Belmont and Marquee Announce Drilling Results at The Lone Star Copper-Gold project highlighted by 1.3% Copper over 44.2 Metres

Highlights:

- Wide zones of high-grade copper mineralization (up to 18.5% Cu) confirmed from first two diamond drill holes with significant elevated gold (up to 10.4g/t Au) and silver (up to 106 g/t Ag) values also received.

- Multiple zones of mineralization intersected which include:

LS21-001

- 2m @ 1.3% Cu from 65.8m (including 19.8m @ 2.4% Cu)

- 1m @ 1.15% Cu from 140.4m (including 8.5m @ 2.1% Cu)

LS21-002

- 54m @ 3.7% Cu & 1.8g/t Au from 48.3m (including. 2.6m @ 18.5% Cu & 10.4g/t Au)

- 6m @ 0.8% Cu from 120.7m (including 7.6m @ 2.1% Cu & 1.4g/t Au)

- Drilling ongoing with 7 diamond holes of 42 completed as part of the 6,000m program.

- Second batch of assays delivered to the lab for analysis and are expected to be received early February

Results from the first two holes of the forty two-hole ~6,000m diamond drilling campaign have been received and include:

LS21-001

- 2m @ 1.3% Cu from 65.8m (including 19.8m @ 2.4% Cu)

- 1m @ 1.15% Cu from 140.4m (including 8.5m @ 2.1% Cu)

LS21-002

- 54m @ 3.7% Cu, 1.8g/t Au & 23g/t Ag from 48.3m (incl. 2.6m @ 18.5% Cu, 10.4g/t Au, 106g/t Ag)

- 6m @ 0.8% Cu from 120.7m (including 7.6m @ 2.1% Cu & 1.4g/t Au)

Upon completion of the drill program, a new 43-101 Mineral Resource estimate will be generated and will be part a Preliminary Economic Assessment study for the development of the Lone Star deposit.

(1) Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

(2) The quantity and grade of reported inferred resources in this estimation are conceptual in nature.

(3) The mineral resources in this estimate were calculated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council December 11, 2005.

(4) Gold equivalent (AuEq) grade was calculated utilizing a gold price of US$593/oz and copper price of US$2.84/lb., based on the 24 month (at July 31, 2007) trailing average of gold and copper prices, to obtain a conversion factor of % copper x 3.284 + gold g/t = Au Eq g/t. Metallurgical recoveries and smelting/refining costs were not factored into the gold equivalent calculation.

(5) The Cu equivalent (CuEq) cut-off value of 1.5% was calculated and rounded utilizing the following: Cu price US$2.84/lb, $US exchange rate $0.88, process recovery $95%, smelter payable 95%, smelting and refining charges C$7/tonne mined, mining cost C$62/tonne mined, process cost $C28/tonne processed, G&A cost $7.50/tonne processed.

(6) A qualified person has not done sufficient work to classify the historic estimate as current mineral resources or mineral reserves. As such the issuer, Belmont Resources, is not treating this historical estimate as current mineral resources or mineral reserves.

Lone Star Diamond Drilling Program Update

7 diamond drill holes for 1,349m have been completed at Lone Star (Table 1) with assay results for the first two drill holes received.

