Arizona: An important source of essential minerals and more to be discovered

Arizona is home to an abundance of critical and strategic minerals capable of meeting America’s manufacturing and national security needs. In fact, 66% of the nation’s copper output came from Arizona in 2018.

The state’s copper deposits often host other valuable metals. For example, the Kay Mine Project of Arizona Metals, besides copper, also contains gold, zinc and silver as do numerous other past-producing mines in the region.

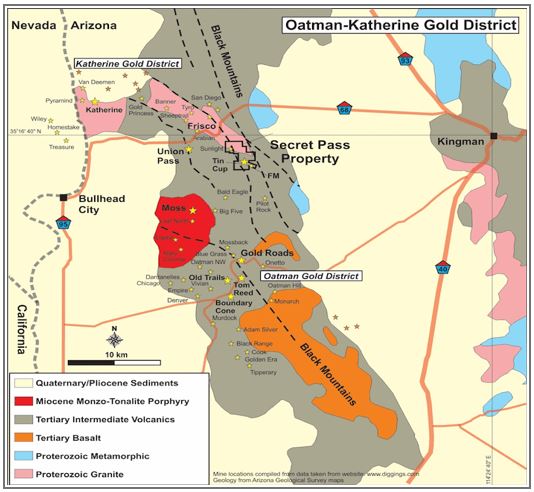

Historically, gold has also been important – the Oatman District in northwestern Arizona produced over 2 million ounces of gold between 1892 and 1940 at an average gold grade of over 15 g/t.

Northern Lights Resources is exploring its Secret Pass Gold Project 15 km north of the historic Oatman-Katherine gold mining district. Also in the Oatman district, more recently, Northern Vertex Mining has put its Moss Gold Mine into production.

Other metals mined in Arizona include silver, iron ore, lead and zinc as well as industrial minerals such as sand, gravel, building stone, cinders and gypsum. Arizona is famous for its beautiful turquoise gemstones.

Arizona’s mining industry has been and still is an important contributor to the state’s economy with non-fuel mineral production in 2019 reaching $6.97 billion. An estimated 38,963 jobs are connected to mining in some way. In 2019, there were 380 active, full-time mines or development projects in the state.

Arizona is characterized by a northwest-trending belt of metallic mineralization across the state. The southeastern part of this belt is dominated by porphyry copper and associated lead, zinc, gold, and silver deposits. Economically significant uranium deposits are concentrated in northeastern Arizona.

In addition to the conventional mining operations, Taseko Mines is extracting copper via in-situ recovery methods at its Florence Copper Project located 65 miles southeast of Phoenix.

And while there is the great northwest-trending mineral belt, other parts of the state are also mineralized. For example, Supernova Metals is exploring its Clanton Hills silver-gold prospect in Yuma County, southwestern Arizona.

Arizona continues to attract explorers as the desert state offers compelling prospects for new mineral discoveries.

Northern Vertex Mining Corp. [NEE-TSXV; NHVCF-OTC NADAQ Int’l] recently posted record gold production and revenue for the quarter ended September 30, 2020 at its 100%-owned Moss gold (silver) mine. The company is Arizona’s largest pure gold and silver producer.

Northern Vertex Mining Corp. [NEE-TSXV; NHVCF-OTC NADAQ Int’l] recently posted record gold production and revenue for the quarter ended September 30, 2020 at its 100%-owned Moss gold (silver) mine. The company is Arizona’s largest pure gold and silver producer.

Located 80 miles southeast of Las Vegas, Nevada, the Moss Mine is situated in the mineral-rich Oatman District of Mohave County, northwest Arizona. The company has seen continued success since declaring commercial production on September 1, 2018 at the open pit heap leach operation.

For Q3 2020, revenue was US$27 million with gold equivalent (Au+Ag) production of 14,673 ounces and gold production of 13,083 ounces. Fiscal Q3 2020 cash costs were US$862 per gold ounce sold.

