Burgeoning industrial demand expected to underpin silver price

By David Duval

Among the precious metals, silver is arguably the most diversified in terms of industrial usage, high economic value and history as a store of value. It has also been referred to less flatteringly as “the poor man’s gold” – more so today perhaps given the current gold-silver ratio of around 70:1.

That being said, there’s hope for a tightening of that ratio following silver’s 47% rise last year on the heels of growing investment and industrial demand which has led to supply shortages – especially for those seeking physical product including coinage.

Governments and Central Banks have been actively influencing and even arbitrarily setting the prices and values for silver and gold for over a century. As a consequence, the over 5,000-year historical average gold to silver value ratio of about 15 has ballooned at times to a ratio as high as 100.

Today, silver is the world’s most affordable precious metal and over the past decade in particular it’s gained a larger portion of many investor portfolios. Throughout history, silver has also served as a trustworthy store of value, money for day-to-day transactions, and a vehicle for long term savings and capital formation.

In addition to holding physical silver, investors have other options to invest in the metal including Exchange Traded Funds which have begun to proliferate in the past decade. Maria Smirnova, Senior Portfolio Manager with Sprott Asset Management, notes that “Silver ETFs have enjoyed record flows. We believe this silver rally will continue given the expansionary monetary and fiscal policies worldwide and silver’s critical role in helping the world embrace the environmentally friendly technologies of the “green revolution.”

Because silver provides critical components for the EV, solar and 5G industries, analysts like Smirnova are quick to emphasize the important role it will play in the upcoming “green revolution” and the move to decarbonize the global economy. According to Sprott, silver will have three primary drivers: the automotive sector and electric vehicles (EV), including the associated infrastructure; the solar energy industry; and 5G (fifth generation technology) broadband cellular networks.

President Biden’s plan for a “Clean Energy Revolution and Environmental Justice” targets all three of these and encompasses a stated investment target of US$2 trillion. Other major industrialized countries are following suit and their expenditures in the aggregate could in fact exceed that of the U.S.

What characteristics does silver have that makes it so indispensable in industrial applications? Among its many features is the fact silver has the highest electrical conductivity of all metals. In fact, silver defines conductivity – all other metals are compared against it. On a scale of 0 to 100, silver ranks 100, with copper at 97 and gold at 76. These superior electrical properties make it virtually irreplaceable in a broad range of automotive applications, many of which are critical to safety and to meeting increased environmental standards.

Growing ICE (internal combustion engine) powertrain electrification has underpinned the increasing use of silver globally in the automotive industry. Silver loadings have been rising over the past few decades and in the case of hybrid vehicles, silver use is higher at around 18-34 grams per light vehicle, while battery electric vehicles (BEVs) are believed to consume in the range of 25-50 grams of silver per vehicle.

The automotive industry uses silver in various components including circuit-breakers, fuses, switches and relays that activate varying electronic devices. Many automotive safety features are dependent on silver including airbag deployment systems, automatic braking and security and driver alertness systems. Increased environmental and safety standards are expected to increase demand for silver loadings as the automotive industry embraces new technologies to accommodate these regulations.

According to a recent report published by the Silver Institute, the automotive industry will use approximately 61 million ounces of silver in 2021 with silver loadings ranging between 15 and 28 grams per ICE light vehicle (depending on the model and market). Looking further ahead it estimates this total could approach 88Moz by 2025.

Last year, hybrid vehicle sales accounted for an estimated 8% of global light vehicle production compared with barely 1% in 2010, noted the Silver Institute, pointing out the next stage (in the context of the vehicle fleet) relates to the growth in battery electric vehicles (BEVs). By 2025, global BEV output could account for around 9% of global light vehicle production.

According to Thomson Reuters, world silver demand has outstripped annual silver supply levels. The vast majority of the past decade and the slowdown in silver mine production is expected to exacerbate this shortfall. Mexico, Peru, and China in respective order produce the largest silver mine outputs in the world. In total they account for over half of the world’s annual silver mine supply.

Silver is driven significantly more by industrial demand than gold (roughly 50% industrial demand for silver vs only 10% industrial demand for gold). Just over half of the annual silver supply is used in industrial applications. Investor buying of fine silver bullion now accounts for roughly one-quarter of annual silver demand while physical silver investment buying has surged over the past decade, accounting in 2006 for just over 5% of total silver demand to almost 25% in 2016 alone.

Blende Silver Corp. [BAG-TSXV] is well along in advancing its 100%-owned flagship Blende Deposit, the largest carbonate-hosted silver-zinc-lead deposit in north-central Yukon Territory. It’s a good time to be developing a silver-zinc-lead rich deposit due to the metal’s supply concerns, a strong demand outlook from China and declining inventories.

