Avino Silver and Gold plans to create a mining hub in Durango

By Ian Foreman

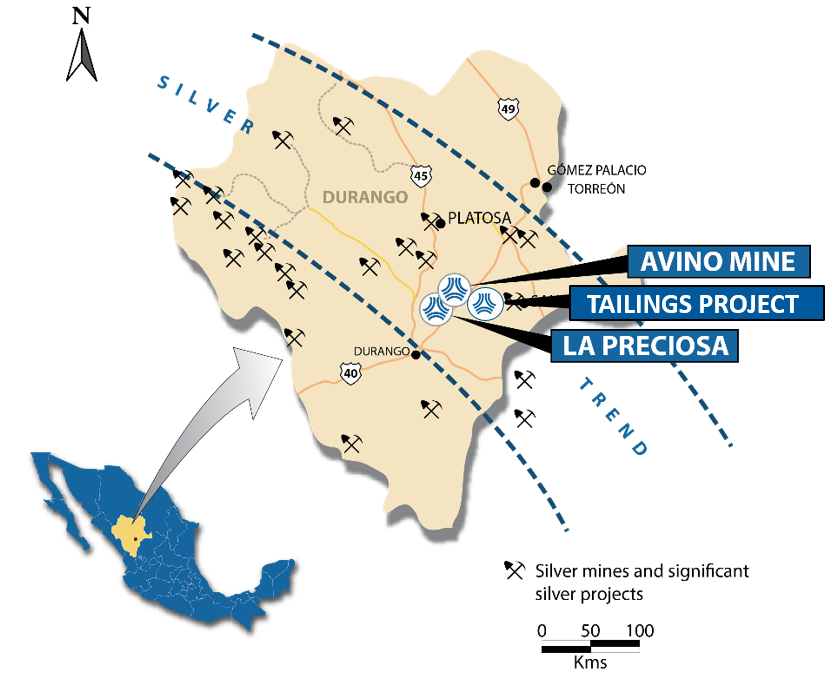

Avino Silver and Gold Mines Ltd. [ASM-TSX; ASM-NYSE] is creating a mining hub based around its wholly owned Avino Mine located in Durango State, Mexico. As a primarily silver producer, Avino is growing through the addition of resources at its namesake flagship Avino Mine as well as through strategic acquisitions.

The decision to concentrate all of the company’s efforts on its operations in Durango has been over a decade in the making. And with good reason – Durango is Mexico’s third largest producer of silver and fourth largest mining state overall.

Over the past number of years, they have sold, optioned or spun out nearly all of their non-core assets with exception to the El Hueco and Aranjuez projects – and for a company that has been around as long as Avino has, that was quite a collection. This has resulted in a slimmer, more focused company that is set on expanding the Avino Mine and developing the surrounding district.

Over the past number of years, they have sold, optioned or spun out nearly all of their non-core assets with exception to the El Hueco and Aranjuez projects – and for a company that has been around as long as Avino has, that was quite a collection. This has resulted in a slimmer, more focused company that is set on expanding the Avino Mine and developing the surrounding district.

The history of the Avino Mine dates back to pre-colonial times as the native population was extracting silver prior to the mid 1500’s when Hernan Cortes (yes, that Cortes) is rumoured to have stepped foot on the property. The Avino property was mined sporadically from 1555 until it closed in 1912 during the Mexican Revolution. In 1908, the Avino mine was considered to be the largest open cut operation in the world.

The property was essentially dormant until Louis Wolfin acquired a 49% interest in the property in the late 1960’s – and Avino Mines was born. Production at the Avino Mine open pit re-commenced in 1974 and continued through until 1999. The underground mining operation was moth balled in 2001 as a result of low metals prices combined with the difficulty of operating in Mexico at the time.

When, in 2006, the Mexican Government changed the law to allow 100% ownership of Mexican mines by foreign companies, Avino acquired the remaining 51%. This allowed for the company to begin an aggressive exploration program with mining at San Gonzalo starting in 2010 and processing commencing in 2011 that continues to this day.

Profits from San Gonzalo enabled Avino to dewater Elena Tolosa and return to mining in 2015 while ramping up mill capacity through several expansions.

The exploration success that the company has had below the current producing mining level – level 17 – has been nothing short of spectacular. Mineralization has now been shown to continue a further 500 metres down dip.

“This has been particularly rewarding for us and our Mexican geological team as our previous partners never drilled below the known resources,” stated president and CEO, Mr. David Wolfin.

