Amarc Provides Update on JOY Copper-Gold District, BC: Initial 2021 Drilling Expands Pine Deposit, Intersecting 101.9 M of 0.56% CuEQ1, Additional Large-Scale Porphyry Copper-Gold Deposit Targets Confirmed

Amarc Resources Ltd. (“Amarc” or the “Company”) (TSX-V:AHR) (OTCQB:AXREF) is pleased to announce assay results from an initial, nine-hole drill program (4,300 m) completed in 2021 with Freeport-McMoRan Mineral Properties Canada Inc. (“Freeport”). Freeport is earning into the Company’s 482 km2Â JOY Cu-Au District (“JOY”) located in the active Toodoggone portion of the Golden Horseshoe trend, north-central British Columbia (“BC”) (Figure 1).

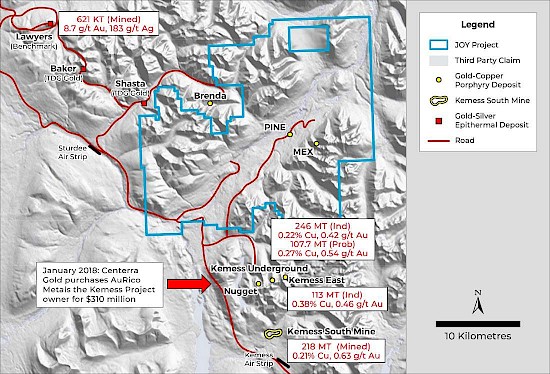

Figure 1: JOY District – Covers Northern Extension of Kemess Belt Porphyry Cu-Au Developments

“One of the key factors that drove our acquisition and consolidation of the JOY District was a recognition of the important-scale potential of the PINE copper-gold deposit,” said Amarc President & CEO Diane Nicolson. “A significant number of historical core holes were available for reassessment, providing the scope for both reinterpretation and rediscovery. Building on these legacy assets, the three long core holes we completed at the PINE deposit in 2021 intercepted some of the highest grades over the longest intervals encountered to date and indicate the extension of copper-gold mineralization to significant depth. Also, valuable information derived from historical core holes combined with new surface mapping and geophysical surveys have confirmed additional potential for higher-grade zones within the known deposit, major lateral extensions and the discovery of proximal deposits.”

Nicolson said initial scout exploration drilling completed on other large-scale porphyry Cu-Au deposit targets within the JOY District, along with extensive Induced Polarization (“IP”) geophysical surveys, have confirmed significant discovery potential. Amarc and Freeport have initiated detailed planning for a drill program at the PINE Deposit and aggressive drill testing of district targets in 2022.

Highlights from 2021 PINE Deposit core drilling include:

- 101.90 m of 0.56% CuEQ1Â (0.23% Cu, 0.57 g/t Au and 2.4 g/t Ag)

- 29.00 m of 0.46% CuEQ (0.20% Cu, 0.44 g/t Au and 2.1 g/t Ag)

- 66.60 m of 0.40% CuEQ (0.21% Cu, 0.32 g/t Au and 1.5 g/t Ag)

- 244.10 m of 0.35% CuEQ (0.11% Cu, 0.41 g/t Au and 1.2 g/t Ag)

- 135.00 m of 0.44% CuEQ (0.14% Cu, 0.53 g/t Au and 1.2 g/t Ag)

- Copper equivalent (CuEQ) calculations do not use 100% recovery but conceptual recoveries based on those from producing and near development BC porphyry Cu deposits of Cu 85%, Au 72% and 67% Ag, and metal prices of Cu US$4.00/lb, Au US$1,800.00/oz Au and Ag US$24.00/oz. Further details are provided below with Table 1.

