Aurcana Provides Initial Assay Results and a Restart Progress Update for Its Revenue Virginius Mine

Aurcana Silver Corporation (“Aurcana” or the “Company”)Â (TSXV: AUN) is pleased to provide the results of the first assays after accessing the Virginius Vein on the 1800 level as well an update on progress towards first production.

INITIAL ASSAY RESULTS

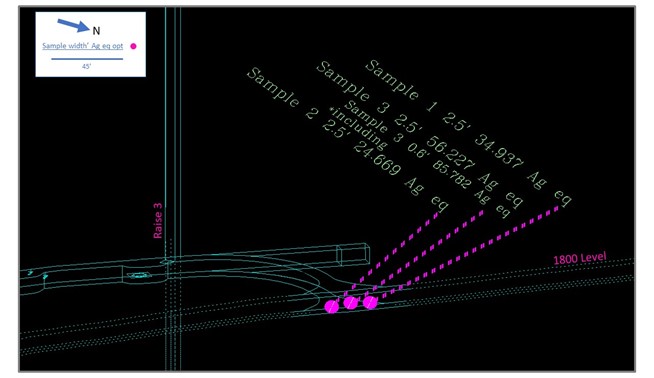

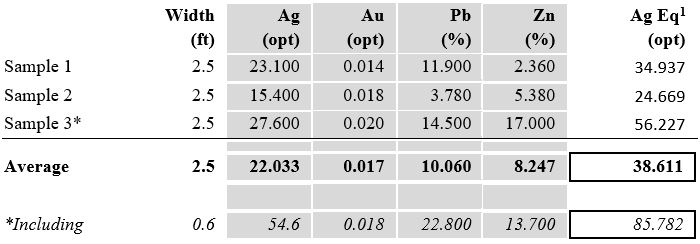

The initial samples of the Virginius Vein intersection on the 1800 level assayed 38.611 ounces per ton (opt) (1,323.8 g/t) of silver equivalent1 over a vein width of 2.5 feet, including 85.782 opt (2,941.1 g/t) of silver equivalent1 over 0.6 feet (see below Table 1 and Figure 1 for details). These results compare favorably with the reserve grade in this location of 24.7 opt (846.8 g/t) silver equivalent1 over 1.4 feet as reported in the 2018 feasibility study (the “2018 FS”) prepared in accordance with National Instrument NI 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A copy of the 2018 FS is posted on the Company’s website www.aurcana.com and is also available on the Company’s profile on SEDAR at www.sedar.com.

Assay Details

Figure 1

RESTART PROGRESS UPDATE

The Revenue-Virginius project remains on track to reach full production (270 stpd) by September 2021.

- Development ore to be delivered to the process plant in July 2021 for commissioning and restart.

- Ore throughput will be ramped up to 110 short tons per day (stpd) during August, and then to full production of 270 stpd during September.

- Concentrate shipments are anticipated to begin in early August. Trafigura Trading LLC is the off-taker for 100% of the concentrates and will pay 95% of the contained metals value based on the mine site concentrate assays at the time of shipment, with final settlement based on smelter returns.

- Payable silver equivalent² production for the period between August and December 2021 is forecast to be 1,300,000-1,600,000 ounces at an estimated cash operating costs of between US$10.00 to US$12.00/oz silver after by-product credits³.

²Silver equivalent is based on the 2Q 2021 average London prices of Ag US$26.6387/oz, Au US$1,805.04/oz, Pb US$0.9568/lb and Zn US$1.3206/lb; includes payability and payment timing of the Trafigura offtake contract.

³By-product credit metal pricing is the same as Silver equivalent pricing

Qualified Person Statement

The scientific and technical content of this news release was reviewed and approved by Michael Gross, P. Geo, a “qualified person” within the meaning of NI 43-101

ABOUT AURCANA CORPORATION

Aurcana Corporation owns the Revenue-Virginius Mine, in Colorado, and the Shafter-Presidio Silver Project in Texas, US. The primary resource at Shafter and Revenue-Virginius is silver. Both are fully permitted for production.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURCANA CORPORATION

“Kevin Drover”

President & CEO

For further information, visit the website at www.aurcana.com or contact:

Aurcana Corporation

850 – 789 West Pender Street

Vancouver, BC V6C 1H2

Phone: (604) 331-9333

Gary Lindsey, Corporate Communications

Phone: (720)-273-6224

Email: gary@strata-star.com

CAUTIONARY NOTES

This press release contains forward looking statements within the meaning of applicable securities laws. The use of any of the words “anticipate”, “plan”, “continue”, “expect”, “estimate”, “objective”, “may”, “will”, “project”, “should”, “predict”, “potential” and similar expressions are intended to identify forward looking statements. In particular, this press release contains forward looking statements concerning, without limitation, statements relating to the Private Placement (including with respect to the timing of closing of the Private Placement). Although the Company believes that the expectations and assumptions on which the forward looking statements are based are reasonable, undue reliance should not be placed on the forward looking statements because the Company cannot give any assurance that they will prove correct. Since forward looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with the receipt of regulatory or shareholder approvals, and risks related to the state of financial markets or future metals prices.

Management has provided the above summary of risks and assumptions related to forward looking statements in this press release in order to provide readers with a more comprehensive perspective on the Company’s future operations. The Company’s actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward looking statements are made as of the date of this press release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward looking statements, whether as a result of new information, future events or results or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.