Max Resources active on Colombia agreement

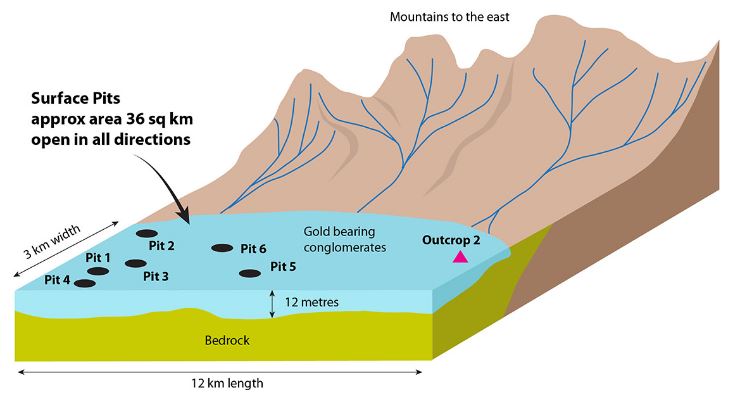

The Choco Precious Metal Project in Colombia. Source Max Resource Corp.

Max Resource Corp. [MXR-TSXV; MAXROF-OTC; M1D1-FSE] advanced in active trading Monday February 11 after the company said it had received conditional approval form the TSX Venture Exchange to acquire additional mineral rights in Colombia.

Max is a Canadian exploration company with a focus on exploration of mineral assets in Colombia. Its portfolio includes 100%-ownership of 82 and 50% ownership of seven mineral license applications covering 1,757 km2 in the Choco Department, approximately 110 km southwest of Medellin.

The Choco Department is the leading producer of precious metals in Colombia. Small-scale operations in the municipality of Novita and the surrounding communities of Condoto, Tado and Sipi produced 15,317 ounces of platinum and 278,702 ounces of gold in 2011.

Along with Stillwater, U.S.A., Choco is the world’s only significant primary platinum-producing district outside South Africa, Russia and Zimbabwe. Choco was the world’s sixth largest source of platinum in 2012, according to the U.S. Geological Survey.

Monday’s news release announces the execution of the final Novita Project Asset Purchase agreement with Australian Stock Exchange-listed Noble Metals Ltd. [NMM-ASX] and its subsidiary Condoto Platinum Ltd.

The Novita agreement area encompasses or is adjacent to Max Resource’s Choco Precious Metals project.

The agreement involves the acquisition of 100% of rights to mineral claims and mineral applications, and more importantly, the “Novita Agreement,” an exclusive right of first refusal to the mineral rights and mining rights over 1,050 km2. These rights are held by the Novita Higher Community Council as sole owners of the land and minerals.

Under the terms of the agreement, The Novita Higher Community Council is entitled to 12.5% of net revenue return, payable to the Council, and 5% of net revenue return, payable to the Committee from any present or future mining production within the Novita Agreement area.

“Bill Hayden, founder and former director of Noble Metals assembled the Novita Project, and he will assist the company’s aggressive exploration programs,” said Max President and CEO Brett Matich.

Following the announcement, Max was the volume leader on the TSX Venture Exchange with 8.3 million shares changing hands. The shares advanced 5.26% or $0.02 to 40 cents after trading up to 47 cents. The shares had previously traded in a range of 12 cents and 40 cents.

The transaction was originally announced in June of 2018, when Max executed a binding agreement with Noble to purchase all the outstanding shares of Condoto Platinum Ltd. (and two other subsidiaries of Noble). However, as a result of extensive due diligence by Max, the transaction evolved from a share purchase to an asset purchase, as reflected in the final agreement.

Under the full executed asset purchase agreement, Max will issue 26.7 million common shares of Max to Noble Metals and pay $500,000 on cash. Upon closing, Noble will own 32.7% of the issued and outstanding shares of Max, becoming the new control person.

As a result, Max said it will require shareholder approval, on a majority of the minority basis. The extraordinary shareholder meeting date is scheduled to be released in the coming days, Max said.

Noble Metals also requires shareholder approval. In addition, the consent of the Novita Higher Community Council is a condition of closing. Max said it fully expects this consent to be granted.

Former operator Choco Pacifico produced 1.5 million ounces of gold and 1.0 million ounces of platinum from the Choco District between 1906 and 1990. This historic production was largely limited to an average depth of 8 metres or less.

Max says its Choco Precious Metals project covers, or is adjacent to much of Choco Pacifico’s historic exploration and production areas.