Yukon’s legacy lives on

By Ellsworth Dickson

Canada’s Yukon Territory, situated in the far northwestern part of the country, home of the fabled Klondike gold rush of 1896-1899, has both suffered and triumphed through unique and tumultuous events.

However, the Klondike gold rush, which took place near Dawson City, was much more than a typical gold rush – it was mass psychology in action. People everywhere had been struggling with an economic depression during the 1890s and were seeking a way to prosper and heading to the Yukon to seek gold appeared to be a good opportunity.

It is generally believed that in 1896 Robert Henderson and George Carmack were the first to discover gold in the Klondike. It was in Bill McPhee’s saloon that “Lying George” Carmack dumped a cartridge full of gold on a nearby weigh scale. Some thought it was a scam of some sort, but others slowly snuck out of the saloon to stake claims on Bonanza Creek.

Successful early Indigenous prospectors included Tagish Charley, a Tagish/Tlingit First Nation person and one of the co-discoverers of gold at the famous Discovery claim and partner Skookum Jim Mason, a member of the Tagish First Nation who was born on the Alaska-Yukon border.

The secret was out but the outside world didn’t know it.

When the SS Excelsior steamship docked with $500,000 in gold from the Klondike at San Francisco’s harbor on July 14, 1897, it triggered pandemonium and the never-to-be-repeated stampede began. Thousands of people jammed the wharf with “gold fever”. A similar event took place when the Portland docked in Seattle.

This is when the madness began that resulted in hundreds of deaths – mostly prospectors on route via over a dozen so-called access routes by land and sea – all hazardous. It was an unbelievable event where prospectors – mostly men but some women too – willingly suffered unbearable hardships on the various trails where some of them died. It was worse for the horses. One could access the Klondike via what became northwestern Canada, via Alaska on the Yukon River on a steamer, or by land from Valdez, Alaska or a couple other Alaskan ports.

Men left their wives and children, although some brought their families to the Yukon. The “stampeders”, as they were known, were mostly American; however, one could find people from all over the world heading for the Klondike.

By the time most Stampeders arrived in 1897 and 1898, all the good ground had been staked. Many just turned around and went back home – never becoming miners. This was because the Klondike gold rush was not just about seeking gold – it was about achieving a personal goal of conquering incredible hardships.

Others set up various businesses in Dawson City – some prospered and some failed. However, as so often happens, money earned by prospectors digging for gold on their Klondike claims was usually wasted away in the saloons by drinking, buying drinks for everyone, gambling and by savvy dance hall girls who knew how to mine the miners. It wasn’t unusual for a gambler to lose $25,000 in one evening. At its peak during its one-year existence, Dawson had 80 saloons operating night and day.

Some stampeders stayed on even when faced with typhoid, tuberculosis, scurvy, malaria, pneumonia, starvation and other serious ailments. But it is thanks to these early believers that the concept of Yukon prospectivity lives on – and not just in gold.

The Klondike Gold Rush lasted exactly one year – July 1896 to July 1897 – when events transpired that spelled the end of Dawson as a boom town. On July 27, 1899, gold was discovered on the beach at Nome, Alaska, and 8,000 men fled Dawson. Real estate prices collapsed, and buildings became vacant.

It had also become apparent that the Klondike gold diggings were limited in scope. Some $300 million in placer gold had been recovered, making the gold rush significant but not huge.

Exploration and mining have continued to the present day in the Yukon Territory since the days of the Klondike Gold Rush. There is hard rock exploration and mining as well; however, placer mining does still exist. While Yukon exploration dwindled during the COVID-19 event, activity has resumed – thankfully without the brutal circumstances and conditions of the Klondike Gold Rush. Here various exploration and mining projects active in the Yukon.

Rackla Metals Inc. [RAK-TSXV] is targeting multi-million-ounce gold discoveries after picking up a large property position northeast of Whitehorse near the border separating Canada’s eastern Yukon and the western Northwest Territories.

Rackla Metals Inc. [RAK-TSXV] is targeting multi-million-ounce gold discoveries after picking up a large property position northeast of Whitehorse near the border separating Canada’s eastern Yukon and the western Northwest Territories.

It is an area where Rackla Metals President and CEO Simon Ridgway began a long and successful career that has featured a number of high-profile discoveries including Cerro Blanco in Guatemala and San Martin in Honduras. He is also a founder of Fortuna Silver Mines Inc. [FVI-TSX, Lima; FSM-NYSE; F4S-FSE], company with five operating mines in West Africa and Latin America.

