Benchmark Drills 49.10 Metres of 2.36 G/t Gold Equivalent at the Dukes Ridge Deposit and Extends Mineralization from Surface to 220 Metres Depth

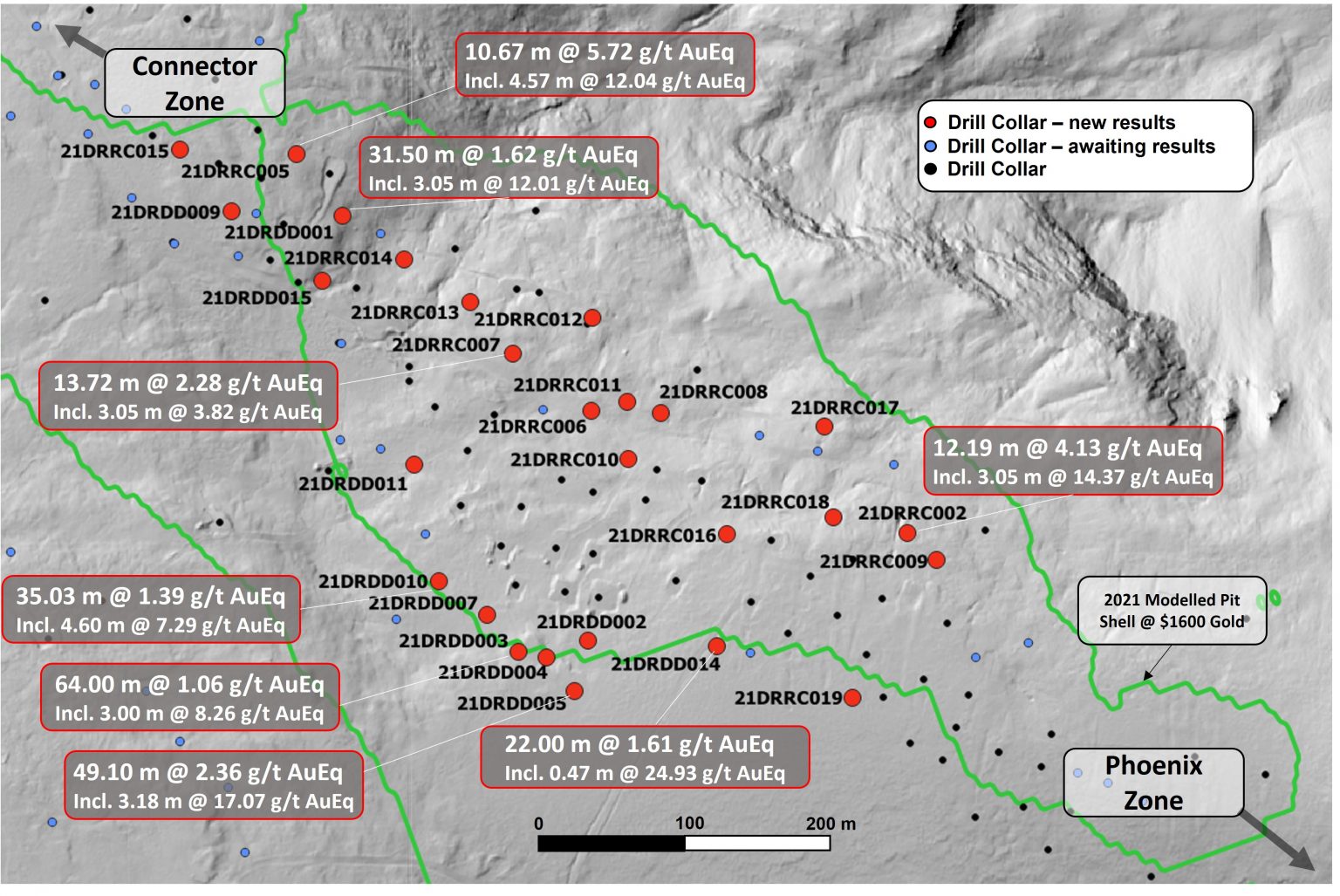

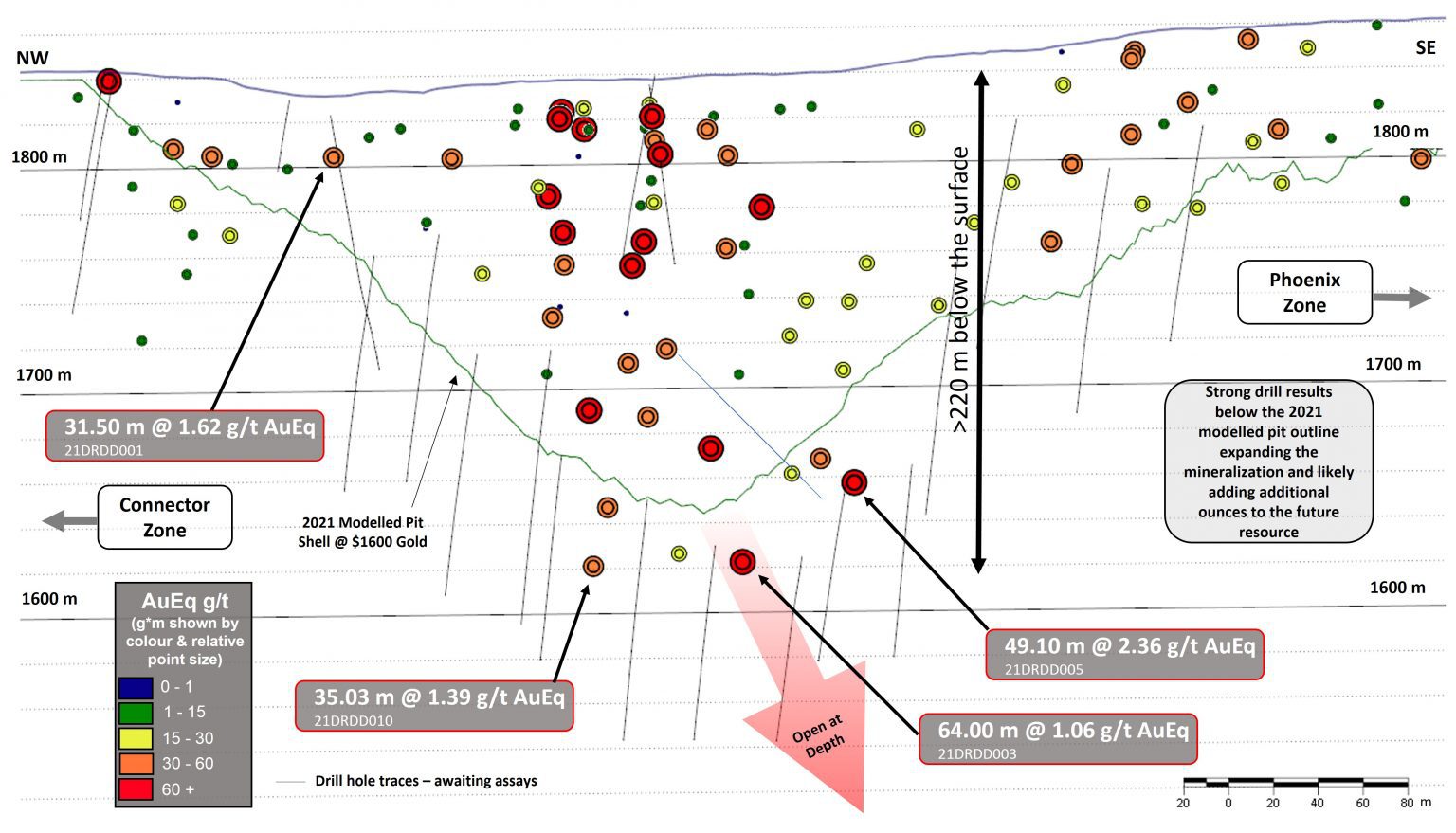

Benchmark Metals Inc. (the “Company” or “Benchmark“) (TSX-V: BNCH) (OTCQX: BNCHF) (WKN: A2JM2X) – is pleased to announce new results from 27 infill and expansion drill holes at the Dukes Ridge Deposit, including 49.10 metres (m) core length of 1.86 grams per tonne (g/t) gold and 39.96 g/t silver or 2.36 g/t gold equivalent (AuEq)* with 3.84 m of 12.50 g/t gold and 240.16 g/t silver or 15.50 g/t AuEq in drill hole 21DRDD005 (Figure 1). These new drill results have the potential to positively impact the updated Mineral Resource Estimate (MRE) scheduled for completion during the first half of 2022. Drilling has also extended mineralization, which remains open, below the 2021 modelled pit shell to a depth of over 220 vertical metres (Figure 2), with additional drilling planned to test the along-strike expansion potential of the mineralizing system. Benchmark’s flagship Lawyers Gold-Silver Project is located within a road-accessible region of the prolific Golden Horseshoe area of north-central British Columbia, Canada.