Meanwhile, Northern Vertex has also been conducting a multi-phase resource expansion program at the Moss Mine utilizing two reverse circulation drill rigs. The drilling discovered an unexpectedly thick stockwork mineralized area surrounding the Ruth vein. Hole AR20-315R returned 109.8 metres (184.5 metres to bottom of hole) grading 0.79 g/t gold and 24.40 g/t silver, including 15.25 metres of 1.75 g/t gold and 41.10 g/t silver and 15.25 metres of 1.85 g/t gold and 85.10 g/t silver. Other 2020 drill results also returned encouraging assays such as 9.11 g/t gold over 15.2 metres, including 21.8 g/t over 6.1 metres and 69.3 g/t over 1.5 metres at the Ruth vein.

Drilling has confirmed that the strike length of the Ruth vein has been extended for 150 metres. The drilling continues to confirm continuity of mineralization for over 650 metres with potential for high-grade ore shoots running parallel to the producing Moss Mine central pit.

Drilling has confirmed that the strike length of the Ruth vein has been extended for 150 metres. The drilling continues to confirm continuity of mineralization for over 650 metres with potential for high-grade ore shoots running parallel to the producing Moss Mine central pit.

Ken Berry, President and CEO, stated: “In addition to the success of high-grade gold and silver results from the previously untested Ruth vein, we are extremely encouraged with the widespread mineralized intercepts encountered at the Gold Bridge and the Gold Tower zones, located directly adjacent to the producing Moss open-pit mine.”

In early November, the company announced plans to add a third core drill rig and proceed with an accelerated $2.5 million, 13,700-metre Phase II infill drilling and resource expansion program. The Phase II program will immediately proceed upon the conclusion the current Phase I, 18,000-metre drilling and resource expansion program. The objective is to double the size of the Moss resources.

Northern Vertex’s strategy is to test district-scale exploration potential by testing multiple distal targets in a “Hub & Spoke” pattern with the Moss Mine processing facilities in the centre.

As of 2019, Measured and Indicated resources stood at 20,560,000 tons grading 0.0108 oz/ton gold and 0.2171 oz/ton silver, for 360,000 ounces of gold and 4,463.000 ounces of silver. Inferred resources were pegged at 129,000 ounces of gold and 1,375,000 ounces of silver.

With a view to optimize operations and reduce costs, metallurgical testwork has been underway on a 45,000-ton bulk sample to determine if switching to a 3/8″ crush size would be better than the current ¼” size. In addition, construction of a 6.9-mile powerline to the Mohave Electric power grid is now completed.

With a view to optimize operations and reduce costs, metallurgical testwork has been underway on a 45,000-ton bulk sample to determine if switching to a 3/8″ crush size would be better than the current ¼” size. In addition, construction of a 6.9-mile powerline to the Mohave Electric power grid is now completed.

Northern Vertex Mining stakeholders include Greenstone Capital, Maverix Metals, Nomad Royalties and others as well as high net worth Swiss investors. The company has 251.3 million shares outstanding and US$12.12 million in the treasury (as of September 30, 2020).

The management team has decades of proven mine building, operational experience, finance and capital markets. They are currently looking at consolidating additional or near-term production assets in the Western United States. Through mergers and acquisition, the company’s goal is to become a mid-tier gold producer.

With Northern Vertex production generating free cash flow, cost reduction measures underway and three drill rigs testing high-priority targets at the Moss Mine, NEE is positioned to become the next Walker Lane Gold Trend success story.

Northern Lights Resources Corp. [NLR-CSE] is a growth-oriented exploration and development company with promising projects in Nevada and Arizona. Northern Lights will soon be trading on the OTCQB under the ticker “NLRCF”. See www.northernlightsresources.com

Northern Lights Resources Corp. [NLR-CSE] is a growth-oriented exploration and development company with promising projects in Nevada and Arizona. Northern Lights will soon be trading on the OTCQB under the ticker “NLRCF”. See www.northernlightsresources.com

The company is led by a team of seasoned mining and capital market professionals. The company employs advanced geological exploration and geophysics to do fundamental exploration work on its projects. Critical time is spent completing background geological work including mapping, sampling, aeromagnetic, IP geophysics, ionic leaching soil geochemistry, spectral analysis and GIS geological modelling to get an understanding of the geological systems for each project prior to drilling. The NLR geology team is led by Gary Artmont, one of the foremost epithermal and porphyry exploration geologists globally.