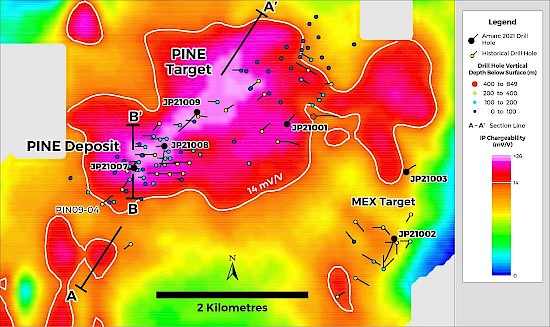

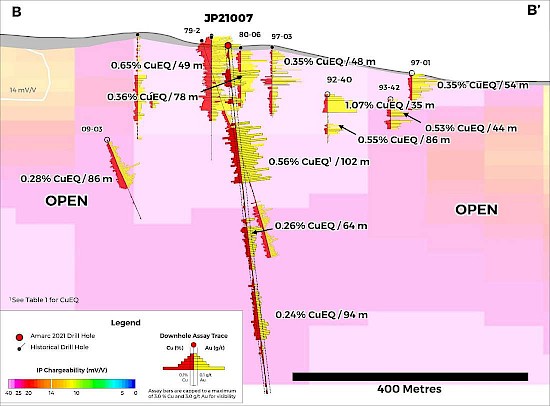

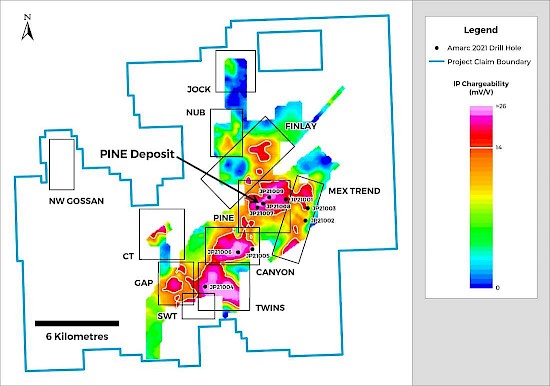

Expanding the PINE Porphyry Cu-Au Deposit

First ever drilling at the PINE Deposit by Amarc comprised three long core holes (up to 701 m in length) that successfully began to test the depth and lateral extent of known porphyry Cu-Au mineralization, with both dimensions remaining open to expansion (Table 1). These holes intercepted significant mineralization over a strike length of 1,100 m and to a vertical depth of at least 550 m (Figures 2 to 4), within an expansive 6 km2 hydrothermal mineralizing system as outlined by Induced Polarization (“IP”) geophysical surveys. Notably, the PINE system has the potential to remain open to expansion for at least 1 km to the southwest, with most of this prospective area concealed under a cover of broadly distributed glacial deposits (Photo 1, Figures 2 and 3).

Table 1: 2021 JOY Drill Hole Assay Results

- Widths reported are drill widths, such that true thicknesses are unknown. Table 2 provides drill hole location information.

- All assay intervals represent length-weighted averages.<

- Some figures may not sum exactly due to rounding.

- Copper equivalent (CuEQ) calculations use metal prices of: Cu US$4.00/lb, Au US$1,800.00/oz and Ag US$24/oz and conceptual recoveries of: Cu 85%, Au 72% and 67% Ag. Conversion of metals to an equivalent copper grade based on these metal prices is relative to the copper price per unit mass factored by conceptual recoveries for those metals normalized to the conceptualized copper recovery. The metal equivalencies for each metal are added to the copper grade. The general formula for this is: CuEQ% = Cu% + (Au g/t * (Au recovery / Cu recovery) * (Au $ per oz/ 31.1034768) / (Cu $ per lb* 22.04623)) + (Ag g/t * (Ag recovery / Cu recovery) * (Ag $ per oz/ 31.1034768) / (Cu $ per lb* 22.04623)).

- Intervals averaging greater than 0.3% CuEQ in bold; included intercepts italicized.

- Ag results capped at 40 g/t.

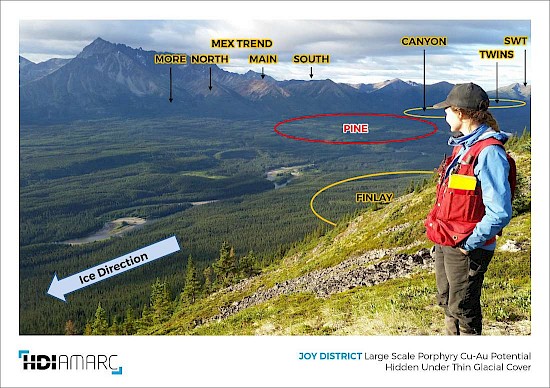

Photo 1: JOY District – Large Scale Porphyry Cu-Au Potential Hidden Under Thin Glacial Cover

Figure 2: Pine Deposit Area – IP Chargeability Surveys have Confirmed a Large Mineral System

A majority of the 60+ mainly short and, frequently, widely spaced historical core holes at the PINE Deposit (80% of which extend to <200 m vertical depth) are collared within a restricted 900 x 600 m area. Reinterpretation of historical drill holes and the new holes drilled by Amarc show good potential to expand the PINE Deposit internally (between the widely spaced drill holes), laterally (beyond the footprint of current drilling) and to depth (Figures 3 and 4).