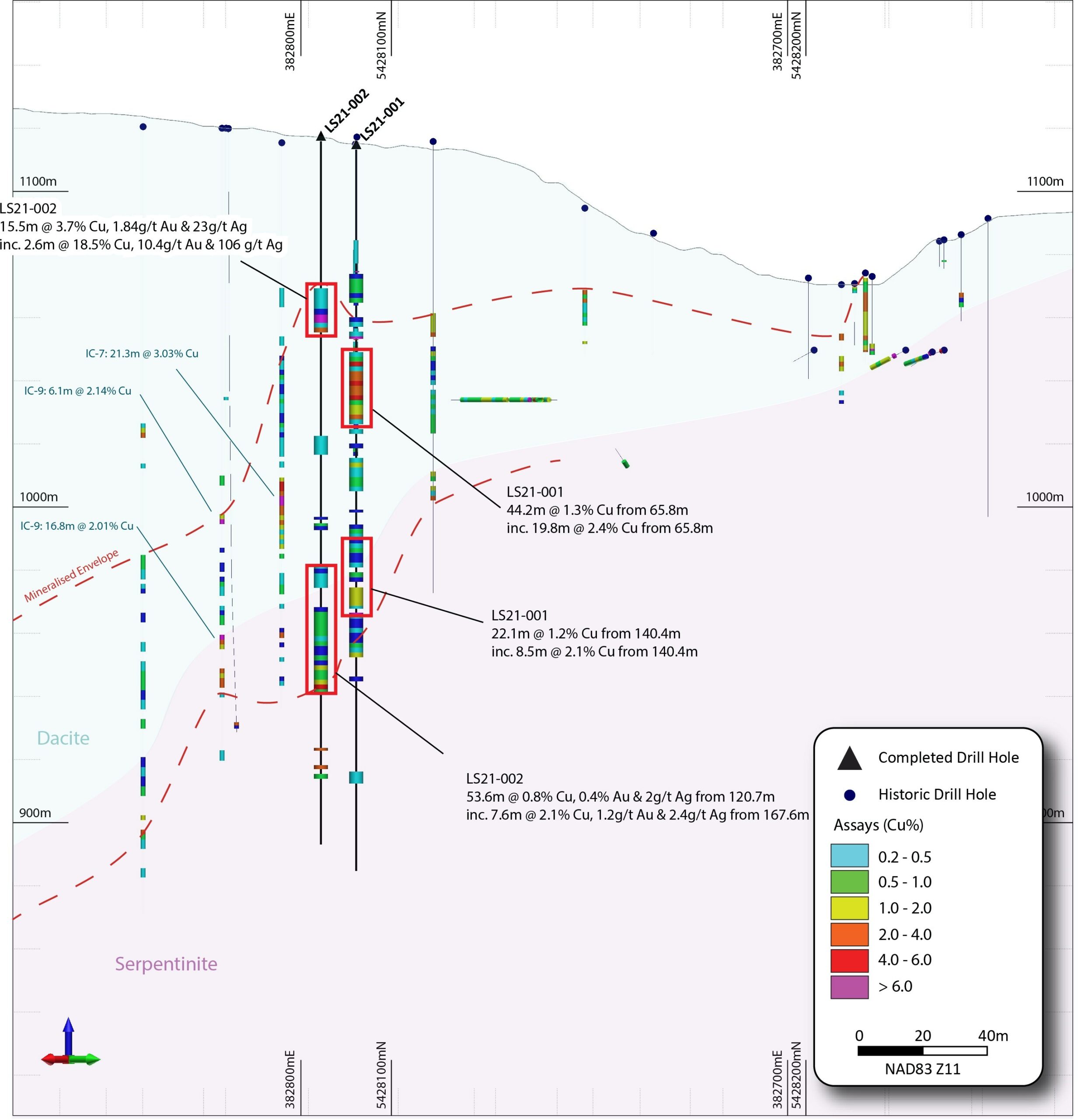

The first drill hole, LS21-001, was completed to a depth 230.1m (755ft) and was designed to validate historical high- grade intercepts in the core of the mineralised system. Two main zones of chalcopyrite-pyrite mineralisation were observed in drill core, a shallow dacite hosted Upper Zone from 65.8-110m, and a Lower Zone of mineralisation from 115.8-162.5m hosted on the margin of and within a serpentinite unit (Figure 2). Significant results from Upper Zone mineralisation include 44.2m @ 1.3% Cu from 65.8m inc. 19.8m @ 2.4% Cu from 65.8m with significant results from Lower Zone mineralisation including 22.1m @ 1.15% Cu from 140.4m inc. 8.5m @ 2.1% Cu from 140.4m. Multiple zones of mineralisation were intersected outside these two zones with all results outlined in Table 2.

