Canada’s Maritimes; don’t overlook this metals-rich region

By Ellsworth Dickson

While the Maritimes is well known for fishing, there is also an active exploration and mining sector. Indeed, gold mining has been a part of Nova Scotia for 150 plus years. Over a million ounces of gold have been produced since mining began in 1861.

Nova Scotia’s mining and quarrying industry provides 5,500 jobs, mostly in rural areas, and contributes $420 million annually to the province’s economy. The province’s mineral industry is dominated by the production of industrial minerals and structural materials such as gypsum, anhydrite, salt, coal, aggregate, limestone, silica sand, quartz, dimension stone (marble, slate, sandstone, granite) and peat.

Australian-owned St. Barbara’s Atlantic Gold operation is located in Moose River Gold Mines (near Middle Musquodoboit), approximately 60km north east of Halifax, Nova Scotia. After a feasibility study was completed in 2015, mining of the current open pit at Touquoy commenced in 2017, with commercial production declared in March 2018. As at 25 March 2019, the Atlantic Gold operation had a combined estimated 1.9 million ounces of gold in reserves at 1.12 g/t.

Anaconda Mining Inc. [ANX-TSX] released an updated and significantly expanded resource estimate for its 100%-owned Goldboro gold project in Nova Scotia.

Aurelius Minerals Inc. [AUL-TSXV; AURQF-OTC] recently intersected 10.5 metres at 11.7 g/t gold, including 1.6 metres at 74.7 g/t gold, including one metre at 118.2 g/t gold at its Aureus East gold project in Nova Scotia.

Another active Nova Scotia explorer includes Northern Shield Resources Inc. [NRN-TSXV] at its Shot Rock Project. Also, MegumaGold Corp. [NSAU-CSE] acquired Osprey Gold Development Ltd. last September.

However, the recent excitement has been a number of gold discoveries followed by a staking rush in the Central Newfoundland Gold Belt that was kick-started by Marathon Gold Corp. [MOZ-TSX] which has now defined 4 million ounces of gold on its Valentine Project.

Attracted by Marathon’s success, other juniors followed including New Found Gold Corp., [NFG-TSXV] at its 100%-owned Queensway Project on the Trans-Canada Highway 15 km west of Gander where drill hole NFGC-20-100 returned 224.7 g/t gold over 2.45 metres.