Further to the open-ended nature of the PINE Deposit, there is also significant potential for the discovery of other centres of porphyry Cu-Au mineralization within the area of the overall PINE mineralized system. Amarc’s hole JP21009, located 500 m northeast of the PINE Deposit, returned 244 m of 0.35% CuEQ1 (0.11% Cu, 0.41 g/t Au and 1.2 g/t Ag), including 135 m of 0.44% CuEQ (0.14% Cu, 0.53 g/t Au and 1.2 g/t Ag) (Figures 2 and 3), indicating high potential to the northeast. Historical drilling also indicates significant potential to the southwest of the PINE Deposit. For example, the historical hole located furthest away to the southwest but within the current known limits of the PINE system (PIN09-04) returned 105 m at 0.17% CuEQ (0.08% Cu, 0.15 g/t Au and 1.1 g/t Ag).

Developing the JOY District Porphyry Cu-Au Deposit Targets

In addition to the PINE Deposit and its internal, lateral and depth potential for expansion, the JOY District hosts five drill-ready, deposit-scale porphyry Cu-Au targets (including Canyon, Twins and MEX). Together, these assets indicate the potential to form a major cluster of Cu-Au mineralized porphyry systems (Photo 1 and Figure 5). Furthermore, other Cu-Au target areas in the JOY District (including GAP, CT, Finlay) will be advanced to drill readiness during the 2022 field season.

Amarc drilled five initial scout exploration core holes (271 m to 404 m in length) in 2021 to test four porphyry Cu-Au deposit targets confirmed by IP, airborne magnetics, geochemical and geological surveys. Three of these JOY District targets had not previously been drill tested.

Like the PINE Deposit, the approximately 5 km2 Canyon porphyry Cu-Au deposit target is largely covered by a veneer of glacial deposits. The Canyon target is defined by a high contrast IP chargeability anomaly, outlining a sizable sulphide system centered on and flanked by magnetic highs. On the eastern and western margins of this target historical drilling returned porphyry-style Cu-Au and high-grade Au intersections, respectively, (Photo 1, Figure 5). Further details are available in the ‘JOY Project 2020 Technical Report’, referenced below.

A single scout hole (JP21006) collared within the 5 km2 Canyon target area intersected 27 m of porphyry style mineralization grading 0.18% CuEQ1 (0.06% Cu, 0.21 g/t Au and 0.7 g/t Ag), indicating a peripheral location to a porphyry Cu-Au system. Hole JP21005, drilled over 1 km to the east did not return significant assays. Systematic drilling of the very extensive Canyon target is planned for 2022.

At the Twins porphyry Cu-Au target, which is also mostly concealed under a thin layer of glacial cover, IP chargeability surveys have outlined a sulphide system that envelopes a number of magnetic highs, that extends over an area of 6 km2 that is open to further expansion to the south and east. The Twins target is centered on an outcrop of moderate to strongly altered monzonite intrusive that locally hosts porphyry-style chalcopyrite-bearing veinlets.

Amarc’s scout exploration hole (JP21004), the first ever drilled into the sizable Twins target, successfully discovered porphyry-type Cu-Au mineralization – intercepting 63 m of 0.18% CuEQ1 (0.09% Cu, 0.15 g/t Au and 0.5 g/t Ag), including 39 m of 0.22% CuEQ (0.11% Cu, 0.19 g/t Au and 0.6 g/t Ag). Systematic drilling of the extensive Twins target is planned for 2022.

At the MEX Cu-Au deposit target, a single hole (JP21002) drilled by Amarc in 2021 intersected anomalous Cu and Au concentrations lateral to and below historical drilling, returning 153 m of 0.17% CuEQ1 (0.09% Cu, 0.13 g/t Au). At the North MEX target, a single hole (JP21003) was drilled to test a multi-element geochemical anomaly. No significant Cu or Au concentrations were encountered in that hole.