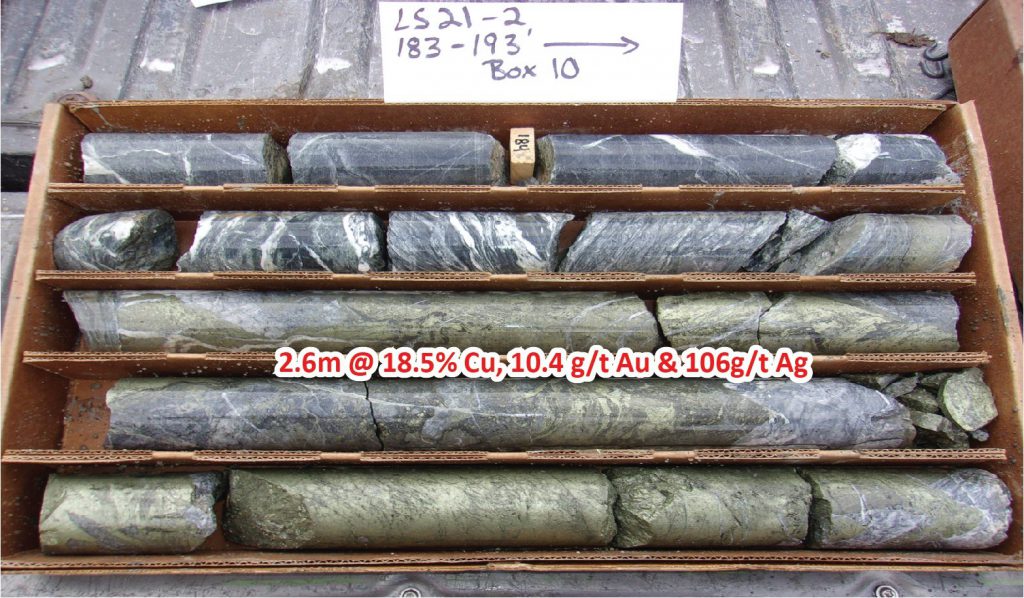

The second drill hole, LS21-002, was collared 13m east of LS21-001 and was drilled to a depth of 224.3m (736ft). Disseminated polymetallic Upper Zone sulphide mineralisation was encountered from 48.3m-62.3m with significant results including 15.54m @ 3.7% Cu, 1.8g/t Au & 23g/t Ag from 48.3m inc. 2.6m @ 18.5% Cu, 10.4g/t Au & 106g/t Ag. Lower Zone mineralisation was intersected from 120.7-176.1m with results including 53.6m @ 0.8% Cu from 120.7m inc. 7.6m @ 2.1% Cu & 1.4g/t Au from 167.6m (Figure 2).

The next batch of core is being transported to the laboratory for assay while drilling is ongoing as part of the forty- two-hole, ~6,000m of diamond drilling program. Drilling is expected to be completed at the Lone Star Copper-Gold Project in Q1-2022.

The drilling program has been designed to satisfy three key objectives:

-Â Â Â Â Â Â Â Â Â Â Â Â Â Validate the historical drill hole database and historic resource model;

-Â Â Â Â Â Â Â Â Â Â Â Â Â Deliver a 43-101 compliant mineral resource estimate; and

-Â Â Â Â Â Â Â Â Â Â Â Â Â Test for extensions to the historical resource.

Table 1: Completed Drill Holes at the Lone Star Project. Coordinates in NAD83 Zone 11

| Hole | Easting | Northing | Elev (m) | Dip | Azi | Depth (ft) | Depth (m) |

| LS21-001 | 382788 | 5428094 | 1115 | -89 | 262 | 755 | 230.1 |

| LS21-002 | 382801 | 5428084 | 1117 | -90 | 736 | 224.3 | |

| LS21-003 | 382799 | 5428053 | 1117 | -90 | 927 | 282.5 | |

| LS21-004 | 382777 | 5428298 | 1095 | -90 | 627 | 191.1 | |

| LS21-008 | 328781 | 5428271 | 1092 | -90 | 437 | 133.2 | |

| LS21-009 | 382818 | 5428273 | 1106 | -90 | 297 | 90.5 | |

| LS21-010 | 382819 | 5428273 | 1106 | -70 | 90 | 647 | 197.2 |

| Total | 4426 | 1349 |

Â

Figure 2:Â Oblique section through completed drill holes LS21-001 & LS21-002

Table 2: Table of Significant Result

| Hole | From (ft) | To

(ft) |

From (m) | To

(m) |

Int.