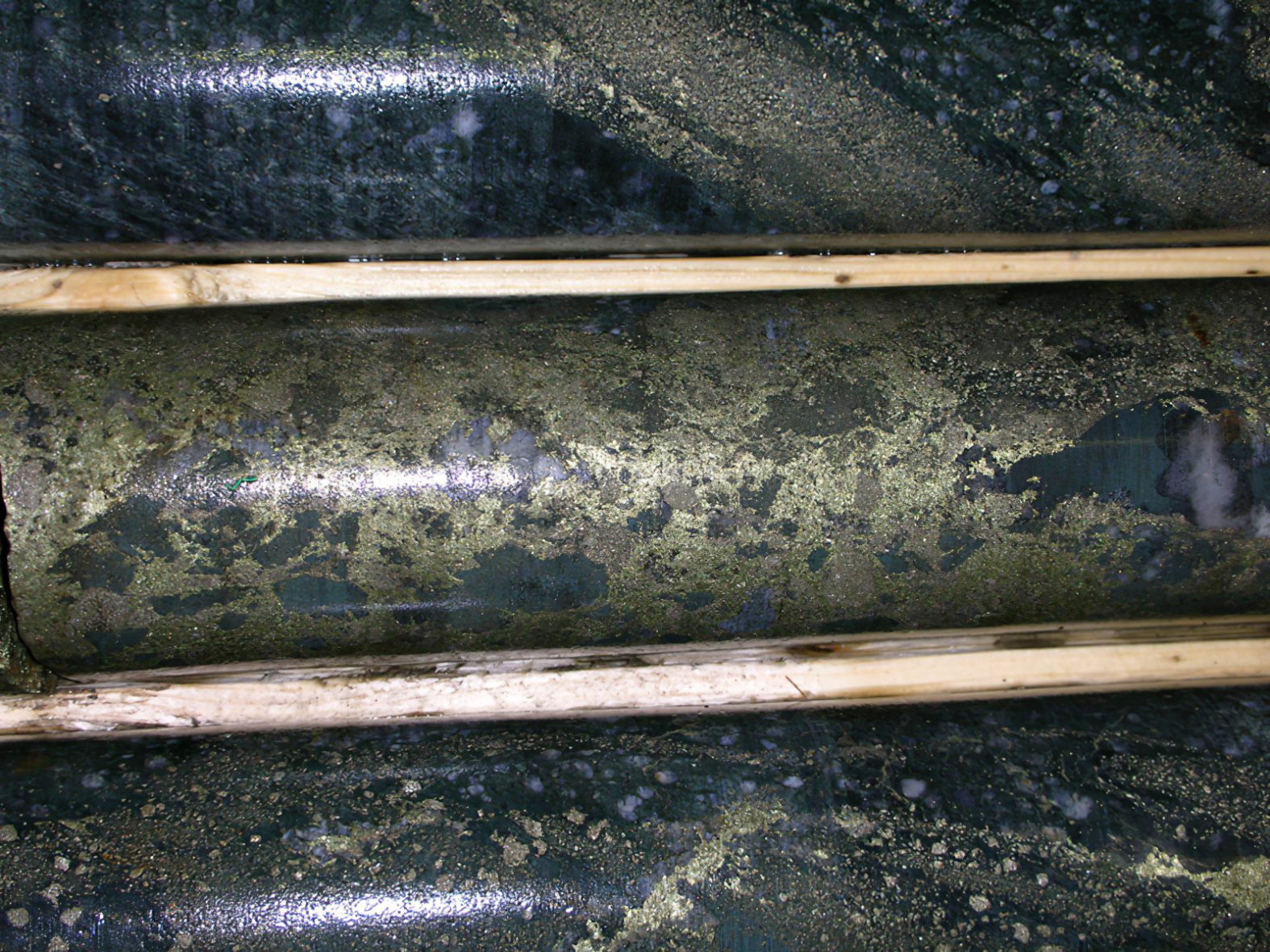

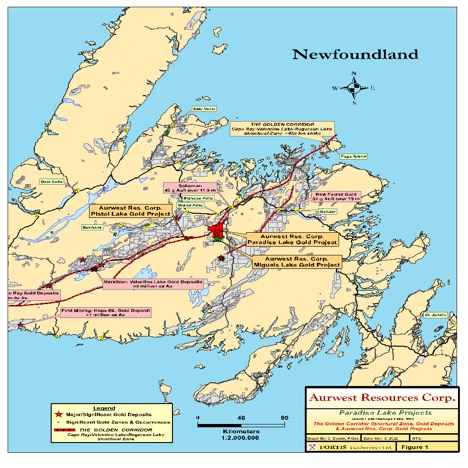

Aurwest Resources Corp. [AWR-CSE; SRSEF-OTC] has finalized the Phase 1 exploration program for its 100%-optioned Paradise Lake gold project located in the Central Newfoundland Gold Belt. On completion of the till sampling program, crews will focus on the four areas of the project where historical work located gold mineralization in outcrop, gold-in-till anomalies (some with pristine gold grams), and gold-in-soil and lake sediment geochemical anomalies.

C2C Gold Corp. [CSE: CTOC; OTCQB: TAKUF] expanded its Badger Project in the prolific Central Newfoundland Gold Belt to total 876 km2.

K9 Gold Corp. [KNC-TSXV] can earn up to a 100% interest in the Stony Lake Project within the Cape Ray/Valentine Lake structural trend in Central Newfoundland, lying parallel to that of New Found Gold’s Queensway Project.

