Coast Copper Makes New Copper-Gold Discovery at Empire: 7.18 g/t Gold and 3.17% Copper over 16.3 m at Raven Bluff Target

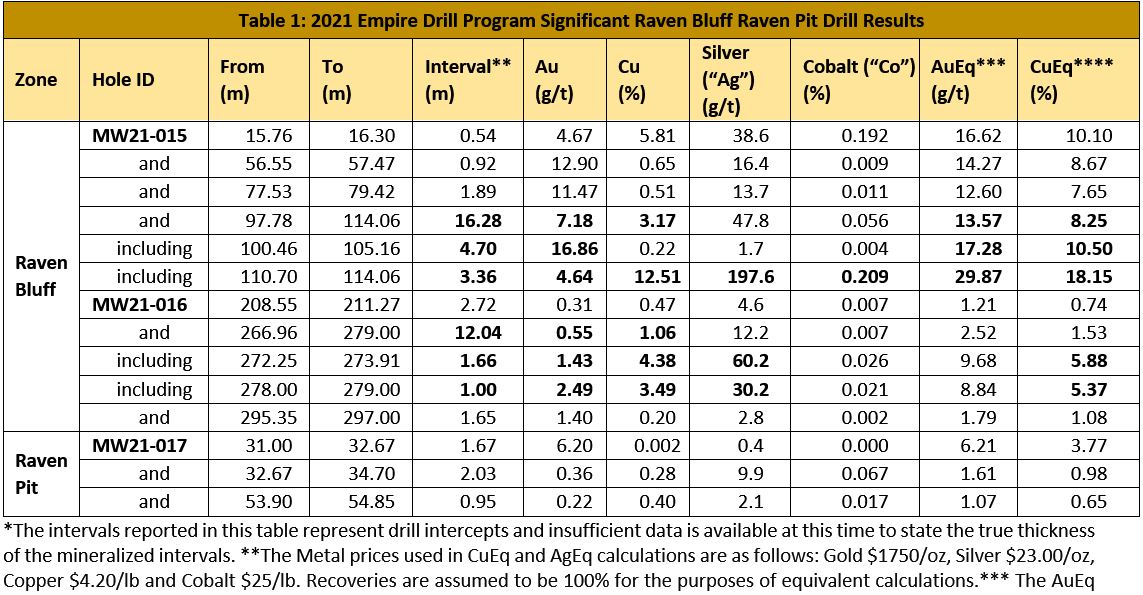

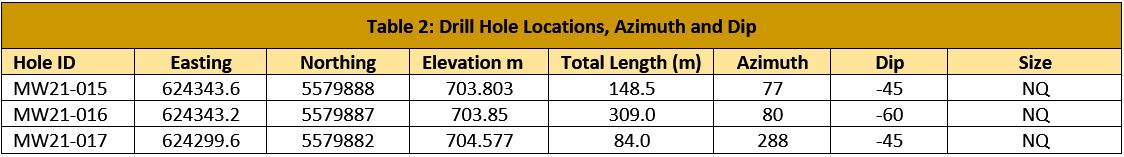

Coast Copper Corp. (“Coast Copper” or the “Company”; TSX-V: COCO) announces assay results for the second batch of samples from its initial 19 drillhole (2,346 metre (“m“)) core drilling program completed in December 2021 on its optioned Empire Mine Property (the “Property“); see news releases dated December 20, 2021 and January 25, 2022. Results reported in this news release are from two drillholes and one partial drillhole (MW21-015, partial 016 and 017) located in the Raven Bluff and Raven Pit approximately 200 m north of the past-producing Merry Widow magnetite iron ore open pit mine (see Figure 1). Drill highlights include 7.18 grams per tonne (“g/t”) gold (“Au”) and 3.17% copper (“Cu”) intersected over 16.3 m at Raven Bluff: and 6.2 g/t Au over 1.67 m at Raven Pit. See Table 1 for full list of highlights.

The objective of drilling at the Raven Bluff and Raven Pit targets was to test parts of the Property that, despite numerous recommendations made over the years since 1988 by consultants, had remained undrilled. The 2021 drillholes encountered significant copper and gold intercepts and more drilling is clearly warranted.

