Arizona Metals Corp Identifies New Priority Drill Targets at its Kay Mine Project

Arizona Metals Corp. (TSX:AMC, OTCQX:AZMCF) (the “Company” or “Arizona Metals”) is pleased to announce the outcome of its comprehensive property-wide rock grid sampling program as another step towards unlocking the full potential of the Kay Project in Arizona. A number of advanced processing techniques were applied to the new data in order to identify at least four new high-priority drill targets, all in areas previously untested by drilling. Planning of these drill holes is now underway and will use a combination of the 11 drill pads permitted under the current Notice of Intent starting early in 2024, and also with new pads, once permitted, using the upcoming Exploration Plan of Operations. The Company will provide an update on timing of the expected EPO approval once the draft EPO has been submitted, (expected in January), and initial comments have been received from BLM (anticipated 1H’24).

Marc Pais, CEO of Arizona Metals comments, “The rock sample grid results released today will pave the way for a more streamlined approach to testing drill targets beyond the already prolific Kay Deposit. Our team has harnessed the power of cutting-edge data analysis techniques, comparing these results with recent drilling endeavors, and cross-referencing them with data from prior geophysical and geochemical test programs. These results will guide our focus in 2024, as we eagerly anticipate drilling in areas that promise to build upon the very promising mineralization we initially discovered in the Central and West Targets.”

Kay Project Drilling Update

Arizona Metals has drilled a total of 99,000 meters on the Kay property. The results of 16 holes are currently pending and will be released early in 2024. The Company is fully funded (with $40 million in cash as of Sept 30, 2023) to complete the remaining 60,000 m of the 76,000-meter Phase 3 drill program, which will include drill holes testing the four new priority targets described below.

Kay Project Metallurgical Testing Update

Metallurgical test work currently underway and completed to date was undertaken by SGS Canada Inc., with input by SRK Consulting (Canada) Inc., and includes an early-stage metallurgical evaluation program designed to test the amenability of Kay Deposit drill core samples to copper-zinc differential flotation. Metallurgical test work currently in process includes Bond ball mill work index, mineralogical characterization, gravity concentration, gold deportment, and rougher and cleaner flotation. The program is intended to provide an understanding of the Kay Deposit metallurgy and will set the basis for preliminary flowsheet selection and further optimization work. The results of these tests are expected to be included in future engineering and economic studies on the Kay Project. The Company plans to release updated results as the optimization work progresses during 2024.

Rock Grid Sample Results and New Priority Drill Targets

Results from the recently completed property-wide rock sample grid have identified four initial exploration targets, based on anomalous values of copper, zinc, and sodium/zinc alteration index.