Up in the Baie Vete mining district, Maritime Resources Corp. [MAE-TSXV] reported a new discovery from the Hammerdown gold project: 6.9 g/t gold and 12.9 g/t silver over 6.0 metres, including 19.9 g/t gold and 24.1 g/t silver over 2.0 metres 150 metres east of the Hammerdown deposit.

New Brunswick’s complex geological past has given rise to a diversity of metallic mineral resources. Metallic mineral deposits may contain base metals such as copper, lead, zinc, and iron; precious metals such as gold and silver; or rare metals such as indium. Clarence Stream in the southwest part of the province is the site of intensive gold exploration.

For example, Galway Metals Inc. [GWM-TSXV] has a 100% interest in the expandable 667,000-ounce Clarence Stream gold project located 70 km south-southwest of Fredericton in southwestern New Brunswick. Recent drilling cut 4.8 g/t gold over 34.0 metres and 23.0 g/t gold over 7.4 metres.

Trevali Mining Corp. [TV-TSX] owns the zinc-copper-lead-silver-gold Caribou Mine, Halfmile and Stratmat properties and the Restigouche Deposit 50 km west of Bathurst. They recently announced restart of Caribou Mine from temporary suspension. This year’s zinc production guidance is 60-651 million payable lbs at AISC of $0.91-0.97 lb.

Stratabound Minerals Corp. [SB-TSXV; SBMIF-OTC] reported 2.26% Copper Equivalent across 7.5 metres true width near surface at the Captain deposit in the Bathurst District 100 road-km to the deep-water port of Belledune. The company is investigating a small-scale, high-grade, direct-shipping mining project to generate near-term cash-flow.

Jaeger Resources Corp. [JAEG-TSXV] entered into an agreement with Stratabound Minerals Corp. [SB-TSXV] to explore and develop the Taylor Brook zinc-lead-silver-copper property in the Bathurst Mining Camp. Recent field work has included mapping of the VLF geophysical anomalies and re-sampling of some of the diamond drill core from the 1995 and 1996 drill campaigns. Mineralized and unmineralized outcrops have been sampled and will be sent out for lithogeochemical analyses.

Avalon Advanced Materials Inc. [AVL-TSX; AVLNF-OTCQB; OU5-FSE] has a 100% interest in the East Kemptville Tin-Indium Project approximately 45 km northeast of Yarmouth, Nova Scotia in the vicinity of the former East Kemptville Tin Mine. In July 2018, Avalon finalized its PEA. The re-development model, as presently conceived, is an environmental remediation project that will be financed through the sale of tin concentrates recovered in large part from previously-mined mineralized material on the site.

The development model utilized for the PEA contemplates a production schedule of approximately 1,300 tonnes per annum of a 55% tin concentrate for 19 years, with tin concentrates being sold and shipped for treatment in international markets. The PEA concludes that the small-scale re-development model for tin concentrate production at East Kemptville is economically viable at current tin prices in the range of US$20,000 to US$22,000/tonne. Assuming an average go-forward tin price of US$21,038/tonne, and an exchange rate of CAD 1.30/USD, the project has an indicated pre-tax IRR of 15.0% and an NPV of C$17.9 million at an 8% discount rate. The initial capital cost is estimated at C$31.5 million. Average annual revenues from sales are calculated as C$17.75 million vs. annual production costs of C$11.6 million.

Puma Exploration Inc. [PUMA-TSXV] released assays results for the surface discoveries of visible gold at the Pepitos gold zone on the Williams Brook gold property. Samples collected contain fine specks of visible gold graded; assays of 52.10 g/t gold and 95.5 g/t silver.

Manganese X Energy Corp. [MN-TSXV; SNCGF-OTC; 9SC2-FSE; SSM-Lima] released assay results from the fall 2020 diamond drilling program at the company’s 100%-owned Battery Hill Project near Woodstock, southwest New Brunswick. Drill hole SF20-43 returned 12.9% MnO across 51.3 metres from 57.7 metres downhole, including 26.5 metres of 16.49% MnO (Moody Central Zone; contains program high 27.69% MnO).

