What’s next for gold?

By Peter Kennedy

Gold continues to trade near record-high levels as investors shrug off the potential impact of a soft economic landing in the United States, a scenario that could be bearish for the yellow metal.

Trading at US$2,334.40 an ounce on April 24, 2024, gold is up by about 15% this year, with gains partially driven by safe-haven demand as geopolitical tensions in the Middle East and Ukraine continue to escalate.

Economic and geopolitical uncertainty tend to be positive drivers for gold, which is widely seen as a safe haven due to its ability to remain a reliable store of value. It has a low correlation with other asset classes, and so can act as insurance during falling markets and times of geopolitical stress. A weaker U.S. dollar and lower interest rates also increase the appeal of non-yielding bullion.

However, the yellow metal has continued to trade at or near record high levels, even as investors weigh a shift in messaging from Federal Reserve Board Chair Jerome Powell, who has said it is appropriate to give the Fed’s restrictive policy more time to work, citing the lack of additional progress made on inflation in recent months following several strong U.S. economic prints.

His comments caused Treasury yields and the dollar to jump and spurred another collapse in market-implied expectations for rate cuts this year. But they have had little impact on the price of gold.

Gold had a strong 2023, defying expectations amid a high-interest rate environment, and outperforming commodities, bonds, and most stock markets.

In a recent report, The World Gold Council said markets are anticipating a “soft landing” in the United States, which should also positively affect the global economy.

“Historically, soft landing environments have not been particularly attractive for gold, resulting in lackluster average returns,” WGC said in its 2024 Outlook report.

“That said, every cycle is different. This time around heightened geopolitical tensions in a key election year for many major economies, combined with continued central bank buying could provide additional support for gold,’’ the WGC said.

“Further, the likelihood of the Fed steering the US economy to a safe landing with interest rates above 5.0% is by no means certain. And a global recession is still on the cards. This should encourage many investors to hold effective hedges, such as gold, in their portfolios,’’ it said.

Meanwhile, several factors are pressing gold to new highs, according to Paul Wong, a Market Strategist with Sprott Asset Management. “Simplistically, a massive-relatively price-insensitive buyer (central banks and sovereigns) is providing persistent support,” Wong said. “At the same time, another large cohort (investment funds as represented by Commodity Futures Trading Commission CFT and ETF positioning) is essentially caught in a short squeeze. Aiding the gold price are signs that the U.S. dollar is making a significant top, and yields are peaking as global central banks are set to begin a synchronized easing cycle,’’ he said.

Wong believes several fundamental factors are in place for gold to potentially move higher, particularly strong central bank buying. He said central banks’ strategic shift toward gold creates a new dynamic in gold pricing, breaking historical correlations. “Their motivations and needs differ significantly from investment funds.”

However, analysts say gold equities have lagged behind the bullion price because the underlying equities have not seen the same degree of support from institutional and retail investors.

That was partly because profit margins were under pressure, as inflation had eroded some of their profitability.

With the positive outlook for gold, could the market for junior gold explorers have bottomed out, and is a new bull market forming?

Sokoman Minerals Corp. [SIC-TSXV, SICNF-OTCQB] offers investors a window into low-risk exploration in the Central Newfoundland Gold District as it gears up to drill on two key projects this summer.

In an interview with Sokoman CEO, Tim Froude said he hopes to spend at least $2 million on the company’s flagship Moosehead project, where the company is planning for deep drilling after finding seven zones of mineralization all of which remain open.

The 100%-owned Moosehead project is located along the Trans-Canada Highway in North-Central Newfoundland on the same structural trend as Calibre Mining Corp’s [CXB-TSXV, CXBMF-OTC] Valentine Gold Project and New Found Gold Corp.’s [NFG-TSXV] Queensway Project.

Sokoman emerged on investor radar screens in July 2018, when discovery hole MH-18-01 returned 11.90 metres of 44.96 g/t gold from 109 metres down hole. That and subsequent exploration results attracted the attention of major players in the gold investment sector, including Bay Street financier Eric Sprott, who currently holds a 21% stake in Sokoman. On April 16, 2024, the shares were trading at $0.05 in a 52-week range of 18.5 cents and $0.05.

At Moosehead, Sokoman is targeting high-grade orogenic gold that is similar in style to the Fosterville gold mine in Australia, which is owned by Agnico-Eagle Mines Ltd. [AEM-TSX, AEM-NYSE] and produced 277,694 ounces of gold in 2023.

With $3.5 million in the treasury, Froude is planning for a program of up to 10,000 metres at Moosehead this summer. He is setting aside $500,000 for early-stage drilling at the Fleur de Lys property near Baie Verte in northwestern Newfoundland.

