Cerrado Gold agrees to acquire Voyager Metals

Cerrado Gold Inc. [CERT-TSXV, CRDOF-OTCQX] has agreed to acquire all the outstanding shares of Voyager Metals Inc. [VONE-TSXV] it doesn’t already own via a plan of arrangement deal.

Upon completion of the transaction, Cerrado will, indirectly through a wholly-owned subsidiary, own a 100% stake in the Mon Sorcier iron and vanadium project in Chibougamau, Que., which is advancing towards feasibility and permitting.

Under the definitive agreement, Voyager shareholders will receive one common share of Cerrado for every six common shares of Voyager, implying a consideration of 15.23 cents per Voyager share, based on the volume weighted average price (VWAP) of the closing price of Cerrado common shares on the TSX Venture Exchange on March 3, 2023, representing a 16.8% premium to the 20-day VWAP of Voyager on the TSX Venture on March 3, 2023.

Upon closing, Voyager shareholders would wind up with 18% of Cerrado shares

The deal was announced after the close of trading on March 7, 2023, when Voyager shares closed at 15 cents. The shares currently trade in a 52-week range of 22.5 cents and $0.09.

Prior to the announcement, Cerrado closed at 89 cents. The shares trade in a 52-week range of $1.96 and 69 cents.

In connection with the arrangement, Cerrado agreed to purchase Voyager shares at a price equal to the transaction price, as part of a larger non-brokered private placement of Voyager for gross proceeds of $4.72 million to be completed prior to closing of the arrangement.

Assuming that the private placement is fully subscribed, it is expected that Cerrado will purchase $3.7 million worth of Voyager shares and own approximately 19.9% of the issued and outstanding shares.

Cerrado is a Toronto-based company with a focus on gold projects in the Americas. It is the 100% owner of the producing Minera Don Nicolas mine in Santa Cruz, province, Argentina and the Monte do Carmo development project in Tocantins State, Brazil.

At Monte do Carmo, Cerrado is rapidly advancing the Serra Alta deposit through feasibility and production. The Serra Alta deposit is estimated to host an indicated resource of 541,000 ounces of contained gold and an inferred resource of 780,000 ounces.

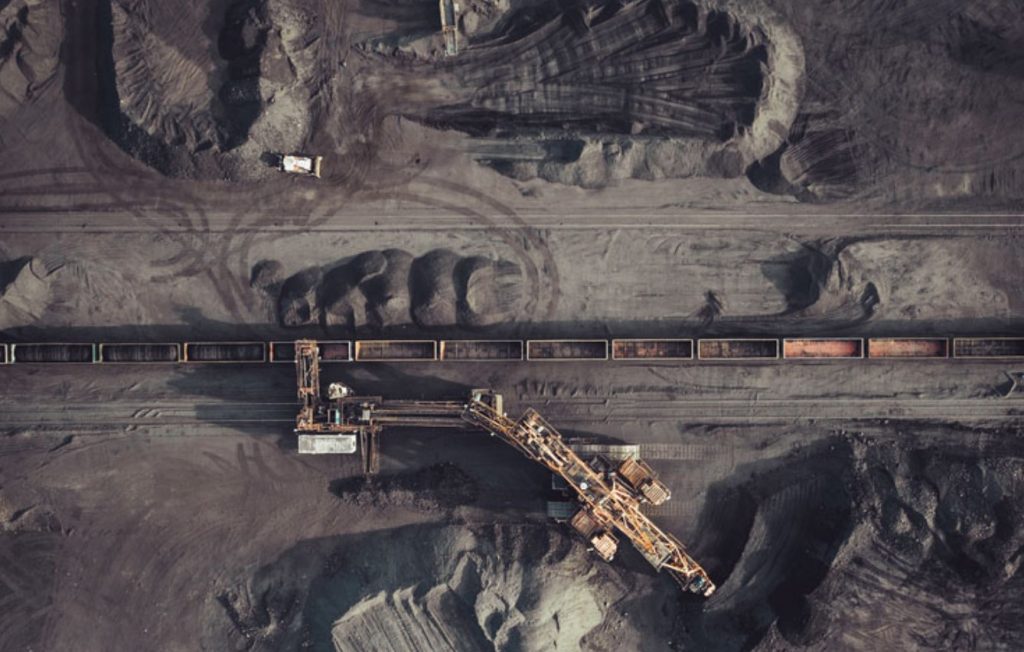

Voyager recently released results from a preliminary economic assessment (PEA) for Mont Sorcier. It said the PEA outlines a robust economic assessment for Mont Sorcier based upon a traditional open pit mining scenario with magnetic separation processing and a reverse flotation circuit to produce approximately 5.0 million tonnes per annum of low sulphur, vanadium rich iron concentrates, with low levels of impurities.

The Mont Sorcier iron ore property hosts a large iron resource with a significant amount of extractable vanadium located 18 kilometres from Chibougamau by road. The project has an indicated resource of 679 million tonnes of grade 27.8% magnetite and 0.20% V205, with the potential to produce 195 million tonnes of magnetite grading at least 65% Fe and 0.52% vanadium pentoxide (V205).