There are three main reasons to like the mineral prospects of the Maritimes: the current exciting Central Newfoundland Gold Belt play; the zinc and manganese potential of New Brunswick; and the gold potential of Nova Scotia.

Aurwest Resources Corp. [AWR-CSE; SRSEF-OTC] shareholders gathered last February 28th, 2020 around the board room table to vote on a new direction for the struggling company. The concerned shareholders of Aurwest urged for change and efforts were ultimately successful. A landslide victory represented by 5,400,324 votes or 41.85% of shareholders, showed favour of a major management changes at the Annual General Meeting.

Aurwest Resources Corp. [AWR-CSE; SRSEF-OTC] shareholders gathered last February 28th, 2020 around the board room table to vote on a new direction for the struggling company. The concerned shareholders of Aurwest urged for change and efforts were ultimately successful. A landslide victory represented by 5,400,324 votes or 41.85% of shareholders, showed favour of a major management changes at the Annual General Meeting.

Since being appointed, the new Board and Management, which is an amalgamation of both pre-existing and new talent have made good on their promises to reorganize the small company.

They’ve tirelessly worked to clean up the balance sheet by reducing over 90% liabilities they were left with, raised over $1.6M in new capital and repositioned the company’s assets to focus on a new large flagship property in the emerging, and subsequently trending gold district of Central Newfoundland.

Newfoundland is becoming a hotbed for mineral exploration activity – Aurwest has strategically positioned itself and investors in Central Newfoundland, right in the flurry of the activity. Right now, projects from the Baie Verte Peninsula to the Gander area and as far south as Millertown are in various stages of exploration & development. Some, like the Valentine Lake Project are advancing towards potential mine development in the near future. Other projects like Queensway and Moosehead are currently seeing exploration/drilling programs exceeding 200,000 samples and 20,000-metre drilling programs respectively, currently underway in the immediate area.

It comes as no surprise why explorers are rushing into the area. Recent drilling results by New Found Gold [NFG-TSXV] on their Queensway property have shown initial grades exceeding 93 g/t gold over 19 metres at the Keats Zone (east of Aurwest’s property), and Sokoman’s [SIC-TSXV] Moosehead property where recent dilling results yielded 5.10 metres of 124.20 g/t gold).

It comes as no surprise why explorers are rushing into the area. Recent drilling results by New Found Gold [NFG-TSXV] on their Queensway property have shown initial grades exceeding 93 g/t gold over 19 metres at the Keats Zone (east of Aurwest’s property), and Sokoman’s [SIC-TSXV] Moosehead property where recent dilling results yielded 5.10 metres of 124.20 g/t gold).

Aurwest has Option Agreements to acquire 100% of Paradise Lake Project which is located approximately 15 km off the Trans-Canada Highway in Central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold – MOZ-TSX), Moosehead Project (Sokoman – SIC-TSXV), and approximately 20 km to the west of Queensway Project (New Found Gold – NFG-TSX).

In November 2020, Aurwest announced the acquisition of its first project in the emerging Central Newfoundland gold belt, a package of gold exploration licenses situated approximately 10 km south of Grand Falls. It is referred to as the Paradise Lake Project.

Paradise Lake consists of three separate claim blocks. Collectively, the properties cover 30 km of strike length of the regional scale structure that hosts the Valentine Lake/Moosehead gold deposits.

Aurwest believes time is of the essence and is currently mobilizing its geological team to commence a Phase 1 till sampling program which will cover 100% of the Paradise Lake Project. Results of the 2,260 till samples are expected to further delineate key structures and mineralization along and in proximity to the magnetic structure underlying the property. The 2021 till sampling and mapping survey lines will be 1,000-metre spacing and are oriented perpendicular to these main structures, which will provide the best geological information obtained from the exploration program.

In addition to the Phase 1 exploration areas of known Au (gold) mineralization will be covered with 500-metre spacing over the Twin Ponds, Paradise Lake, South Paradise Lake and Pistol Lake targets, which will allow higher resolution of geophysical data and geological information.

