With some of the best lithium real-estate in Nevada, ACME Lithium anticipates potential bonanza

By Robert Simpson

The electric car revolution will stall in the West if supplies of crucial battery elements like lithium fail to keep up with the forecast huge increase in demand. The International Energy Agency (IEA) has estimated that the growth in EVs could see lithium demand increase by over 40 times by 2030-last year, lithium demand was about 320,000 tonnes and is expected to hit one million by 2025 and three million by 2030, which explains the potential bonanza for companies like ACME Lithium Ltd [ACME-CSE] when they discover new lithium resources.

“I don’t think we can ignore the billion-ton elephant in the room. A carbon-free future can’t exist without securing a large amount of lithium which is currently mined and produced by only a handful of foreign countries. Right now, global production is not keeping up. We simply aren’t extracting and producing enough lithium to match the projected demand. In fact, there’s only  a couple of operating commercial mines currently in North America.” says Steve Hanson, President and CEO of ACME Lithium Ltd.

Hanson says he’s never seen anything like the tsunami that is coming for lithium over his 30 years working in the alternative energy, oil and gas and mining financial markets, still the demand wave was only part of the reason he formed ACME Lithium Ltd. The other is that North America is a small player in the global battery industry. China dominates both battery manufacturing and lithium supply chains. On its current trajectory, North America is expected to supply less than half the projected demand for lithium-ion batteries for electric vehicles on its roads by 2028, and without a larger and reliable domestic supply could see the green energy transition stall.

“We have the makings of what will be a great market over the next decade, so that’s why I started evaluating and purchasing North American-based lithium projects that have the near-term potential to support the domestic supply chains,” says Hanson.

