Allegiant Gold’s Giustra sees bright future as stock debuts

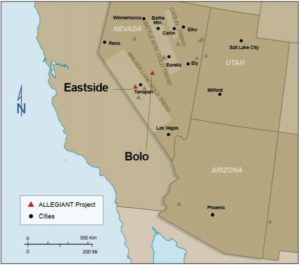

Location map of the Allegiant Gold's Bolo and Eastside properties in Nevada. Source: Allegiant Gold Ltd.

Allegiant Gold Ltd. [AUAU-TSXV], the new spin out comprised of the Western U.S. exploration assets of Columbus Gold Corp. [CGT-TSX, CBGDF-OTCQX], got off to a positive start Tuesday, the first day of trading on the TSX Venture Exchange. The shares rose 23% or $0.14 to 74 cents in early afternoon trading.

“Today marks the beginning of a new and exhilarating chapter for our shareholders,” said Robert Giustra, Chairman of Allegiant and Columbus.

“Allegiant’s portfolio of high-priority gold exploration projects are in the right place, Nevada, with the right team – and for the first time in more than a decade for gold exploration – at the right time.”

Columbus currently owns 7,933,496 shares of Allegiant, or 16.7% of the junior’s issued and outstanding common shares. The spin-out is aimed at unlocking the value of a basket of U.S. exploration assets, mainly located in Nevada, which are currently overshadowed by Columbus Gold’s 45% interest in the Montagne d’Or (Mountain of Gold) Project in French Guiana. It hosts 2.75 million ounces of proven and probable gold reserves. Its joint venture partner in French Guiana is Norgold, a private company owned 90% by a Russian Oligarch.

Allegiant owns 14 drill-ready projects in the Western U.S., including 11 in Nevada. All were handpicked by Andy Wallace, a successful and highly experienced geologist. His track record of success includes multi-million ounce gold discoveries including the Marigold, Pinson and Dee mines in Nevada. He is now CEO at Allegiant. Working through his private company, Cordex Exploration LLC, Wallace has assembled a portfolio of projects headed by the 100%-owned Eastside property which hosts an inferred gold resource of 721,000 ounces of gold, and the Bolo property (also 100%-owned), which was the target of a 14-hole, 2,800-metre drill program this year. Eastside and Bolo are both located in Nevada.

The company said 1,900 drill samples were shipped out Bolo in early December and results are expected to be announced soon. Bolo is a Carlin-type gold and silver project, where surface sampling has defined widespread gold mineralization. That material is amenable to cyanide leaching, according to results of preliminary metallurgical tests.

Eleven of the holes completed this year tested the previously undrilled Uncle Sam patented claim, which was acquired by Columbus in 2016. Uncle Sam covers a 500-metre strike extension of a fault zone located immediately south of an area that Columbus previously drilled. Highlights include hold BL-38 which returned 133 metres of 1.28 g/t gold from surface (including 30.5 metres of 3.24 g/t gold).

On December 5, 2017, Columbus announced that it had commenced drilling at Eastside. The aim is to expand the Original Zone, which hosts the inferred gold resource. Eastside also hosts an historical resource of 11.1 million tonnes grading 0.024 oz/ ton gold (0.82 g/t), for a total of 272,153 ounces. The company has said it sees a pathway to double the amount of gold resources at Eastside.

Subject to obtaining financing, Allegiant is planning to spend the next 12 months drilling 10 of the 14 projects in its portfolio. In keeping with that plan, Allegiant recently closed a non-brokered private placement of subscription receipts that raised $4.2 million, an amount that is being held in escrow until the spin-out is complete. Another private placement by Allegiant is planned in early 2018 following the spin-out.