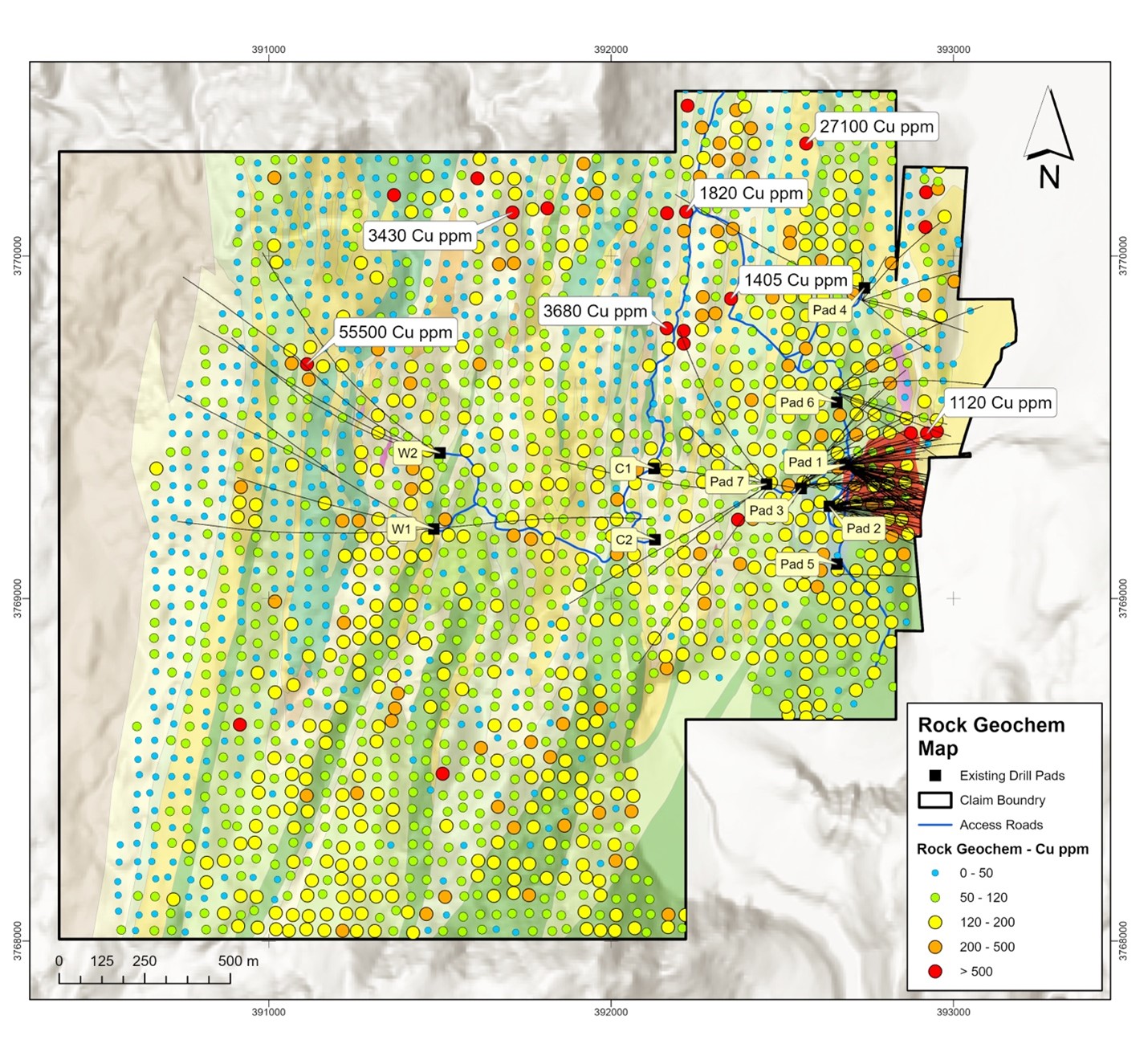

The copper concentration map (Figure 1) reveals that anomalously high copper samples tend to be localized within felsic host rocks. Two samples assayed percent-grade copper, including 5.5% Cu along the West Target sulfide horizon, and 2.7% Cu in the northeast portion of the property. A number of high copper samples stretch north from the Central Target, forming a surface anomaly above mineralization intersected in drill hole KM-22-95 (2.7 m @ 0.5% CuEq), and confirming this area as a primary exploration target.