About the JOY District

Amarc’s 100%-owned JOY District is located on the northern extension of the prolific Kemess porphyry Cu-Au District, which includes the former Kemess South mine, the permitted and development-stage Kemess North underground deposit, and the advanced-stage Kemess East underground deposit – all currently held by Centerra Gold Inc. Through its association with Hunter Dickinson Inc., Amarc’s technical team was first to recognize the Kemess District’s true porphyry potential, acquiring Kemess North and Kemess South as early-stage prospects and advancing both to significant porphyry Cu-Au deposits. Kemess South was sold in 1996 on beneficial terms to a predecessor of Northgate Minerals, which brought that deposit into production.

The JOY District is readily accessed via resource roads servicing the southern end of the Toodoggone region, including Centerra’s Kemess porphyry Cu-Au deposits and the historic Lawyers, Baker and Shasta epithermal precious metal mines now being redeveloped by Benchmark Metals Inc. and TDG Gold Corp, respectively.

In May 2021, Amarc announced it had entered into a Mineral Property Earn-In Agreement (the “EIA”) with Freeport-McMoRan Mineral Properties Canada Inc. (“Freeport”), a wholly owned subsidiary of Freeport-McMoRan Inc. (see Amarc release May 12, 2021 on its website at www.amarcresources.com and at www.sedar.com).

In its Year 1, Freeport contributed $5.94 million to the 2021 JOY exploration program, and recently confirmed its continuation of the earn-in for Year 2 (see Amarc releases November 15 and December 15, 2021). Amarc is the Operator of the JOY District. Drill programs at the PINE Deposit and at other porphyry Cu-Au deposit targets in the JOY District are now being planned for the 2022 field season.

Further in-depth information on historical and contemporary exploration activities completed within the JOY District prior to 2021 can be found in the Company’s ‘JOY Project 2020 Technical Report’, filed under Amarc’s profile at www.sedar.com or located on its website at https://amarcresources.com/projects/joy-project/technical-report/.

Other News

Amarc welcomes Tom Wilson as interim Chief Financial Officer, taking over from Jeannine Webb. Mr. Wilson has more than 43 years of experience in areas of financial planning and management, including corporate governance, and government and securities compliance for a range of public and private companies. The Company thanks Ms. Webb for her contributions.

About Amarc Resources Ltd.

Amarc is a mineral exploration and development company with an experienced and successful management team focused on developing a new generation of long-life, high-value porphyry copper-gold mines in BC. By combining high-demand projects with dynamic management, Amarc has created a solid platform to create value from its exploration and development-stage assets.

Amarc is advancing its 100%-owned IKE, DUKE and JOY porphyry copper±gold districts located in different prolific porphyry regions of southern, central and northern BC, respectively. Each district represents significant potential for the development of multiple and important-scale, porphyry copper±gold deposits. Importantly each of the three districts is located in proximity to industrial infrastructure – including power, highways and rail.

Amarc is associated with HDI, a diversified, global mining company with a 30-year history of porphyry discovery and development success. Previous and current HDI projects include some of BC’s and the world’s most important porphyry deposits – such as Pebble, Mount Milligan, Southern Star, Kemess South, Kemess North, Gibraltar, Prosperity, Xietongmen, Newtongmen, Florence, Casino, Sisson, Maggie, IKE and PINE. From its head office in Vancouver, Canada, HDI applies its unique strengths and capabilities to acquire, develop, operate and monetize mineral projects.

Amarc works closely with local governments, Indigenous groups and stakeholders in order to advance its mineral projects responsibly, and in a manner that contributes to sustainable community and economic development. We pursue early and meaningful engagement to ensure our mineral exploration and development activities are well coordinated and broadly supported, address local priorities and concerns, and optimize opportunities for collaboration. In particular, we seek to establish mutually beneficial partnerships with Indigenous groups within whose traditional territories our projects are located, through the provision of jobs, training programs, contract opportunities, capacity funding agreements and sponsorship of community events. All Amarc work programs are carefully planned to achieve high levels of environmental and social performance.

Qualified Person as Defined Under National Instrument 43-101

Dr. Roy Greig, P.Geo., a Qualified Person as defined under National Instrument 43-101, has reviewed and approved the technical content in this release.