In past 12 months, Rackla has assembled a property portfolio that covers 59,000 hectares in the Tombstone Gold Belt, part of the Tintina gold province that extends through more than 1,000 kilometres of the north American Cordillera that includes Alaska, Yukon, and NWT.

The company’s flagship asset is the Astro project, which covers 288 square kilometres and is situated in NWT along the Yukon border. It is a property that was previously drilled by Newmont Corp. [NGT-TSX, NEM-NYSE], the world’s leading gold producer.

But while Newmont was focused on Carlin-style gold mineralization that is often found in Nevada, Rackla is taking a different approach.

During an interview with Resource World, Ridgway said his interest in the area was piqued by Snowline Gold Corp.’s [SGD-CSE, SNWGF-OTCQB] recent gold find at the Valley occurrence on the Rogue property in eastern Yukon. He said the Snowline discovery has demonstrated the potential for significant Reduced Intrusion-related gold system (RIRGs) deposits in the eastern part of the Tombstone Belt

Kinross Gold Corp.’s [K-TSX, KGC-NYSE] Fort Knox mine in Alaska and Victoria Gold Corp.’s [VIT-TSXV] Eagle mine in the Yukon are producing from RIRGS deposits. The Brewery Creek mine in the Yukon was also a RIRGS producer. “These are typically very large deposits,’’ Ridgway said.

Kinross Gold Corp.’s [K-TSX, KGC-NYSE] Fort Knox mine in Alaska and Victoria Gold Corp.’s [VIT-TSXV] Eagle mine in the Yukon are producing from RIRGS deposits. The Brewery Creek mine in the Yukon was also a RIRGS producer. “These are typically very large deposits,’’ Ridgway said.

To help with exploration effort, Ridgway has gathered a team of geologists, led by the company’s Vice-President Exploration, Scott Casselman. The team has been working from a camp located about six hours by road northeast of Ross River, Yukon. Proximity to the Canol Road and Macmillan Pass airstrip offers efficient access to the various project sites.

“I am more of a prospector and financier than a geologist,’’ said Ridgway, who described Rackla as a “high risk, high reward’’ type of investment. On October 19, 2023, the shares were trading at 21 cents in a 52-week range of 44 cents and 15.5 cents, leaving the company with a market cap of $12.2 million, based on 58.2 million shares outstanding. The company currently has about $2.7 million in the treasury.

Ridgway said the Rackla team has used its historic experience in the district to trace the geology and geophysics 90 kilometres southeast of the Snowline discovery across the Yukon-NWT borders.

This led to a flurry of property deals, starting in September, 2022, when Rackla said it had been granted an option by Orogen Royalties Inc. [OGN-TSXV] to acquire a 100% interest in the Astro prospect.

This led to a flurry of property deals, starting in September, 2022, when Rackla said it had been granted an option by Orogen Royalties Inc. [OGN-TSXV] to acquire a 100% interest in the Astro prospect.

Astro was generated from a two-year US$1.8 million regional alliance between Orogen and Newmont that identified gold mineralization associated with an intrusive stock during a regional stream sampling survey. Newmont covered a large area of the NWT/Yukon border doing stream geochemistry. It identified a very large gold anomaly in the stream sediments at the southern end of the property.

Work on the property identified outcropping gold mineralization in a 10-kilometre-long structural corridor flanking the hornfelsed aureole of the Border granodiorite pluton. Gold mineralization consists of gold-arsenic-antimony bearing quartz veins, gold-bismuth skarn and gold associated with disseminated sulphides in siltstone.

Surface sampling of showings returned strong chip-channel results, including 30.0 metres of 17.7 g/t gold and 18.6 metres of 3.6 g/t gold. Results from limited RC scout drilling program returned best intercepts of 3.0 metres grading 3.1 g/t gold, 7.6 metres grading 0.7 g/t gold and 6.0 metres grading 1.1 g/t gold.

“We looked at the data and identified that this was an intrusive-hosted gold system and not the Carlin-style that they (Newmont) were looking for,” Ridgway said.

Rackla subsequently acquired rights to the nearby Hit and SER gold projects. Hit is strategically located on the Yukon side of the border, adjacent to the Astro property. The 376-claim SER project surrounds the HIT property on three sides and extends 16 kilometres to the southwest and 18 kilometres to the northwest. It also lies adjacent to Astro.

Several stream sediment gold anomalies in creeks draining the intrusive bodies indicate the potential for gold mineralization within the intrusive rocks at SER. Rock samples assayed 27 g/t gold and 35 ppm Bi.