Secret Pass Gold Project – Arizona

Secret Pass Gold Project – Arizona

In Arizona, Northern Lights Resources owns 100% of the Secret Pass Gold Project. The Secret Pass Gold Project is located 15 km north of the historic Oatman-Katherine gold mining district in northwest Arizona that produced 2 million ounces of gold between 1892 and 1940 at an average gold grade of over 15 g/t.

Over the last several years the area has been rediscovered with several gold exploration and production projects active. Producing gold projects in the area include Northern Vertex Corp.’s Moss mine, an open-pit heap leach operation, and Aura Minerals [ORA-TSX] that operates the Gold Roads underground mine.

The Tin Cup mine at Secret Pass operated from the early 1900’s to approximately 1930.

Exploration drilling completed at Tin Cup from 1984 to 1991 by Santa Fe Gold and other companies intersected high-grade gold mineralization from near-surface to a depth of approximately 180 metres. The average depth of the 145 historic holes completed on the Secret Pass property was 95 metres. Assay results from the historic drilling at Tin Cup ranged up to 40 g/t Au.

Prior to ownership by Northern Lights, exploration on the Secret Pass Gold Project was limited to the Tin Cup and FM zones that represent only 10% of the total project area. 90% of the claim area has never been explored by modern methods and technology. There are over 20 historic workings that have been identified on the Secret Pass claim area.

Prior to ownership by Northern Lights, exploration on the Secret Pass Gold Project was limited to the Tin Cup and FM zones that represent only 10% of the total project area. 90% of the claim area has never been explored by modern methods and technology. There are over 20 historic workings that have been identified on the Secret Pass claim area.

Exploration work completed by Northern Lights during 2020 has identified significant potential for high-grade gold mineralization at the Tin Cup and FM zones plus the newly identified Fiery Squid zone as well as 20 additional targets based on field work and aeromagnetic and IP geophysical survey results.

The Secret Pass Gold Project is a promising gold exploration property with no production royalty allowing shareholders potentially significant exploration upside.

Medicine Springs Project – Nevada

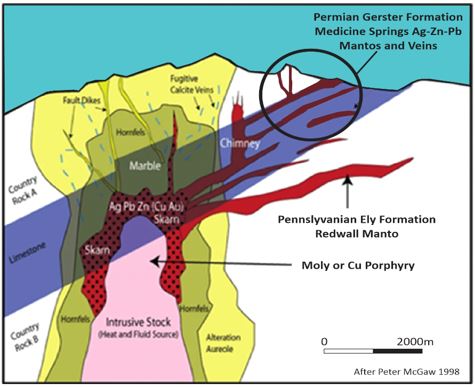

Northern Lights Resources’ second strategic property is the Medicine Springs Silver-Lead-Zinc Project located in Elko County, northeastern Nevada.

The Medicine Springs Project comprises 149 unpatented Federal mineral claims covering 1,189 hectares located in the Ruby Mountains Valley just off the famous Carlin Trend. The Medicine Springs Project has the potential to host a large scale high grade silver-zinc-lead Carbonate Replacement Deposit (CRD) deposit.

Key Highlights

- Strong, experienced management and in-house geology teams.

- Sufficient cash and funding to complete initial exploration programs.

- High-grade gold exploration exposure at Secret Pass plus large scale CRD potential at Medicine Springs.

- Both projects are situated in mining-friendly jurisdictions in the US.

- Upcoming drill results from both Secret Pass and Medicine Springs.

- Current sub $10 million market capitalization, ~10 cent share price.

Supernova Metals Corp. [SUPR-TSXV; ABETF-OTC; A1S.F-FSE], a well-structured Canadian junior offering exploration upside in both precious and battery metals with exposure to energy revenue, is embarking on a new phase in its development.

Supernova Metals Corp. [SUPR-TSXV; ABETF-OTC; A1S.F-FSE], a well-structured Canadian junior offering exploration upside in both precious and battery metals with exposure to energy revenue, is embarking on a new phase in its development.

Having changed its name from Volt Energy Corp., Supernova is very excited to have just recently launched a maiden drill program on the prospective Clanton Hills silver project in Arizona, after signing a deal with Allegiant Gold Ltd. [AUAU-TSXV] that gives Supernova the option to earn up to a 70% interest in the property.

Within a rising precious metals market, anticipated drilling success should have a positive impact on Supernova’s share price, which was trading at $0.15 on November 10, 2020, in a 52-week range of $0.02 to $0.32.