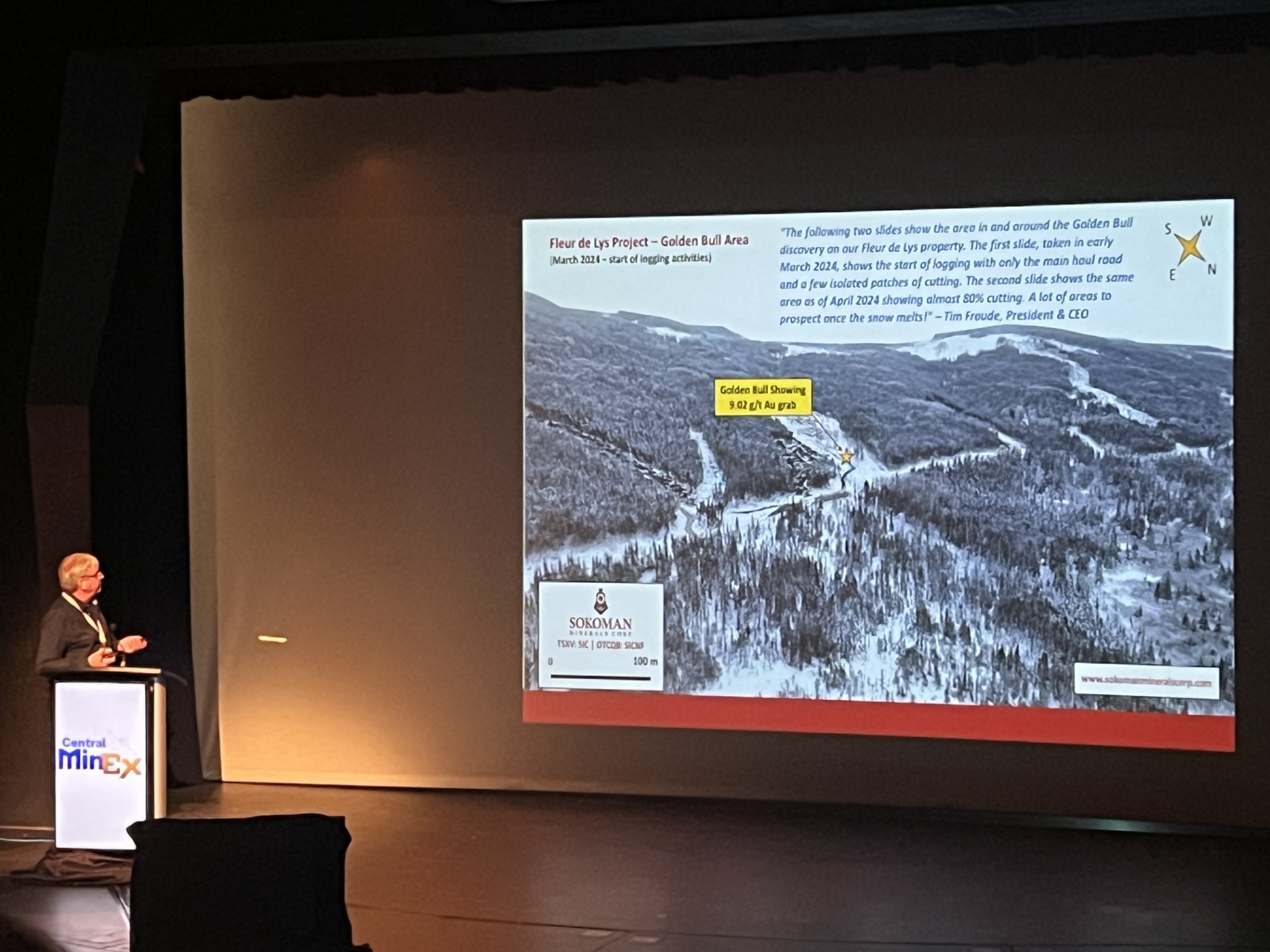

An exploration-focused geologist, with a track record of success, Froude has high hopes for Fleur de Lys which is considered to be highly prospective for Dalradian-style orogenic vein-hosted gold deposits and as such, represents a readily accessible, yet underexplored, district-scale, gold target in the Newfoundland Appalachians.

At Fleur de Lys, Sokoman is targeting gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland and Cononish in Scotland.

Having recently formed a strategic alliance with Benton Resources Inc. [BEX-TSXV] to jointly acquire and explore gold opportunities in Newfoundland, Sokoman is one of the largest landholders in Newfoundland with direct ownership or co-ownership of over 150,000 hectares.

The move paid off in an unexpected way on August 16, 2021, when the joint venture announced what is believed to be the first discovery of significant lithium mineralization on the island of Newfoundland.

However, Sokoman remains focused on the Moosehead project where recent exploration has focused on the 552 Zone which Froude has described as “extremely important’’ since it represents a new gold-bearing structure and has the potential to host sections of significantly higher gold grades.

The 552 Zone is located to the east of the Eastern Trend, the furthest east of any mineralization located to date. Drilling highlights include 2.10 metres of 5.00 g/t gold in MH-23-574, and 2.05 metres of 8.31 g/t gold, including 0.50 metres of 27.79 g/t in MH-24-580. Both holes had specks of visible gold.

In a March 28, 2024 press release, the company said 1,825 metres had been completed in the current program (12 holes). It said visible gold had been intersected in five holes.

Froude believes 552 could be linked to deeper mineralization below 350 metres that the company aims to target this summer.

“I do believe the best is yet to come from Moosehead,’’ Froude said, adding that the company has retained structural consultant Dr. David Coller to update the structural model and help plan for deeper drilling at Moosehead later this year.

Dr Coller has been involved with the project since our first year and has been instrumental in guiding us to several high-grade discoveries.

Dr. Coller and Sokoman’s geological team are evaluating drill sections from the recently discovered 552 Zone to characterize the mineralization, to determine the significance of the zone and what it means for future exploration.