Columbus Gold takes key step in Allegiant spin-out plan

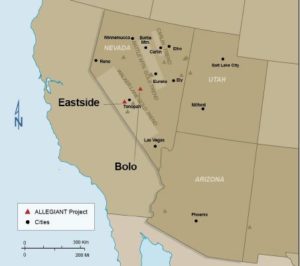

Map depicting the various mineral properties of Columbus Gold's spin-out company, Allegiant Gold Ltd. Source: Columbus Gold Corp.

Columbus Gold Corp. [CGT-TSX, CBGDF-OTCQX] on Friday January 12 said it has taken another key step towards the planned spin-out of its Western United States exploration assets into a new company, Allegiant Gold Ltd. The company said it has obtained conditional approval from the TSX Venture Exchange to list Allegiant.

“This was the last required condition to set the share distribution record date and to complete the spin-out of Allegiant to Columbus shareholders,” Columbus said in a press release. The share distribution record date is January 19, 2018.

The spin-out is aimed at unlocking the value of the U.S. exploration assets, mainly located in Nevada, which are currently overshadowed by Columbus Gold’s 45% interest in the Montagne d’Or (Mountain of Gold) project in French Guiana. Â It hosts 2.75 million ounces of proven and probable gold reserves. Its joint venture partner in French Guiana is Norgold, a private company owned 90% by a Russian Oligarch.

Shareholders of record on January 19, 2018 will receive one share of Allegiant for every five shares of Columbus that they currently own. Shareholders who sell their Columbus shares prior to the share distribution record date will not be entitled to receive shares of Allegiant. Post spin-out, Allegiant will own 14 drill-ready projects in the Western U.S., including 11 in Nevada. All were handpicked by Andy Wallace, literally a rock star in the field of geology.

His track record of success includes multi-million ounce gold discoveries including the Marigold, Pinson and Dee mines in Nevada. He has agreed to become Chief Executive Officer at Allegiant

Working through his private company Cordex Exploration LLC, Wallace has assembled a portfolio of projects headed by the 100%-owned Eastside property which hosts an inferred gold resource of 721,000 ounces of gold, and the Bolo property (also 100%-owned), which was the target of a 14-hole, 2,800-metre drill program this year. Eastside and Bolo are both located in Nevada. The company said 1,900 drill samples were shipped out Bolo in early December and results are expected to be announced in early January. Bolo is a Carlin-type gold and silver project, where surface sampling has defined widespread gold mineralization. That material is amenable to cyanide leaching, according to results of preliminary metallurgical tests.

Eleven of the holes completed this year tested the previously undrilled Uncle Sam patented claim, which was acquired by Columbus in 2016. Uncle Sam covers a 500-metre strike extension of a fault zone located immediately south of an area that Columbus previously drilled. Highlights include hold BL-38 which returned 133 metres of 1.28 g/t gold from surface (including 30.5 metres of 3.24 g/t gold).

On December 5, 2017, Columbus announced that it had commenced drilling at Eastside. The aim is to expand the Original Zone, which hosts the inferred gold resource. Eastside also hosts an historical resource of 11.1 million tonnes grading 0.024 oz/ton gold (0.82 g/t), for a total of 272,153 ounces.

The company has said it sees a pathway to double the amount of gold resources at Eastside.

Allegiant is currently awaiting approval to list its shares on the TSX Venture Exchange. The hope is that when the shares begin trading in early January, investors will assign a much greater value for the U.S exploration assets.

After the spin-out is complete, Allegiant is planning to spend the next 12 months drilling 10 of the 14 projects in its portfolio. In keeping with that plan, Allegiant recently closed a non-brokered private placement of subscription receipts that raised $4.2 million, an amount that is being held in escrow until the spin-out is complete. Another private placement by Allegiant is planned in early 2018 following the spin-out.