Blende Silver Corp. [BAG-TSXV] is well along in advancing its 100%-owned flagship Blende Deposit, the largest carbonate-hosted silver-zinc-lead deposit in north-central Yukon Territory. It’s a good time to be developing a silver-zinc-lead rich deposit due to the metal’s supply concerns, a strong demand outlook from China and declining inventories.

Located 63 kilometres northeast of the famous silver mining region of Keno Hill and only 20 kilometres north of ATAC’s recent high-grade Ocelot silver-lead-zinc discovery, the 5,345-hectare, winter road-accessible property has had over $9.2 million in past exploration, including $5.2 by the company.

This previous work included over 25,000 metres of drilling in 132 drill holes that lead to completion of an independent NI 43-101 compliant open pit resource estimate.

Currently, Indicated Resources stand at 3.65 million tonnes grading 5.18% zinc equivalent (ZnEq) and Inferred Resources of 32.98 million tonnes of 5.03% ZnEq, at a Base Case cut-off grade of 2.0% zinc, approximately equivalent to an NSR cut-off of CDN$39.35/tonne.

Indicated Resources represent 4.19 million oz silver, 0.16 billion lbs zinc and 0.16 billion lbs lead. The Inferred Resources contain 33.98 million oz silver, 1.46 billion lbs zinc and 1.37 billion lbs lead.

As examples, drilling in the West Zone has returned 24.3 metres grading 7.43% lead+zinc and 61.1 g/t silver with other holes returning similar assays. Drilling in the East Zone has returned 21.7 metres of 7.03% lead+zinc and 52.1 g/t silver and other similar results. Metallurgical studies have determined that the Blende mineralogy will respond well to standard process techniques.

There is excellent potential for delineating further resources as mineralization on the property starts at surface and is open to the northwest, southeast and below the mineralization that extends along a 6km strike length, 20 metres wide and 700 metres vertical.

As such, the company’s objective for 2021 exploration will focus on upgrading and expanding known resources in preparation of an updated resource estimate. Camp facilities will also be upgraded to accommodate the work programs that are designed to advance the project towards the next phase of development, part of which is commissioning of a Preliminary Economic Assessment.

Andrew Rees, director, notes that “with the increase in metal prices, updating the company’s resource estimate is a key part in contributing to where drilling will be focused, both within and targeting extensions of the current Blende Deposit.”

Blende Silver has 47,223,620 shares outstanding, a large percentage of which are held by insiders. On April 14, shares were trading at $0.12. The year High-Low is $0.27 and $0.02. The company has held consultations with the Na-Cho Nyäk First Nation and has also completed Heritage studies, a requirement for a Class 4 Permit.

Under the guidance of Thomas Kennedy, CEO, with the Yukon a favoured pro-mining jurisdiction for explorers and rising metal prices and demand, Blende Silver is in a good position to be advancing the Blende Deposit.