Aurwest recently outlined its 2021 exploration program for Paradise Lake, saying it has assembled an experienced team of geologists and prospectors to conduct planned field activities.

The Phase 1 program is the initial exploration to be fulfilled as part of the first year $500,000 commitment under the option agreement. The aim is to move priority targets to the next phase and develop drill targets.

President and CEO Colin Christensen has been active in Canadian equity markets for over 35 years. In that time, he played a key role in the financing and development of two small scale heap leach gold mines in Kazakhstan as well as various mineral projects in North America.

Brian Willett, P.Geo., will manage all the company’s exploration activity. Brian has worked extensively with Capstone Mining Corp. [CS-TSX] as a senior geologist on various advanced and grass roots exploration programs in North and South America, and most recently as a contract geologist with Maritime Resources Corp. in Newfoundland.

“The acquisition of these strategically located properties is the first step in implementing Aurwest ‘s corporate strategy,” said Christensen. “These properties to date have yielded six gold-in-till anomalies, visible gold in outcrop and 10 altered/mineralized areas, all representing significant exploration targets that cover a 30-kilometre-long portion along the under-explored western side of the Golden Corridor in Central Newfoundland.”

Aurwest is also a significant land holder in British Columbia with its 100%-owned, 22,255 hectares of exploration ground known as the Stellar Copper-Gold Project. The property lies on the Nechako Plateau and is located 25 km southwest of Houston, adjoins the M3 Metals Stars copper discovery, and is approximately 58 km north of the Imperial Metals Corp. [III-TSX] Huckleberry Copper Mine.

The property partially surrounds the M3 Metals Corp.’s [MT-TSXV] Stars porphyry copper-gold-silver-moly discovery. On February 28, 2018, M3 Metals reported that drill hole #4 intersected 40.2 metres of 1.02% copper equivalent (CuEq), within a broader interval of 204 metres of 0.50% CuEq close to surface.

In 2019, Aurwest completed a 1,049-km airborne geophysical survey which identified four priority targets which represent the magnetic structure typical of a porphyry system. The 2021 phase of work includes mapping, prospecting, stream sediment and soil geochemical sampling, and a deep-penetrating geophysical survey. The ultimate aim is to outline potential drill targets to test the copper mineralization exposed on surface at depth.

On April 12, 2021, Aurwest shares were trading at 14 cents in a 52-week range of 14 cents and $0.02, leaving the company with a market cap of $8.5 million, based on 60.8 million shares outstanding.

Manganese X Energy Corp. [MN-TSXV; MNXXF-OTC; 9SC2-FSE] (“Manganese X” or the “company”) is aiming to become a supplier of high purity (plus 99.95%) manganese to the cathode for the production of lithium-ion batteries in the growing electric vehicle, energy storage and possible steel sectors.

Manganese X Energy Corp. [MN-TSXV; MNXXF-OTC; 9SC2-FSE] (“Manganese X” or the “company”) is aiming to become a supplier of high purity (plus 99.95%) manganese to the cathode for the production of lithium-ion batteries in the growing electric vehicle, energy storage and possible steel sectors.

The company views the manganese market as extremely bullish due to the explosion in demand for lithium-ion batteries and the increasing use of manganese as a key material in the fabrication of these batteries.

Manganese X, in collaboration with Kemetco Research Inc. of Richmond, B.C, has been able to produce manganese sulfate with a purity exceeding 99.95% and with very low levels of base and alkali metals using material sourced from its flagship Battery Hill Manganese deposit, which is located near Woodstock, New Brunswick only 12 km. from the US border.

This has been a transformational achievement, demonstrating that its resource material can be compliant with electric vehicles and other requirements.

Why manganese? Manganese is among the most widely used metals in the world, fourth after iron, aluminum and copper. Yet there are currently no producing manganese mines in North America.

As electrolytic manganese (EMM) production outside China is minimal, Manganese X has an opportunity to become one of the few Western players in the EMM sector, said Christopher Ecclestone of Hallgarten & Company in a research report.

