Continental Gold unveils US$175 million financing

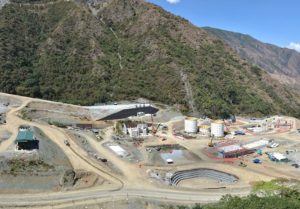

Construction Photos from the Buriticá Project Source: Continental Gold

Continental Gold Inc. [CNL-TSX; CGOF-OTCQX] on Friday March 15 announced details of a US$175 million financing package that will be used in part to fund the advancement of its Buritica Project in Colombia.

Continental shares rallied on the news, jumping 15.4% or 40 cents to $3.00 on volume of 1.18 million shares. The shares trade in a 52-week range of $1.76 and $3.98.

A 19.9%-owned affiliate of Newmont Mining Corp. [NEM-NYSE], Continental Gold is an advanced-stage exploration and development company with an extensive portfolio of wholly-owned gold projects in Colombia.

Continental said the financing package consists of US$75 million of unsecured convertible debentures that were issued to certain investors, including a US$50 million debenture from Newmont, and a US$100 million gold and silver stream from Triple Flag Mining Finance Bermuda Ltd.

The 75,023-hectare Buritica property is Continental’s flagship asset. It contains several known areas of high-grade gold and silver mineralization, of base metal carbonate-style variably overprinted by texturally and chemically distinctive high-grade mineralization.

Mineral reserves on the property currently stand at 3.7 million ounces of gold, grading 8.4 g/t and 10.7 million ounces of silver, grading 243 g/t.

That material is expected to support an average annual production rate in the first five years of 282,000 ounces of gold at a life-of-mine at an all-in sustaining and construction cost of US$604 an ounce. Production is scheduled to commence in early 2020, the company has said.

According to a February, 2016, feasibility study, initial capital costs are pegged at US$389.2 million. Total project costs were estimated at between US$475 million and US$515 million.

In a January 28, 2019 press release, Continental said an updated mineral resource estimate for the project is progressing well and ahead of schedule.

The project remains on schedule for construction completion and first gold pour in the first half of 2020, the company said. Ramp-up to commercial production is anticipated approximately six months thereafter.

Debenture details

The five-year and two-month debentures feature a 5% interest rate payable semi-annually in arrears.

Each of the debentures will be convertible at the holder’s option into common shares of the company at a conversion price of $3 (Canadian) per share. Assuming full conversion of the debenture issued to Newmont only, Newmont’s stake in the company would rise to 28%.

The company has the option to redeem all of the debentures at a redemption price equal to 100% of the principal amount then outstanding, plus all accrued and unpaid interest, if the closing price of the shares on the TSX is at least 130% of the conversion price for each of the 20 trading days before a notice of redemption is delivered to the holders, subject to the terms of the debentures (including the right of holders to convert prior to redemption).

Gold and silver stream

- A US$100 million subordinated secured 2.1% gold and 100% silver stream on the Buritica Project, where payable silver is deemed to be 1.84 ounces of payable silver for each ounce of payable gold.

- Continuing payments of 10% and 5% of the spot price of gold and silver, respectively.

- Full buyback option, on or before December 31, 2021 of the entire gold stream for US$80 million, less any gold stream net cash flows received at the time of the buyback.

- Closing of the financing of the stream deposit is subject to customary closing conditions.