Atac Resources announces positive updated PEA results at the Rackla Gold Project, Yukon

ATAC Resources Ltd. [ATC-TSXV] announced, on May 31, the completion of an updated Preliminary Economic Assessment (PEA) for the Tiger deposit, located at the western side of the company’s 100% owned Rackla Gold Project, Yukon.

ATAC Resources Ltd. [ATC-TSXV] announced, on May 31, the completion of an updated Preliminary Economic Assessment (PEA) for the Tiger deposit, located at the western side of the company’s 100% owned Rackla Gold Project, Yukon.

ATAC reports that the 2016 PEA has incorporated results of geotechnical and infill drilling conducted in 2015 and metallurgical studies completed in early 2016. Key changes to the 2014 PEA consist of the inclusion of both oxide and sulphide resources and the adoption of a simplified year-round agitated tank carbon-in-pulp (CIP) leaching process. The 2014 PEA (see ATAC news release dated July 23, 2014) only investigated the extraction of oxide resources by means of a seasonal hybrid heap-leach and agitated tank carbon-in-leach (CIL) process.

Highlights from PEA update announcement:

The 2016 PEA uses a base case gold price of US $1,250/oz and an exchange rate of CDN $1.00 equal to US $0.78 are as follows. Unless specified otherwise, all values are shown in Canadian dollars.

- NPV(5%)of $106.6 million and an IRR of 34.8% before tax, and an NPV(5%)Â of $75.7 million and an IRR of 28.2% after tax, with an all-in sustaining cost of US $864/oz;

- Compared to the 2014 PEA, the 2016 PEA extends the mine life by 2 years, more than doubles the pre-tax NPV(5%)and increases the pre-tax IRR by 4.8%;

- Approximately 302,307 ounces of gold produced at an average undiluted grade of 3.81 g/t gold;

- Total project life increases to approximately nine years, including one year of construction and pre-stripping followed by six years of owner-operated open-pit mining and two years of reclamation; and,

- Pre-production capital cost of $109.4 million and life-of-mine (LOM) sustaining capital costs totaling $8.3 million.

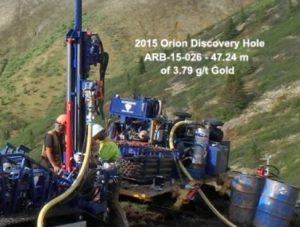

“We are very pleased to have doubled the pre-tax NPV to over $100 million and to have been able to improve on every other 2014 PEA metric. The future development of the Tiger deposit would bring critical infrastructure, including tote road access, to the Rackla gold project. Exploration will begin shortly at the newly discovered 10 km2Â Airstrip gold anomaly and elsewhere within the Rau Trend with the objective of identifying additional nearby resources. ATAC will continue to explore opportunities to advance or monetize the Tiger deposit through sole development or joint venture,” states Graham Downs, President and CEO of ATAC. “ATAC remains committed to further advancing the entire Rackla gold project, including the Carlin-type targets within the Nadaleen trend. Drilling is scheduled to begin soon at the Orion discovery, where one of the last holes of 2015 (ARB-15-026) intersected 3.79 g/t gold over 47.24 m.”

Key Improvements over the 2014 PEA:

The 2016 PEA envisions a conventional year-round operation and has improved upon all aspects of the 2014 PEA. Key improvements include:

- Increased the pre-tax NPV(5%)by $54.4M;

- 36% increase in total recovered ounces;

- Project life extended by 2 years;

- Pre-tax payback period reduced to 1.85 years;

- Tote road access:supports year-round operations and simplifies project logistics;

- 100% CIP process:simplified and conventional process allows for year-round operations and reduces LOM sustaining capital costs;

- Relocated and consolidated project infrastructure:reduced overall environmental footprint and haulage costs; and,

- Year-round operations:alleviates logistical and staffing challenges associated with seasonal access and operations.

Mining and Processing

The Tiger Project has been modeled as an owner-operator, conventional truck-and-shovel open-pit mining operation with a conventional CIP gold recovery process. Year-round operations would be supported via a 68 km tote road, which connects the project to the Yukon highway system, near Keno City.

Mineralized material will be loaded into 40 tonne articulated trucks and delivered to the process plant, located 1 km southwest of the pit. High-grade mineralized material will be sent directly to the primary crusher, while low-grade stockpile material will be stored close to the primary crusher. Waste material from the pit will be stored in two waste dumps, located at the northwest and southwest sides of the pit. A total of 3.2 Mt of the mineral resource and 15.6 Mt of waste rock will be produced from the pit during the 7 years of mining operations and pre-stripping. The LOM average gold grade of mined oxide and sulphide resources is 4.06 g/t and 2.99 g/t, respectively. The LOM stripping ratio (defined as waste material mined divided by mineral resources mined) is 4.9.