Ecclestone said lithium-ion manganese batteries are a promising technology as their manganese-oxide components are earth-abundant, inexpensive, non-toxic and provide better thermal stability. Historically, the demand, and hence the price, of the metal is closely tied to demand for iron ore in China.

Because manganese sells for US$1,700 per ton, the company says using manganese can significantly bring down the manufacturing cost of lithium-ion batteries, a major factor in the high cost of electric vehicles. Cobalt (which manganese has the ability to replace), by comparison, is selling for US$52,000 a ton.

Manganese X is aiming to produce battery-grade manganese from ore extracted from its Battery Hill Project, which spans 1,228 hectares, covering a significant portion of the known historic manganese-bearing horizons in an area approximately 6 kilometres northwest of Woodstock, southwestern New Brunswick.

Exploration in the region dates back to 1836, when an iron-manganese deposit was discovered in the Woodstock area and then mined for almost 40 years, starting in 1848. According to a technical report, 70,000 tons, primarily from a mineralized zone named Iron Ore Hill, was mined. This material was reported to have been sent to the U.K. for use in armour plating Royal Navy gun-boats due to its exceptional quality.

Battery Hill encompasses all or part of five manganese zones (or occurrences): Iron Ore Hill, Moody Hill, Sharpe Farm, Wakefield and Maple Hill. They are estimated to host a historic resource of 39 million tonnes at 9% Mn, which does not meet NI 43-101 standards of disclosure.

In a February 16, 2021 press release the Company announced results of a fall 2020 drill program (28 holes totaling 4,509 metres) which was designed to provide sufficient data to establish a NI 43-101-compliant mineral resource estimate, expected in approximately 2-3 months

Upon completion of the resource estimate, the company will launch programs related to a planned preliminary economic assessment (PEA) of the Battery Hill project.

Meanwhile, Manganese X has struck a deal to spin out its Lac Aux Bouleaux (LAB) graphite property in southern Quebec. The arrangement is expected to result in the creation of Graphano Energy Ltd. (now a subsidiary of Manganese X) as an independent public company that will be focused on exploration at LAB.

The LAB property covers 738.12 hectares and is located near the town of Mont-Laurier. It is also contiguous to the south of Imerys SA’s TIMCAL Graphite and Carbon’s Lac des Iles graphite mine in Quebec.

The Lac des Iles graphite mine has the capacity to produce 25,000 tonnes of graphite annually.

Past exploration at LAB intersected significant graphite mineralization in drill holes and trenches. Preliminary metallurgical tests delivered recoveries of up to 96%.

Manganese X said the high percentage of large flake graphite is positive for a high quality premium priced product. It also said infrastructure is excellent with road access and electrical power on site.

The company recently completed a non-brokered private placement that raised $1.63 million by issuing 4.96 million units at 33 cents each. Proceeds are earmarked for working capital purposes.

Manganese X’s wholly owned subsidiary, Disruptive Battery Corp., in conjunction with its US JV Partner, PureBiotic Air Inc., has received positive preliminary results from its ongoing research study with Virginia State University including the successful production of the biofilm required to advance its research and testing of the PureBiotic heating, ventilation and air conditioning air purification delivery system for the mitigation of COVID-19 and other contaminants.

On April 12, 2021, Manganese X shares were trading at 54 cents in a 52-week range of $1.11 and $0.06.

Stratabound Minerals Corp. [SB-TSXV; SBMIF-OTC] is a fully-funded Canadian exploration and development company with a focus on gold exploration at its flagship Gold Culvert Project in the Yukon and its McIntyre Brook Project in New Brunswick.

Stratabound Minerals Corp. [SB-TSXV; SBMIF-OTC] is a fully-funded Canadian exploration and development company with a focus on gold exploration at its flagship Gold Culvert Project in the Yukon and its McIntyre Brook Project in New Brunswick.

Stratabound also offers investors a window on a quick entry to the battery metals sector via its Captain volcanic massive sulphide (VMS) deposit in New Brunswick and might soon provide cash flow that could be used to fund its other exploration projects.