(m) |

Cu% Wt avg | Au g/t Wt avg | Ag g/t Wt avg |

| LS21-001 | 135 | 165 | 41.5 | 50.3 | 9.1 | 0.6 | 0.16 | 3.2 |

| LS21-001 | 180 | 202.5 | 54.9 | 61.2 | 6.86 | 1.2 | 0.78 | 12.9 |

| LS21-001 | 216 | 361 | 65.8 | 110 | 44.2 | 1.3 | 0.24 | 4.6 |

| INC. | 216 | 291 | 65.8 | 88.7 | 19.8 | 2.4 | 0.48 | 6.7 |

| LS21-001 | 380 | 455 | 115.8 | 138.7 | 19.1 | 0.4 | NSR | NSR |

| LS21-001 | 460.5 | 533 | 140.4 | 162.5 | 22.1 | 1.2 | 0.25 | 2.2 |

| INC. | 460.5 | 488.4 | 140.4 | 162.5 | 8.5 | 2.1 | 0.83 | 2.4 |

| LS21-001 | 652 | 659 | 198.7 | 200.9 | 4.7 | 0.8 | 0.25 | 1 |

| LS21-002 | 158.5 | 204.5 | 46.9 | 60.8 | 15.5 | 3.7 | 1.84 | 23 |

| INC. | 186 | 194.5 | 56.7 | 59.3 | 2.6 | 18.5 | 10.4 | 106 |

| LS21-002 | 312 | 332 | 95.1 | 101.1 | 6 | 0.42 | NSR | 2.5 |

| LS21-002 | 396 | 578 | 120.7 | 176.1 | 53.6 | 0.8 | 0.4 | 2 |

| INC. | 550 | 578 | 167.6 | 176.1 | 7.6 | 2.1 | 1.38 | 6.2 |

| LS21-002 | 636 | 639 | 193.8 | 194.7 | 0.9 | 3.8 | 1.2 | 4 |

| LS21-002 | 654 | 658 | 199.3 | 200.5 | 1.2 | 3 | 1.94 | 4 |

| LS21-002 | 663 | 668 | 202 | 203.6 | 1.6 | 0.9 | 1 | 2 |

The true thickness of mineralized intervals intercepted by drilling has not yet been determined