Clanton Hills was discovered by the legendary U.S. geologist John Livermore, whose discoveries along the fabled Carlin Trend helped establish Nevada as one of the world’s leading centres for gold exploration, and now home to the world’s leading producers. Supernova recognizes that Clanton Hills represents a unique opportunity and is eager to be the first company to drill this primary silver target.

Following the successful geophysical and prospecting program completed on Clanton Hills in October 2020, Supernova is launching an initial 2,000-metre reverse circulation drill program, comprised of approximately 10 holes. The company believes Clanton Hills has the potential for a shallow, open-pittable silver deposit in the mining friendly jurisdiction of Arizona.

Following the successful geophysical and prospecting program completed on Clanton Hills in October 2020, Supernova is launching an initial 2,000-metre reverse circulation drill program, comprised of approximately 10 holes. The company believes Clanton Hills has the potential for a shallow, open-pittable silver deposit in the mining friendly jurisdiction of Arizona.

The optimism is based on historic mapping and sampling on a central outcrop area that resulted in the identification of silver values up to 242 g/t silver from grab samples related to discrete vein/shear structures in the outcrop, as well as significant silver mineralization within broad zones of silica/carbonate-matrix breccia zones spatially associated with the vein system.

Supernova’s corporate mission is based on targeting and acquiring highly prospective precious metals exploration targets in jurisdictions that can be permitted and drilled with modest capital expenditures, such as Arizona. The company recently completed a non-brokered private placement of 10 million common shares priced at $0.10 per share (no warrants attached), raising gross proceeds of $1 million, of which a portion will be used to fund the Clanton Hills exploration program.

At the same, the company recently beefed up its management strength by naming Roger March to its board of directors. March is currently vice-president, exploration for Foran Mining Corp. Prior to that March spent an 11-year spell with Cumberland Resources Ltd. where he was part of a team that was responsible for the completion of pre-feasibility and feasibility level studies for the Meadowbank Gold Project in the Canadian Arctic, including resource increases from 800,000 to over 4.0 million ounces of gold.

At the same, the company recently beefed up its management strength by naming Roger March to its board of directors. March is currently vice-president, exploration for Foran Mining Corp. Prior to that March spent an 11-year spell with Cumberland Resources Ltd. where he was part of a team that was responsible for the completion of pre-feasibility and feasibility level studies for the Meadowbank Gold Project in the Canadian Arctic, including resource increases from 800,000 to over 4.0 million ounces of gold.

In addition, Kent Ausburn, PhD geologist and PGeo, has been appointed as a technical advisor to the company. Dr. Ausburn has spent the last nine years as a director and senior geologist for American Potash/New Tech Minerals focused on exploring and developing potash deposits and lithium-bromine brines in the Paradox Basin, SW Utah and, more recently, identifying and acquiring several cobalt prospects in Missouri and Nevada, as well as generating properties and consulting for other groups.

Previously, Dr. Ausburn has for the past 35+ years worked for and with several American and Canadian Junior mining companies focused on exploring for and developing precious metal (Au-Ag), platinum-group-elements (PGE’s) and base metal deposits around the world.

Supernova’s project portfolio includes another drill-ready gold-silver property in Nevada, the Cold Springs Project. It is known to host high-grade epithermal gold-silver mineralization. Grab sampling to date has yielded values of up to 64.9 g/t gold and 1,779 g/t silver. The company expects to initiate a drill program at Cold Springs in December 2020 after the completion of the program at Clanton Hills.

Supernova also generates positive cash flow from its non-operating working interests in four medium crude oil wells in southeastern Saskatchewan, where the operating production partners are Crescent Point Energy Corp. and Tundra Oil & Gas Ltd. Cash flow from these wells enables Supernova to allocate more of its expenditures to on-the-ground exploration activities for each of its projects.

Arizona Metals Corp. [AMC-TSXV; AZMCF-OTCQB] is advancing its 100%-owned, 1,330-acre, flagship Kay Mine Project in Yavapai County, Arizona. The company is also exploring its 100%-owned Sugarloaf Peak Gold Project in La Paz County, Arizona.