The ongoing exploration program below the existing workings is testing the continuity of the steeply dipping mineralization. The depth extent of at least 750 metres of known mineralization is unusual in comparison with most Mexican epithermal deposits. The changing styles of the mineralization could be reflecting a transition from epithermal to porphyry-style mineralization. To that end, Avino has enlisted several world-renowned consulting geologists to help in the understanding of these changing mineralization characteristics.

“It appears that we have higher copper grades at depth,” expanded Mr. Wolfin. “This then may be similar to the scenario with Capstone’s Cozamin Mine and could prove to be a bulk tonnage-style target that is suitable for long hole sub level cave mining.”

As if extending the deposit down dip and along strike wasn’t enough of a success, the recent drilling campaign returned the best drill intersection in the company’s 55-year history. Drill hole ET-23-09 intersected mineralization grading 296 grams per tonne silver equivalent over a true width of 57 metres. This remarkable interval included 407 grams per tonne silver equivalent over 37 metres true width and 2,866 grams per tonne silver equivalent over 3.43 metres true width. Avino has enlisted several world-renowned structural geologists to help figure out the ultimate potential still to be determined after all these centuries.

Production at the Avino Mine, however, has continued unabated and the second quarter of 2023 saw a 33% increase in mill throughput to 157,371 tonnes of ore that produced 232,417 oz of silver, 1.45 million lbs of copper and 1,520 oz of gold. This higher throughput coupled with an increase in commodity prices has been a boon to the company as their silver, gold and copper production remains unhedged.

This high level of production is music to the ears of Samsung. Most of the product is sold to Samsung C&T U.K. Ltd. (a subsidiary of the South Korean multinational conglomerate Samsung Group), who has an exclusive agreement for concentrate from Avino.

This high level of production is music to the ears of Samsung. Most of the product is sold to Samsung C&T U.K. Ltd. (a subsidiary of the South Korean multinational conglomerate Samsung Group), who has an exclusive agreement for concentrate from Avino.

The success at Avino coincides with the company’s previous commitment to expand the operations as they have recently upgraded the mill, incorporated a new dry-stack process for their tailings and calculated a resource within the historic tailings. With the Avino Mine on track to become the mine that Louis Wolfin had imagined all those years ago, David Wolfin set his eyes on a larger goal – to create a mining hub with the Avino Mine and mill at its core.

This vision has come to fruition with the purchase of the La Preciosa deposit from Coeur Mining. The addition of the La Preciosa deposit is an accretive purchase that seemed custom made for Avino as Avino, for all extents and purposes, is the only company that can maximize the value of La Preciosa.

La Preciosa hosts one of the largest undeveloped primary silver resources in Mexico and is located only 18 kilometres from the Avino Mine.

Mr. Wolfin stated, “The closing of the acquisition of La Preciosa represents a major milestone for Avino as we advance our growth strategy to augment Avino to an intermediate silver producer with a large silver resource base. Now that the transaction is complete, we can fully assess how to optimally integrate this large, high-quality silver project into our mine plan and leverage our existing processing facilities and infrastructure.

Avino raised the cut-off grade for La Preciosa to 120 g/t silver equivalent, which resulted in a smaller but higher-grade resource. The current mineral resource on La Preciosa prepared for Avino highlighted indicated mineral resources totaling 113 million silver equivalent ounces as well as inferred mineral resources of 24 million silver equivalent ounces.

Avino is re-imagining La Preciosa as an underground mine that would then be a satellite deposit of Avino as ore would have to be trucked by paved road to the Avino mill. “We expect a large portion of the La Preciosa resource can be mined via an underground operation to potentially improve Avino’s organic production growth profile and we are excited to combine this strategic asset with our current operations.” explained Mr. Wolfin.

“The plumbing system [of La Preciosa and Avino] may be linked”, stated Mr. Wolfin.

The initial mining plan for La Preciosa is to have considerably lower production costs than those outlined in Coeur’s feasibility study as Avino is planning to mine the deposit from a single large decline and trucking the ore on paved roads to the Avino mill. Within five years this decline will facilitate mining of the three known veins.

The company is not only looking just five years into the future, they also have grand plans to be a going concern in Durango for much longer.

“We are looking to grow the company to be an intermediate producer,” explained Mr. Wolfin. “The internal plan is to get to 8 to 10 million ounces of silver equivalent per year.”

This seems to be a reasonable target for the company as exploration at the Avino Mine continues to uncover new resources that could support significant increases in production and mine life. In addition, the acquisition of the La Preciosa deposit ensures that the company has the potential to be operating a mining hub in Durango for decades to come.