grade of 0.34 g/t gold. Mineralization remains open down dip and to the east.

The Fondaway Canyon property is adjacent to and partially overlain by the Stillwater Wilderness Study Area (WSA). The US Bureau of Land Management issued a final Environmental Impact Statement in 1987 that concluded that the 94,607-acre Stillwater Range WSA would be recommended as non-suitable for wilderness designation.

With Nevada ranked as the world’s top mining jurisdiction by the Fraser Institute, coupled with the company’s past-producing mines with known resources open for expansion, Getchell Gold is in an excellent position for creating successful mining operations.

Getchell Gold has 73,512,911Â shares outstanding.

GeoXplor Corp. is a private company that offers mineral exploration services and mineral prospects to explorers. The company operates as a mining exploration company that uses geosurveying and mining property acquisition to maximize the potential of any mining prospect.

GeoXplor Corp. is a private company that offers mineral exploration services and mineral prospects to explorers. The company operates as a mining exploration company that uses geosurveying and mining property acquisition to maximize the potential of any mining prospect.

It was set up by Clive Ashworth, and his late partner John Rud, savvy prospectors who recognized the impending demise of the fossil fuel era and the need to focus on the energy metals sector and the emerging electric vehicle revolution.

Together they identified the Clayton Valley in southwestern Nevada as an obvious candidate for lithium exploration, later proving that this area was the only lithium brine source in North America. Through staking and having all claims controlled through option agreements, the team’s mineral land package eventually encompassed almost the entire playa basin. This led to the launch of various lithium exploration projects on “deposit claims” such as Pure Energy Minerals Ltd.’s [PE-TSXV; PEMIF-OTCQB; A11EG-FSE] Clayton Valley Project which has a positive preliminary economic assessment (PEA) for 40 years of lithium production.

Lithium is the lightest of all metals. It is a soft white metal that is used in the production of heat-resistant glass and ceramics, lithium grease lubricants, iron, steel and aluminum. It is also a key ingredient in the production of lithium-ion batteries, which are used in small electronic devices, including smart phones, laptops, and electric vehicles.

Brines (in salt ponds or salars) and spodumene (hard rock) represent the two main sources of commercial lithium production. The largest known deposits are found in South America.

The Clayton Valley lithium deposit is a salty groundwater (brine) with high levels of lithium contained in a series of acquifers. The brine is mined by drilling boreholes into the acquifers and pumping the brine to surface for lithium removal.

Schlumberger Technologies Inc. has acquired a 19.9% stake in Pure Energy and is building a pilot plant incorporating the lithium membrane extraction technologies by Tenova Advanced Technologies and Sclumberger’s in-house engineers. GeoXplor holds a 3% over-riding royalty on the Pure Energy/Schlumberger claims.

The intention is to deploy a novel lithium recovery process to recover lithium and produce lithium hydroxide monohydrate without the need for conventional evaporation ponds. As a result of this novel process, the consumptive use of water would be small compared to conventional processing.

Most of the brine pumped from the aquifer would be returned and infiltrated into the basin.

The selection of lithium hydroxide monohydrate as the product is driven by the requirements of potential customers, such as Tesla Motors Ltd. [TSLA-NASDAQ] for use in the production of lithium-ion batteries.

The hydroxide form of lithium is becoming more important in the electric vehicle market due to evolving cathode chemistries used to power electric vehicles.

The Tenova process design is such that the lithium in the input brines can be converted to lithium hydroxide monohydrate without the need to produce lithium carbonate as an intermediate step. Combined with the avoidance of the long evaporation cycle, this results in a much faster time to final product than conventional lithium brine mines.

Ashworth believes that companies with viable lithium-oriented projects – exploration, development and technologies – will enjoy a lot of success in the next few years. The cliché slogan “The trend is your friend” applies,” he told Resource World Magazine in a recent interview.

He said there are a number of companies that are doing exemplary work in this field that are focusing on everything to do with extraction efficiency, marketing product, and the environment. They include Pure Energy/Schlumberger in Clayton Valley, as well as Tenova, Standard Lithium, MGX Minerals/PurLucid, Millenial Lithium, Neo Lithium, Nano One, Livnet, E3 and numerous other companies that have advanced their properties and technologies. All of them are getting closer to commercial viability.