While its key gold projects are early stage, the company is run by a team of executives and directors who have been involved in all aspects of the mine development cycle. President and CEO Kim Tyler, for example, has been a mining and exploration professional with over 40 years of progressive management and executive experience in a career that includes spells with Vale SA [VALE-NYSE], Rio Tinto Plc [RIO-NYSE], and Royal Oak Mines.

The company is fully funded and debt free after raising $8.7 million in December 2020, thus providing the company with “more than enough money to roll us through the next couple of years with our programs,” Tyler said recently.

Key shareholders include Jerritt Canyon Canada, a company owned 100% by Eric Sprott, which holds a 17% stake in Stratabound and Coast Capital Midas Fund, based out of New York, NY holds 25%.

Stratabound remains tightly focused on advancing its flagship Golden Culvert and secondarily its McIntyre Brook early-stage exploration projects. Both are located in exciting new gold districts that are developing in the Yukon and northern New Brunswick.

Golden Culvert is located approximately 20 kilometres northeast of Seabridge Gold Inc.’s [SEA-TSX; SA-NYSE] 3 Aces and Aben Resources Ltd.’s [ABN-TSXV] Justin high-grade gold projects in the southeast Yukon.

At Golden Culvert, eight diamond drill holes totaling 1,370 metres and 24 surface trenches reported in previous exploration programs have intersected and outlined a 970-metre-long by 130-metre-wide mineralized corridor containing parallel gold-bearing structures.

Stratabound recently received complete assay results for the first six of 17 drill holes completed on a Phase 2 diamond drilling program that concluded last fall. The company said four of the five holes were drilled to extend 200 metres to the northwest of beyond the 430 metres of strike drilled previously. The fifth was drilled to extend a further 170 metres to the southeast.

All of the holes intersected gold mineralization hosted in multiple quartz vein and breccia structures.

The company has said its objective is to have an initial NI 43-101 inferred resource completed this year.

In December 2019, the company struck an option deal to acquire the McIntyre Brook Project, an exciting new iron oxide-copper-gold (IOCG) exploration target. It is located in a region of New Brunswick that has been overlooked for such targets despite mounting evidence of a geological environment that is similar to the ones that host such world class deposits as Olympic Dam in Australia and Candelaria in Chile.

However, the company has been looking at the possibility of being able to generate cash that could be used to fund its flagship projects by developing a small but high-grade operation based on output form its 100%-owned Captain copper-cobalt deposit.

It is one of three base metal deposits that are situated on Stratabound’s significant land position in New Brunswick’s Bathurst mining camp on the same stratigraphic contact that hosts the world-class Glencore Brunswick No. 12 and No. 6 mines with past production of 149.4 million tonnes of 8.72% zinc, 3.3% lead, 0.35% copper and 99 g/t silver.

The Captain Deposit hosts a NI 43-101 compliant measured and indicated resource of 448,000 tonnes averaging 1.75% copper, 0.046% cobalt, 0.30 g/t gold or 2.2% copper equivalent CuEq, plus an inferred resource of 162,000 tonnes averaging 1.47% copper, 0.04% cobalt, and 0.24 g/t gold for a 1.87% CuEq.

The company has been drilling the project in a bid to confirm near-surface grade and continuity to define and investigate the opportunity for a small-scale, high-grade mining project.

Stratabound takes the view that the Captain Deposit’s road access, close proximity to a rail head and deep-water port at Belledune near Bathurst allows for the possibility of monetizing this asset via micro-capital intense, small-scale mining and delivery of high-grade product through truck, rail or marine shipping.

“Given the recent surge in copper and cobalt prices and the healthy outlook for both of these battery metals, we are more than obliged to review this asset for its direct cash generating opportunities,” Tyler said recently.

On April 12, 2021, Stratabound shares were trading at $0.205, in a 52-week range of 38 cents and $0.055, leaving the company with a market cap of just under $16.4 million, based on 79.8 million shares outstanding.