In a press release on September 26, 2023, Rackla said it has completed a 2023 exploration program that included 3,039 metres of drilling in 17 holes focused on RIRGS at the Astro, HIT and SER properties. It said broad spaced drilling has identified sheeted quartz veining with minor amounts of sulphide minerals in the intrusive. Follow up drilling is planned for the 2024 season, the company has said.

Sitka Gold Corp. [SIG-CSE, SITKF-OTCQB, 1RF-FSE] is a diversified company that is advancing new gold discoveries in Nevada and the Canadian Yukon, two of the most mining friendly jurisdictions in North America.

Sitka Gold Corp. [SIG-CSE, SITKF-OTCQB, 1RF-FSE] is a diversified company that is advancing new gold discoveries in Nevada and the Canadian Yukon, two of the most mining friendly jurisdictions in North America.

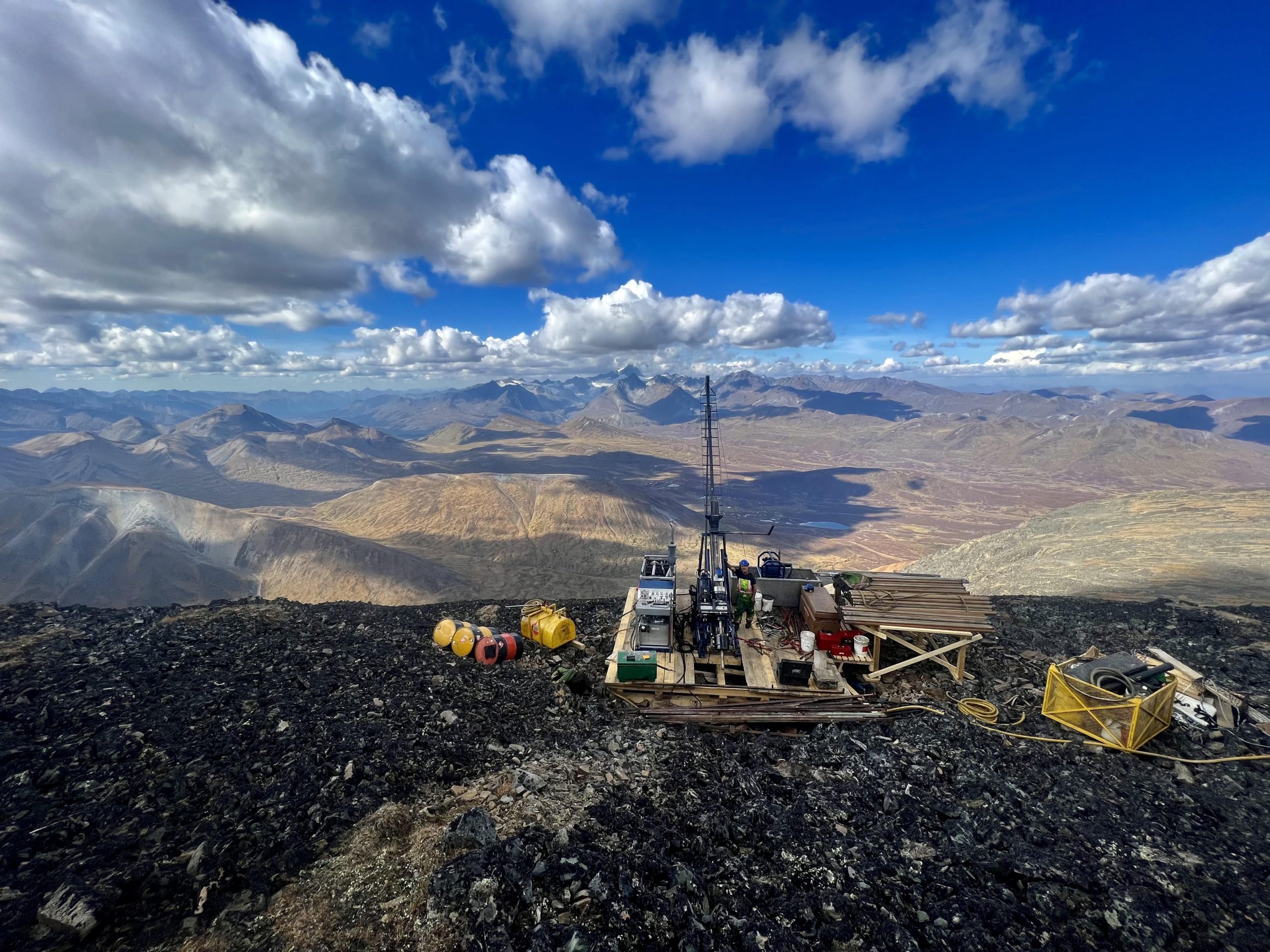

The company’s flagship asset is the RC Gold project, which is located 100 kilometres east of Dawson City, Yukon, in the Tombstone Gold Belt, a region that includes Victoria Gold Corp.’s [VIT-TSXV] Eagle and Brewery Creek mines, Banyan Gold Co.’s [BYN-TSXV] Aurmac project, and Snowline Gold Corp.’s [SGD-CSE, SNWGF-OTCQB] Valley discovery.

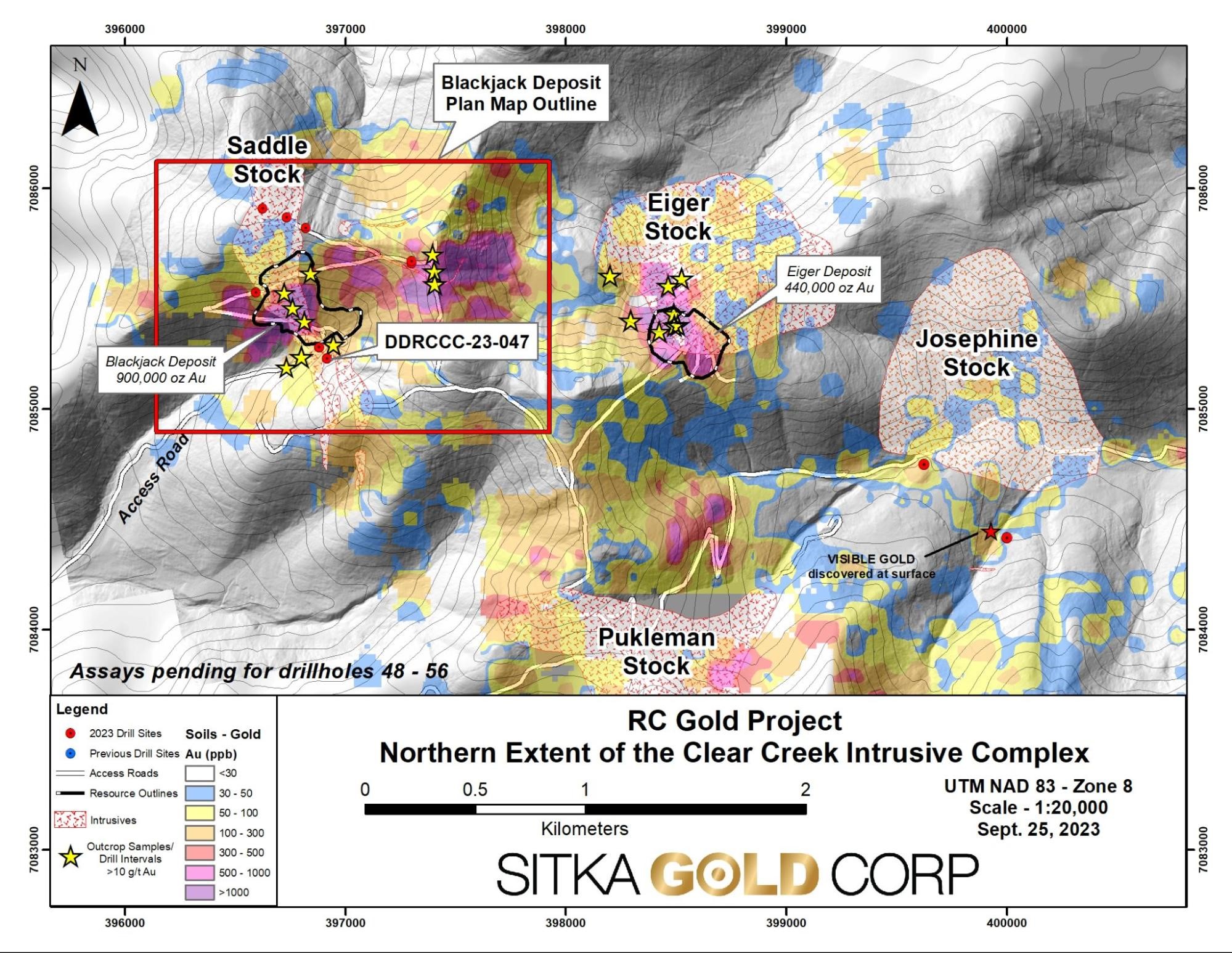

With $5 million in the treasury and no debt, Sitka is currently placing 90% of its effort into the RC project, where the company is working to add significantly more ounces of gold to a pit constrained inferred resource of 1.3 million ounces of gold (61.1 million tonnes of 0.68 g/t gold) in two near surface/on surface zones known as the Blackjack (900,000 oz averaging 0.83 g/t gold) and Eiger (440,000 oz averaging 0.50 g/t gold) deposits.

