China President puts spotlight back on rare earths

Photo courtesy of the Ford Motor Company

By Peter Kennedy

Avalon Advanced Materials Inc. [AVL-TSX; AVLNF-OTCQX], a company that has toiled for many years in the rare earths space, experienced a sudden 111% in its share price Tuesday May 21.

The catalyst for the rally was speculation that China could retaliate in a trade war with the United States by blocking exports of rare earths to the U.S., potentially impacting American supply chains that rely on rare earth commodities

Talk of a possible blockade followed a visit by Chinese President Xi Jinping to a rare earths facility in Jiangxi, China. That sparked a rise in the share value of JL MAG Rare-Earth, the company that owns the facility.

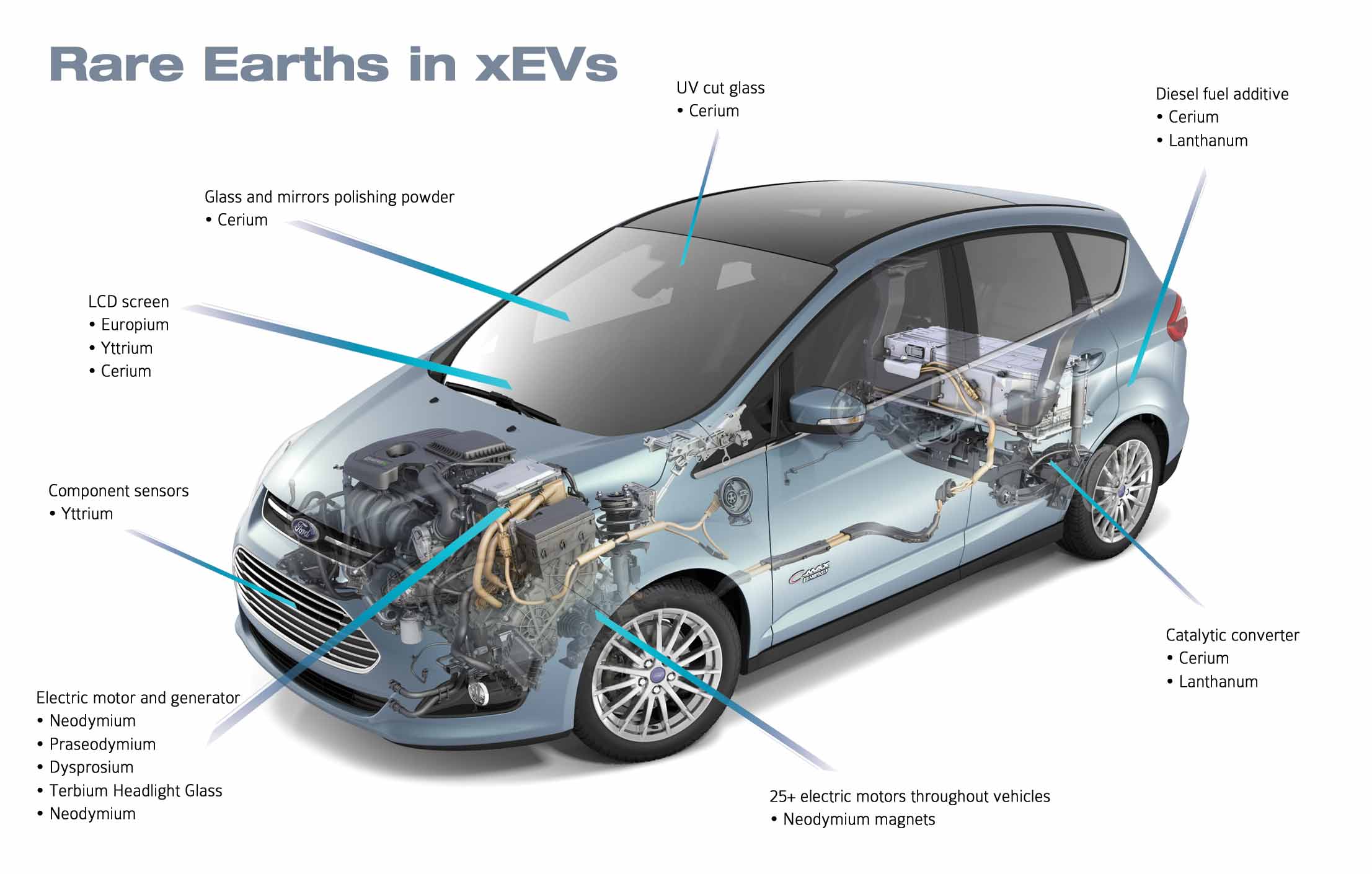

Rare earth elements are a group of 15 elements with tongue-twisting names like neodymium, terbium and dysprosium, and which are vital to green technology and high-tech applications. They fall into two sub-groups: light and heavy, with the heavies being more scarce.

Since the U.S. relies on China, the dominant global supplier, for about 80% of its rare earths imports, security of supply became an issue at the beginning of this decade when China imposed export restrictions, a move that sparked renewed investor interest in the sector.

Security of supply has re-emerged as a concern following the Chinese President’s trip to the rare earth facility. Bloomberg News has described the visit as a scripted move that aims to send a signal about what China might be prepared to do next in a trade war with the U.S.

Xi was accompanied on the trip by Liu He, the vice-premier who has led the Chinese side in trade negotiations.

“The visit sends a warning signal to the U.S. that China may use rare earths as a retaliation measure as the trade war heats up,” said Pacific Securities analyst Yang Kunhe. That could include curbs on rare earth exports to the U.S., he said.

China has dominated the rare earths industry for 30 years and there is little indication that this will change any time soon, industry officials say. Now, with a dramatic increase in demand for rare earth magnets needed to drive electric transportation and produce clean energy solutions, the industrial world remains exposed to Chinese dominance.

Investor reaction to the threat of a possible Chinese blockade has put the spotlight back on companies in the rare earth space