At Raven Bluff (see Figure 1) a detailed review of historical records, compilation of previous geological mapping and our own site inspections indicated that sulphide mineralization was more likely associated with north-northwesterly trending greenstone dykes within a 200 m x 200 m area that has never been adequately tested. Coast Copper’s drillholes MW21-015 & MW21-016 were drilled as a preliminary test of this hypothesis and were successful in intercepting semi-massive chalcopyrite and pyrrhotite bands, in core lengths up to 16.28 m, associated with the margins of the greenstone dykes. These sulphide-rich mineralized zones intercepted in hole MW21-015, occurring as deep as 100 m below surface (see Figure 2 and Table 1), gave assays of up to 7.18 g/t Au, 3.17% Cu over 16.28 m. Assay results have only been partially completed for drill hole MW21-016, which was drilled below drillhole MW21-015 returned initial assay results up to 0.55 g/t Au and 1.06% Cu over 12.04 m and suggestive that the mineralization at Raven Bluff persists to depth. Detailed controls to mineralization are still being determined and complete assay results are awaited for the rest of MW21-016. Â

Historical records indicate that the 21 m wide, north-trending Raven magnetite deposit with associated sulphides: pyrrhotite, pyrite, sphalerite and chalcopyrite was mined in the Raven Pit during 1959. As a magnetite resource, its high sulphide content made the Raven deposit uneconomic and after extracting about 22,000 tons, the Raven deposit was abandoned and later backfilled with waste rock from the Merry Widow Pit (J. Lund 1966). A substantial body of massive pyrrhotite, with lesser chalcopyrite and pyrite (with gold and silver values reportedly associated with these sulphides), cut by late occurring calcite-sphalerite veins, was described as occurring near the Raven Pit’s eastern boundary². Coast Copper’s drillhole MW21-017 (see Figure 2 and Table 1 and 2) is the first ever drillhole to be drilled under the backfilled Raven Pit and, after passing through 30 metres of waste dump material, immediately cored into 4.70 m of semi-massive pyrrhotite and chalcopyrite that assayed 6.2 g/t Au over 1.67 m followed by 2.03 m grading 0.36 g/t Au and 0.28% Cu. Deeper in the hole, other bands of massive magnetite of up to 8. 6m were encountered. It is important to note that it appears that this drillhole clipped the top of the zone and now that the historical pit and mineralization has been re-located subsequent drillholes can be properly located to test the entire reported widths of this > 20 m wide zone.

Adam Travis, Coast Copper’s CEO commented, “We have now reported two new gold discoveries at Raven Bluff and Raven Pit, one of ten main target areas on the Property, to go along with our significant copper and gold results released last week, which I would encourage everyone to read. Our drill success at Raven Bluff opens up at least a 200 m x 200 m target area. These new discoveries confirms our belief that additional areas on the Property are prime exploration targets for new copper and gold discoveries as previous operators either focused on the mining of magnetite or drilling in the Merry Widow Pit. Even within the Merry Widow area which is a small portion of the overall Property zones such as South Pit, Lower Marten and Whiskey Jack have not been drilled. This is also another step forward in proving that the Empire Mine Property covers a large district scale potential with multiple target types (magnetite, copper/gold and zinc skarns, gold and copper veins, Iron Oxide Copper-Gold) that have seen little to no modern exploration. We look forward to adding this drill core to our display at the AMEBC Roundup conference February 3rd and 4th, 2022 in Vancouver, B.C.”

Coast Copper will continue to update its geological interpretation and modelling and will report additional assay results once received. Photos of select drill core will be available on the Coast Copper website under the Empire Mine Property tab.

QA/QC Statement on Assay Results

The 2021 drill sample collection was supervised on-site by Coast Copper personnel and sub-contractors who inserted certified standards, blanks, and field duplicates consisting of quarter core samples into each batch of samples at regular intervals. QA/QC samples account for 8% of the total samples sent to the labs.  Samples were sealed on site and shipped to MSALABS in Langley, British Columbia for analysis. Samples were prepared by crushing the entire sample to 70% passing -2mm, riffle splitting of 1kg and pulverizing the split to better than 85% passing 75 microns. MSALABS also conducts a rigorous QA/QC policy by inserting standards, blanks and conducting pulp duplicates on certain drill core intervals.