Figure 1. Copper concentration map

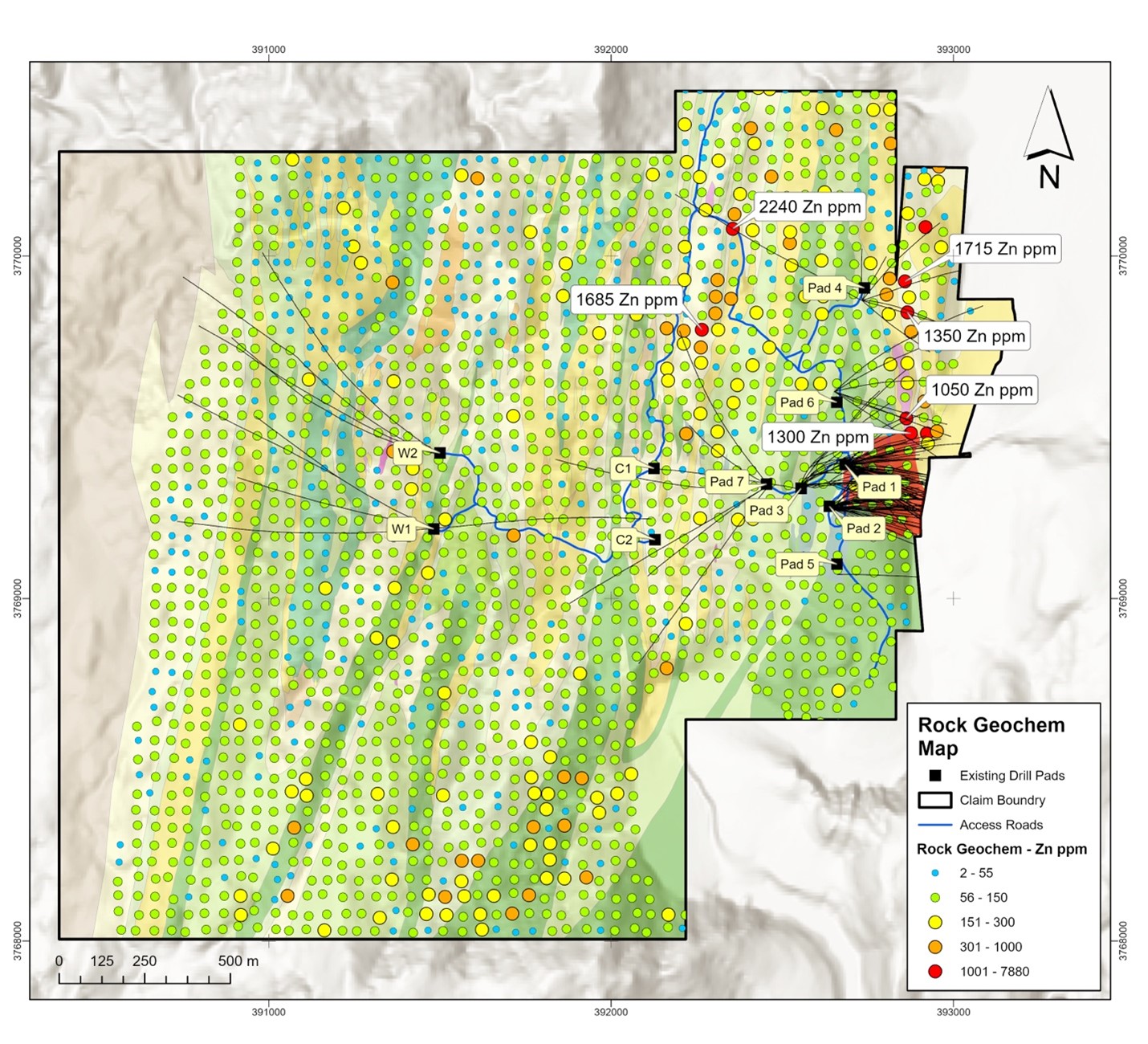

Zinc assays (Figure 2) reveal a trend similar to that of copper, with discrete zones of anomalously high values, generally concentrated in the northeast portion of property. Similar to copper trends, elevated zinc values stretch north from the Central Target and effectively track the northern extension of the Kay horizon. The south-central portion of the property also shows a zone of anomalous zinc values.

Figure 2. Zinc concentration map

The Na/Zn ratio map (Figure 3) identifies areas affected by mineralizing hydrothermal fluids. These fluids have removed sodium by converting feldspar into mica, and they have added zinc, the principal indicator of metal-rich fluids in volcanogenic massive sulfide systems. Thus, lower values of Na/Zn are more prospective (orange and red), and higher values less prospective (blue). Favorable low ratios are observed to the east in the felsic unit hosting the Kay Deposit and forming a trend stretching north from the Central Target, coincident with elevated copper and zinc. Additionally, low Na/Zn ratios are present in the south-central portion of the property coincident with anomalous zinc, as well as throughout the West Target.