John Williamson, CEO, commented, “The Dukes Ridge area is providing significant expansion potential from the recent drill program. The area remains open in all directions with infill drilling replacing gaps in the Mineral Resource at surface with higher-grade gold and silver material. January 2022 drilling has started at Dukes with two drill rigs focused on proving-up more mineralization at surface and expending gold-silver areas beyond 220 metres vertical depth.”

Highlights

- High-grade near surface intercepts potentially contributing to higher-grade starter pits and significant rewards to future mine production schedules and project economics, and;

- Increasingly robust mineralization within the northwest portion of the Dukes Ridge deposit, marginal to the Connector Zone, including near-surface 31.50 m core length of 1.45 g/t gold and 13.65 g/t silver or 1.62 g/t AuEq with 3.05 m of 11.17 g/t gold and 67.27 g/t silver or 12.01 g/t AuEq in drill hole 21DRDD001 (Figure 1), and;

- Extension of mineralization beyond the 2021 modelled pit shell including 64.48 m core length of 0.70 g/t gold and 29.02 g/t silver or 1.06 g/t AuEq with 3.00 m of 4.88 g/t gold and 270.79 g/t silver or 8.26 g/t AuEq in drill hole 21DRDD003 (Figure 2).

Dukes Ridge Deposit Resource

The 2021 Mineral Resource Estimate (May 14, 2021) at the Dukes Ridge Deposit established 109,000 ounces AuEq at 1.29 g/t AuEq Indicated. The Company anticipates new drilling will positively impact expansion and grade to the Dukes area. The January 2022 drill program has started at the Dukes area with a focus on shallow drilling and areas with higher grade gold-silver mineralization.

The Dukes Ridge Deposit forms part of a global Mineral Resource Estimate from 3 separate but nearby deposits that delivered 2.1 million ounces of 1.62 g/t AuEq Indicated and 821,000 ounces of 1.57 g/t AuEq Inferred for its initial Mineral Resource Estimate. All Resource areas are open to expansion from recent drilling and will see the addition of gold-silver from new zones that include the Connector and Mid-Cliff Creek zones.

Figure 1: Plan map at the Dukes Ridge Zone highlighting new 2021 drill results.

Figure 2: Long-section at the Dukes Ridge Deposit providing gold and silver from a series of results.

Table 1: Drill results summary from the Dukes Ridge Zone

Quality Assurance and Control

Results from samples were analyzed at ALS Global Laboratories (Geochemistry Division) in Vancouver, Canada (an ISO/IEC 17025:2017 accredited facility). The sampling program was undertaken by Company personnel under the direction of Rob L’Heureux, P.Geol. A secure chain of custody is maintained in transporting and storing of all samples. Gold was assayed using a fire assay with atomic emission spectrometry and gravimetric finish when required (+10 g/t Au). Analysis by four acid digestion with 48 element ICP-MS analysis was conducted on all samples with silver and base metal over- limits being re-analyzed by atomic absorption or emission spectrometry.

The technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc, P.Geol., P.Geo., a qualified person as defined by National Instrument 43-101.

About Benchmark Metals

Benchmark Metals Inc. is a Canadian based gold and silver company advancing its 100% owned Lawyer’s Gold-Silver Project located in the prolific Golden Horseshoe of northern British Columbia, Canada. The Project consists of three mineralized deposits that remain open for expansion, in addition to +20 new target areas along the 20 kilometre trend. The Company trades on the TSX Venture Exchange in Canada, the OTCQX Best Market in the United States, and the Tradegate Exchange in Europe. Benchmark is managed by proven resource sector professionals, who have a track record of advancing exploration projects from grassroots scenarios through to production.

ON BEHALF OF THE BOARD OF DIRECTORS

s/ “John Williamson”

John Williamson, Chief Executive Officer

For further information, please contact:

Jim Greig

Email: jimg@BNCHmetals.com

Telephone: +1 604 260 6977

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This news release may contain certain “forward looking statements”. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.