Sitka Director and CEO Corwin Coe leads a highly experienced management team with a proven ability to create shareholder value by aggressively exploring and leveraging assets in regions such as Arizona, Nevada and the Yukon.

The company’s advisory board features Dr. Craig Hart, an internationally recognized geoscientist who has played a pivotal role in the development of intrusion-related gold systems like the one that Sitka is developing at its RC project.

Hart is the Independent Chair of Snowline Gold, which has been in the spotlight following the company’s recent discovery of an intrusion-related gold system in the eastern part of the Tombstone Belt.

Sitka’s RC project is situated in similar geological terrain. It consists of a 376 square kilometre contiguous district-scale land package located in the newly road accessible Clear Creek, Big Creek and Sprague Creek districts in the heart of the Tombstone Gold Belt.

Sitka’s RC project is situated in similar geological terrain. It consists of a 376 square kilometre contiguous district-scale land package located in the newly road accessible Clear Creek, Big Creek and Sprague Creek districts in the heart of the Tombstone Gold Belt.

The land package consists of five underlying properties namely, the RC, Bee Bop, Mahtin, Clear Creek and Barney Ridge properties. While the project contains several high priority intrusion-related gold targets, Sitka has focused its efforts on the underlying Clear Creek property where it has identified a large 3000 metre by 5,000 metre corridor, containing the Blackjack and Eiger deposits, and encompasses a cluster of 5 intrusions that are highly prospective for hosting additional intrusion-related gold deposits.

During an interview with Resource World, Coe said he believes RC Gold has the potential to host several multi-million-ounce gold deposits. It was his view that was reinforced when the company released the new drilling results from an exploration program that began earlier this year.

In a press release on September 26, 2023, the company said hole 47 (the fifth to be completed in the current program) returned 219.0 metres of 1.34 g/t gold, including 124.8 metres of 2.01 g/t gold and 55.0 metres of 3.11 g/t gold, making the best intercepts reported so far at this project.

In a press release on September 26, 2023, the company said hole 47 (the fifth to be completed in the current program) returned 219.0 metres of 1.34 g/t gold, including 124.8 metres of 2.01 g/t gold and 55.0 metres of 3.11 g/t gold, making the best intercepts reported so far at this project.

Hole 47 was located in a wide- open area at the southern extent of the Blackjack zone. The previous hole 46 was located 405 metres to the northeast and also returned the highest-grade interval reported so far in the Clear Creek intrusive. Both 47 and 46 are wide open step outs from the maiden resource at Blackjack. Both indicate the potential for a very large gold endowment, the company has said.

Having so far completed 16 drill holes (6,515 metres) as part of its 2023 drilling program, the company is awaiting analytical results from the last two drill holes.

Both the Eiger and Blackjack deposits are thought to be amenable to open pit, heap leach mining methods. Initial bottle roll tests indicate that the gold is not refractory and has high recoveries of up to 94%.

Both deposits are located in close proximity to highway and power infrastructure and are road accessible year-round. “Placer gold miners have been working there for more than 100 years,’’ Coe said.

Aside from the RC project, Sitka also holds a 100% interest in the Alpha Gold property in Nevada, where drilling in 2021 and 2022 returned Carlin-type gold deposit mineralization associated with broad gold zones throughout the target horizon. The company is focused on vectoring towards the high-grade core of this system, which is located near McEwen Mining Inc.’s [MUX-TSX, NYSE] new Gold Bar mine.

The portfolio also includes the Burro Creek project in Arizona which hosts a historical resource of 5.0 million ounces of silver and 120,000 ounces of gold.

On October 17, 2023, Sitka shares were priced 16 cents, and trade in a 52-week range of 19 cents and $0.085, leaving the company with a market cap of $29.8 million, based on 186 million shares outstanding.

