Barrick, Newmont CEOs to discuss joint venture

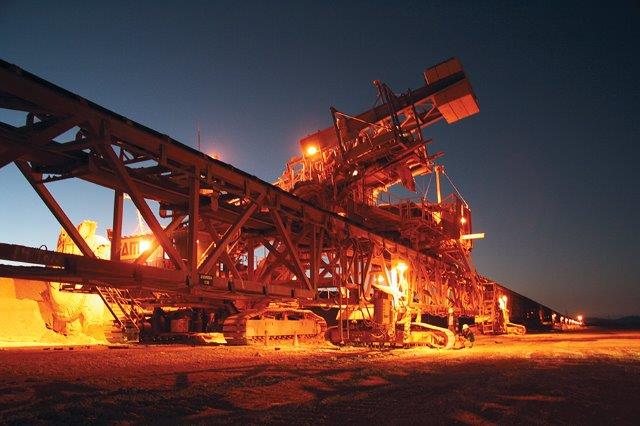

The Zaldivar copper mine in Chile. Source: Barrick Gold Corp.

After a week of verbal sparring over a proposed merger, the ceos of Barrick Gold Corp. [ABX-TSX, NYSE] and Newmont Mining Corp. [NEM-NYSE]were set to meet in New York late Tuesday.

Newmont CEO Gary Goldberg told Bloomberg News that he won’t be discussing Barrick’s bid for his company, but rather Newmont’s proposal for a joint venture around the companies’ assets in Nevada.

The gold mining head honchos have scheduled a meeting after Newmont rejected an offer to be acquired by Barrick Gold Corp. [ABX-TSX, NYSE] and countered with a proposal that would see both companies embarking on a Nevada joint venture while Newmont proceeds with its acquisition of Goldcorp. [G-TSX, NYSE-GG].

Newmont’s rebuttal comes a week after Barrick launched a US$18 billion hostile bid to acquire its biggest U.S. rival in an all share transaction that would create the world’s largest gold producer.

Barrick has said the combined company would have a market cap of $42 billion. It would produce 10 million ounces of gold annual at an all-in-sustaining cost of under US$900 an ounce and hold reserves of over 140.5 million ounces.

However, Newmont is proposing a joint venture with Barrick that wold see both parties contribute all of their Nevada-related assets and liabilities to the joint venture. Barrick would hold a 55% economic interest with Newmont holding the other 45%. Each company would have an equal number of representatives on the management and technical committees.

Voting rights would be proportionate to economic ownership on several matters, including annual budgets and life of mine plans.

Under the Newmont proposal, the 45%/55% split was based on consensus net asset values of each party’s Nevada-related assets plus a 50%/50% split of Barrick’s estimated Nevada synergies.

Barrick CEO Mark Bristow has subsequently rejected Newmont’s joint venture proposal, saying successful joint ventures are based on the majority owner also being the operator. He also argued that ownership should be divided on a 63%/37% basis in favour of Barrick.

The merger proposal has emerged as Newmont works to complete a friendly merger with that Goldcorp that was announced on January 14, 2019.

If the Newmont bid for Goldcorp succeeds, the combined company, called Newmont Gold would rank as the largest producer globally by some distance with output of between 6.0 million and 7.0 million ounces of gold annually.

In an update on, Newmont said it has identified additional synergies that would stem from the merger with Goldcorp. Newmont said it now expects combined pre-tax synergies of $365 million, an amount that is $100 million higher than a previous estimate and results from work completed by the two companies supply chain teams.

On Tuesday, Newmont shares were up 0.15% or US$0.05 to US$34.50. On the Toronto Stock Exchange, Barrick advanced 0.78% or 13 cents to $16.75.