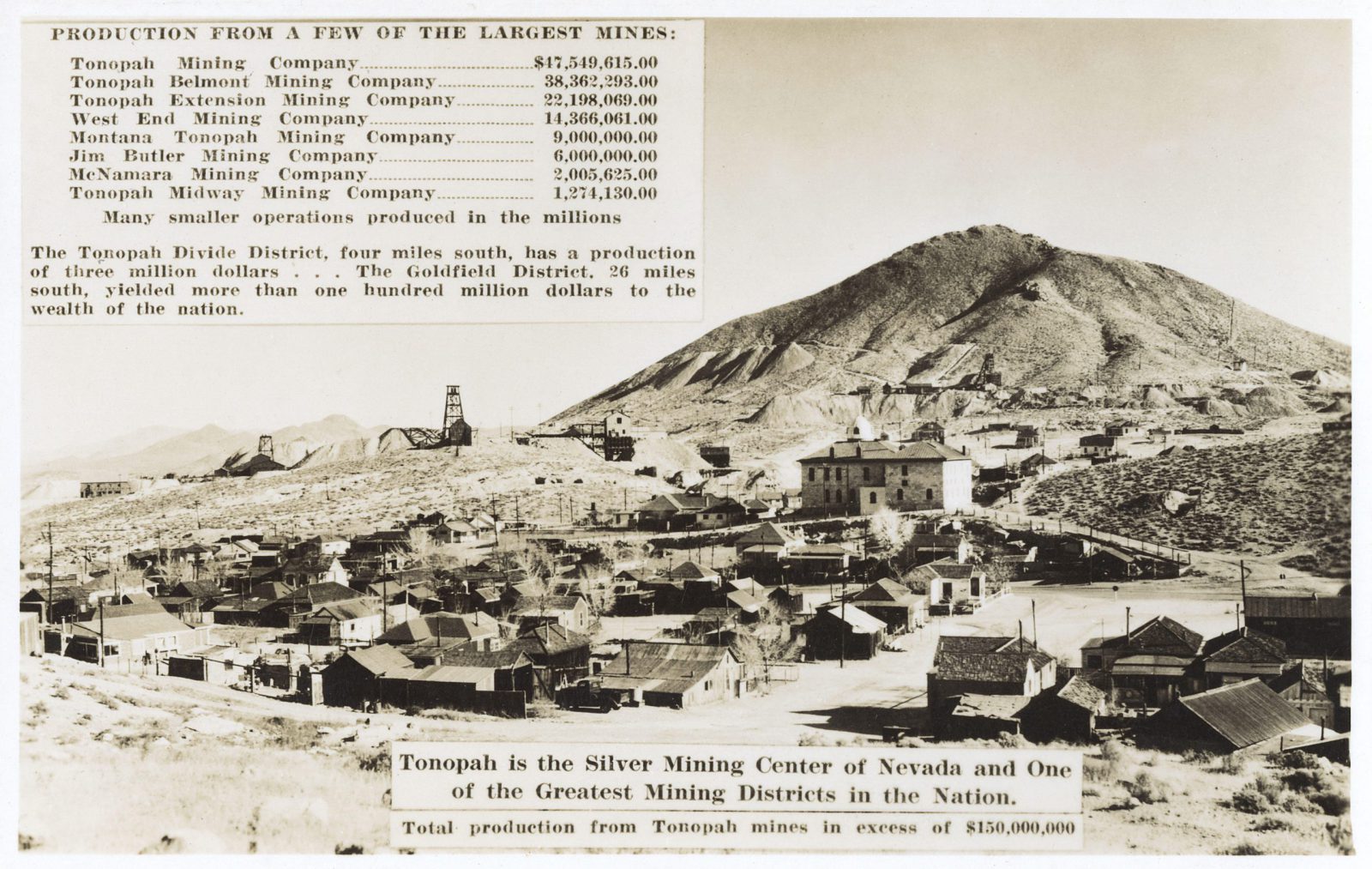

Blackrock Silver Corp. [BRC-TSXV], formerly Blackrock Gold, is focused on advancing its Tonopah West project in Nevada, where multiple high-grade silver and gold discoveries were made in 2020 during their maiden round of drilling at the project.

Blackrock Silver Corp. [BRC-TSXV], formerly Blackrock Gold, is focused on advancing its Tonopah West project in Nevada, where multiple high-grade silver and gold discoveries were made in 2020 during their maiden round of drilling at the project.

Tonopah West represents the consolidation of the western half of the famed Tonopah Silver District, located on one of the largest historic silver districts in North America. The Tonopah silver district is second to only the Comstock Lode in terms of historic silver production in the “Silver State” of Nevada, having produced 174 million ounces of silver and 1.8 million ounces of gold, primarily between the years of 1900 to 1930. In the silver world, in addition to the high-grades that were consistently mined in Tonopah, what made the district unique was the consisten 100 to 1 silver to gold ratio that was produced, making this a pure play precious metals district in the heart of the Nevada, which was recently rated by the Fraser Institute as the top mining jurisdiction in the world. Despite being one of the largest and highest-grade silver primary districts in North America, Blackrock is the first group to bring exploration back to the many historic mines on their property since production shut down due to low metals prices during the Great Depression.

The company’s first drillhole into the project at their Victor target, encountered 29 metres grading 965 g/t silver equivalent. Though they only intended to drill 7,500 metres on their initial round of exploration, given their immediate success, they completed over 30,000 metres of drilling between June and December of last year.

The company’s first drillhole into the project at their Victor target, encountered 29 metres grading 965 g/t silver equivalent. Though they only intended to drill 7,500 metres on their initial round of exploration, given their immediate success, they completed over 30,000 metres of drilling between June and December of last year.

With multiple discoveries to their credit during their initial round of drilling, Blackrock laid out their intention to drill an additional 40,000 metres during 2021 and plans to have a maiden resource estimate completed by the end of the year on their DPB target at Tonopah West.

There are four drill rigs currently in operation at the project, not only focused on delineating a resource, but also on making new discoveries, and expanding on known veins. On March 18, 2021, the company announced they discovered a new vein, just outside the DPB target area, where they encountered 3.1 metres grading 1,003 g/t silver equivalent.

The company is well funded after recently raising $10.3 million from an upsized offering of 14.4 million units priced at $0.72. Each unit consist of one common share and one-half of one common share purchase warrant. Each whole warrant is exercisable into one common share at $1.10 at any time up to 36 months after the closing date.

