Goldcorp restarts Argentina gold mine

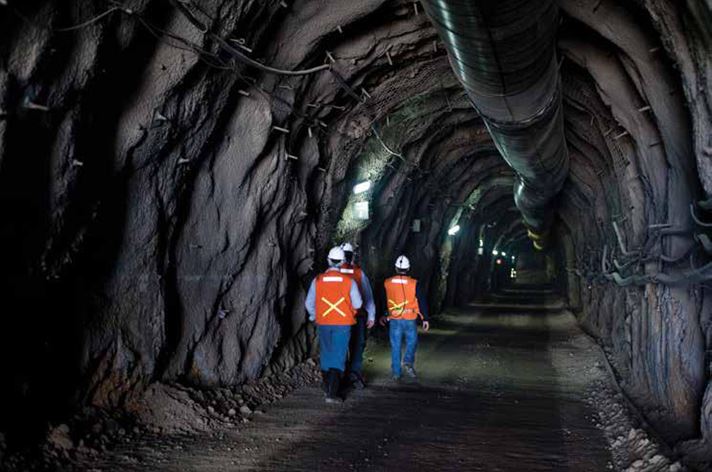

Goldcorp's Cerro Negro Mine in southern Argentine. Miners inside the Eureka vein Photo courtesy Goldcorp Inc.

Goldcorp Inc. [G-TSX, NYSE-GG] said Thursday that operations have resumed at its Cerro Negro mine in Argentina following a work stoppage which began on March 8, 2019.

The company previously said it had ceased mining at Cerro Negro because of an illegal work stoppage by the AOMA mining union.

However, on Thursday the company said a conciliation process resolution was issued by the provincial government of Santa Cruz and accepted by the parties. During this period, Goldcorp will work with the employee representatives and the government on a fair and equitable solution, the company said. Meanwhile, the site is ramping up to normal operations.

Situated on a remote mine site on the low Patagonian plains in Southern Argentina, Cerro Negro was expected to produce 490,000 ounces of gold in 2018 at an all-in sustaining cost of US$600 an ounce.

In 2017, Cerro Negro accounted for 14% of Goldcorp’s total production and 18% of revenue.

News of the illegal work stoppage comes as Goldcorp is being swept up on a wave of gold mining industry consolidation. On March 11, 2019, Barrick Gold Corp. [ABX-TSX, NYSE] said it had abandoned its hostile bid for Newmont Mining Corp. [NEM-NYSE] and will instead create a joint venture that will combine the two companies’ Nevada gold mining operations.

The agreement allows Newmont to complete a friendly merger with Goldcorp that was announced on January 14, 2019.

On Monday evening, Newmont filed its definitive proxy statement and scheduled a special meeting of stockholders to vote on the pending merger with Goldcorp on April 11, 2019 in Denver, Colorado.

Meanwhile, Goldcorp has announced that Chairman Ian Telfer has informed Newmont that he will not be joining the Newmont Goldcorp board of directors upon completion of the proposed acquisition of Goldcorp by Newmont. Telfer is focusing all of his efforts on having Goldcorp shareholders approve the pending transaction with Newmont.

If the deal does proceed, Goldcorp Chairman Ian Telfer will be entitled to receive a lump sum payment retirement allowance from Goldcorp equal to approximately US$12 million. That marks an increase from his current entitlement of approximately US$4.5 million.

The increased amount of the retiring allowance was recommended by the Human Resources and Compensation Committee, reviewed and considered by the Goldcorp special committee, and approved by the Goldcorp board on the basis of Telfer’s role as founder and strategic leader of Goldcorp subsequent to the acquisition of Glamis Gold Ltd. in November, 2006.

On Thursday, Goldcorp shares eased 1.82% or 27 cents to $14.59 on volume of 1.3 million. The shares trade in a 52-week range of $18.78 and $11.00.