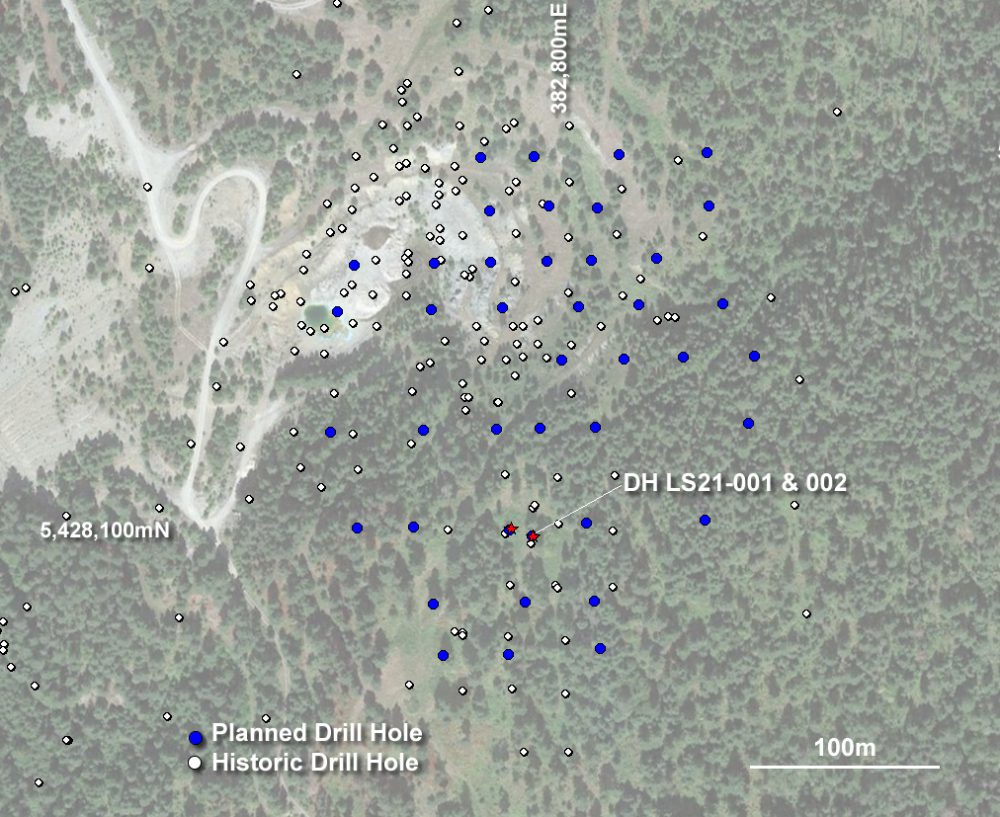

Figure 3:Â Lone Star Drill Hole Plan

Lone Star Option/JV Agreement

Belmont recently signed an option/JV agreement with Marquee Resources (ASX:MQR) (see NR Nov.4, 2021) whereby Marquee agrees to commit the following:

- $504,000 cash payments

- $2,550,000 Work Program

- 3,000,000 MQR Shares

- Produce a Preliminary Economic Assessment on the project

- All within a 24 month term

- For 80% ownership of the Lone Star project.

- Upon completion, a joint venture is to be formed and a decision will be made in regards to bringing the Lone Star into production

Lone Star Copper-Gold Mine (Washington State, USA)

The Lone Star property is located in northern Washington State on the northeastern tip of the Republic Graben, an important geological feature which hosts several gold and copper mines.

The property is situated on a three kilometre long mineralized trend of gold-copper with past producing gold-copper mines and prospects, including No.7, City of Paris, Lincoln and the Lexington. The Lexington mine is owned by Golden Dawn Minerals and has a Current Resource and a Preliminary Economic Assessment.Â

This mineralized system is structurally controlled by the NW-SEÂ No.7 fault. The geology of the Lone Star Property is strongly influenced by the No. 7 Fault. The fault has an accurate northwesterly trace on the Lexington Property to a southerly trace on the Lone Star Property.

The Lone Star property was previously owned by Merrit Mining. In 2007 Merrit had completed a 43-101 Technical Resource Report and were about to produce a Preliminary Economic Assessment report but due to the 2008 market crash Merrit Mining went into receivership and the property remained dormant until purchased by Belmont.

The 200 tpd Greenwood Toll Mill is located only 13kms north of the Lone Star property and will potentially receive ore for milling from the Lone Star mine.

Figure 4: Lone Star Project Location

About Belmont Resources Inc.

Belmont Resources is engaged in the business of acquiring and re-developing past producing copper-gold-silver mines in southern British Columbia and Northern Washington State. This region is considered to have the highest concentration of mineralization and past producing mines in western North America. By utilizing new exploration technology, geological modelling and specialized 3D data analysis, the company is successfully identifying new areas of mineralization beneath and/or in the near vicinity of the past producing mines

The Company’s project portfolio includes 6 past producing mines:

- Athelstan-Jackpot, B.C. – *Gold-Silver mines

- Come By Chance, B.C. – * Copper-Gold mine

- Lone Star, Washington – *Copper-Gold mine

- Pathfinder, B.C. – * Gold-Silver mine

- Black Bear, B.C. – Gold

- Pride of the West, B.C.- Gold

- Kibby Basin, Nevada – Lithium

* past producing mine

Qualified Person

Technical disclosure in this news release has been approved by Jim Ebisch. P.Geo, SME., a Qualified Person as defined by National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS

“George Sookochoff”

George Sookochoff, CEO/President

Ph: 604-505-4061

Email:Â george@belmontresources.com

Website:Â www.BelmontResources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.