Aurania Resources searches for Ecuador’s Lost City of gold.

By Robert Simpson

Many exploration geologists would call it quits after 40-years scouring for gold in 19 countries, finding, and then selling a gold discovery for C$1.2 billion, receiving the Thayer Lindsley International Discovery Award and the Mining Man of the Year. But quitting is not in books for Dr. Keith Barron who’s is at the helm of Aurania Resources Ltd. [TSXV: ARU; OTCQB: AUIAF; Frankfurt: 20Q] stalking what he believes could be the next world-class discovery in Ecuador.

“I retired for three months but got incredibly bored and started to look for Logroño de los Caballeros and Sevilla del Oro, the last two of six known conquistador settlements that produced gold in Ecuador during the 16th century,” says Barron.

If anyone knows a thing or two about finding Gold in Ecuador, unquestionably, it’s Barron. He’s credited with discovering the colossal Fruta del Norte gold deposit in southern Ecuador near the Peruvian border that was acquired in 2008 by Kinross Gold [TSX- KRG] for CAD$1.2 billion. But when gold prices climbed and the Ecuadorian government introduced a 70% windfall tax, Kinross wrote off the CAD$1.2 billion, and in 2014 sold Fruta del Norte to Fortress Minerals (later renamed Lundin Gold) for $240 million.

Today, Fruta del Norte is one of the highest-grade, lowest cost gold mines in the world.

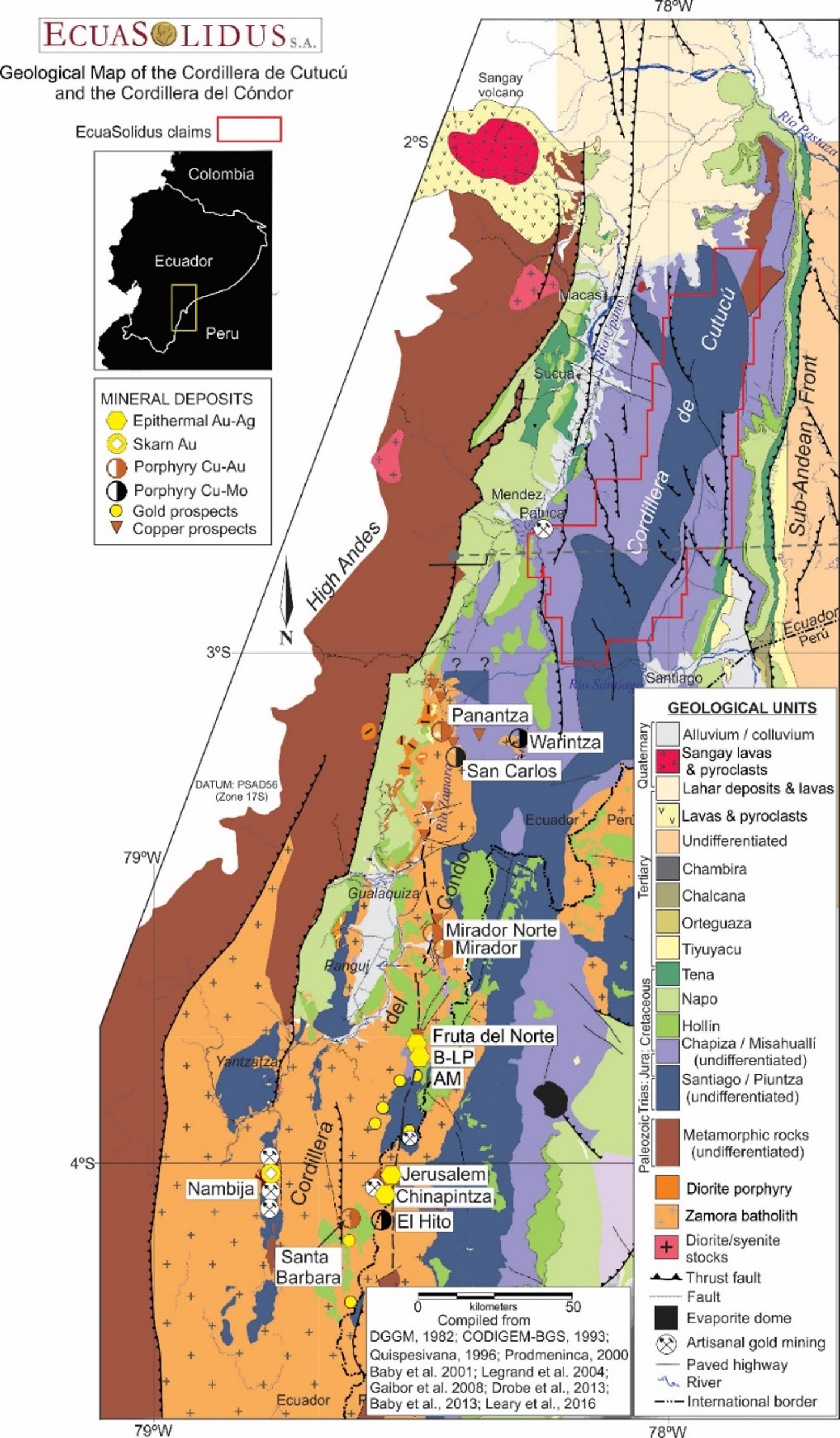

Barron’s next venture, Aurania Resources is focused on exploring the Lost Cities-Cutucu Project that lies along the geological trend of the Cordillera de Cutucu. The same Trend as the Fruta del Norte deposit, which contains in aggregate 26-million-ounces of gold, and 30-billion-pounds of copper in a belt of porphyries.

Along the Trend, Fruta del Norte (gold) was brought into production in November 2019, and the other large scale mine, Ecuador’s first open-pit copper mine, Mirador, was brought into production in mid-2019.