On April 14, 2021, Blackrock shares were trading at 70 cents in a 52-week range of $1.61 and $0.15, leaving the company with a market cap of $73.57 million based on 105.1 million shares outstanding.

It is worth noting that in a previous role Blackrock Executive Chairman Bill Howald oversaw exploration for what was a major mining company, serving as General Manager of Exploration, the United States and Latin America at Placer Dome up until their takeout by Barrick in 2005 for $10 billion dollars. More recently he was the founder of Rye Patch Gold, a company that was sold in March, 2018 to Alio Gold Inc. for $128 million.

Pantera Silver Corp. [PNTR-TSXV] is a junior exploration company that offers investors exposure to early-stage exploration in the Pregones Mining District, an area of Mexico that is considered prospective for its high-grade silver and gold mineralization.

Pantera Silver Corp. [PNTR-TSXV] is a junior exploration company that offers investors exposure to early-stage exploration in the Pregones Mining District, an area of Mexico that is considered prospective for its high-grade silver and gold mineralization.

Pantera is focused on their newly-acquired Nuevo Taxco Silver property, located in northern Guerrero State, approximately 125 kilometres southwest of Mexico City near the municipality of Taxco, the historic silver capital of Mexico. The company acquired the 1,100 hectare Nuevo Taxco property from Impact Silver Corp. [IPT-TSXV] under an option agreement and concurrent financing that closed on March 10, 2021.

Impact Silver had completed an initial field program of mapping and sampling on the property, which identified and mapped 21 silver-bearing veins with significant widths, open along strike and depth, within a 135-hectare exploration area. Many of these veins were sampled by Impact and returned compelling silver results.

A collection of 395 rock samples were found to contain high silver values grading over 1.0 kilogram per tonne silver in three samples (1,430, 1,230, 1.100 g/t). Another 18 samples assayed between 500 and 900 g/t silver, while an additional 92 samples assayed between 100 and 499 g/t silver. Drill targets were identified but due to market conditions at the time, Impact turned their focus on increasing production efficiencies at their San Ramon Mine located northwest of Nuevo Taxco. Pantera is now following up this field work with a maiden exploration drill program.

A collection of 395 rock samples were found to contain high silver values grading over 1.0 kilogram per tonne silver in three samples (1,430, 1,230, 1.100 g/t). Another 18 samples assayed between 500 and 900 g/t silver, while an additional 92 samples assayed between 100 and 499 g/t silver. Drill targets were identified but due to market conditions at the time, Impact turned their focus on increasing production efficiencies at their San Ramon Mine located northwest of Nuevo Taxco. Pantera is now following up this field work with a maiden exploration drill program.

In a March 18 press release, the company said a permit application for exploration drilling is being prepared for filing with SEMERNAT, the Mexican national environmental authority, to allow for the drilling of some 20 identified initial drill targets. The company said it anticipates permitting for up to 4,500 metres of exploration drilling with an initial exploration program to include a drill program of ~1,600 metres, focused on priority targets identified within the 21 silver-bearing veins mapped to date.

The company said field personnel have mobilized to the Nuevo Taxco property for site preparation and further surveying in anticipation of receiving their initial drilling permit. The initial drill program will utilize “man-portable” drill rigs to minimize environmental impact to and at each drill target location.

The entire 1,100-hectare project is considered to be significantly underexplored. Pantera is planning to expand mapping and sampling within the 135-hectare mineralized target to extend mapped veins as well as prospect outside the target zone to identify additional veins and comprehensively map potential hosts of further mineralization.

The entire 1,100-hectare project is considered to be significantly underexplored. Pantera is planning to expand mapping and sampling within the 135-hectare mineralized target to extend mapped veins as well as prospect outside the target zone to identify additional veins and comprehensively map potential hosts of further mineralization.

The initial exploration program may also include, satellite remote sensing, mapping and selective channel sampling of local historical adits, where they are open and safe to enter.

Pantera agreed to acquire a 100% interest in the Nuevo Taxco property from Impact in return for a cash payments, shares and exploration spending commitments to be carried out over three years.

The district around Nuevo Taxco property has a mining culture with a rich history of mining dating back to 1520. There are as many as 11 old mills on the property, and a number of old mine adits and underground workings that provide Pantera’s geologists valuable insight into the stratigraphic orientation of subsurface geology. Skilled labour is readily available.

On April 14, 2021, Pantera shares were trading at 19 cents in a 52-week range of 20 cents and $0.075, leaving the company with a market cap of $5.38 million, based on 28.3 million shares outstanding.