Bullish outlook on uranium sector

By Peter Kennedy

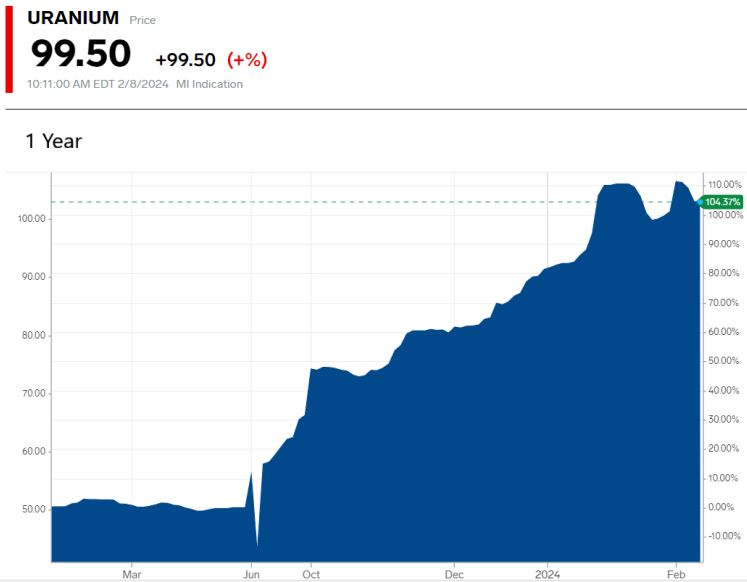

Even after the recent breakneck rally, investors continue to be bullish on the outlook for uranium.

The price of uranium futures surged 5.0% to more than US$106 a pound on February 1, 2024, the highest level since 2007 on news that Kazatomprom (KAP), the world’s biggest uranium miner has cut its guidance for production this year by as much as 14%.

The price of uranium futures surged 5.0% to more than US$106 a pound on February 1, 2024, the highest level since 2007 on news that Kazatomprom (KAP), the world’s biggest uranium miner has cut its guidance for production this year by as much as 14%.

A major factor behind the optimistic outlook is that demand for uranium in western markets (excluding Russia) – currently at approximately 200 million pounds – is about 40 million pounds greater than the radioactive metal’s supply. Furthermore, market analysts project an average supply deficit of 35 million pounds per year over the next decade. That projection considers existing production, secondary supply, and returning mine production.

Another factor behind the market is the Sprott Physical Uranium Trust [U.UN-TSX, U.U-TSX], a Toronto-based vehicle (SPUT) set up to give investors direct exposure to the commodity via its holding of U308.

SPUT began buying uranium in 2021 to take the metal out of circulation and impound it for the long term. As of early 2024, it had impounded more than 63 million pounds of uranium.

John Ciampaglia of Sprott Asset Management, which operates SPUT, said the bull market is partly attributable to a nuclear resurgence. “Who would have thought that in just two years, public sentiment and government support would have shifted this strongly?’’ he said. “The industry will require significant capital investments to meet its ambitious expansion plans.’’

It is worth noting that a number of mining operations are ramping up their uranium production, including Boss Energy’s Honeymoon (in South Australia), Paladin Energy’s Langer Heinrich (in Namibia) and Cameco Corp.’s [CCO-TSX, CCJ-NYSE] McArthur River project (in Saskatchewan). The latter company plans to increase its uranium production to 22 million pounds this year. However, to meet the market’s base demand out to 2040, much more production will be required from additional mining operations. However, a new uranium mine can take as long as 15 years to come online from discovery to first production, so meeting the demand will be difficult. “Therefore, the underlying market fundamentals are still ratcheting tighter,’’ according to Leigh Goehring, managing partner with Goehring & Rozencwajg Associates a natural resources investors group.

In an investment newsletter, Scotiabank said Kazatomprom’s (KAP) move to lower its 2024 production guidance by approximately 9.3 million pounds or 14%, represents upwards of 6% of Scotiabank’s estimated 2024 primary production.

“We continue to view KAP’s medium-term production guidance as overly optimistic. With the uranium market already in a structural deficit, this KAP update is likely to provide further momentum for the rising spot price (currently US$100 per pound; the spot price previously peaked at US$137 a pound in 2027).

The price of uranium has historically experienced long bear markets and periods of exponential growth, said Sprott Physical Uranium Trust.

Sprott has noted that nuclear energy is one of the cleanest energy sources based on C02 emissions. It believes that major policy shifts by governments, aggressive decarbonization goals and growing energy needs should bolster greater demand for uranium in the future.

Meanwhile, Hertz Energy Inc. [HZ-CSE, HZLIF-OTC, QE2-FSE], a company that offers a unique diversification opportunity in the energy metals space, is conducting advanced due diligence on uranium mineral projects in various jurisdictions. The aim is to capitalize on the recent surge in the price of the nuclear metal.

In a February 13, 2024, press release, the company said it has agreed to acquire a uranium project in Nunavut from BullRun Capital Inc. a company owned by Hertz CEO Kal Malhi. Hertz agreed to pay $75,000 and issue a 2.0% net smelter return royalty to Bullrun in exchange for the Cominco Uranium Project, which is located in Bathurst Inlet and contains two main uranium showings that were previously explored in the 1970s by companies formerly known as Cominco and Noranda.

On February 9, 2024, news that Hertz had changed its name from Hertz Lithium lifted the share price to 18 cents, a gain of almost 6.0%. The shares currently trade in a 52-week range of 38 cents and 10 cents.

Since its shares were first listed on the CSE in April 2023, Hertz has built a portfolio of lithium projects and recently raised $2.53 million from a private placement financing. However, Malhi said the possible acquisition of uranium projects does not mean that the company is switching its focus away from lithium. “Adding the Cominco property fits extremely well with our energy metals offering and we aim to aggressively explore both the lithium and uranium mineral projects and continue to offer investors a well-diversified energy metals project portfolio,’’ Malhi said. It is worth noting that uranium was recently priced at over US$100 a pound, the highest level since 2007. Many analysts believe the price will continue to rise from current levels.

The Cominco property covers the Yon and Pomie “Advanced Exploration” stage showings and consists of four licenses spanning 5,046 hectares of favourable geology. The Geological Survey of Canada identified mineral potential for uranium on the property, based on the favourable stratigraphy for the formation of Unconformity Related Uranium deposits similar to the stratigraphy found in Saskatchewan’s Athabasca Basin.

Prior to the pivot into uranium, Hertz was working to capitalize on expectations of increasing demand for lithium that is being driven by the movement to green technologies and their reliance on battery metals, including lithium, a key ingredient in the production of electric vehicles.

The company continues or offer investors a window on a new hard rock lithium discovery in Quebec and the development of patent-pending lithium processing technology via its partnership with Penn State University (see details below). The company also has highly promising lithium properties in Arizona and Brazil.

Hertz owns two lithium projects in the James Bay region of Quebec. They include the AC/DC property, which covers 265 square kilometres and lies adjacent to Rio Tinto’s Kaanaayaa lithium project. The Snake property covers 217 square kilometres and is contiguous to Brunswick Exploration’s Elrond lithium project. “Our strategy is that if we find lithium, we have a natural partner in Rio Tinto, that we could sell the project to,” Malhi said.

The company plans to move ahead strongly in James Bay with $1.5 million in charity flow-through funds raised in December, 2023.

THIS IS NOT A RECOMMENDATION TO BUY OR SELL ANY SECURITY.