The Lost Cities-Cutucu project consists of 208,000 hectares in 42 concessions occupying the central part of the Cordillera de Cutucu. The concessions extend approximately 95 kilometers along the Cordillera and have had no modern exploration conducted.

The Cordillera de Cutucu forms part of the Northern Andean Jurassic Metallogenic Belt that extends through Colombia, Ecuador and northern Peru and contains clusters of porphyry copper, gold-copper skarn and epithermal gold deposits.

Deposits in the Cordillera del Condor are hosted by Upper Triassic to Late Jurassic – Early Cretaceous rocks. The lower part of the Triassic Santiago Formation contains tholeiitic basalts that formed during a period of extensive continental rifting, while the upper sequence of volcanic rocks are subduction-related, calc-alkaline lavas that were linked to development of a Mesozoic volcanic arc – an early analogy to the present Andean Mountain chain. The gold-copper skarns of the Nambija deposit and the Fruta del Norte gold-silver deposit formed within the Piuntza Member that constitutes the lower part of the Santiago Formation.

There are no significant known mineral deposits in the Cordillera de Cutucú. However, Aurania’s work, covering approximately 60 percent of the Property, has identified multiple areas with potentially economic values in hand samples of copper, lead, zinc, and silver.

The silver-lead-zinc anomalies appear compatible with Mississippi Valley Irish-type, or carbonate replacement deposits. The copper anomalies appear mostly related to sedimentary-hosted copper (copper-silver) – type deposits with copper in soil potentially related to porphyry systems.

Aurania has systematically approached the exploration over the vast project area. Progressing from airborne magnetic and radiometric geophysical survey and stream sediment sampling to highlight anomalous areas and following up on the identified targets with detailed soil sampling, prospecting, and geological mapping prior to selecting initial drill targets.

“In January of 2022, after much market malaise and non-performance in our share price I pivoted the Company back to its “core competency”; namely gold and copper exploration, believing that several of our prospects were now sufficiently matured to be considered for drilling and that success would be just around the corner,” Barron wrote to investors in his 2022 year in review.

Aurania’s program has yet to rediscover one of the gold deposits, dating to Spanish Colonial times, that originally was the driving concept behind the Project. With nearly half the Property yet to be covered by the stream sediment sampling program, these “lost” deposits may yet be found.

While an outcropping precious metal deposit has so far eluded Aurania, its geochemical sampling program has identified large areas with high-grade copper, silver, zinc and lead in outcrop or float. The high-grade copper samples are typical of sedimentary-hosted copper deposits and the high-grade zinc-lead samples are of carbonate replacement type. Of these, the sedimentary-hosted copper potential appears the most attractive. Anomalous copper mineralization, now encountered in multiple reduced layers in Chapiza Formation red beds, extends for 22-kilometre on strike. Rock chip sampling within this trend has returned multiple samples with high-grade values in copper and silver.

One of the most promising targets is Tatasham, located on the north-west side of the Property. Tatasham is both a magnetic anomaly and a mobile magnetotelluric anomaly, geophysical characteristics common for a combined porphyry-magnetite skarn body but does not outcrop at surface and is buried at unknown depth.

Four drill holes were planned at Tatasham to test geophysical targets at moderate depth and areas of alteration on surface.

To date, Aurania has reported the first drill hole drill intersected two zones of silicification and silica replacement with potassic alteration over 37 metres and 30 metres (core length) respectively between two fault zones. While the second drill hole, located 2.1 kilometers along strike intersected a zone of intense silicification over more than 60 metres (core length), surrounding a zone with hydrothermal breccias and local chalcedonic veins. In addition to these characteristic epithermal textures, the altered rock in TT-002 has abundant disseminated sulphides locally accompanied by replaced lattice bladed calcite textures.

The strike length of the entire zone of interest is approximately four kilometres.

These are still early days for Aurania, but Barron is enthused by the recent results of a PIMA (Terraspec portable infra-red mineral analyzer) assessment of the alteration minerals from a mapping campaign performed over Tatasham prior to drilling. The PIMA delineated a north-south oriented zone of silicification on surface, within a high temperature illite clay alteration envelope. Further from the axis of the zone, the presence of pervasive chlorite indicated propylitic alteration. The mineral “kutnahorite” a rare pink calcium manganese carbonate mineral with magnesium and iron that is a member of the dolomite group, has been found on surface in several places at Tatasham. This is a common gangue mineral at the Fruta del Norte gold mine.

In a recent news release, Barron compared the discovery of Fruta del Norte with what he’s seeing at Tatasham.

“Fruta del Norte, of which I was involved, came about from follow-up of three grab samples which were highly anomalous in arsenic (up to 1,895 ppm), antimony (up to 212 ppm) and mercury (up to 27.9 ppm). Gold was very weakly anomalous (up to 0.15 g/t). We did not have access to a PIMA instrument at that time, though later it was found that illite was a common alteration component. Our assessment was that the area represented a leakage zone from a blind target at depth, and that precipitation kinetics meant that the precious metal zone would be decoupled and be deeper beneath the volatile pathfinder elements (As, Hg, Sb). Diamond drilling of the zone resulted in a gold-silver discovery directly beneath a buried sinter. I do not expect high levels of gold in the Tatasham sinter samples,”, says Barron.

Time will tell, but Barron is enthused with what he’s seeing at Tatasham and so are his investors.

The company works closely with local communities within the direct area of interest of its mineral concessions in Ecuador to develop mutually beneficial and respectful relationships. Many community projects are done in conjunction with Dr. Barron’s private foundation in Ecuador, the Step Forward Foundation, and include clean water projects, education, healthcare and nutrition workshops.

Shares of the company trade on the TSX Venture exchange closing on February 13, 2023, at C$0.63 per share.