The best lithium real estate in Nevada

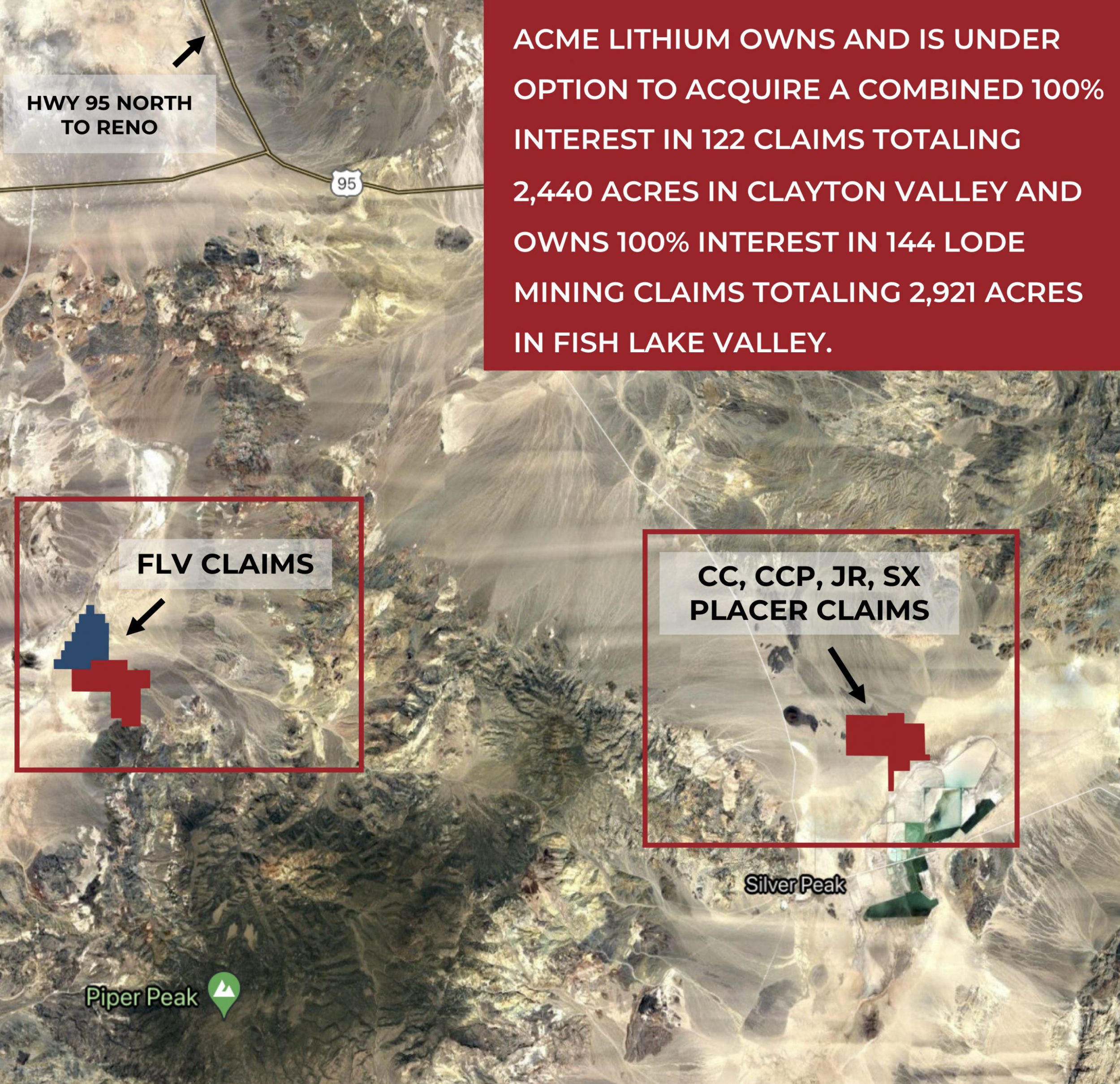

Early to the game, Hanson successfully cherry picked a couple of lithium projects in Nevada located square in the middle of what many are calling the great white gold rush. In May 2021 ACME entered into an option agreement with GeoXplor Corporation for 100 percent of the first 1,280 acres of the Clayton Valley Project considered by many as some of the best real estate in the neighbourhood, because like in real-estate, if you can’t buy the biggest house, then being next door is the next best thing.

The Clayton Valley Project, which now includes 2,440 acres, is located just north west and contiguous with the Silver Peak mine run by Albemarle Corporation since 1966 and is currently the only lithium brine operation in North America. And on the north east, the Clayton Valley project claims are contiguous with Pure Energy Minerals’ joint venture with Schlumberger Technology Corporation.

The Clayton Valley Project, which now includes 2,440 acres, is located just north west and contiguous with the Silver Peak mine run by Albemarle Corporation since 1966 and is currently the only lithium brine operation in North America. And on the north east, the Clayton Valley project claims are contiguous with Pure Energy Minerals’ joint venture with Schlumberger Technology Corporation.

With proximity of the Clayton Project so close to a producing mine and along trend, and after a couple of successful geophysical surveys, that based on the resistivities values showed multiple areas and zones that look like lithium brine occurrences in saline rich aquifers or brine saturated pebble gravel, Hanson and his team had reason to be excited. The size of the anomalies over the 9.5-kilometre survey were impressive and now Hanson and his geological team are eager to find out what they’ve got here, especially in the east and southeast portions of the claim area where it appears lithium brine starts at the surface to around 340 meters below the ground, while the same resistivities are present to 740 meters.

A couple of weeks ago (February 7, 2022-NR), ACME Lithium received its notice of intent for drilling from the U.S. Bureau of Land Management (BLM), and if all goes well, the drills should be turning on the first of three 500-metre holes by late-March or early April. And unlike hard-rock mining, where you need to drill sometimes hundreds of holes to define a target, Hanson explains drilling for lithium is more like drilling water wells.

“We can drill a handful of holes and with success, come up with a resource estimate, and that’s one of the advantages of brine, there’s lower Capex necessary to reach a preliminary economic resource,” says Hanson.

Hitting the geological jackpot

If Hanson’s bet is right and he hits the geological jackpot, the rewards for making an important discovery can be very lucrative. In fact, lithium is fast becoming more lustrous to investors than gold. So much so that it’s even been hailed “the new gasoline” by Wall Street’s most powerful and influential investment bank, Goldman Sachs.

But Hanson has been around the business long enough to know not to put your eggs in one basket, and that’s one of the reasons he’s accumulated a pipeline of projects, including the Fish Valley Claims that are over the foothills 25 miles away from the Clayton Valley project and previous exploration has identified anomalous lithium values ( up to 600 ppm) in Tertiary claystone. Some more mapping is being done on this project, and a geophysics survey is expected later in 2022.

