B2Gold reduces production forecasts in Nicaragua

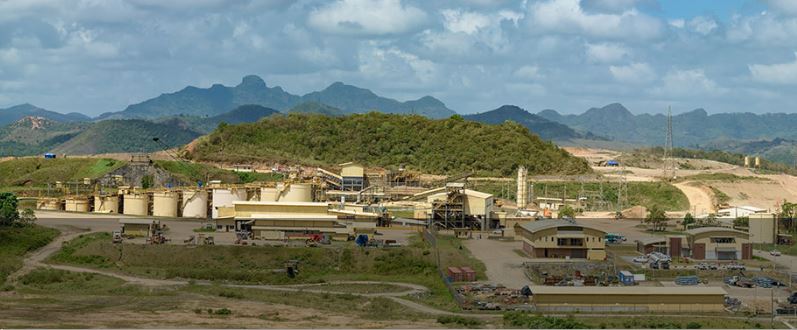

B2Gold's La Libertad Mine in Nicaragua. Source: B2Gold Corp.

B2Gold Corp. [BTO-TSX, BTG-NYSE] has reduced the production forecasts at two mines in Nicaragua as a result of country roadblocks.

However, the company’s overall production guidance remains intact at between 910,000 ounces and 950,000 ounces, as it plans to make up the shortfall with production from other operations.

Based in Vancouver, B2 Gold is a senior gold producer with five operating mines and numerous exploration and development projects in various countries, including Nicaragua, the Philippines, Namibia, Mali, Burkina Faso, Colombia and Finland.

Its roster of producing mines includes the Fekola Mine in Mali, West Africa, the Masbate Mine in the Philippines, and the Otjikoto Mine in Namibia. The company also has two mines in Nicaragua – the La Libertad and El Limon mines.

Production guidance at La Libertad has been reduced to 110,000-115,000 ounces from 115,000-120,000 ounces, largely due to supply disruptions from ongoing in-country roadblocks that necessitated processing of lower-grade material to reduce reagent consumption.

At El Limon, 2018 guidance has been reduced to 50,000-55,000 ounces from 55,000-60,000 ounces as production was disrupted in June by illegal road blockages (subsequently resolved). B2Gold continues to evaluate the potential to extend the mine life there from the new El Limon Central Zone. Further details are expected to be released in the third quarter of 2018.

The Nicaragua mines account for 17% of the company’s total production.

Meanwhile, B2Gold is expects its Masbate, Fekola and Otjikoto mines can make up the make up the production shortfall in Nicaragua.

At Fekola, the company has said infill drilling continues on the resources outlined immediately below the Fekola reserve boundary, immediately to the north of the boundary and the near-surface portion of the Kiwi Zone (to the north, now part of Fekola Zone).

Based on positive exploration results so far, B2Gold is expanding the exploration program at Fekola North with eight active rigs (compared to five previously). The company has completed 39,000 metres of drilling so far this year with another 16,000 metres planned.

The exploration budget has been increased to $19 million from $15 million as the company continues to evaluate the potential to expand the mine and mill at Fekola.

More details are expected to be released later this year along with an updated resource for Fekola North. At the nearby Anaconda Zone, B2Gold has indicated that exploration activities have been reduced, allowing the company to prioritize Fekola North exploration.

On Friday, B2Gold shares eased 1.02% or $0.035 to $3.39. The stock is trading in a 52-week range of $4.06 and $3.01.

The company has estimated that it could add up to 900,000 ounces of gold, consisting of 720,000 ounces from the existing indicated category and 180,000 ounces from the existing inferred category to the Fekola mine plan with further infill drilling.

Exploration drilling at Fekola has included step out drilling to the north of the Fekola resource. The aim is to begin testing the ultimate size potential of the Fekola deposit.