Avalon Advanced Materials, which is working to develop a Rare Earth Elements project in the Northwest Territories, saw its share price jump 111% or $0.05 to 9.5 cents Tuesday on heavy volume of almost 20 million shares traded.

Avalon recently announced a deal with private Australian company Cheetah Resources Pty Ltd., which has agreed to participate in the development of Avalon’ Nechalacho Project at Thor Lake, NWT.

Avalon said Cheetah is focused on the small-scale development of rare-earth resources enriched in the “magnet rare earths”, neodymium and praseodymium, presently in short supply and in high demand for clean technology applications, notably electric vehicles.

Under the deal, Cheetah agreed to become owner of the near surface resources in the T-Zone and Tardiff Zone for a $5 million cash payment, leaving Avalon as owner of the Basal Zone. The Basal Zone was the subject of a feasibility study in 2013.

Avalon has said it will continue to manage work programs on the property and retain its 3% net smelter return royalty. It hopes to start production by 2020.

Commerce Resources Corp. [CCE-TSXV; CMRZF-OTC; D7H-FSE] jumped 16.67% or $0.01 to $0.07 on volume of 1.63 million. Commerce is specifically focused on the development of its advanced-stage Ashram Rare Earths Project at the Eldor property in northern Quebec and its Upper Fir Tantalum and niobium deposit at the Blue River Project in British Columbia.

The company has said both projects are ready to market to potential partners. Although not rare earths, one of Commerce’s key assets is the Blue River tantalum-niobium project which is located in east central British Columbia, about 230 km north of Kamloops.

Medallion Resources Ltd. [MDL-TSXV; MLLOF-OTCQX] advanced 20% or $0.02 to 12 cents on volume of 1.3 million.

Medallion is focused on becoming a low-cost producer of industrially important rare earth elements, the critical components of virtually all computing and mobile electronic products, as well as electric and hybrid vehicles.

But the company is taking a different approach to competitors who extract rare earths using conventional mining and processing techniques and therefore must deal with complex metallurgy, huge investments for infrastructure and long time lines from exploration to production. Instead, Medallion is aiming to produce rare earths from monzanite, an igneous intrusive rock that is readily available as a by-product of existing mineral sands operations, primarily in the Indian Ocean Basin.