Ashworth said that if the LCE (lithium carbonate equivalent) price stays around $10,000 per tonne, then hard rock lithium mining is viable.

However, he said brines should always out-compete the spodumene mine with the help of the new extraction technologies that are capable of delivering a huge accelerated production and environmental advantage. In an investment report on March 5, 2020, Scotiabank noted that in China, the price of lithium carbonate has moved up to $11,000 per tonne from $6,000 at the start of the year. “Simply put, there is a limited availability of both carbonate and spodumene right now due in large part to temporary inventory rebuilding,” Scotiabank said.

There are currently a number of research groups who are aiming to replace the lithium in lithium-ion batteries with different metals such as aluminum and Tellurium. But Ashworth said he doesn’t see anything on the horizon that would impact the lithium business for at least 15 or 20 years. Contact GeoXplor

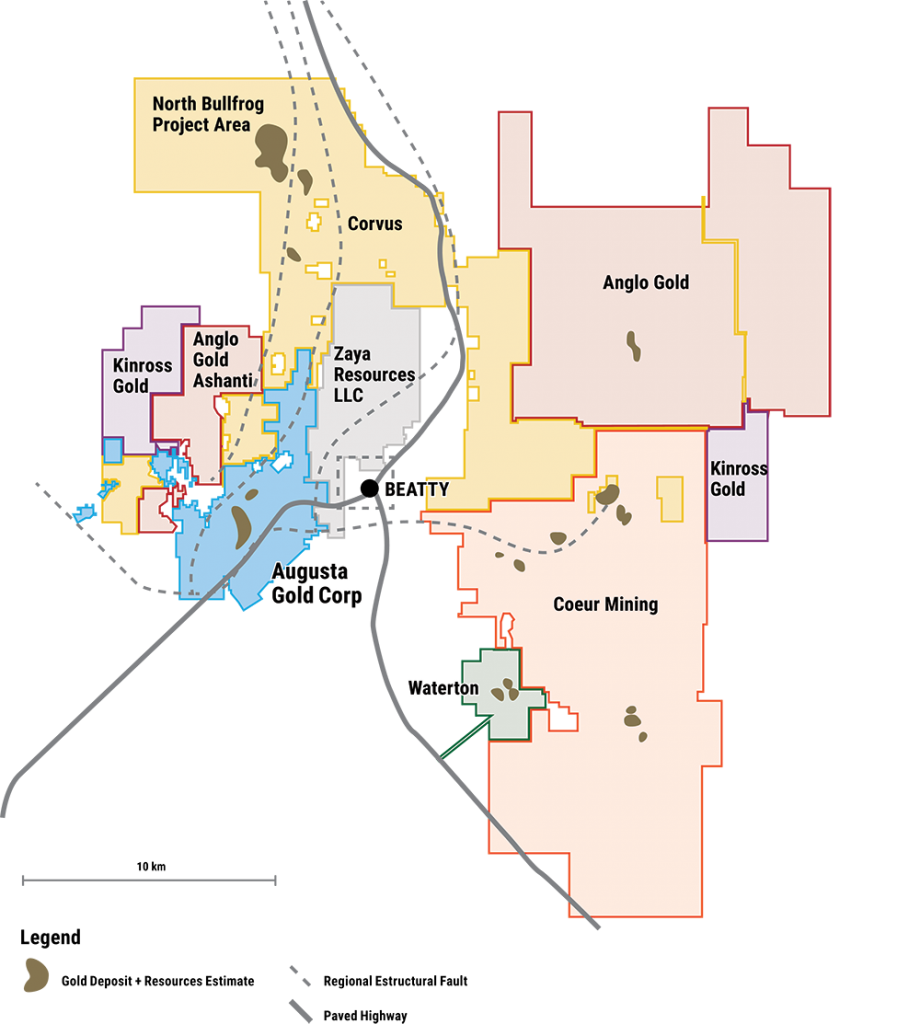

Augusta Gold Corp. [G-TSX; AUGG-OTCQB; 11B-FSE] is a rapidly growing exploration and development company with a focus on building shareholder value by developing the Bullfrog Gold Project in Nevada and pursuing M&A opportunities.

Augusta Gold Corp. [G-TSX; AUGG-OTCQB; 11B-FSE] is a rapidly growing exploration and development company with a focus on building shareholder value by developing the Bullfrog Gold Project in Nevada and pursuing M&A opportunities.