Quality Control/Quality Assurance Program

Amarc drilled 30% HQ and 70% NQ size core in 2021. All drill core was logged, photographed and cut in half with a diamond saw. Half core samples from JOY were sent to Activation Laboratories Ltd. (Actlabs), Kamloops, Canada facility for preparation and analysis. At Actlabs Kamloops, samples were dried, crushed to 2 mm and 250 g sub-sample pulverized to 105 microns. The sub-sample was analyzed for Au by fire assay fusion of a 30 g sample with an ICP-OES finish and for Cu, Ag and 33 additional elements by 4 acid digestion of a 0.25 sample followed by an ICP-OES finish. At the Actlabs Ancaster Ontario facility, the sub-samples were analyzed for Cu, Au, Ag and 60 additional elements by Aqua Regia digestion of a 0.5 g sample followed by an ICP-MS finish. Both Actlabs facilities are ISO/IEC 17025 accredited. As part of a comprehensive Quality Assurance/Quality Control (“QAQC”) program, Amarc control samples were inserted in each analytical batch at the following rates: standards one in 20 regular samples, in-line replicates one in 20 regular samples and blanks one in 50 regular samples. The control sample results were then checked to ensure proper QAQC.

For further details on Amarc Resources Ltd., please visit the Company’s website at www.amarcresources.com or contact Dr. Diane Nicolson, President and CEO, at (604) 684-6365 or within North America at 1-800-667-2114.

ON BEHALF OF THE BOARD OF DIRECTORS OF AMARC RESOURCES LTD.

Dr. Diane Nicolson

President and CEO

Neither the TSX Venture Exchange nor any other regulatory authority accepts responsibility for the adequacy or accuracy of this release.

Forward Looking and other Cautionary Information

This news release includes certain statements that may be deemed “forward-looking statements”. All such statements, other than statements of historical facts that address exploration plans and plans for enhanced relationships are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Assumptions used by the Company to develop forward-looking statements include the following: Amarc’s projects will obtain all required environmental and other permits and all land use and other licenses, studies and exploration of Amarc’s projects will continue to be positive, and no geological or technical problems will occur. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, potential environmental issues or liabilities associated with exploration, development and mining activities, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and tenure and delays due to third party opposition, changes in and the effect of government policies regarding mining and natural resource exploration and exploitation, exploration and development of properties located within Aboriginal groups asserted territories may affect or be perceived to affect asserted aboriginal rights and title, which may cause permitting delays or opposition by Aboriginal groups, continued availability of capital and financing, and general economic, market or business conditions, as well as risks relating to the uncertainties with respect to the effects of COVID-19. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on Amarc Resources Ltd., investors should review Amarc’s annual Form 20-F filing with the United States Securities and Exchange Commission at www.sec.gov and its home jurisdiction filings that are available at www.sedar.com.

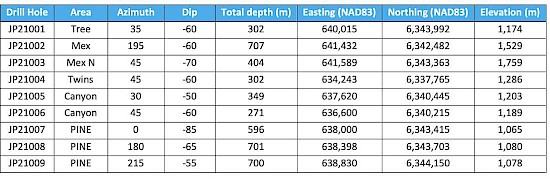

Table 2: 2021 Drill Hole Information

Photo 1: JOY District – Large Scale Porphyry Cu-Au Potential Hidden Under Thin Glacial Cover

Figure 1: JOY District – Covers Northern Extension of Kemess Belt Porphyry Cu-Au Developments2

2Â Sources:

BC MINFILE Number 094E 066, LAWYERS

“Technical Report on the Kemess Underground Project and Kemess East Project, BC” for Aurico Metals Ltd., Golder Associates, July 2017; Kemess UG and Kemess East at C$17.30/t NSR cut off; Kemess South past production (ore milled)

Figure 2: Pine Deposit Area – IP Chargeability Surveys have Confirmed a Large Mineral System

Figure 3: Pine Deposit Area – Extensive PINE System Hosts Significant Expansion Potential Laterally and to Depth

Figure 4: PINE Deposit Drill Area – Drilling and IP Surveys Confirm the PINE Deposit is Open Internally, Laterally and to Depth

Figure 5:Â JOY District IPÂ – IP Surveys Have Outlined a Cluster of Large-Scale Mineral Systems at Canyon, Twins and Other Targets