Other companies in the region include Victoria Gold Corp. [VGCX-TSX]: Following the second evacuation of its gold-silver producing Eagle mine 85 km north of Mayo on August 4, 2023, due to the proximity of the East McQuesten wildfire, favourable conditions allowed for the return of employees to site on August 10. Full production rates were resumed August 11.

White Gold Corp.’s [WGO-TSXV; WHGOF-OTCQX; 29W-FSE] portfolio includes over 40% of the White Gold District where it has the flagship Golden Saddle and Arc gold deposits. Its maiden diamond drilling program is underway at the Cali target on the Nolan property, in the White Gold District, west-central Yukon. The Cali target is located approximately 77 km west of Dawson City. At the Betty Ford property, drill results included 3.38 g/t gold over 53.0 metres from 7.30 metres depth in hole BETFD23D013, which included higher grade subintervals of 7.19 g/t gold over 6.30 metres and 8.00 g/t gold over 4.35 metres.

Alexco Resource Corp. was acquired by Hecla Mining Company [HL-NYSE]. The surviving entity has a number of Yukon projects within the Keno Hill project/mine that includes the Bellekeno silver-lead-zinc mine, the Flame and Moth, and Birmingham project. Hecla acquired the Rackla project (formerly ATAC). The Keno Hill mine continued ramping up to full production in the third quarter, producing more than 700,000 oz silver. Throughput in the quarter averaged 268 tpd with silver grades of 33 oz/ton. Tonnage mined was constrained while underground infrastructure and ore headings were being developed. Most of the planned infrastructure is complete, and 12 ore headings should be in place by the end of October.

Western Copper and Gold Corp. [WRN-TSX, NYSE American] has been drilling the advanced-stage Casino copper-gold project 300 km northwest of Whitehorse. A 2,200-metre diamond drill program of seven drill holes, ranging from 130 metres to 560 metres in depth, is underway. These drill holes are located inside the current open pit boundaries and, upon completion, the program is expected to result in upgrading some of the indicated resources to the measured resource category. A metallurgical program, using drill core collected from this program, will begin upon completion of drilling and receipt of assays.

Triumph Gold Corp. [TIG-TSXV; TIGCF-OTCQB; 8N61-FSE] is exploring its road-accessible polymetallic Freegold Mountain Project 70 km northwest of Carmacks. Since Triumph Gold acquired the property in 2006, more than 20 mineralized zones have been identified and NI 43-101 mineral resources have been delineated at the Revenue Au-Ag-Cu-Mo porphyry-related deposit, Nucleus Au-Ag-Cu deposit and the Tinta Hill Au-Ag-Cu-Pb-Zn vein-related deposit.

Rockhaven Resources Ltd. [RK-TSXV] has a positive PEA for its 100%-owned, road-accessible Klaza Project where a March 2023 drill intercept returned 5.48 g/t gold and 128 g/t silver (7.00 g/t AuEq) over 5.85 metres. The project is located in the Dawson Range Gold-Copper Belt of southern Yukon, a prolific belt that hosts several important mineral deposits including Western Copper and Gold’s Casino copper-gold deposit and Newmont’s Coffee gold deposit.

Granite Creek Copper Ltd. [GCX-TSXV; GCXXF-OTCQB], a member of the Metallic Group of Companies, is advancing its flagship Carmacks copper-gold-silver project. The 176 km2 brownfields property in the southern portion of high-grade Minto Copper District has a 2022 NI 43-101 mineral resource estimate of 36.2 Mt (M&I), grading 1.07% CuEq (0.81% Cu, 0.26g/t Au, 3.23 g/t Ag and 0.011% Mo) for a total of 651 Mlbs contained M&I copper with an additional 38 Mlbs Cu Inferred. A 2023 PEA delivers a Pre-tax NPV (5%) of C$321 million and 36% IRR with average cash costs of US$1.77/lb CuEq and an AISC of US$2.58/lb CuEq.

Metallic Minerals Corp. [MMG-TSXV; MMNGF-OTCQB] has completed field activities at the 100%-owned, 166 km2 Keno silver project, adjacent to Hecla Mining in the high-grade Keno Hill silver district. The 2023 exploration program included 1,112 metres in four diamond drill holes focused on resource expansion at the Formo target, the highest-grade and largest target area to be included in an inaugural NI 43-101 mineral resource estimate for the property expected in Q4 2023. The company also conducted additional soil geochemical sampling on open-ended earlier-stage targets for future drill campaigns.

Some of this information in this article was gleaned from Pierre Berton’s excellent book entitled “Klondike – The Last Great Gold Rush 1890 – 1899.”