The company is focused on building one of the next operating mines in Nevada. In executing on that plan, the company is undertaking an approximate $20 million exploration drill program this year, targeting its under-explored land package in the Bullfrog district with a focus on resource expansion, increasing the confidence level in the current mineral resource and targeting a new discovery. Key targets of its drill program which is expected to be in excess of 85,000 metres of diamond and reverse circulation include Montgomery-Shoshone, Bullfrog open pit, Bonanza Mountain, Paradise Ridge and Gap.

In October 2020, Bullfrog Gold completed a transaction whereby it acquired the rights to 1,500 acres adjoining its Bullfrog Gold Deposit in Nevada from Barrick Gold Corp. [ABX-TSX; GOLD-NYSE] and a C$22 million financing by Augusta Investments which is led by Richard Warke. The transaction left the company with a commanding land and resource position in the Bullfrog Mine area where Barrick produced 2.3 million ounces of gold via mining and conventional milling between 1989 and 1999 when ore reserves were depleted.

Concurrent to the transaction closing Maryse Belanger was appointed President and CEO. Belanger was President, COO and a director of Atlantic Gold Corp., a company that was acquired by Australian Stock Exchange-listed Santa Barbara Ltd. in July 2, 2019.

In January 2021 the company changed its name from Bullfrog Gold to Augusta Gold, consolidated its capital on the basis of one new share for six old ones, and further strengthened its board of directors. The appointees included Richard Warke, who was named Executive Chairman, John Boehner, Poonam Puri and Len Boggio

As a result, the company is now led by a management team and board of directors with a proven track record of success in financing and developing mining assets and delivering shareholder value.

The Bullfrog Gold Project is located on the prolific Bullfrog district approximately 200 kilometres northwest of Las Vegas and 10 kilometres west of Beatty, Nevada. The company controls approximately 7,800 acres of mineral rights including the Bullfrog and Montgomery-Shoshone (MS) deposits. It has identified significant additional mineralization around the existing pits and defined several exploration targets that could further enhance the project.

The Bullfrog Gold Project is located on the prolific Bullfrog district approximately 200 kilometres northwest of Las Vegas and 10 kilometres west of Beatty, Nevada. The company controls approximately 7,800 acres of mineral rights including the Bullfrog and Montgomery-Shoshone (MS) deposits. It has identified significant additional mineralization around the existing pits and defined several exploration targets that could further enhance the project.

Measured and indicated resources in the Bullfrog pits and MS areas stand at 525,000 ounces of gold averaging 1.02 g/t and 1.34 million ounces of silver grading 2.61 g/t, according to a 2017 estimate by Tetra Tech Inc. Most of these resources are in the north extension of the Bullfrog pit.

On top of that is an inferred resource of 110,000 ounces of gold averaging 1.2 g/t, and 243,000 ounces of silver grading 2.64 g/t, material that is located in the Mystery Hill area adjacent to the Bullfrog pit.

It is believed that those deposits extend under the additional Barrick lands that were acquired last year. The agreement with Barrick allows for the backfilling of nearly all mine waste in the south part of the Bullfrog pit once the necessary regulatory approvals are secured, thereby substantially reducing environmental impacts and mining costs.

Augusta recently raised in March 2021 a further C$17 million from a private placement of 7.56 million units priced at C$2.25 each. Net proceeds from the private placement will be used to advance exploration efforts at the company’s wholly-owned Bullfrog Project and for general and working capital purposes.

Under the terms of the private placement, each unit consists of one common share of the company and one-half of one common share purchase warrant. Each full warrant entitles the holder to acquire one common share for a period of three years at an exercise price of C$2.80.

On March 19, 2021, Augusta shares were trading at C$2.75 in a 52-week range of C$3.60 and C$0.48 cents.

The private placement units were taken up by company insiders, including Richard Warke and other strategic investors. Belanger said the financing provides the funds to fully execute on the company’s 2021 programs, including the drill program and de-risking the project through environmental, permitting and engineering work.

On March 17, 2021, the company said it has received conditional approval to list its common shares on the Toronto Stock Exchange. Concurrent with the TSX listing, the shares will be de-listed from the Canadian Securities Exchange. Its trading symbol will remain G.