Barrick Gold takes option on Hemlo Explorers’ project

Hemlo Explorers Inc. [HMLO-TSXV] shares rallied Monday after the company said it has signed a definitive agreement that gives Barrick Gold Corp. [ABX-TSX, GOLD-NYSE] the right to earn a 80% in interest in the company’s Pic project in northwestern Ontario.

The company said the gold mining major has also agreed to subscribe for, on a private placement basis, 1.84 million shares of Hemlo priced at 10.5 cents each, generating gross proceeds of $193,722. The financing is expected to close by August 31, 2022.

Hemlo Explorers shares advanced on the news, rising 5.3% or $0.005 to 10 cents. The shares are currently trading in a 52-week range of 34.5 cents and $0.095.

Through acquisition and staking programs, Hemlo Explorers has assembled a large land package, covering 380 square kilometres of prospective mineral rights in the Hemlo-Schreiber Greenstone Belt in northern Ontario.

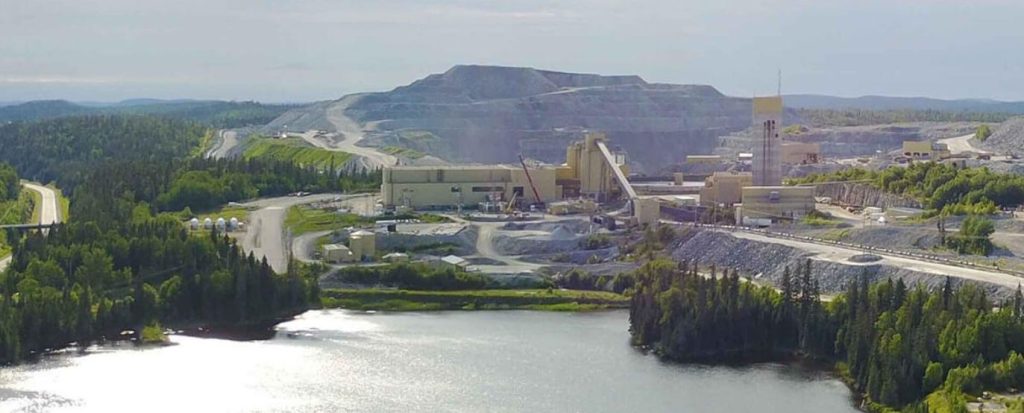

The Hemlo Camp is famous for hosting the Hemlo Deposit, with historical production of more than 22 million ounces of gold since 1985. The Williams mine remains in operation.

The land package includes the Pic Project, which is located 25 kilometres west of Barrick’s Hemlo gold mine, and close to Generation Mining Ltd.’s [GENM-CSE] Marathon palladium-copper deposit.

Under the agreement, Barrick can earn an 80% interest in part of the Pic Project (910 claims, covering 16,800 hectares) by delivering a pre-feasibility study within six years of signing of a definitive agreement. Barrick has committed to spending at least $800,000 within the first 12 months.

In order to maintain the earn-in right from the date of the first anniversary of the definitive agreement to the end of the expenditure period, Barrick must fund work expenditures of $1.0 million on or before each anniversary of the definitive agreement.

Barrick will have the option to extend the expenditure period by two additional one-year periods by paying the company $500,000 for each one-year extension.

Subject to a successful earn-in by Barrick, Hemlo Explorers and the major will establish a joint venture company held 20% by Hemlo and 80% by Barrick. If either party’s interest in the joint venture company falls below 10%, then that party’s interest will be converted to a 1.0% net smelter return royalty.

Hemlo CEO Brian Howlett has previously said his company has moved the Pic Project to a point where it is ready to option to a major and that Barrick is the best possible partner. For the 2022 field season, Howlett said the company planned to focus on the area in the southwest corner of the project called Project Idaho.

The company has said it believes that the structural, geophysical and geological setting of Project Idaho resembles Generation Mining’s Marathon palladium-copper project, which is located 3.0 kilometres west, and which is now under development.