Figure 3. Sodium/Zinc ratio map

Priority Drill Targets for 2024

Four new priority target areas (Figure 4) have been identified through a number of data analysis techniques on the Kay property-wide rock grid results, some of which are described above. Newly collected rock sample data has been combined with the results of previously completed electromagnetic, magnetic, gravity and soil sampling tests. Additional targets may emerge from further data analysis.

North Central Target

The North Central Target is one of the largest Na/Zn low footprints on the property. This coincides with a strong trend of high copper and zinc samples, a strong chlorite-pyrite alteration assemblage, and drill results from hole KM-22-95 (2.7 m @ 0.5% CuEq). Target 1 may represent a folded continuation of the Kay Deposit horizon. Additional surface rock sampling is underway on this target to refine drill-hole planning. This target can be reached from pads 4, 6, and 7; drilling is anticipated here during Q1 2024.

North Target

Directly west of the North Central Target, this target shows a strong felsic host-rock signature, anomalous zinc and copper values, and low Na/Zn ratios, supplementing a previously collected rock sample that assayed 3.3% Cu and 3.1 g/t Au. This target will require new road access and will be drilled on receipt of the EPO.

Northwest Target

The Northwest Target is the northern extension of the West Target. Along with drill results indicating that mineralization is strengthening to the north (KM-23-113, 3.0 m @ 2.0% Cueq), both field mapping and Zr/Ti ratios from the rock sample grid suggest that more felsic rock is concentrated in this northern area compared to the previously drilled western edge of the property. Additionally, recent field mapping in this area discovered copper mineralization in outcrop (malachite and visible sulfides, assays pending). This target will require a road extension north from pad W2 and will be drilled on receipt of the EPO.

Southeast Target

The Southeast target shows promising indications of a buried mineralized horizon beneath mafic rocks mapped at surface. This includes a zone of low Na/Zn ratio, a chlorite-pyrite alteration signature, and elevated copper and zinc. Portions of this target are reachable from pad 5. Initial drilling is anticipated here during Q2 2024, with full drill testing on receipt of the EPO.

Figure 4. Priority drill targets map

About Arizona Metals Corp

Arizona Metals Corp owns 100% of the Kay Mine Property in Yavapai County, which is located on a combination of patented and BLM claims totaling 1,300 acres that are not subject to any royalties. An historic estimate by Exxon Minerals in 1982 reported a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.” The historic estimate at the Kay Mine was reported by Exxon Minerals in 1982. (Fellows, M.L., 1982, Kay Mine massive sulphide deposit: Internal report prepared for Exxon Minerals Company)

*The Kay Mine historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Kay Mine is a steeply dipping VMS deposit that has been defined from a depth of 60 m to at least 900 m. It is open for expansion on strike and at depth.

The Company also owns 100% of the Sugarloaf Peak Property, in La Paz County, which is located on 4,400 acres of BLM claims. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5 g/t (Dausinger, N.E., 1983, Phase 1 Drill Program and Evaluation of Gold-Silver Potential, Sugarloaf Peak Project, Quartzsite, Arizona: Report for Westworld Inc.)

The historic estimate at the Sugarloaf Peak Property was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Qualified Person who reviewed and approved the technical disclosure in this release is David Smith, CPG.

For further information, please contact:

Morgan Knowles

Vice President of Investor Relations

(647) 202-3904

mknowles@arizonametalscorp.com

or

Marc Pais

President and CEO Arizona Metals Corp.

(416) 565-7689

mpais@arizonametalscorp.com

https://twitter.com/ArizonaCorp

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements contained in this press release include, without limitation, statements regarding the acquisition of the Property, including completion of due diligence and the satisfaction of the Company’s payment obligations under the Purchase Agreement, and the completion of the Offering. In making the forward- looking statements contained in this press release, the Company has made certain assumptions. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: availability of financing; delay or failure to receive required permits or regulatory approvals; and general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward- looking statements or otherwise.

NEITHER THE TSX VENTURE EXCHANGE (NOR ITS REGULATORY SERVICE PROVIDER) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

Not for distribution to US newswire services or for release, publication, distribution or dissemination directly, or indirectly, in whole or in part, in or into the United States