Ascot Resources closes Yamana $20.64-million private placement

Ascot Resources Ltd. [AOT-TSX; AOTVF-OTCQX] closed its previously announced private placement. A total of 24 million common shares of the company were sold at the offering price of $0.86 per Share for gross proceeds to the company of $20,640,000. Yamana Gold Inc. [YRI-TSX; AUY-NYSE, LSE] now holds approximately 6.4% of Ascot’s issued and outstanding common shares on a non-diluted basis.

The private placement financing was conducted pursuant to an underwriting agreement between Ascot and Stifel GMP, whereby Stifel GMP agreed to purchase the shares at the offering price. Yamana agreed to be the substitute purchaser, acquiring all of the shares sold under the offering.

Derek White, president and CEO of Ascot Resources, commented: “This investment by Yamana demonstrates significant support in Ascot’s flagship Premier Gold Project by an experienced Canadian-based precious metals producer. We are pleased to be a part of their high quality portfolio of investments. We have had a very productive first quarter at Ascot, and with the recent capital raised, we anticipate starting our exploration and underground development activities as soon as practicable.”

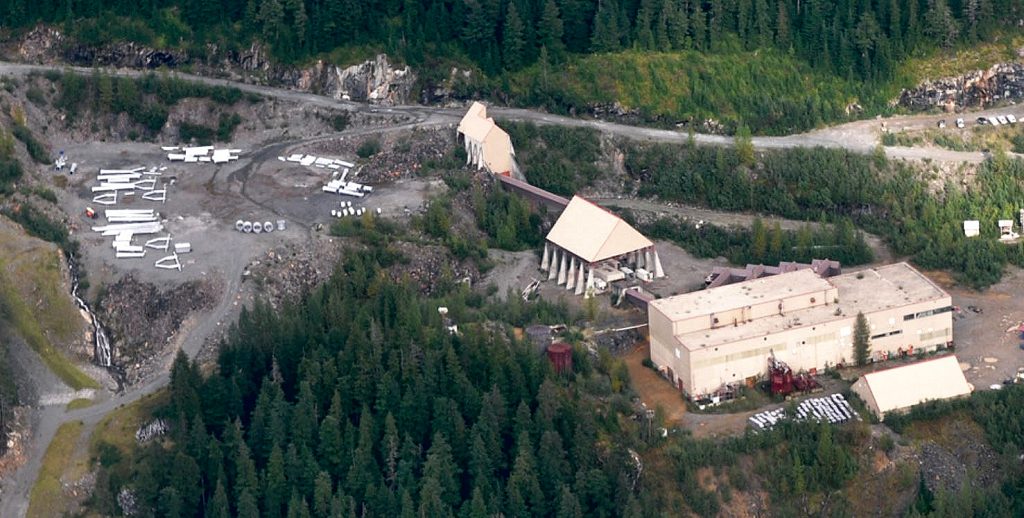

The net proceeds from the offering will be used to finance construction of Ascot’s Premier gold project in northwest British Columbia’s Golden Triangle region, working capital and general corporate purposes.

Ascot Resources is a Canadian-based exploration and development company focused on re-starting the past producing historic Premier gold mine, located in British Columbia’s Golden Triangle. The company continues to define high-grade resources for underground mining with the near-term goal of converting the underground resources into reserves, while continuing to explore nearby targets on its Premier/Dilworth and Silver Coin properties (collectively referred to as the Premier Gold Project). Ascot’s acquisition of IDM Mining added the high-grade gold and silver Red Mountain Project to its portfolio and positions the company as a leading consolidator of high-quality assets in the Golden Triangle.