Due to the soft nature of the mineralization and host rock, a single stage of crushing will be performed by a MMD sizer. Crushed material will be ground to 80% passing 75 microns using a semi-autogenous grinding mill and a ball mill in series before cyanide leaching in a conventional CIP circuit. The leach tailings will be detoxified and stored in a lined facility within the Tiger Valley. Gold will be refined into doré bars on site through a standard Adsorption, Desorption and Recovery treatment. Based on the results of metallurgical testwork and the mining schedule, projected LOM average recoveries are 90.3% for oxide mineralization and 57.7% for sulphide mineralization.

The processing plant will operate year-round at a rate of 1,500 tonnes per calendar day, and will achieve full throughput in Year 2. Peak annual production will be approximately 86,555 oz of gold in Year 2, with a LOM average annual production of approximately 50,000 oz gold, excluding the final year which will operate for a reduced period.

Capital and Operating Costs

Total LOM capital costs are $117.7 million, with $109.4 million in pre-production costs and $8.3 million in sustaining capital. To minimize initial capital costs, the PEA has assumed that modular equipment would be used where possible and that some equipment and facilities will be leased.

Opportunities to Enhance Value

ATAC is very pleased with the increased value of the Tiger deposit shown in this updated PEA relative to the initial 2014 PEA and believes that opportunities exist to further enhance the economics of the project. Some key opportunities include:

- Significant potential exists to increase the resource base and life expectancy of the project with the exploration of more than 15 early-stage satellite oxide gold targets and geochemical anomalies;

- Additional geotechnical studies may permit steeper pit slopes, which would further reduce the strip ratio and could potentially allow additional known resources to be accessed;

- Additional diamond drilling within the sulphide zone would convert inferred resources to the indicated category and could potentially lead to the inclusion of additional known sulphide resources; and,

- Additional diamond drilling targeting high-grade oxide structures (including 162.0 g/t gold over 2.90 m in Rau-09-019) could better define high-grade domains for inclusion in future resource estimates.

Environmental and Community Engagement

Since 2008, ATAC has completed comprehensive water, heritage, wildlife and fisheries studies. ATAC will continue environmental baseline work and ongoing studies as it advances the Tiger deposit and other targets throughout the Rackla gold project.

Community and First Nation engagement began in 2008, and an Exploration Cooperation Agreement with the First Nation of Na Cho Nyak Dun (NNDFN) was signed in 2010.

Metallurgy

Metallurgical testwork has been previously conducted in several phases on both the oxide and sulphide material, including work by G&T Metallurgical, SGS Canada, and Kappes, Cassiday & Associates in support of the 2014 PEA. Additional variability cyanide leach test work was conducted on the Tiger deposit by Blue Coast Research Ltd. in 2016 for the updated PEA. Bottle roll testing was conducted on eight oxide and eight sulphide composites, and master composites samples. Samples were selected to evaluate potential variability in grade and mineralization throughout the deposit. Oxide recoveries from 24-hr bottle roll tests ranged from 77% to 98%. Sulphide recoveries from 24-hour bottle roll tests ranged from 13% to 88%.

Mineral Resources

The mineral resource estimate used in the updated PEA was completed by Gary Giroux, P.Eng., M.A.Sc. (Giroux Consultants Ltd.) using 6,222 assays taken from 150 diamond drill holes, totalling 26,844 m. The effective date of this Mineral Resource estimate is October 28, 2015. A three dimensional solid model was constructed to constrain oxide and sulphide mineralization.

Mineral resources are reported at a 0.5 g/t cut-off in oxides and 1.0 g/t cut-off in sulphides are reported in the table below. These cut-off grades were selected based on comparison to other analogous deposits.

Table VI: Combined Oxides and Sulphide Resource

| Type | Classification | Au Cut-off (g/t) | Tonnes > Cut-off | Grade>Cut-off | Contained Metal | ||

| Au (g/t) | Ag (g/t) | Au (oz) | Ag (oz) | ||||

| Oxides | Measured | 0.50 | 2,600,000 | 3.10 | 4.77 | 259,100 | 398,700 |

| Indicated | 0.50 | 1,720,000 | 2.47 | 4.10 | 136,300 | 226,700 | |

| Sulphides | Indicated | 1.00 | 1,360,000 | 2.07 | 0.56 | 90,300 | 24,500 |

| Total | M+I | 5,680,000 | 2.66 | 3.56 | 485,700 | 649,900 | |

| Oxides | Inferred | 0.50 | 280,000 | 1.52 | 5.67 | 13,700 | 51,000 |

| Sulphides | Inferred | 1.00 | 2,950,000 | 1.84 | 0.47 | 174,800 | 44,600 |

| Total | Inferred | 3,230,000 | 1.81 | 0.92 | 188,500 | 95,600 | |

The primary difference between this Mineral Resource and the Mineral Resource used in the 2014 PEA is an increase in measured resources within the oxide domain. There is little difference in the total tonnes and contained ounces of gold between the two mineral resources.