The Kay Mine has an historic estimate of 5.8 million tonnes grading 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver (Exxon Minerals – 1982)*. Arizona Metals engaged SRK Consulting (Canada) Inc. to conduct a metallurgical review of the Kay property mineralization. SRK reviewed historical information and recent drilling on the Kay Mine and noted that the Kay Mine VMS (volcanic massive sulphide) copper-gold-zinc deposit has similar metallurgical characteristics and grades to HudBay’s 777 and Lalor mines at Flin Flon, Manitoba and Glencore’s Kidd Creek Mine near Timmins, Ontario – all very successful VMS mining operations.

SRK anticipates that metallurgical processing of Kay Mine mineralization would use industry-Â standard methods of crushing, milling and flotation to produce separate saleable copper and zinc concentrates with recoveries ranging from 80% to 90% for copper and zinc and 60% for gold and silver.

Meanwhile, drilling at Kay has returned encouraging results. Drill results during 2020 from Cu-Au zone included 43.1 metres grading 3.9% CuEq (incl. 15.2m at 6.7% CuEq). Drilling in Au-Zn zone, outside of the historic estimate by Exxon, included 6.1 metres of 7.8 g/t AuEq and 6.8 metres of 7.3g/t AuEq. The Phase 1 drill program – now completed – totalled 6,700 metres in 20 holes. The Phase 2 drill program will commence shortly with permitting for 11,000 metres underway. Step-out drilling at Kay will test size potential on strike and test for new deposits to the west.

Meanwhile, drilling at Kay has returned encouraging results. Drill results during 2020 from Cu-Au zone included 43.1 metres grading 3.9% CuEq (incl. 15.2m at 6.7% CuEq). Drilling in Au-Zn zone, outside of the historic estimate by Exxon, included 6.1 metres of 7.8 g/t AuEq and 6.8 metres of 7.3g/t AuEq. The Phase 1 drill program – now completed – totalled 6,700 metres in 20 holes. The Phase 2 drill program will commence shortly with permitting for 11,000 metres underway. Step-out drilling at Kay will test size potential on strike and test for new deposits to the west.

Arizona Metals has completed structural mapping, soil sampling, rock sampling and a helicopter VTEM survey over these targets, all of which show coincident anomalies.

At the 4,400-acre Sugarloaf Peak Gold Project in La Paz County, Arizona Metals has completed a four-hole, 1,700-metre Phase 1 drill program. Two diamond drill holes were extended to depths of approximately 550 metres each to test a large geophysical target that the company believes has the potential to host a higher grade feeder zone. Phase I drilling returned 137 metres grading 0.53 g/t gold from surface, including 30 metres of 0.90 g/t gold.

The Sugarloaf Peak property is a heap-leach, open-pit target with a historic estimate of 100 million tons containing 1.5 million ounces gold grading 0.5 g/t gold (Westworld, 1983)*.

Headed by Marc Pais, President and CEO, the Arizona Metals management team has decades of exploration, development, operational and finance experience. The company has 64,800,000 shares outstanding and, as of June 30, 2020, had $8 million in its treasury. Eleven institutional investors hold 17% of the company’s shares.

Headed by Marc Pais, President and CEO, the Arizona Metals management team has decades of exploration, development, operational and finance experience. The company has 64,800,000 shares outstanding and, as of June 30, 2020, had $8 million in its treasury. Eleven institutional investors hold 17% of the company’s shares.

Arizona Mining ticks off all the boxes for investors to consider; one of the main ones being that the Kay Mine Project is surrounded by about 70 past-producing underground VMS copper-gold-zinc mines within a 150-km radius. The Phelps Dodge United Verde Mine, one hour north of Kay, produced 30 million tons of 5% copper and Resolution Copper will start producing 130,000 tpd in 2021.

Besides being located in a mining-friendly jurisdiction with power and water, the Kay Mine Project has strong community support as it could create hundreds of jobs and dynamic economic activity. The Kay Mine Project is a company-maker and the Sugarloaf Peak near-surface, open pit prospect Gold Project helps to build the company’s attractive mineral holdings that should add value going forward.

* the historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be compliant with current NI 43-101 standards. The Company’s QP has not yet 3 undertaken sufficient work to classify the historic estimate as a current resource and the Company is not treating the historic estimate as a current resource.