All samples were analyzed by 48 element ultra-trace 4-acid ICP digestion. Copper assays >10,000 ppm and Ag assays >100 g/t were reanalyzed with an Ore Grade method. The analytical results are verified with the application of industry standard Quality Assurance and Quality Control (“QA/QC”) procedures. The gold assays were determined by 30g fire assay with AAS finish method which reports in parts per million (“ppm; equivalent to g/t). Any samples greater than 10.0 g/t gold were re-analyzed by fire assay method with a gravimetric finish.

Iron ore analysis was determined by borate fusion and XRF finish.

Qualified Persons

The technical information contained in this news release has been prepared, reviewed, and approved by Wade Barnes, P.Geo. (BC) of Tripoint Geological Services, Coast Copper’s geological consultant and a Qualified Person within the context of Canadian Securities Administrators’ National Instrument 43-101; Standards of Disclosure for Mineral Projects.

About Coast Copper Corp.Â

Coast Copper’s exploration focus is the optioned Empire Mine Property, located on northern Vancouver Island, BC, which covers three historical open pit mines and two past-producing underground mines that yielded iron, copper, gold and silver. Coast Copper’s other properties include its 100% owned Eldorado, Gin and Bonanza properties located in BC’s prolific Golden Triangle district which are adjacent to Newcrest Mining Limited’s and Imperial Metals Corporation’s Red Chris Mine, its Knob Hill NW Property located on northern Vancouver Island and its 100% owned Sterling, Sandy and Home Brew properties which are located in central BC. Coast Copper’s management team continues to review precious and base metals opportunities in western North America.

On Behalf of the Board of Directors:

“Adam Travis”

Adam Travis, Chief Executive Officer and Director

For further information, please contact:

Adam Travis, CEO

Coast Copper Corp

409 Granville Street, Suite 904

Vancouver, B.C. V6C 1T2, Canada

P: 877-578-9563

E: adamt@coastcoppercorp.com

NR22-02

Cautionary Notes Related to this News Release and/or maps

1. NI 43-101 Technical Report: Giroux, G.H., & Raven, W. (November 30, 2008). Technical Report on the Copper Gold Resources for the Merry Widow Property. Filed on SEDAR January 22, 2009. The 2008 Grand Portage resource estimate was completed by Gary H. Giroux, P.Eng, MASc, of Giroux Consulting Ltd. in Vancouver, B.C. The estimate was based on a 3D geological model integrating 4,448 metres of diamond drilling of 43 drill holes, 2,290 assays, with 104 down-hole surveys collected between June and December 2006. The resource was reported utilizing gold cut-off grades ranging from 0.10 g/t to 3.00 g/t gold, as more particularly set out in the report. A complete copy of the report is available on Grand Portage’s public filings on SEDAR (www.sedar.com). A gold cut-off grade of 0.50 g/t gold was selected as representing one possible mining scenario. For the purposes of the calculations, lognormal cumulative frequency plots were used to assess grade distribution to see if capping of high values was required and if so at what levels. For all elements, capping levels were established based on the individual grade distributions as follows: Gold — a total of 18 gold assays were capped at 32.0 g/t gold, Silver –a total of 9 silver assays were capped at 165 g/t silver, Copper — a total of 7 assays were capped at 11.7% copper, Cobalt — a total of 5 assays were capped at 0.48% cobalt, Iron — all iron assays were capped at 50% iron (the analytical detection limit).

2. 2017 Prepatory/Physical Report for the Blue Gold Project. Dan P. Berkshire, James Hume. April 15, 2018. British Columbia Geological Survey Assessment Report 37,471.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in this press release, including any information regarding the proposed Transaction, private placement, board and management changes, as to our strategy, projects, plans or future financial or operating performance, constitutes “forward-looking statements.” All statements, other than statements of historical fact, are to be considered forward-looking statements. Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable by Coast Copper, are inherently subject to significant business, economic, geological and competitive uncertainties and contingencies. Although Coast Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include but are not limited to: fluctuations in market prices, exploration and exploitation successes, continued availability of capital and financing, changes in national and local government legislation, taxation, controls, regulations, expropriation or nationalization of property and general political, economic, market or business conditions. Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance and, therefore, readers are advised to rely on their own evaluation of such uncertainties. All of the forward-looking statements made in this press release, or incorporated by reference, are qualified by these cautionary statements. We do not assume any obligation to update any forward-looking statements.