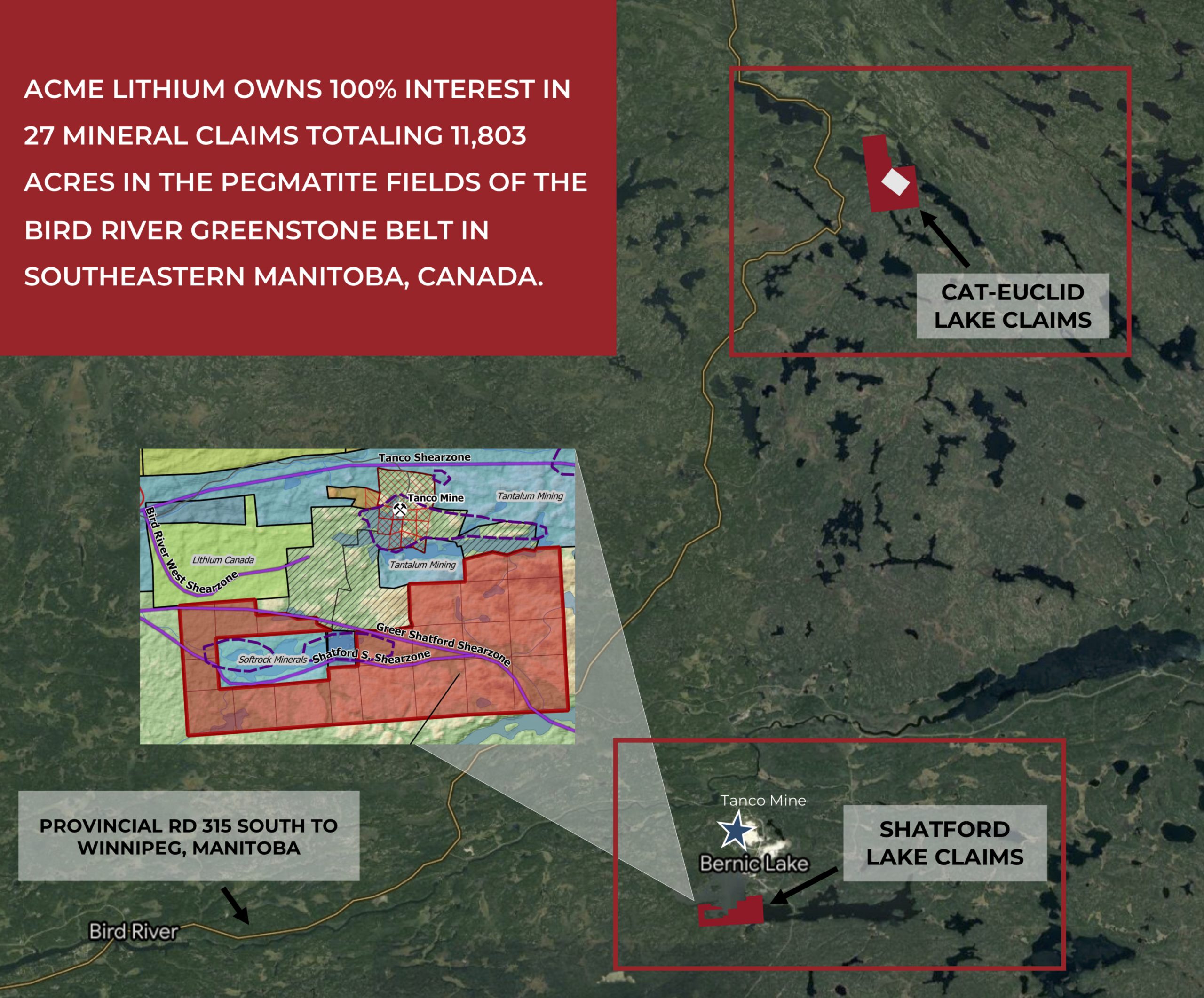

Hanson and his team have also staked a couple of projects in an up and coming area in Southern Manitoba. The 2,930- acre Cat-Euclid property straddles the Cat-Euclid Lake shear zone and extends along the southeasterly trend of known pegmatite occurrences just to the west of to where Australia’s Mineral Resources Limited (MRL), one of the world’s leading lithium producers with a market capitalization of over AUD$8 billion recently signed a joint venture agreement with Lithium Canada Development (New Age Metals Inc.).

Hanson and his team have also staked a couple of projects in an up and coming area in Southern Manitoba. The 2,930- acre Cat-Euclid property straddles the Cat-Euclid Lake shear zone and extends along the southeasterly trend of known pegmatite occurrences just to the west of to where Australia’s Mineral Resources Limited (MRL), one of the world’s leading lithium producers with a market capitalization of over AUD$8 billion recently signed a joint venture agreement with Lithium Canada Development (New Age Metals Inc.).

Next steps, include focusing exploration efforts in on the spodumene-bearing LCT pegmatites that can be a source for lithium carbonate deposits, remote sensing, structural geology, ground-based geological mapping, and geochemical sampling to localize targets for drilling.

A second property, the 8,883-acre Shatford Lake Project, is in the southern limb of the Bird River Greenstone Belt in southeastern Manitoba and straddles a 15-kilometer-long structural trend of the Greer-Shatford Shear Zone with numerous pegmatite dykes and favourable host rocks. The northeast corner of the claims neighbours the Mineral Lease of the Tanco Mine, and the south shore of Bernic Lake with the Buck, Pelgi, and Dibs pegmatites nearby.

“We’re really excited about Manitoba. In fact, and we have a large program planned for 2022. We’ll begin a sampling and trenching program, mapping and some additional groundwork starting in May, and based on results, that could lead to a full-scale drill program shin early fall of 2022,” says Hanson.

All the right stuff

There’s a lot of activity in ACME Lithium for investors. The stock is well distributed, with 10 percent held by institutional investors, 10 percent by management and 80 percent, retail investors. The drill program on the Clayton Valley Project could be a catalyst, as might any of the other three exploration projects planned for 2022.

ACME lithium is a company with the the right fundamentals and is worth keeping an eye on.